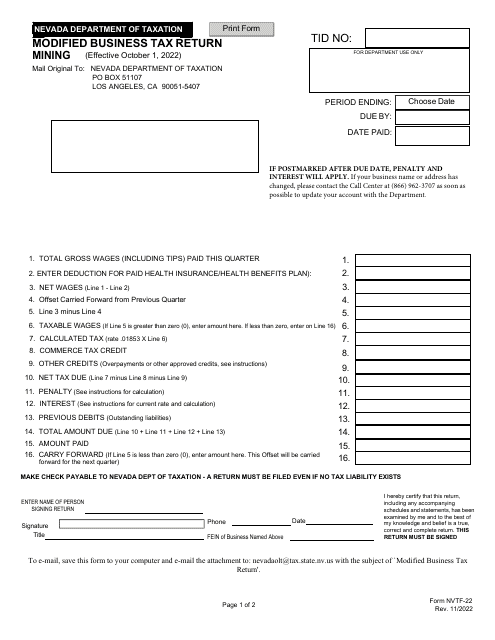

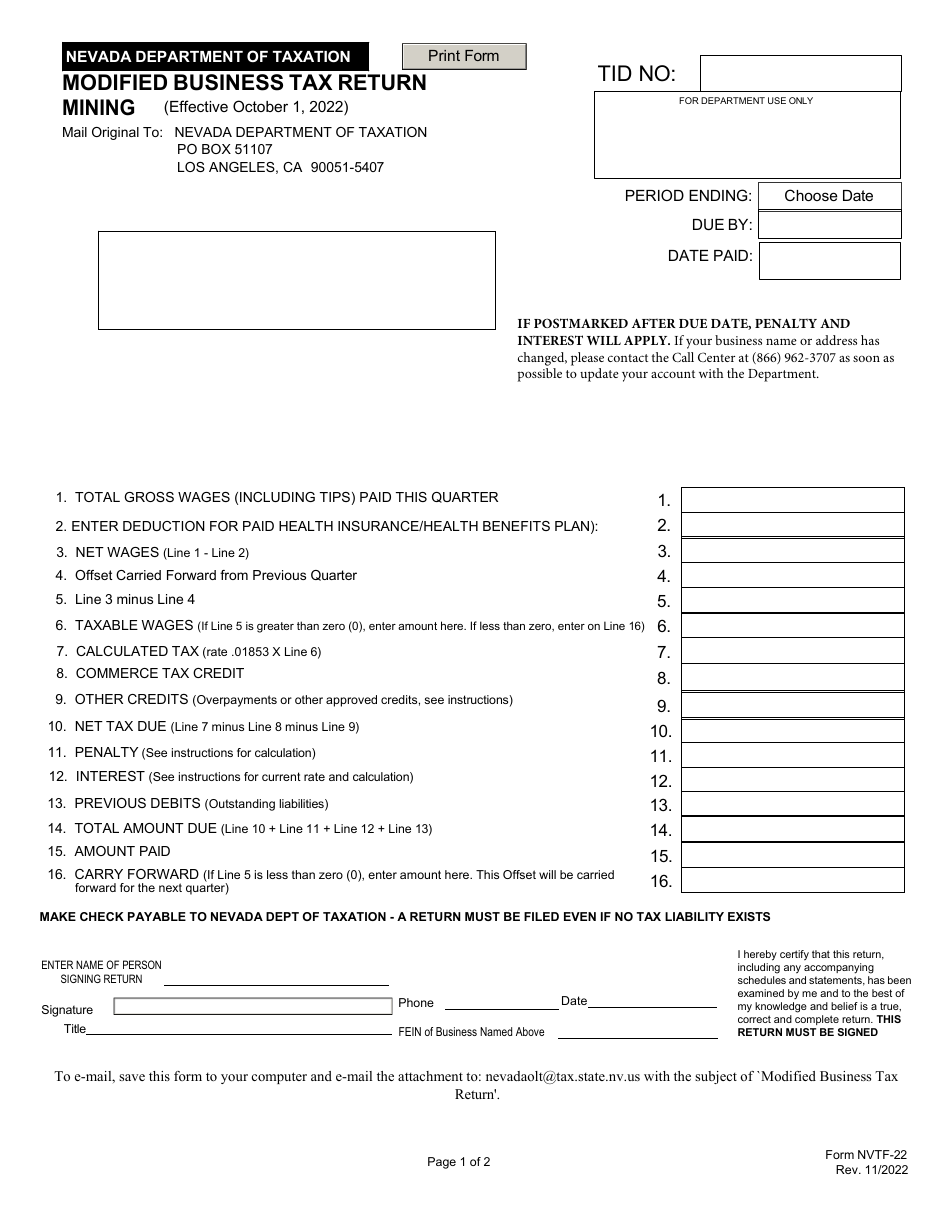

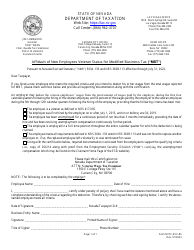

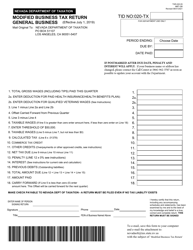

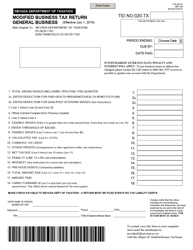

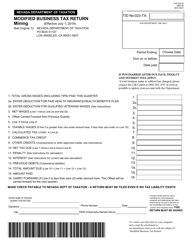

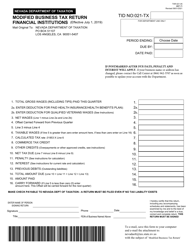

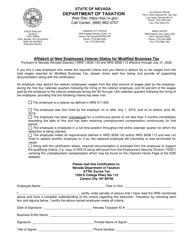

Form NVTF-22 Modified Business Tax Return - Mining - Nevada

What Is Form NVTF-22?

This is a legal form that was released by the Nevada Department of Taxation - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NVTF-22?

A: Form NVTF-22 is the Modified Business Tax Return specific to the mining industry in Nevada.

Q: Who needs to file Form NVTF-22?

A: Mining businesses in Nevada are required to file Form NVTF-22 to report and pay their modified business tax.

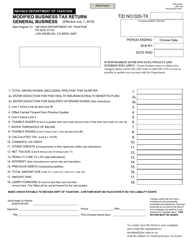

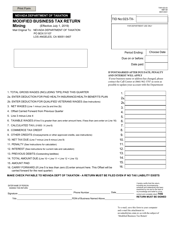

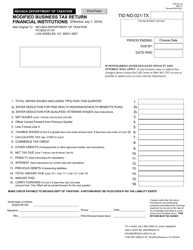

Q: What is the Modified Business Tax?

A: The Modified Business Tax is a tax imposed on certain types of businesses in Nevada, including mining.

Q: What information is required on Form NVTF-22?

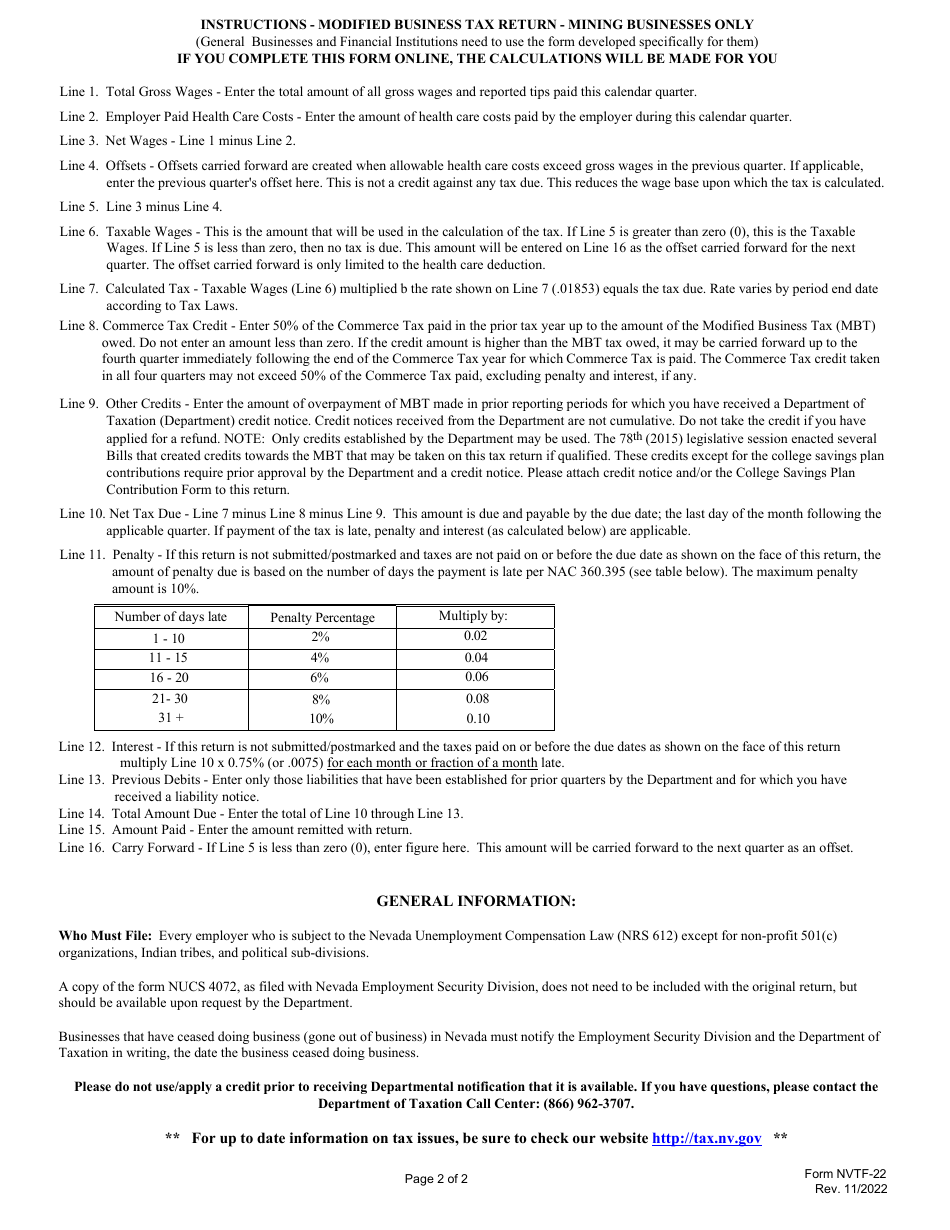

A: Form NVTF-22 requires the mining business to report their gross wages paid to employees for mining activities in Nevada.

Q: When is Form NVTF-22 due?

A: Form NVTF-22 is due on the last day of the month following the end of the quarter. For example, the return for the first quarter is due by April 30th.

Q: Are there any penalties for late or incorrect filing of Form NVTF-22?

A: Yes, there are penalties for late or incorrect filing of Form NVTF-22, including potential penalties and interest charges.

Q: What other taxes do mining businesses in Nevada need to pay?

A: In addition to the Modified Business Tax, mining businesses in Nevada may also be subject to other taxes, such as sales tax and property tax.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Nevada Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NVTF-22 by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.