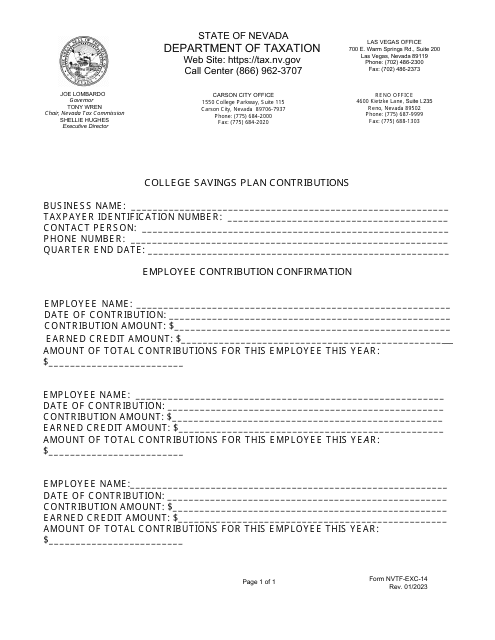

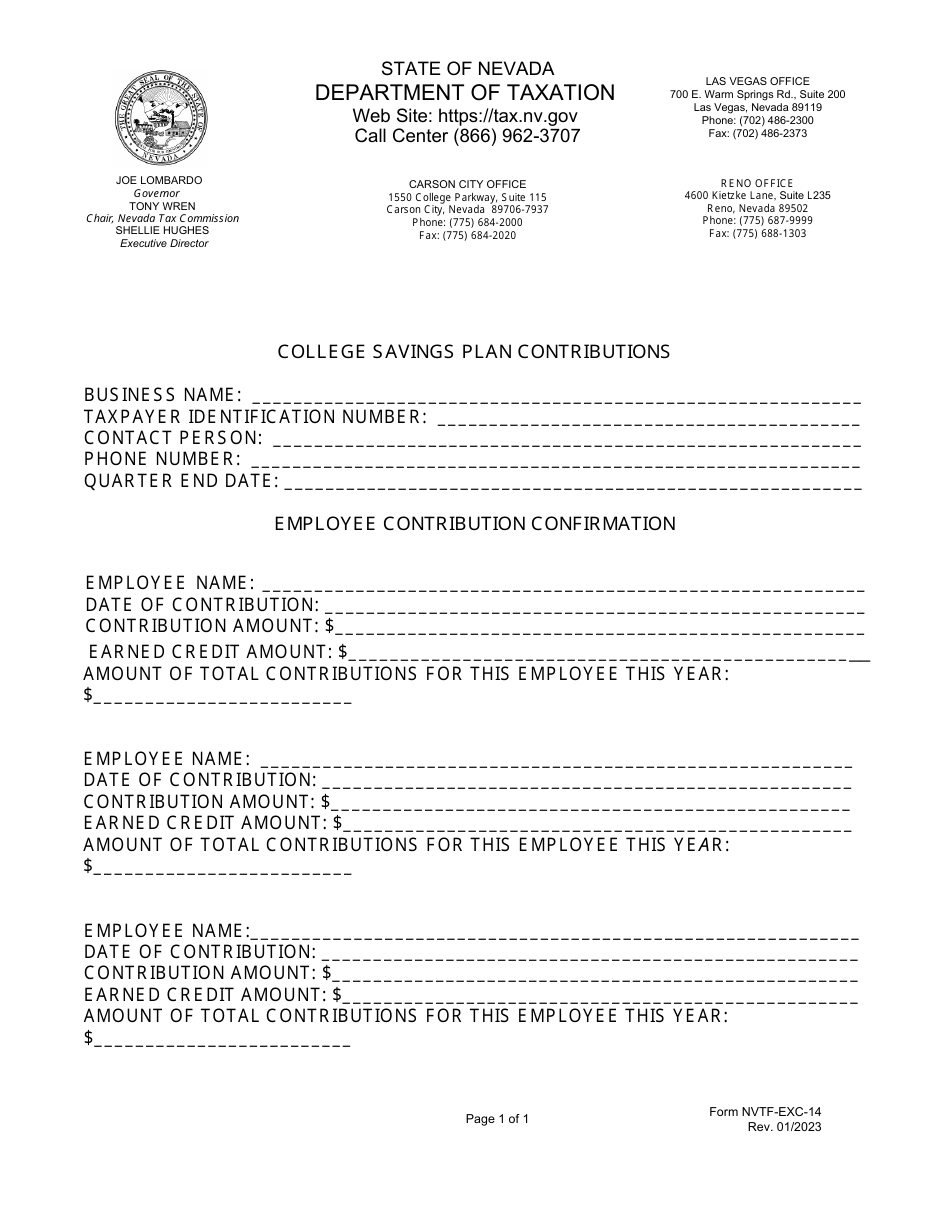

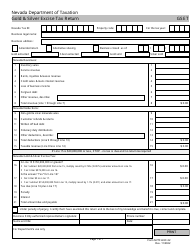

Form NVTF-EXC-14 Payroll Tax: Credit for Matching Employee Contributions to Prepaid Tuition Contracts and College Savings Trust Accounts - Nevada

What Is Form NVTF-EXC-14?

This is a legal form that was released by the Nevada Department of Taxation - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NVTF-EXC-14?

A: Form NVTF-EXC-14 is a form related to payroll tax credit for matching employee contributions to prepaid tuition contracts and college savingstrust accounts in Nevada.

Q: What is the purpose of Form NVTF-EXC-14?

A: The purpose of Form NVTF-EXC-14 is to claim a payroll tax credit for matching employee contributions to prepaid tuition contracts and college savings trust accounts in Nevada.

Q: Who is eligible to use Form NVTF-EXC-14?

A: Employers in Nevada who offer matching contributions to their employees' prepaid tuition contracts or college savings trust accounts are eligible to use Form NVTF-EXC-14.

Q: How can employers claim the payroll tax credit?

A: Employers can claim the payroll tax credit by completing and filing Form NVTF-EXC-14 along with their payroll tax return.

Q: What is the benefit of using Form NVTF-EXC-14?

A: Using Form NVTF-EXC-14 allows employers to receive a tax credit for their matching contributions to employee prepaid tuition contracts and college savings trust accounts.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Nevada Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NVTF-EXC-14 by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.