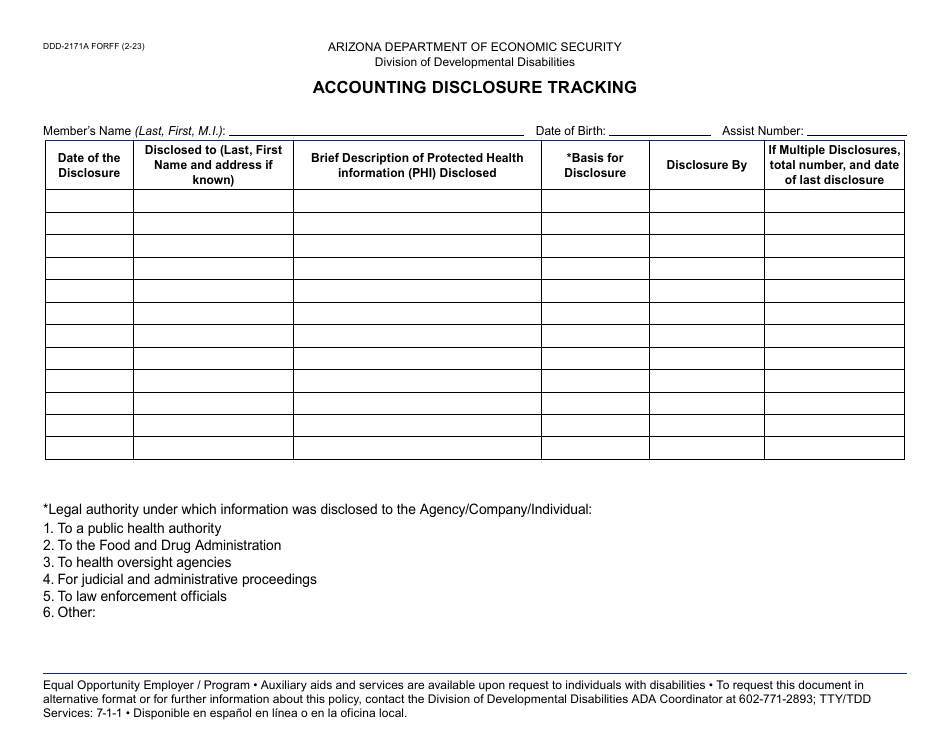

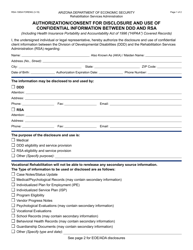

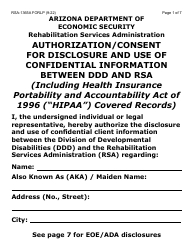

Form DDD-2171A Accounting Disclosure Tracking - Arizona

What Is Form DDD-2171A?

This is a legal form that was released by the Arizona Department of Economic Security - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DDD-2171A?

A: Form DDD-2171A is an Accounting Disclosure Tracking form.

Q: What is the purpose of Form DDD-2171A?

A: The purpose of Form DDD-2171A is to track accounting disclosures.

Q: Who is required to file Form DDD-2171A?

A: It is required to be filed by individuals or entities involved in accounting disclosures in Arizona.

Q: Is there a deadline for filing Form DDD-2171A?

A: It is recommended to file Form DDD-2171A within a specified time frame. Please refer to the instructions on the form or consult with the relevant authorities.

Q: Are there any fees associated with filing Form DDD-2171A?

A: There may be fees associated with filing Form DDD-2171A. Please check the instructions or contact the Arizona government for more information.

Q: What information do I need to provide on Form DDD-2171A?

A: Form DDD-2171A requires you to provide information related to accounting disclosures.

Q: Are there any penalties for not filing Form DDD-2171A?

A: Failure to file Form DDD-2171A or providing false information may result in penalties. It is important to comply with the filing requirements and provide accurate information.

Q: What should I do if I have further questions about Form DDD-2171A?

A: For further questions or clarifications about Form DDD-2171A, you should reach out to the relevant authorities or consult with a professional advisor.

Form Details:

- Released on February 1, 2023;

- The latest edition provided by the Arizona Department of Economic Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DDD-2171A by clicking the link below or browse more documents and templates provided by the Arizona Department of Economic Security.