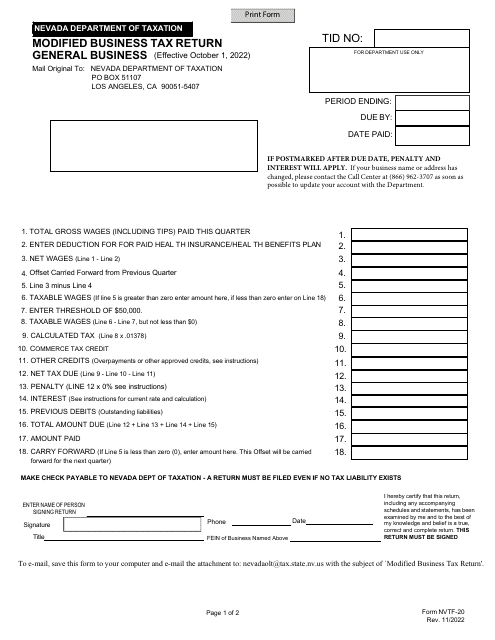

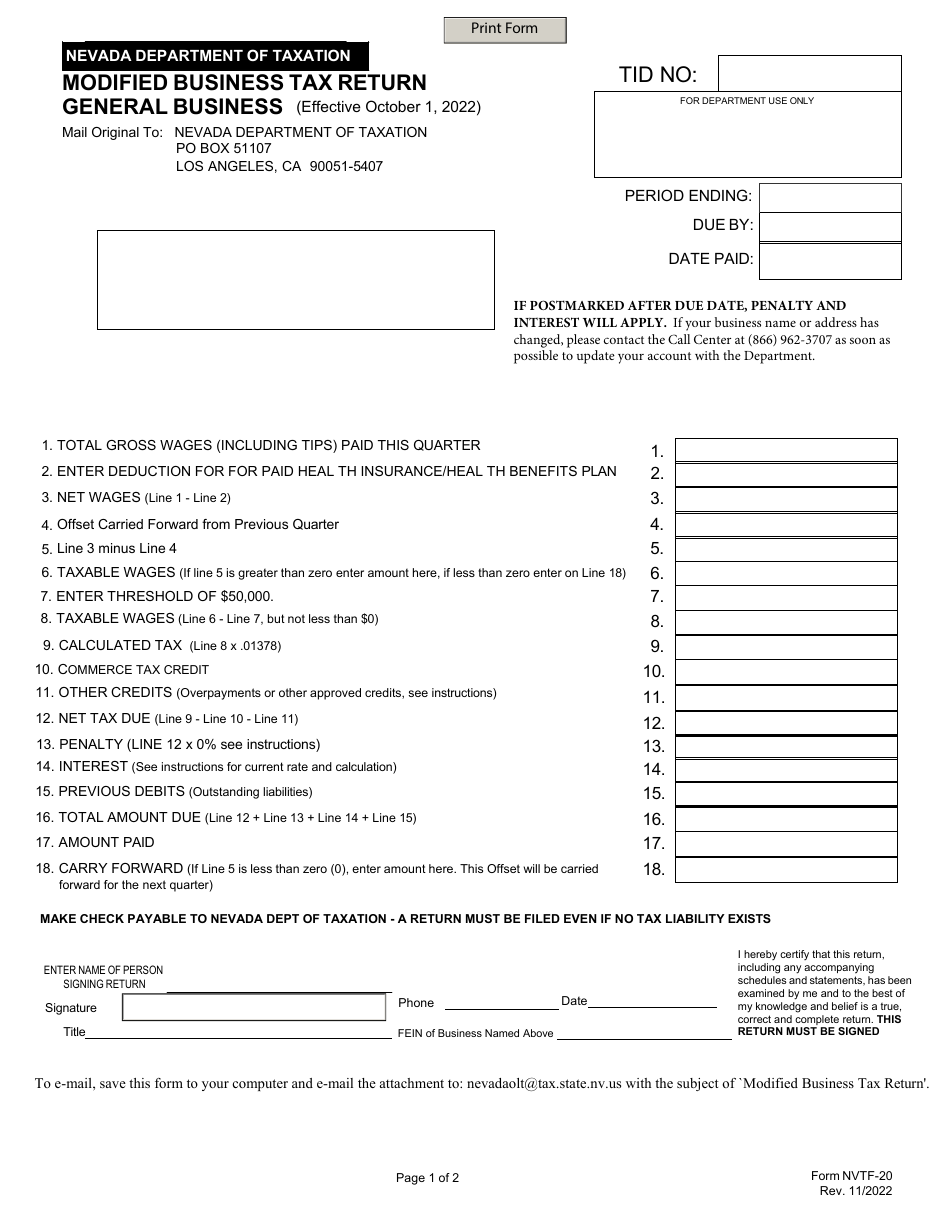

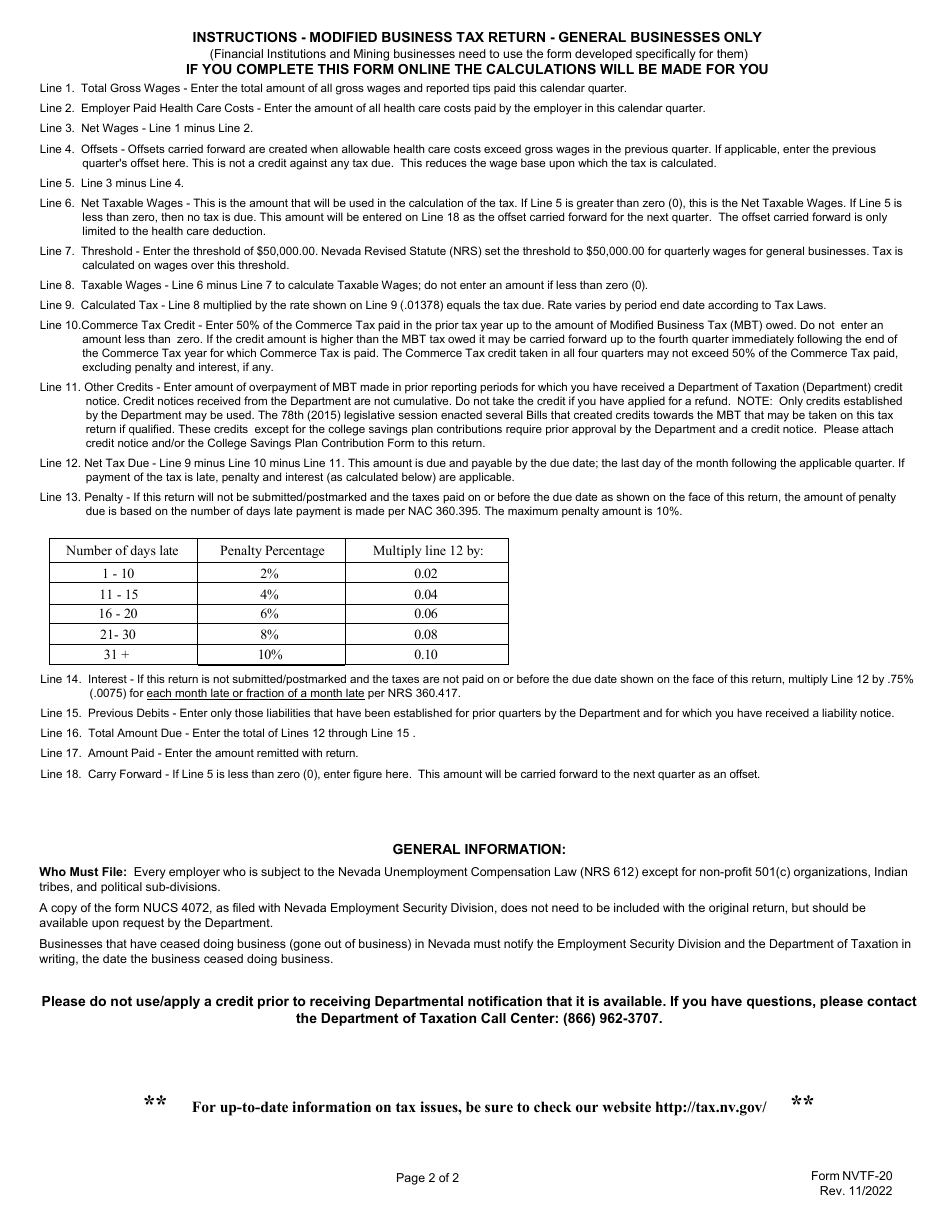

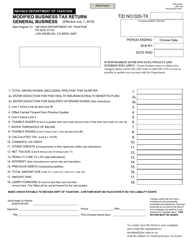

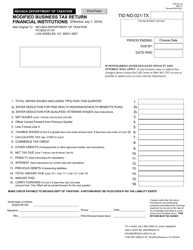

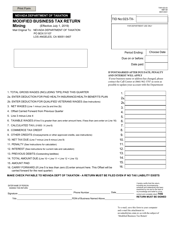

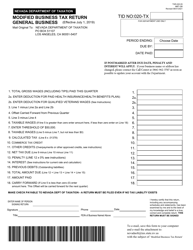

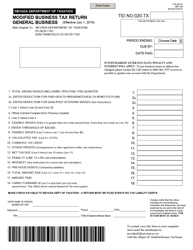

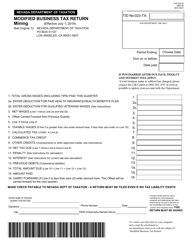

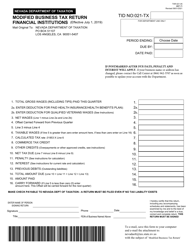

Form NVTF-20 Modified Business Tax Return - General Business - Nevada

What Is Form NVTF-20?

This is a legal form that was released by the Nevada Department of Taxation - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NVTF-20?

A: Form NVTF-20 is the Modified Business Tax Return for general businesses in Nevada.

Q: Who needs to file Form NVTF-20?

A: General businesses in Nevada are required to file Form NVTF-20.

Q: What is the purpose of Form NVTF-20?

A: Form NVTF-20 is used to report and pay the Modified Business Tax (MBT) in Nevada.

Q: What is the Modified Business Tax (MBT)?

A: The Modified Business Tax (MBT) is a tax imposed on businesses in Nevada based on employee wages.

Q: When is Form NVTF-20 due?

A: Form NVTF-20 is due on the last day of the month following the end of the taxable quarter.

Q: How can Form NVTF-20 be filed?

A: Form NVTF-20 can be filed electronically through the Nevada Tax Center or by mail.

Q: What are the consequences of not filing Form NVTF-20?

A: Failure to file Form NVTF-20 or pay the required taxes may result in penalties and interest.

Q: Are there any exemptions or deductions available on Form NVTF-20?

A: Yes, there are certain exemptions and deductions available on Form NVTF-20. Consult the instructions for more details.

Q: Can I amend Form NVTF-20?

A: Yes, you can file an amended Form NVTF-20 if you need to make changes or corrections to your original return.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Nevada Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NVTF-20 by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.