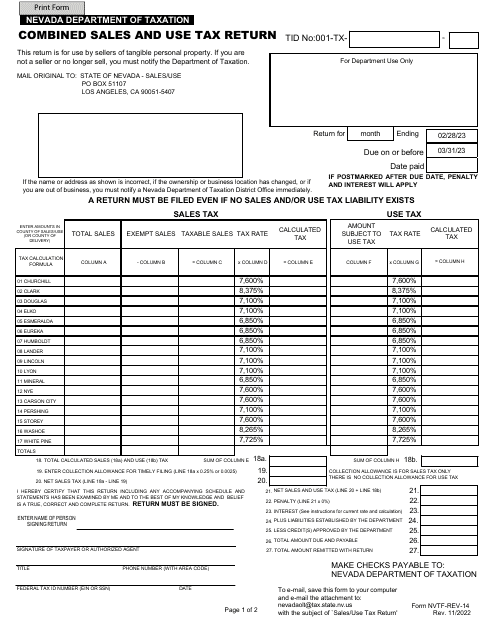

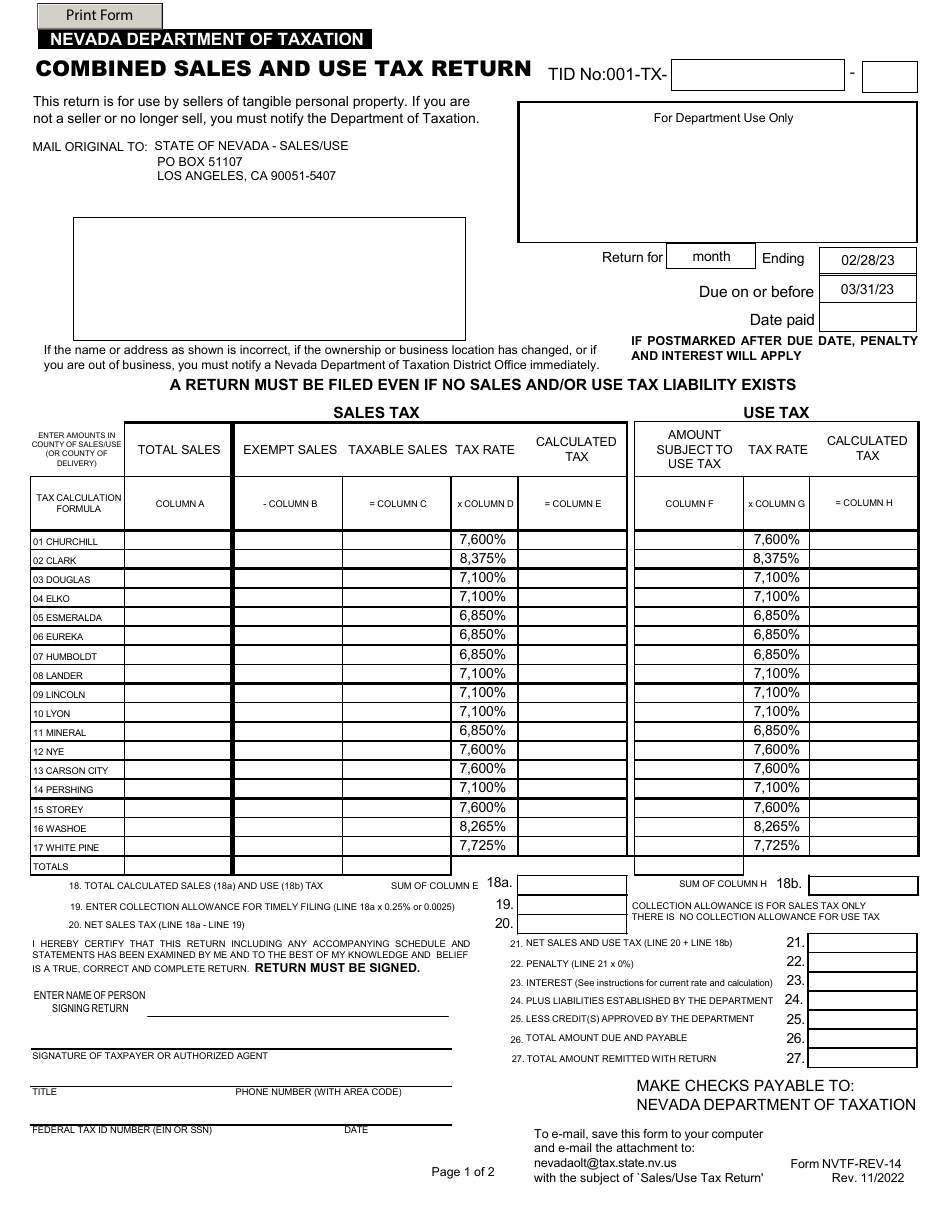

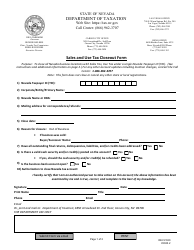

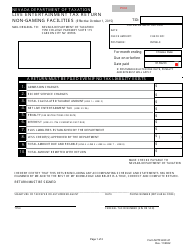

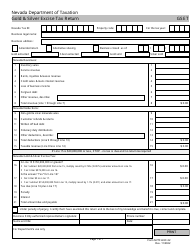

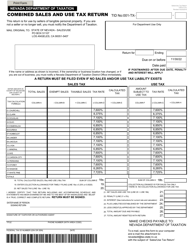

Form NVTF-REV-14 Combined Sales and Use Tax Return - Nevada

What Is Form NVTF-REV-14?

This is a legal form that was released by the Nevada Department of Taxation - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NVTF-REV-14?

A: Form NVTF-REV-14 is the Combined Sales and Use Tax Return for the state of Nevada.

Q: What is the purpose of Form NVTF-REV-14?

A: The purpose of Form NVTF-REV-14 is to report and remit sales and use tax owed to the state of Nevada.

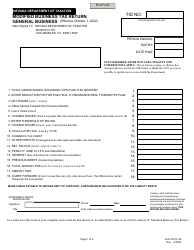

Q: Who is required to file Form NVTF-REV-14?

A: Businesses that have sales and use tax obligations in Nevada are required to file Form NVTF-REV-14.

Q: How often is Form NVTF-REV-14 filed?

A: Form NVTF-REV-14 is typically filed on a monthly basis. However, certain businesses may be eligible to file on a quarterly or annual basis.

Q: Is there a deadline for filing Form NVTF-REV-14?

A: Yes, Form NVTF-REV-14 must be filed by the last day of the month following the reporting period.

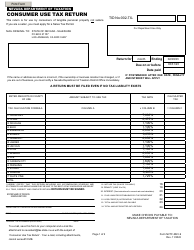

Q: What information is required on Form NVTF-REV-14?

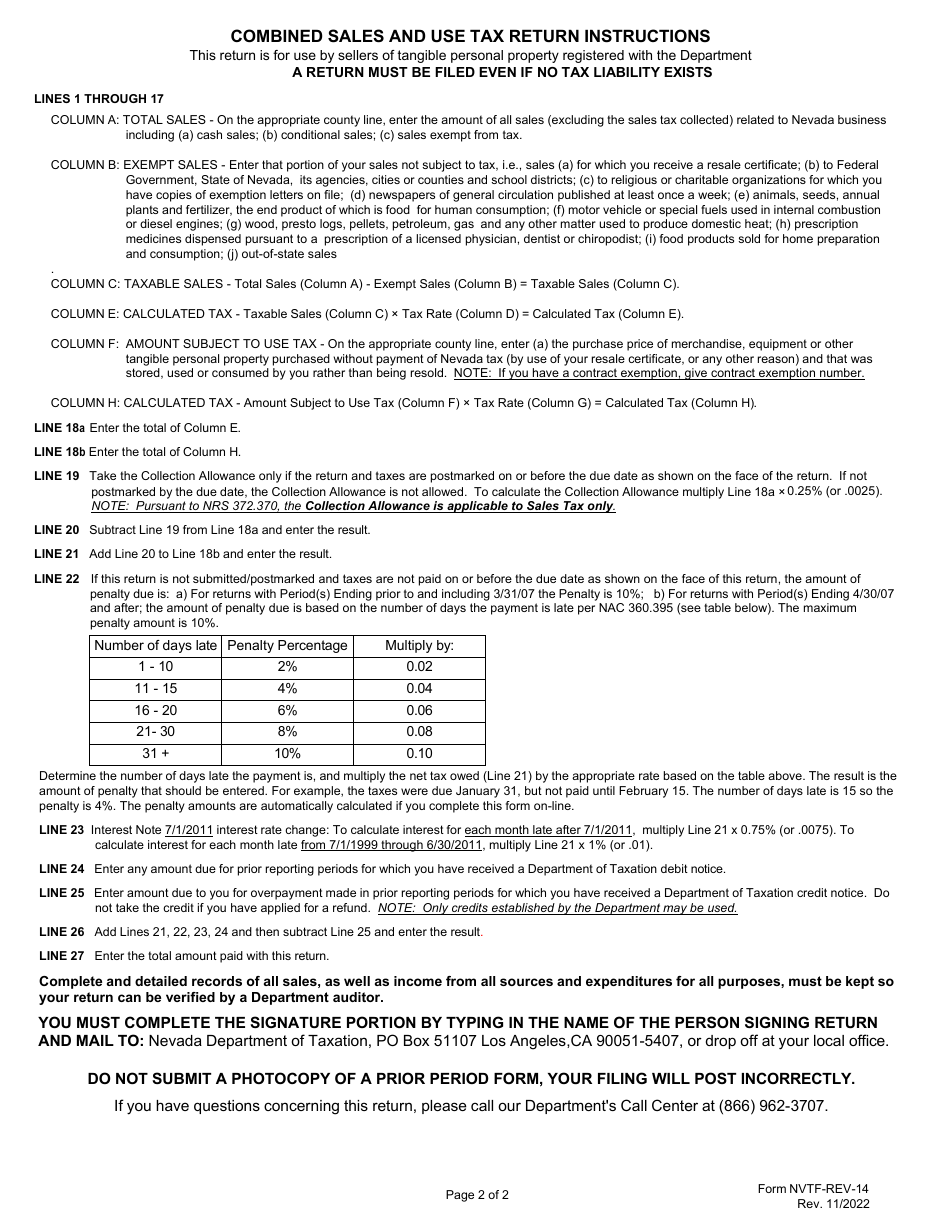

A: Form NVTF-REV-14 requires businesses to provide information about their sales and purchases, as well as calculate the amount of tax owed.

Q: Are there any penalties for late or incorrect filing of Form NVTF-REV-14?

A: Yes, there are penalties for late or incorrect filing of Form NVTF-REV-14. It is important to ensure that the form is filed accurately and on time to avoid these penalties.

Q: Do I need to include payment with Form NVTF-REV-14?

A: Yes, businesses are required to remit payment for the amount of tax owed along with filing Form NVTF-REV-14.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Nevada Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NVTF-REV-14 by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.