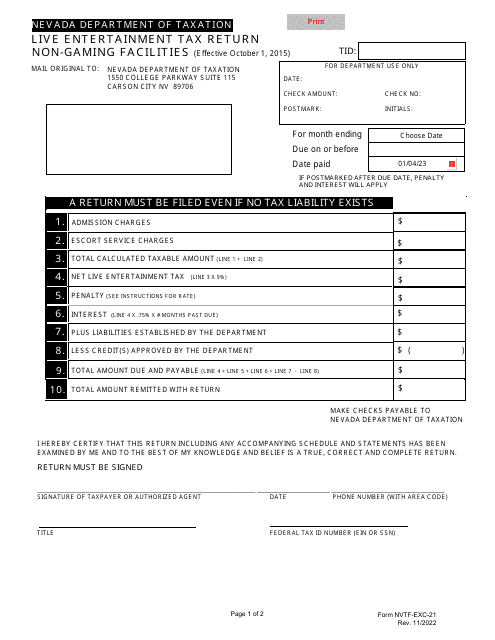

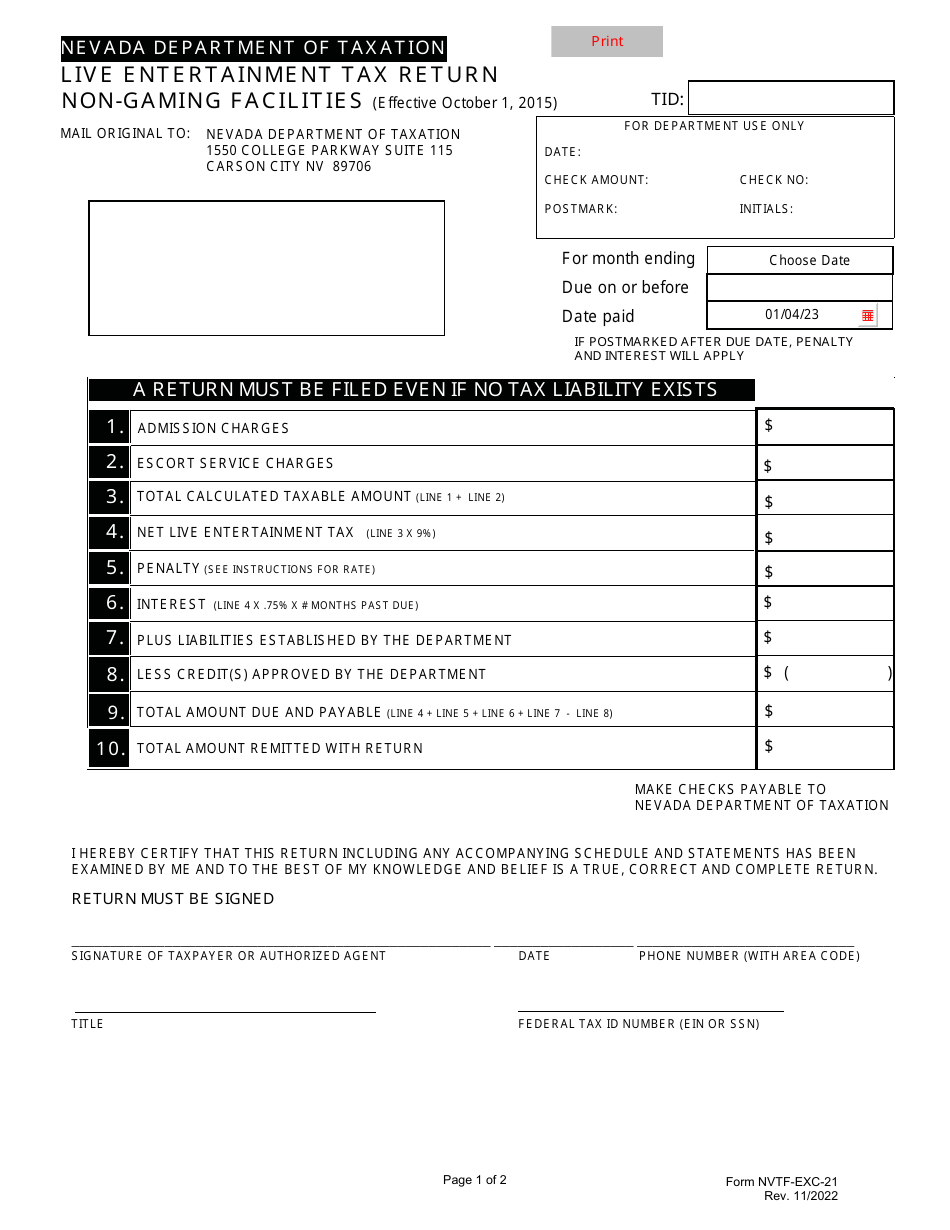

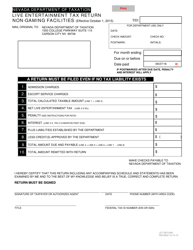

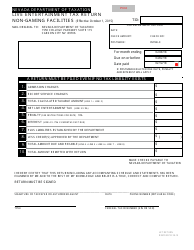

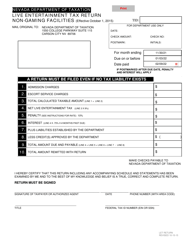

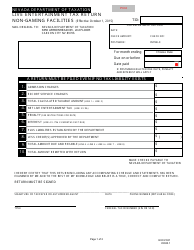

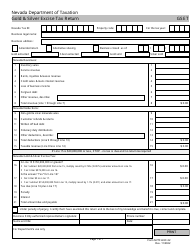

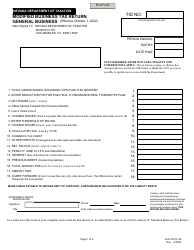

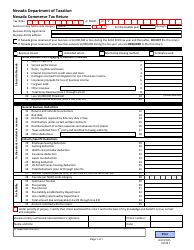

Form NVTF-EXC-21 Live Entertainment Tax Return - Non-gaming Facilities - Nevada

What Is Form NVTF-EXC-21?

This is a legal form that was released by the Nevada Department of Taxation - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NVTF-EXC-21?

A: Form NVTF-EXC-21 is the Live Entertainment Tax Return form for non-gaming facilities in Nevada.

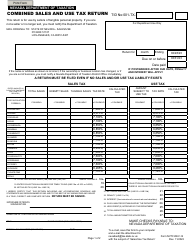

Q: Who needs to file Form NVTF-EXC-21?

A: Non-gaming facilities in Nevada that provide live entertainment need to file Form NVTF-EXC-21.

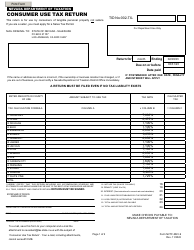

Q: What is the purpose of Form NVTF-EXC-21?

A: The purpose of Form NVTF-EXC-21 is to report and pay the Live Entertainment Tax for non-gaming facilities in Nevada.

Q: What is the Live Entertainment Tax?

A: The Live Entertainment Tax is a tax imposed on non-gaming facilities in Nevada that provide live entertainment.

Q: How often should Form NVTF-EXC-21 be filed?

A: Form NVTF-EXC-21 should be filed monthly.

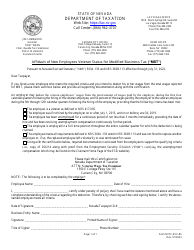

Q: Are there any exemptions to the Live Entertainment Tax?

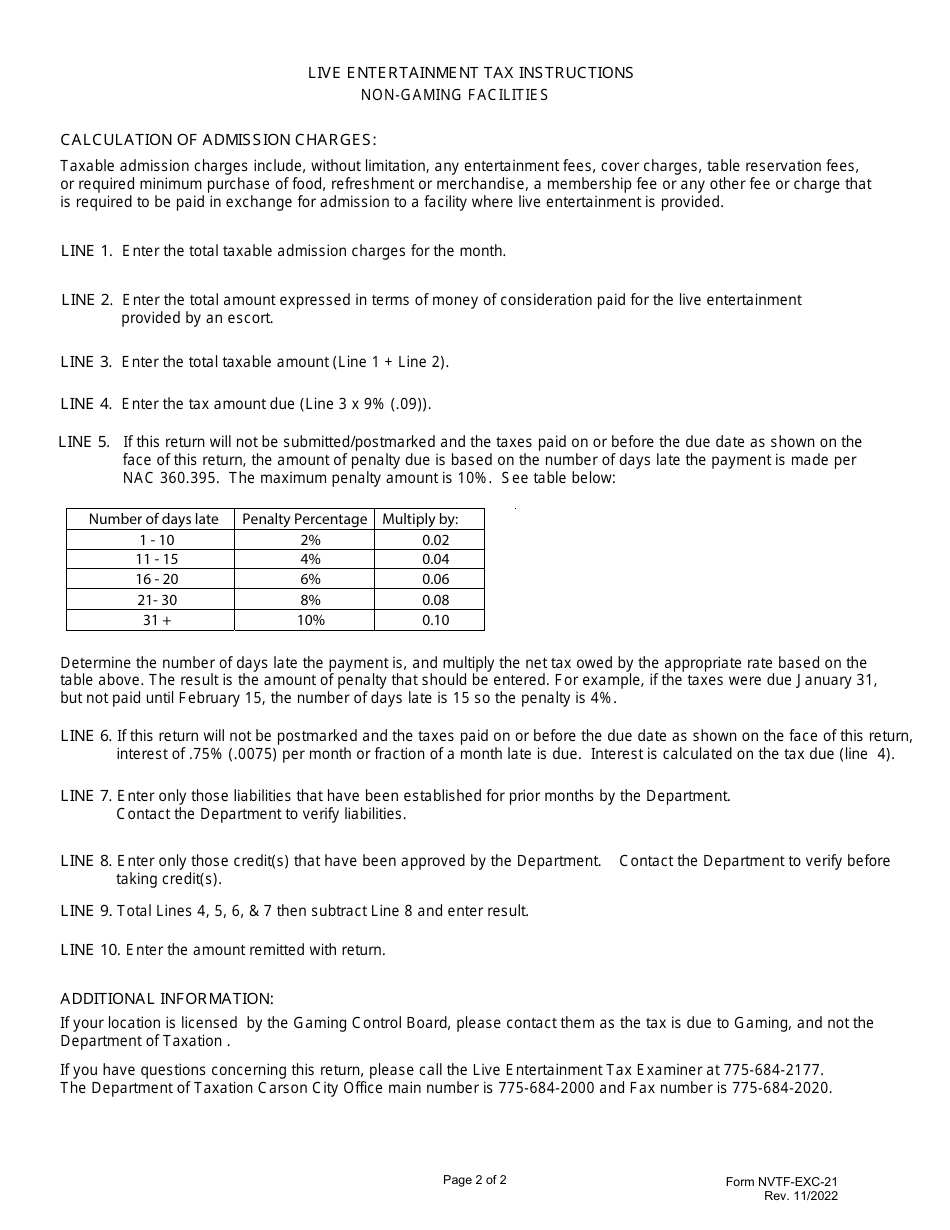

A: Yes, certain exemptions apply to the Live Entertainment Tax. You should consult the instructions for Form NVTF-EXC-21 to determine if you qualify for an exemption.

Q: What happens if I don't file Form NVTF-EXC-21?

A: Failure to file Form NVTF-EXC-21 may result in penalties and interest being imposed.

Q: What supporting documents do I need to include with Form NVTF-EXC-21?

A: You may be required to attach supporting documents such as ticket sales records, entertainment contracts, and other relevant records.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Nevada Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NVTF-EXC-21 by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.