This version of the form is not currently in use and is provided for reference only. Download this version of

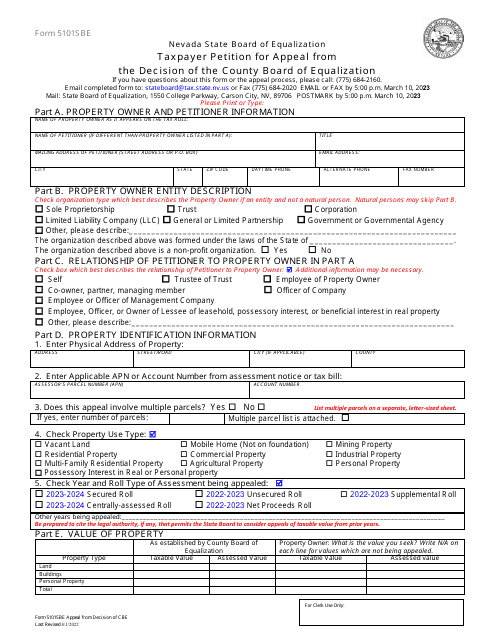

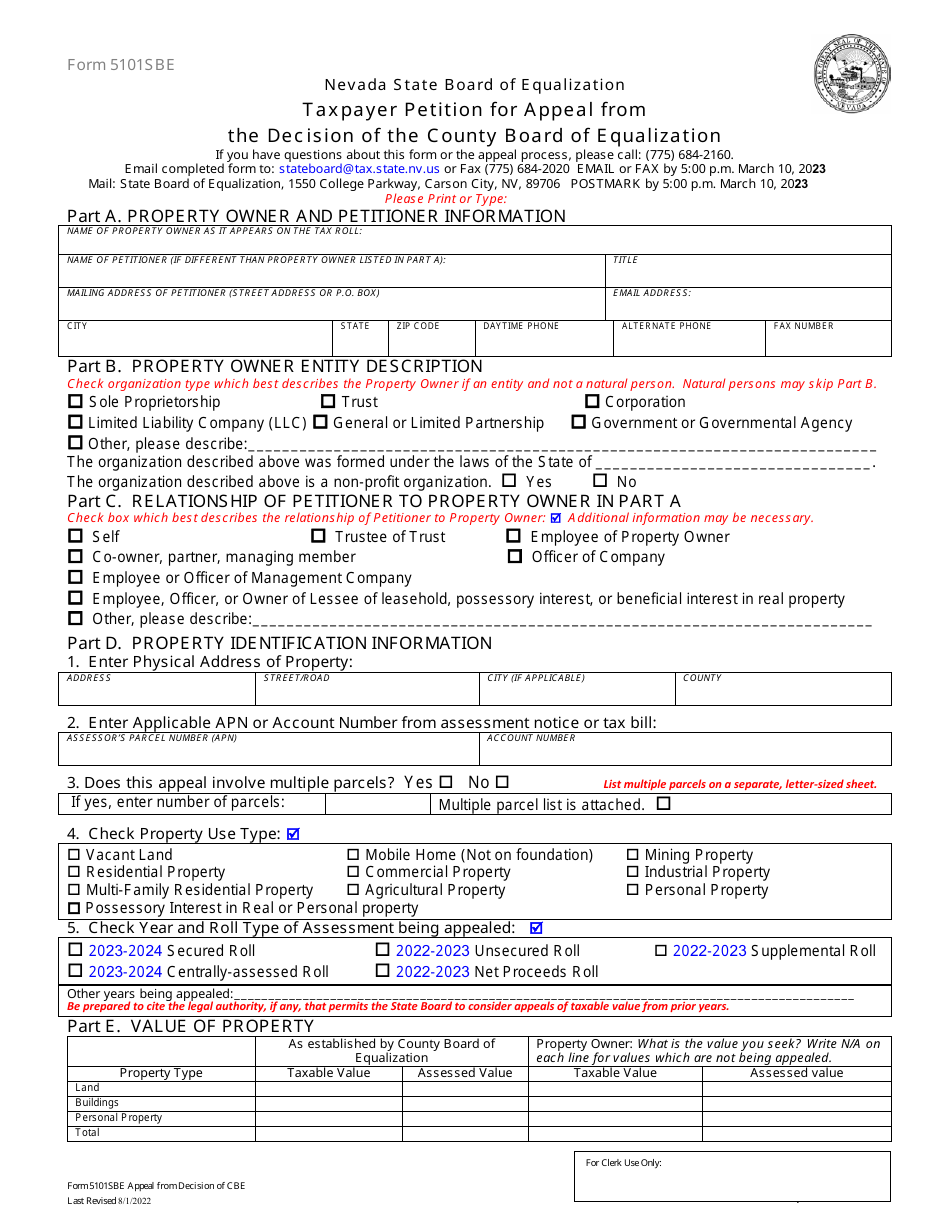

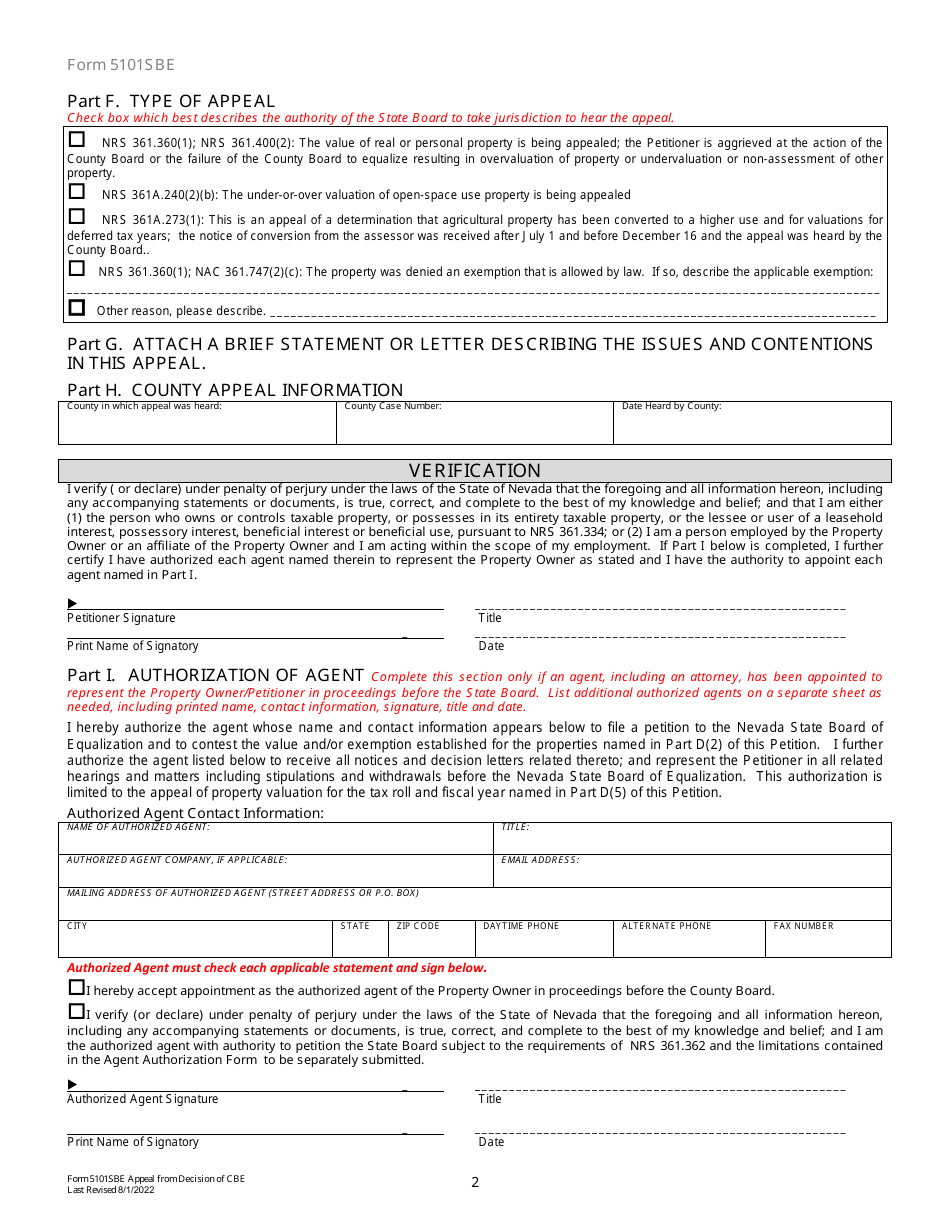

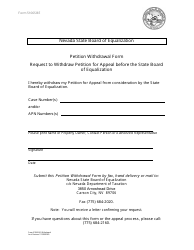

Form 5101SBE

for the current year.

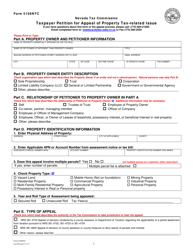

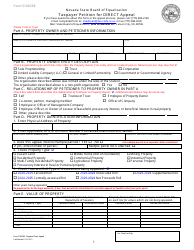

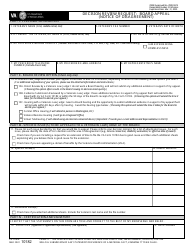

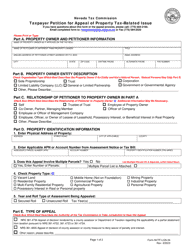

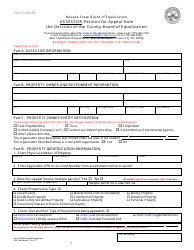

Form 5101SBE Taxpayer Petition for Appeal From the Decision of the County Board of Equalization - Nevada

What Is Form 5101SBE?

This is a legal form that was released by the Nevada Department of Taxation - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5101SBE?

A: Form 5101SBE is a petition for appeal filed by taxpayers in Nevada against the decision of the County Board of Equalization.

Q: What is the purpose of Form 5101SBE?

A: The purpose of Form 5101SBE is to request an appeal and present your case to the State Board of Equalization in Nevada.

Q: Who can file Form 5101SBE?

A: Taxpayers who are dissatisfied with the decision of the County Board of Equalization in Nevada can file Form 5101SBE.

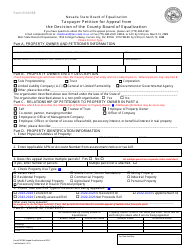

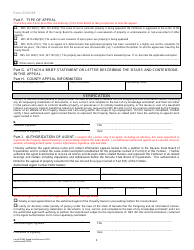

Q: What should be included in Form 5101SBE?

A: Form 5101SBE should include the taxpayer's contact information, a detailed explanation of the appeal, supporting evidence, and the relief sought.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Nevada Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5101SBE by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.