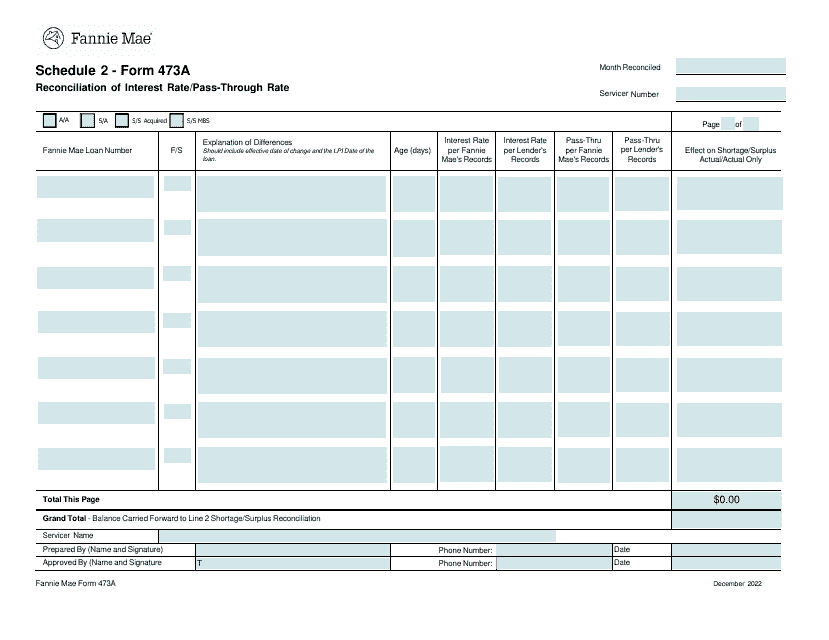

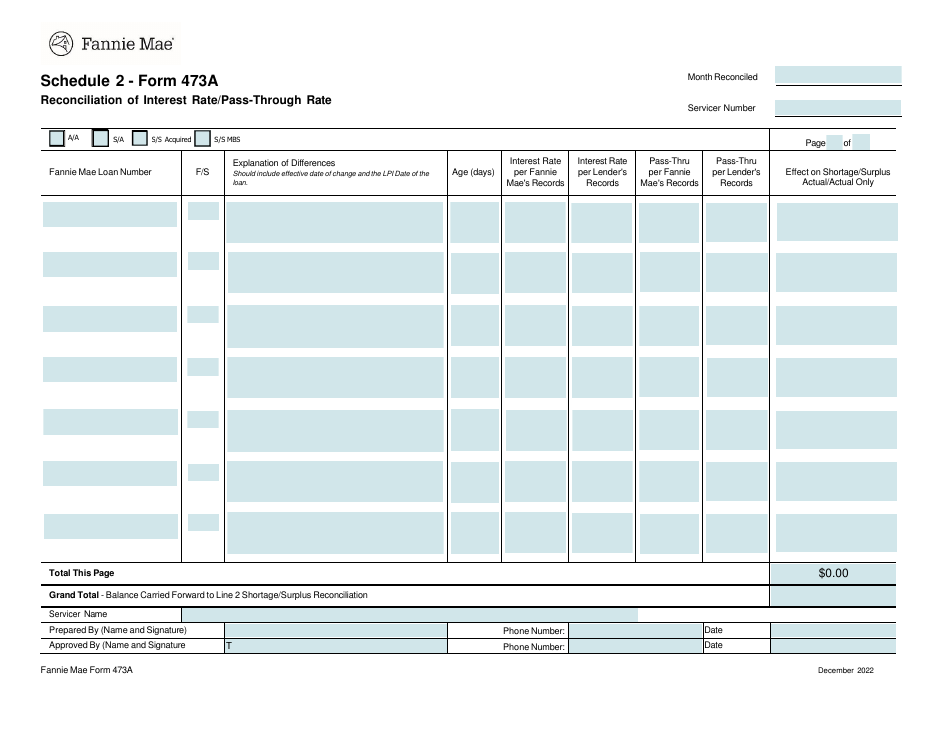

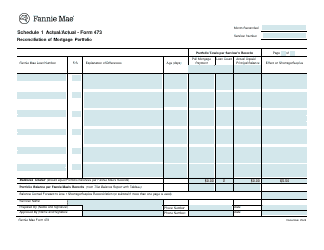

Fannie Mae Form 473A Schedule 2 Reconciliation of Interest Rate / Pass-Through Rate

What Is Fannie Mae Form 473A Schedule 2?

This is a legal form that was released by the Federal National Mortgage Association (Fannie Mae) on December 1, 2022 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Fannie Mae Form 473A Schedule 2?

A: Fannie Mae Form 473A Schedule 2 is a form used to reconcile interest rate or pass-through rate.

Q: What does the form reconcile?

A: The form reconciles interest rate or pass-through rate.

Q: Who uses Fannie Mae Form 473A Schedule 2?

A: Fannie Mae Form 473A Schedule 2 is used by mortgage lenders and investors.

Q: Is the form specific to a certain country?

A: No, the form is used in both the United States and Canada.

Q: What information is included in the form?

A: The form includes details about the interest rate or pass-through rate, as well as any changes or adjustments made.

Q: Is the form mandatory?

A: The use of Fannie Mae Form 473A Schedule 2 may be required by Fannie Mae or other mortgage investors.

Q: Can individuals fill out the form?

A: Typically, this form is completed by mortgage lenders and investors, not individual borrowers.

Q: What is the purpose of the reconciliation?

A: The reconciliation ensures that the interest rate or pass-through rate aligns with the terms of the mortgage or investment.

Q: Are there any filing fees associated with the form?

A: The form itself does not have filing fees, but there may be other costs associated with the reconciliation process.

Form Details:

- Released on December 1, 2022;

- The latest available edition released by the Federal National Mortgage Association (Fannie Mae);

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Fannie Mae Form 473A Schedule 2 by clicking the link below or browse more documents and templates provided by the Federal National Mortgage Association (Fannie Mae).