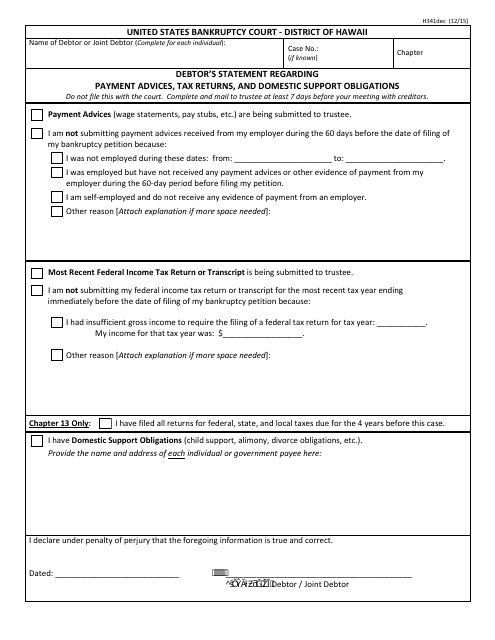

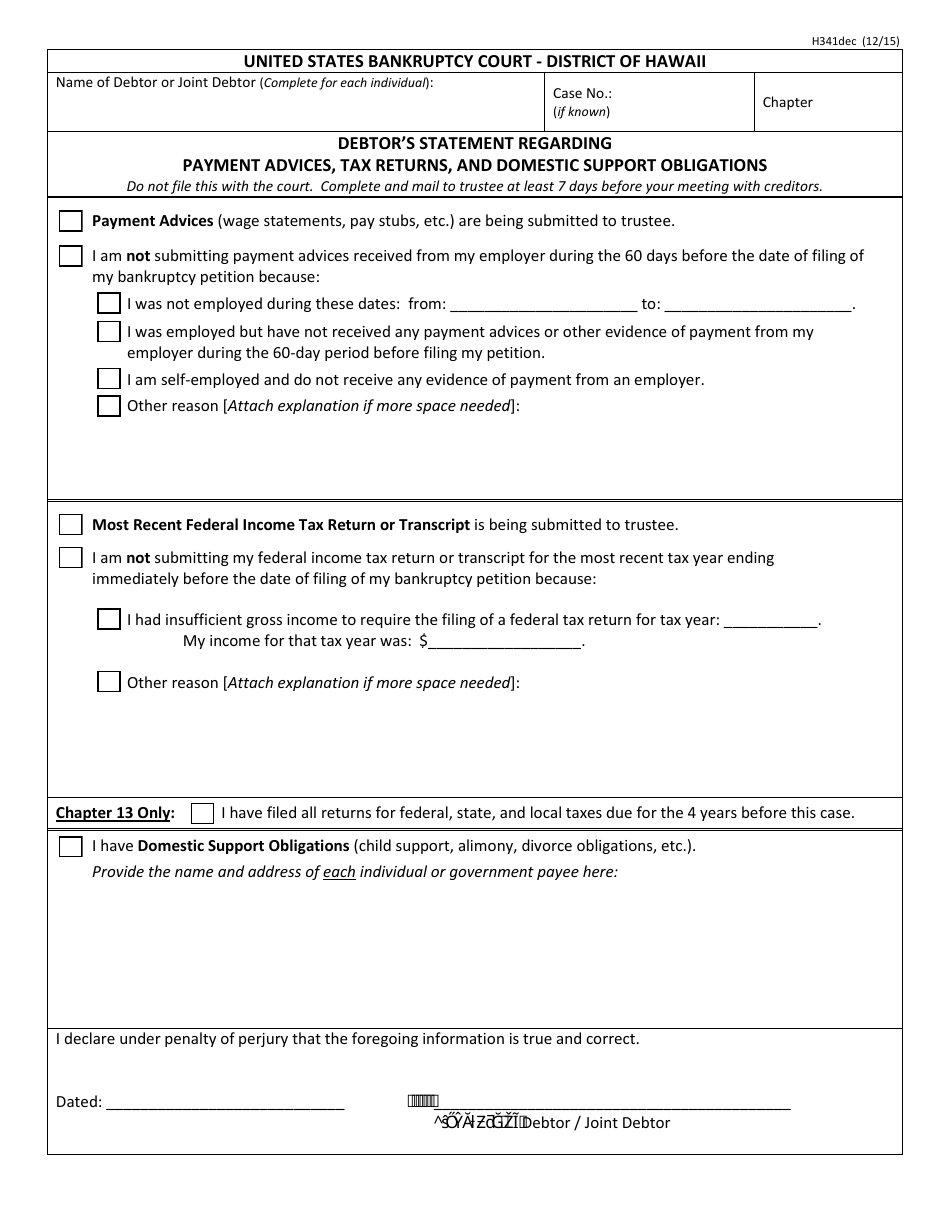

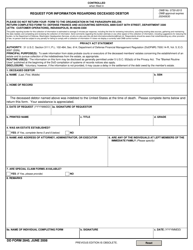

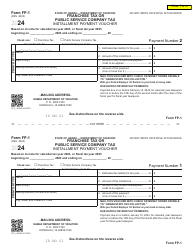

Form H341DEC Debtor's Statement Regarding Payment Advices, Tax Returns, and Domestic Support Obligations - Hawaii

What Is Form H341DEC?

This is a legal form that was released by the United States Bankruptcy Court - District of Hawaii - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form H341DEC?

A: Form H341DEC is the Debtor's Statement Regarding Payment Advices, Tax Returns, and Domestic Support Obligations specific to Hawaii.

Q: What is the purpose of Form H341DEC?

A: The purpose of Form H341DEC is to provide information about payment advices, tax returns, and domestic support obligations in relation to the debtor's bankruptcy case.

Q: Who needs to fill out Form H341DEC?

A: Debtors in Hawaii who are filing for bankruptcy need to fill out Form H341DEC.

Q: What information is required on Form H341DEC?

A: Form H341DEC requires information regarding payment advices, tax returns, and domestic support obligations of the debtor.

Q: Is Form H341DEC specific to Hawaii?

A: Yes, Form H341DEC is specific to Hawaii and is not used in other states.

Q: When should Form H341DEC be filed?

A: Form H341DEC should be filed along with the initial bankruptcy petition or as directed by the bankruptcy court.

Q: What happens if I don't fill out Form H341DEC?

A: Failure to fill out Form H341DEC may result in delays or complications in the bankruptcy process.

Q: Are there any fees associated with filing Form H341DEC?

A: There may be filing fees associated with submitting Form H341DEC, which can vary depending on the bankruptcy court.

Q: Can I seek assistance in filling out Form H341DEC?

A: Yes, you can seek assistance from a bankruptcy attorney or a legal professional to help you fill out Form H341DEC accurately.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the United States Bankruptcy Court - District of Hawaii;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form H341DEC by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court - District of Hawaii.