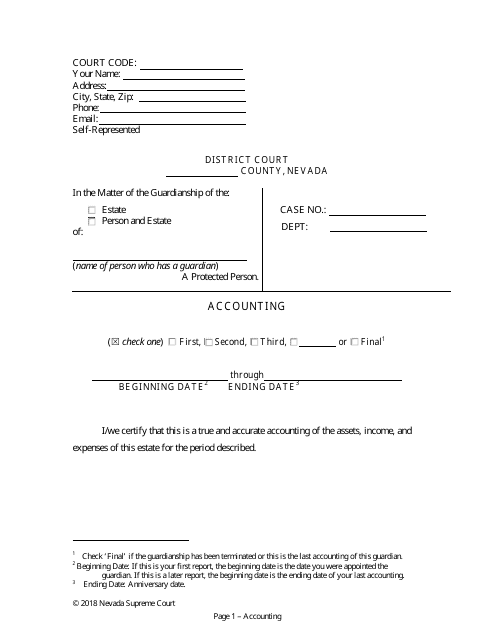

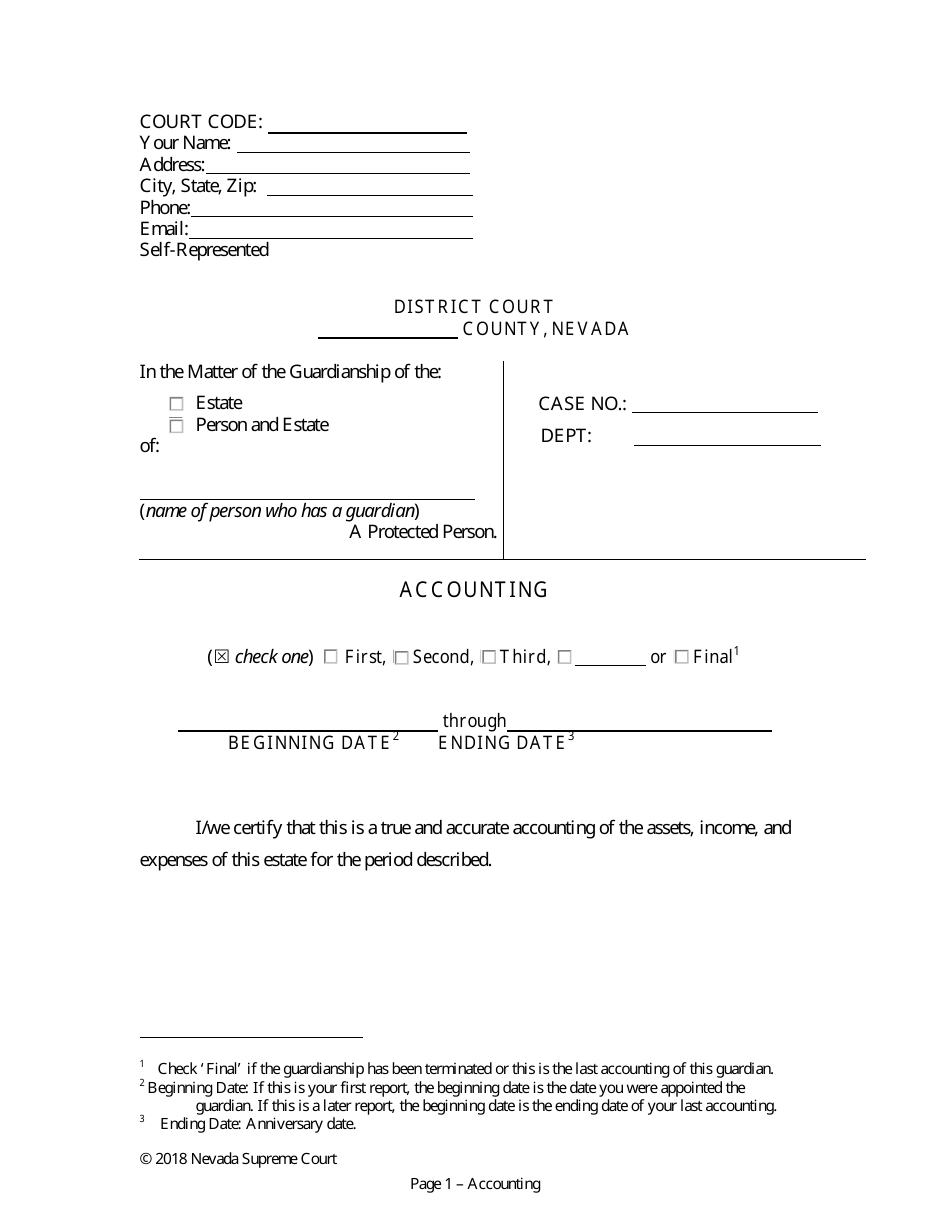

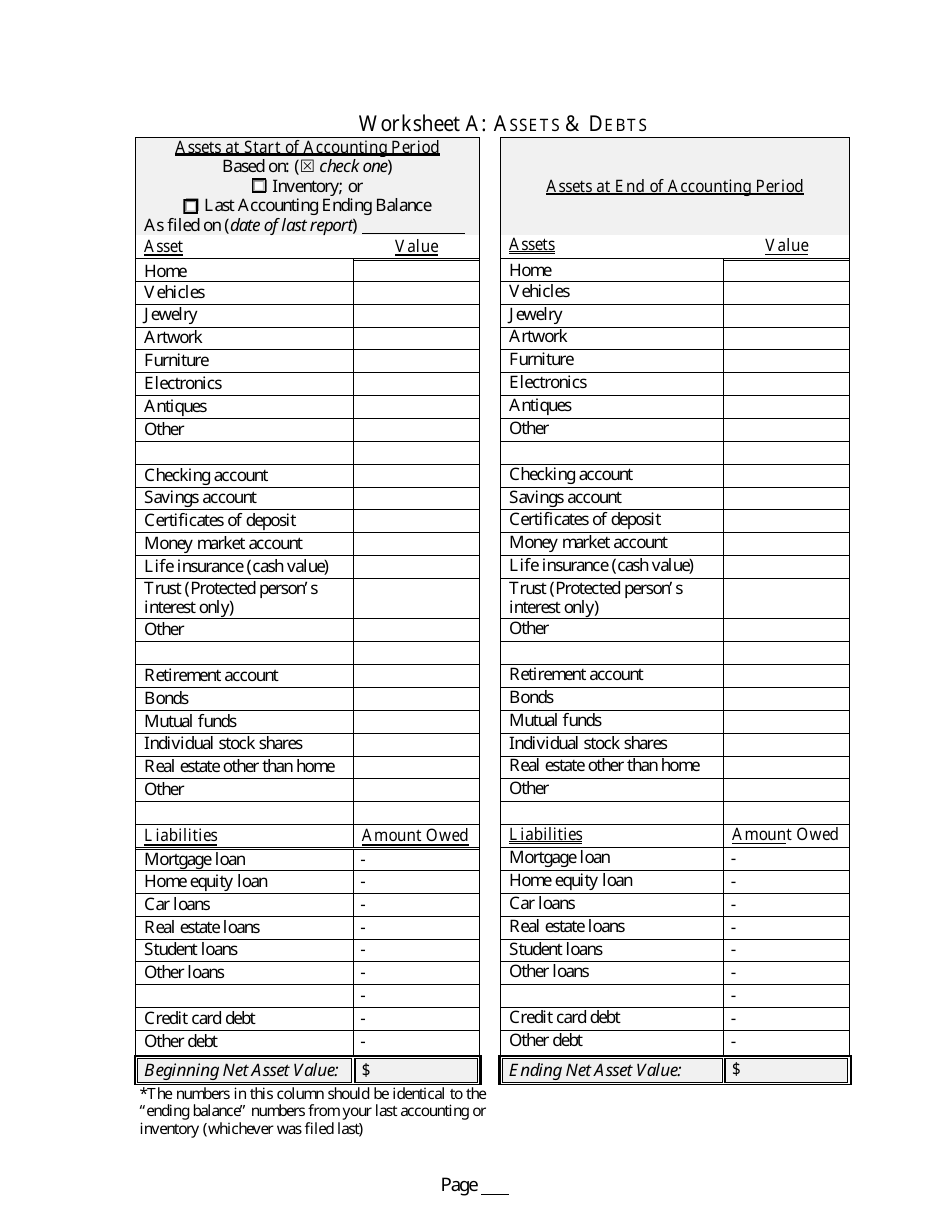

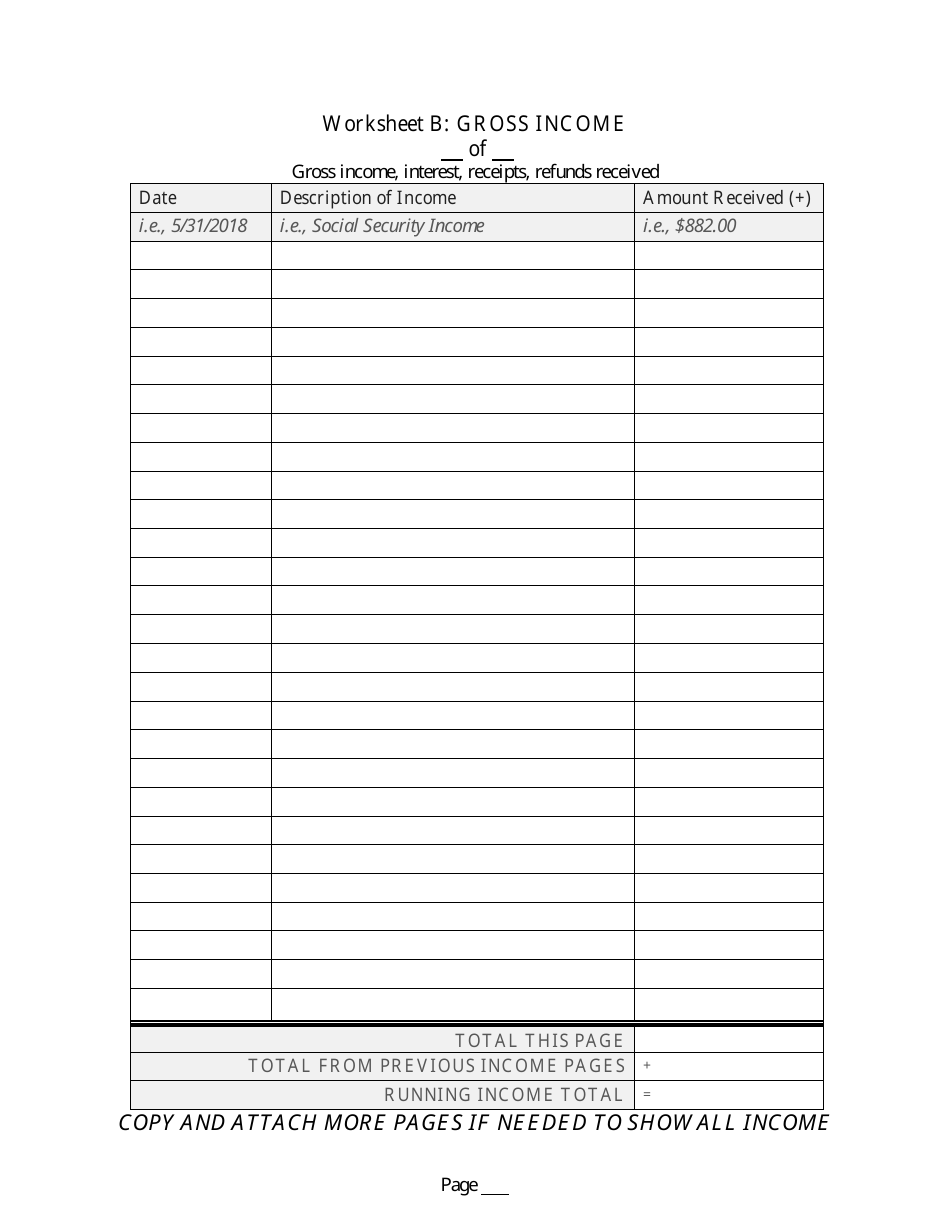

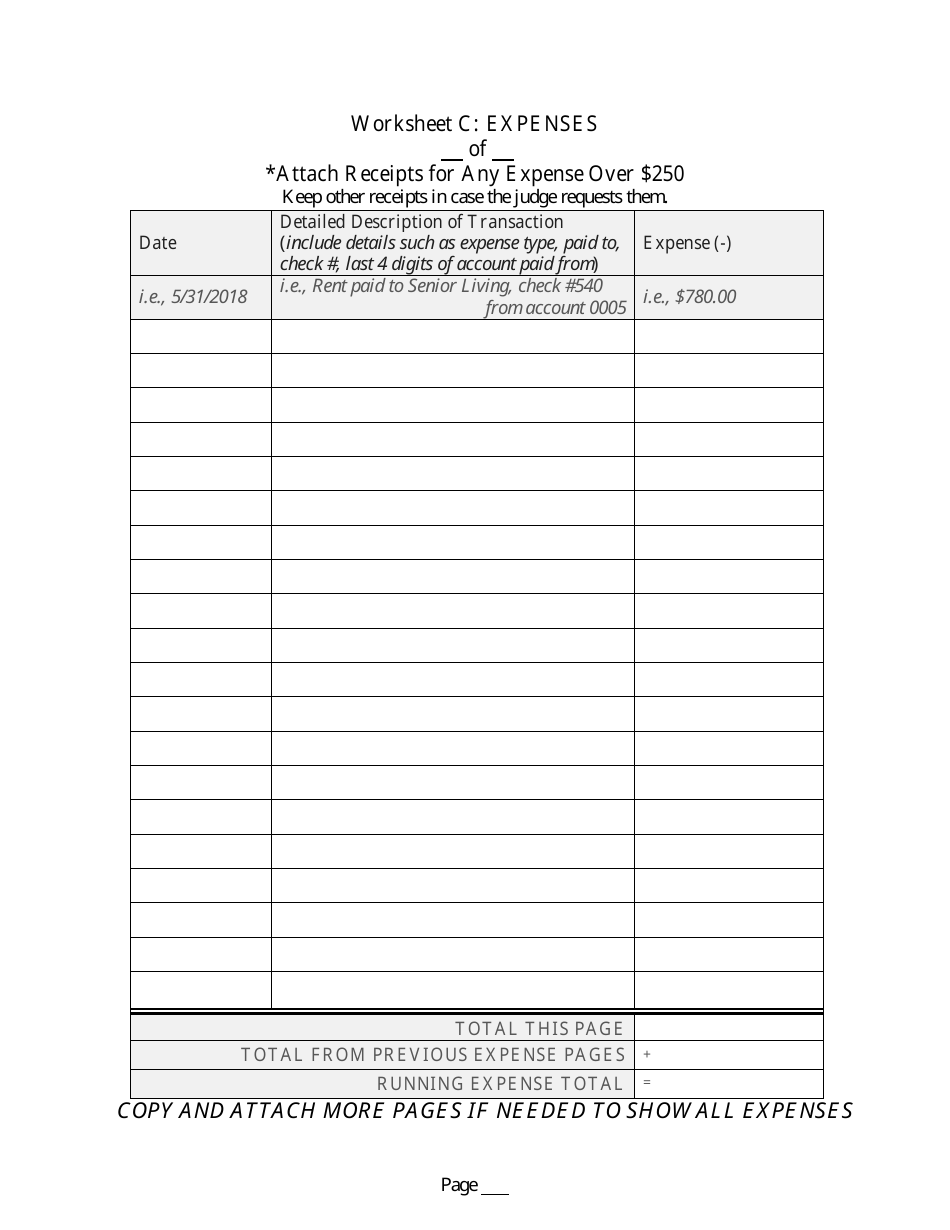

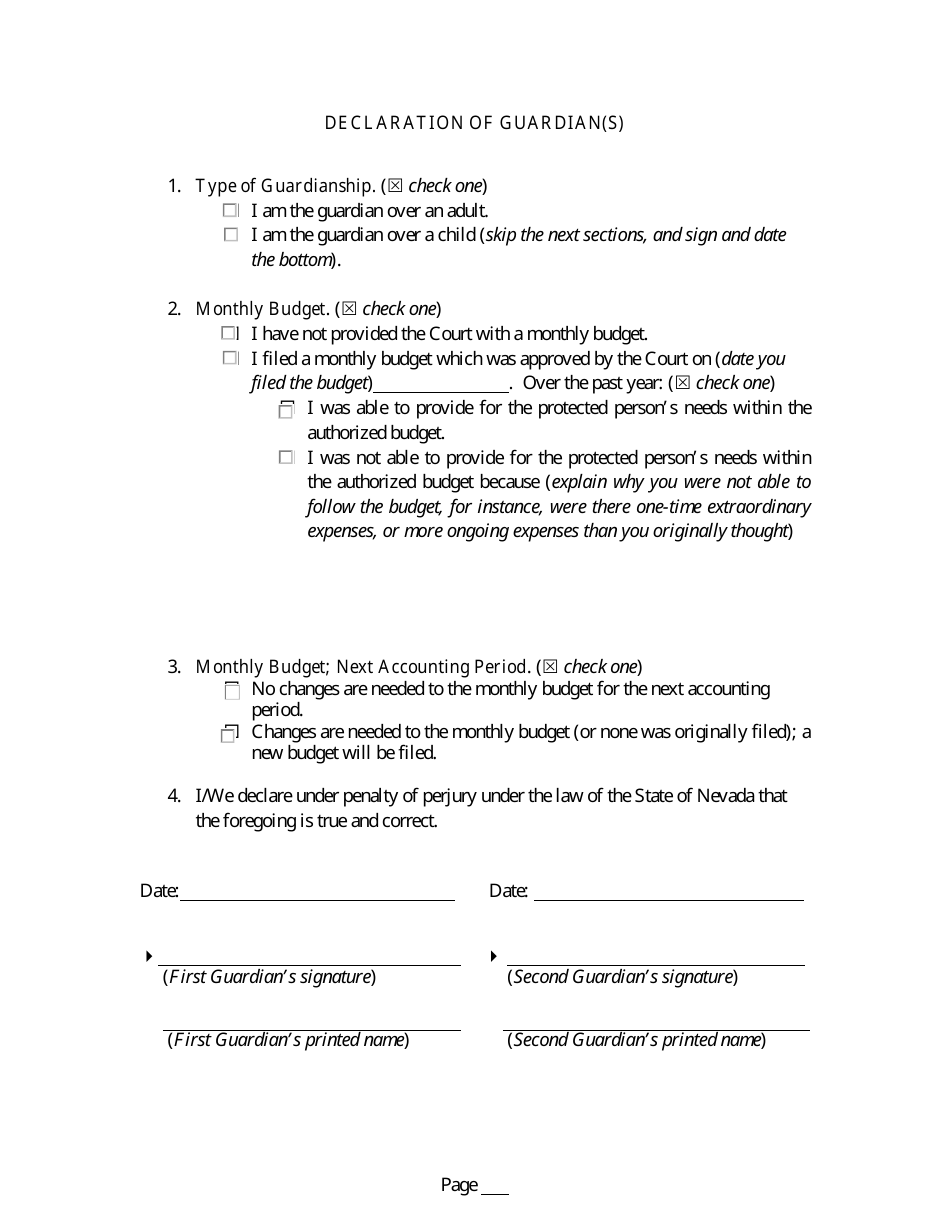

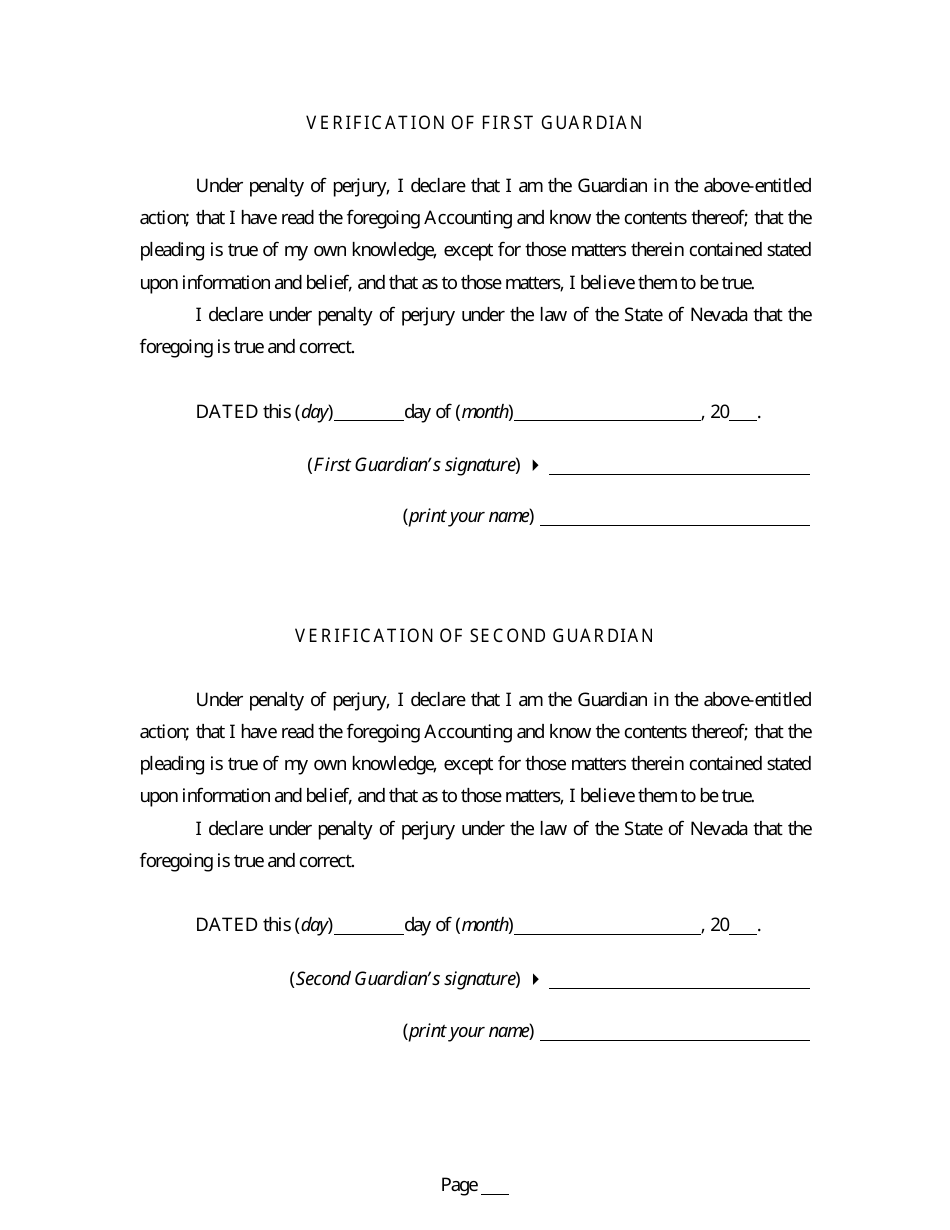

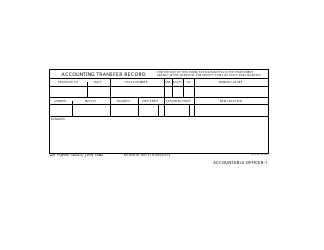

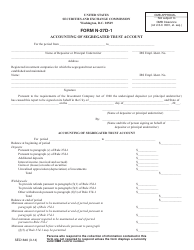

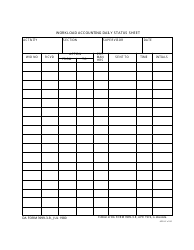

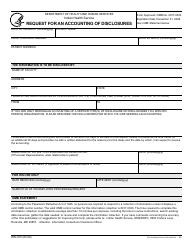

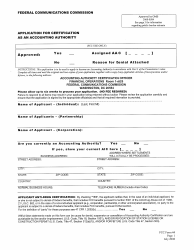

Accounting - Nevada

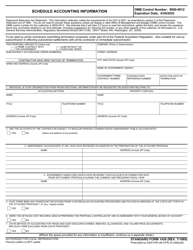

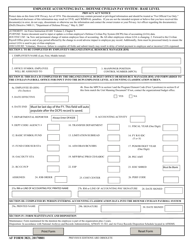

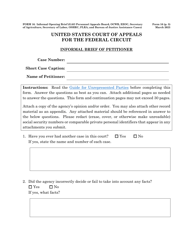

Accounting is a legal document that was released by the Nevada District Courts - a government authority operating within Nevada.

FAQ

Q: What is the sales tax rate in Nevada?

A: The sales tax rate in Nevada varies by county but can range from 6.85% to 8.375%.

Q: What is the corporate income tax rate in Nevada?

A: Nevada does not have a corporate income tax.

Q: What is the personal income tax rate in Nevada?

A: Nevada does not have a personal income tax.

Q: Are there any tax incentives for businesses in Nevada?

A: Yes, Nevada offers various tax incentives for businesses, including sales tax abatement, property tax abatement, and tax credits.

Q: Do I need a business license in Nevada?

A: Yes, most businesses in Nevada are required to have a business license.

Q: How do I register a business in Nevada?

A: To register a business in Nevada, you can file the necessary forms with the Nevada Secretary of State.

Q: What is the minimum wage in Nevada?

A: The minimum wage in Nevada is $8.75 per hour for employees who receive qualified health benefits, and $9.75 per hour for employees who do not receive qualified health benefits.

Q: Are there any special labor laws in Nevada?

A: Yes, Nevada has specific labor laws regarding overtime pay, meal breaks, and rest breaks.

Q: What are the employment taxes in Nevada?

A: Employment taxes in Nevada include federal incometax withholding, Social Security and Medicare taxes, and unemployment insurance tax.

Q: Can I deduct the sales tax on my federal income tax return?

A: Yes, you can choose to deduct either your state and local income tax or your state and local sales tax on your federal income tax return.

Form Details:

- The latest edition currently provided by the Nevada District Courts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada District Courts.