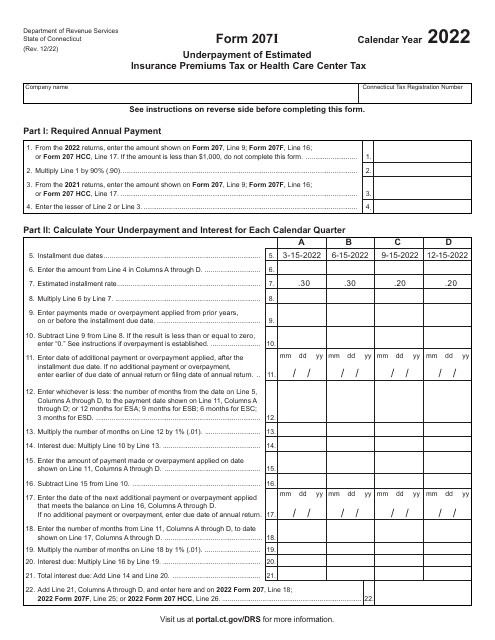

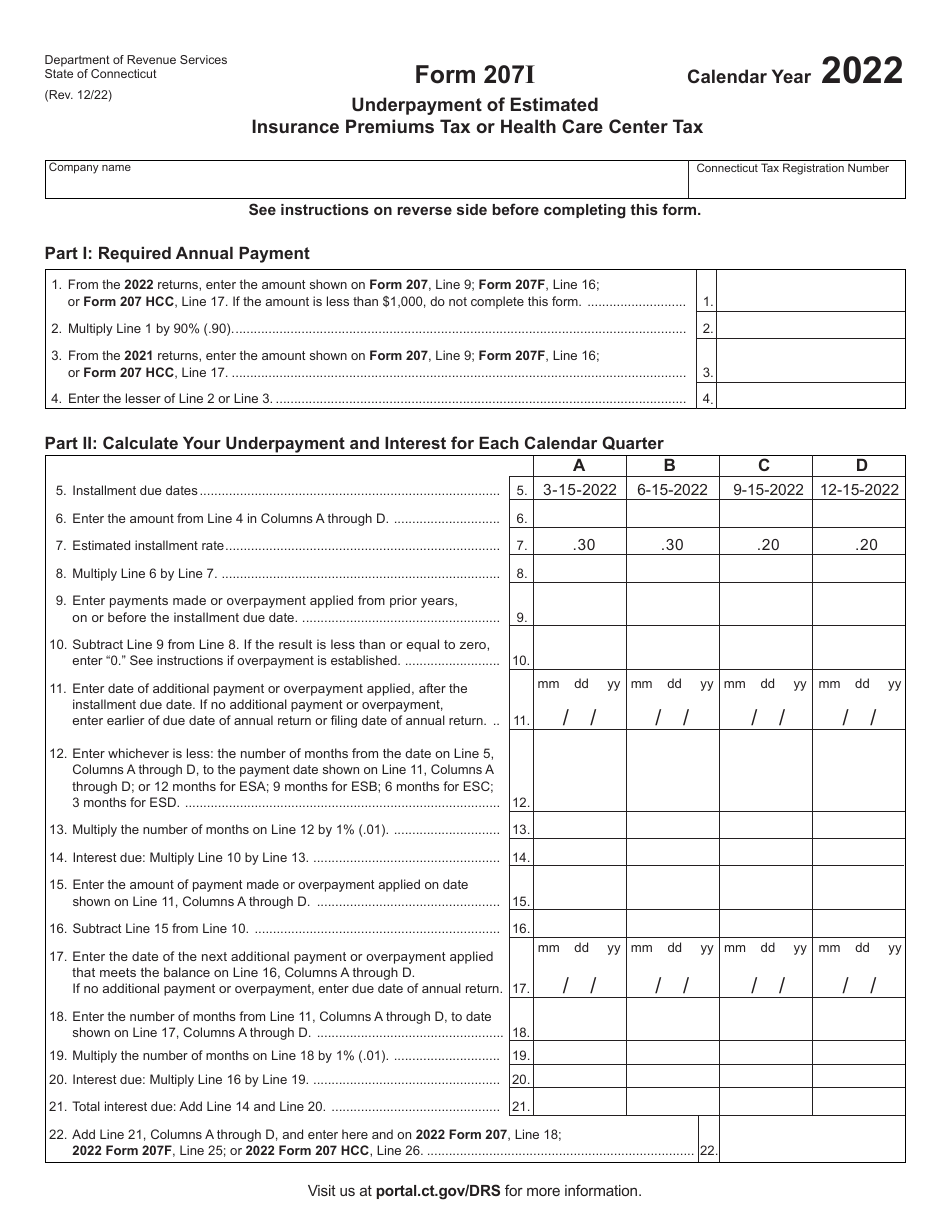

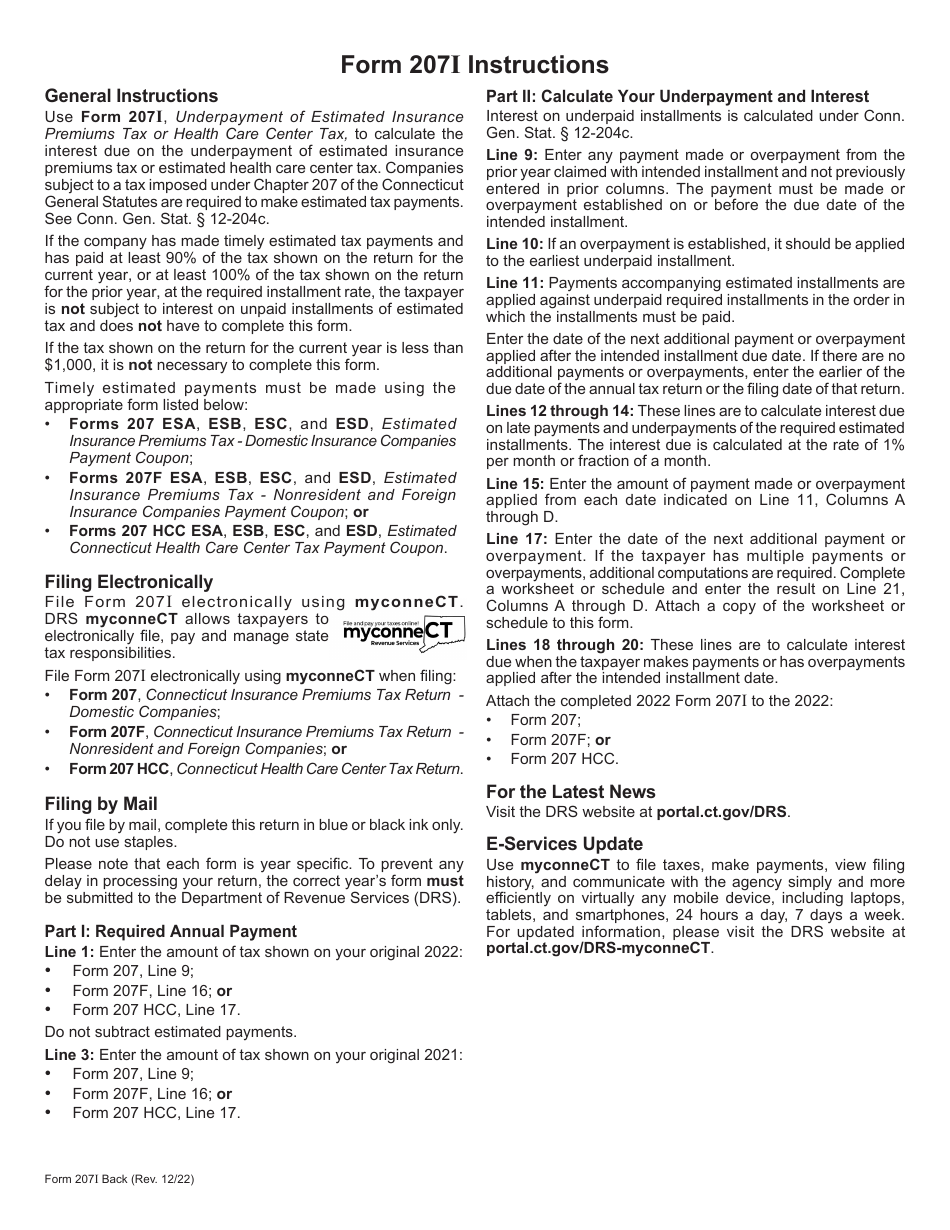

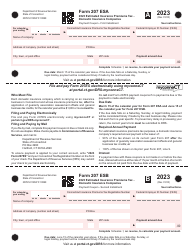

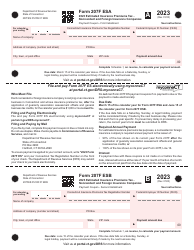

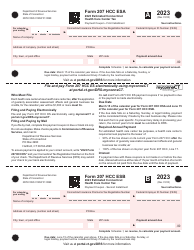

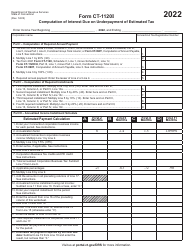

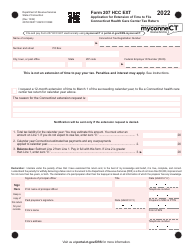

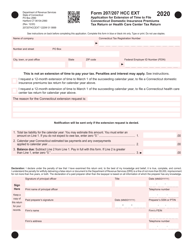

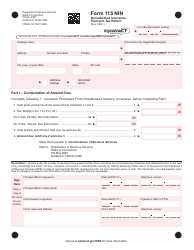

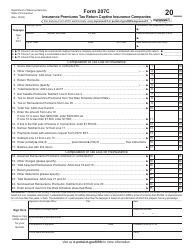

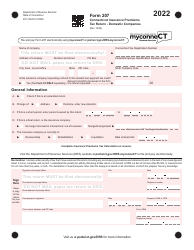

Form 207I Underpayment of Estimated Insurance Premiums Tax or Health Care Center Tax - Connecticut

What Is Form 207I?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 207I?

A: Form 207I is a form used to report underpayment of estimated insurance premiums tax or health care center tax in Connecticut.

Q: What is the purpose of Form 207I?

A: The purpose of Form 207I is to calculate and report any underpayment of estimated insurance premiums tax or health care center tax in Connecticut.

Q: Who needs to fill out Form 207I?

A: Any individual or business that has underpaid their estimated insurance premiums tax or health care center tax in Connecticut needs to fill out Form 207I.

Q: When is Form 207I due?

A: Form 207I is generally due on or before the original due date of the tax return for the year in which the underpayment occurred.

Q: What happens if I don't file Form 207I?

A: If you fail to file Form 207I or pay the underpayment, you may be subject to penalties and interest on the unpaid amount.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 207I by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.