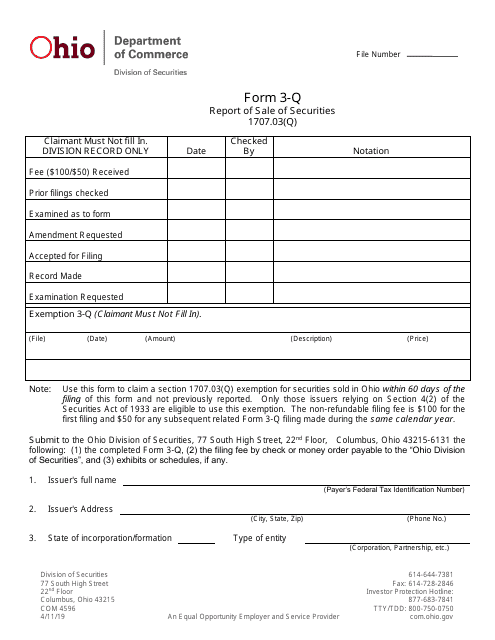

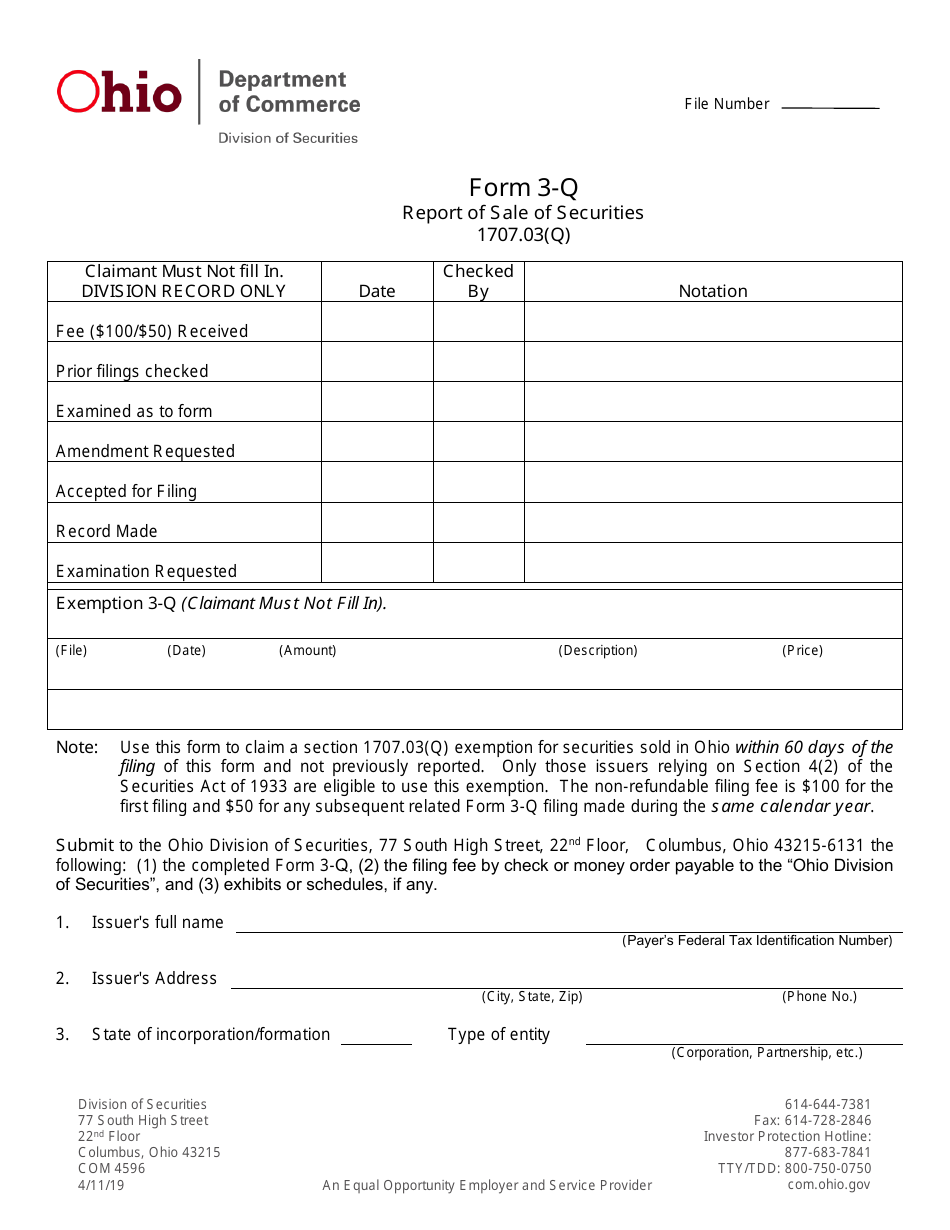

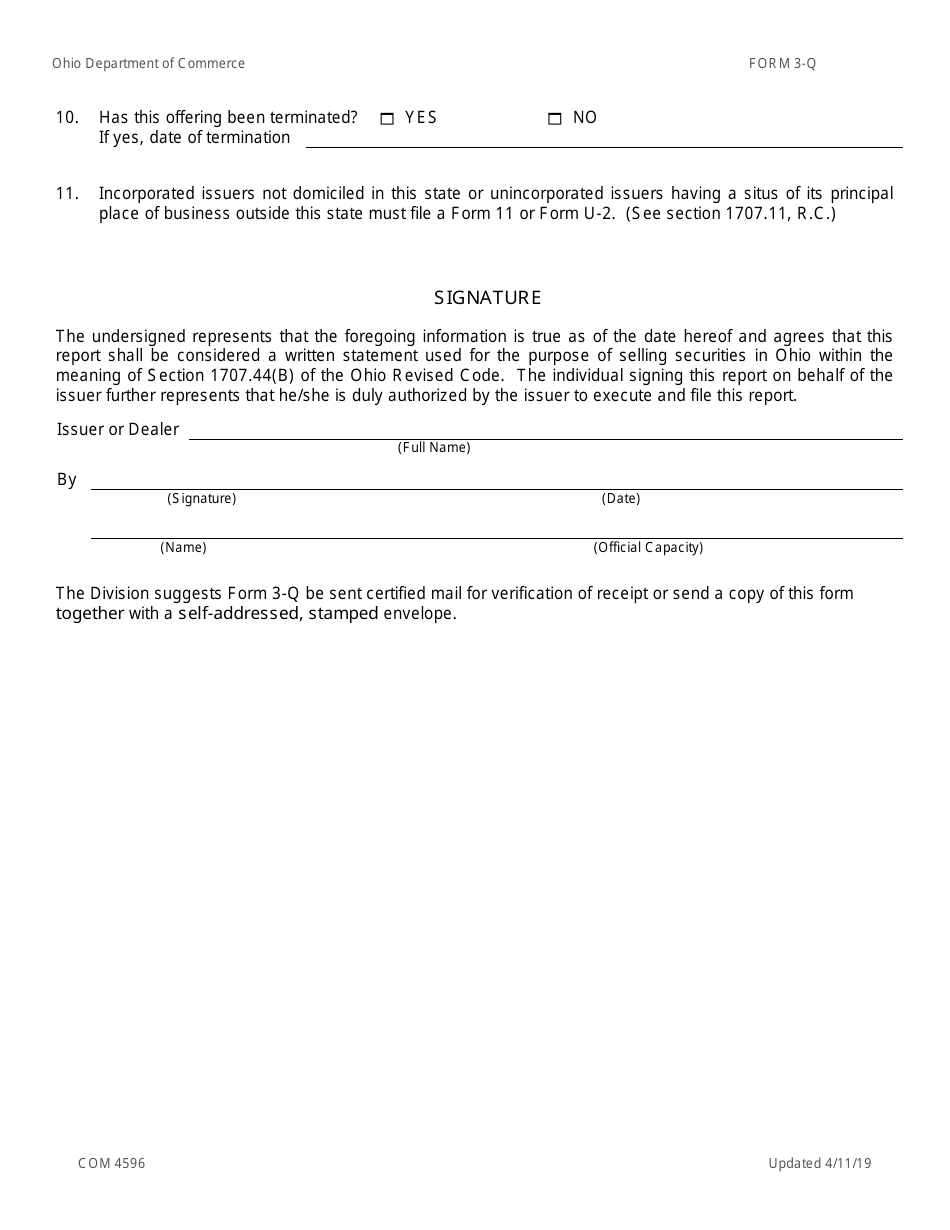

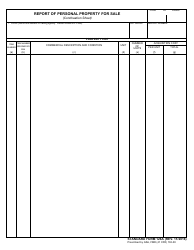

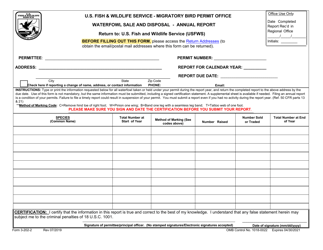

Form 3-Q (COM4596) Report of Sale of Securities - Ohio

What Is Form 3-Q (COM4596)?

This is a legal form that was released by the Ohio Department of Commerce - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3-Q (COM4596)?

A: Form 3-Q (COM4596) is a report of sale of securities specific to the state of Ohio.

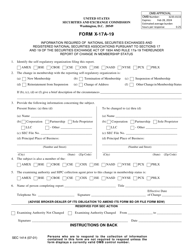

Q: Who is required to file Form 3-Q (COM4596)?

A: Individuals or entities that have sold securities in Ohio are required to file Form 3-Q (COM4596).

Q: What information does Form 3-Q (COM4596) require?

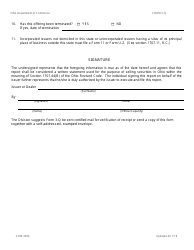

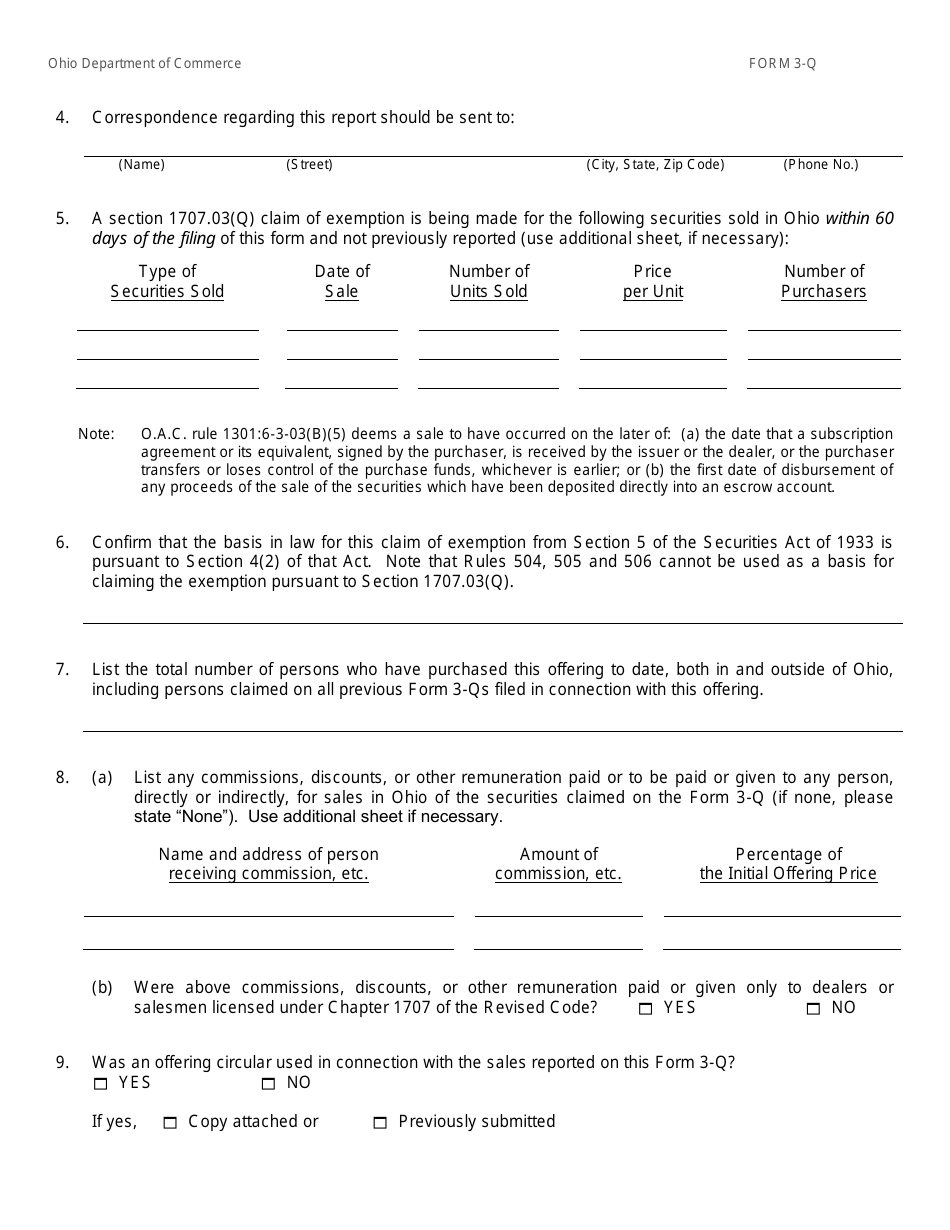

A: Form 3-Q (COM4596) requires information about the seller, the securities being sold, the sale price, and any exemptions claimed.

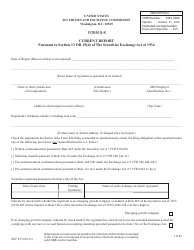

Q: When is Form 3-Q (COM4596) due?

A: Form 3-Q (COM4596) is due within 15 days after the sale of securities.

Q: Is there a fee to file Form 3-Q (COM4596)?

A: Yes, there is a fee to file Form 3-Q (COM4596). The fee amount may vary.

Q: What happens if I fail to file Form 3-Q (COM4596) or file it late?

A: Failure to file Form 3-Q (COM4596) or filing it late may result in penalties and legal consequences.

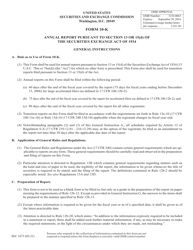

Q: Can Form 3-Q (COM4596) be filed electronically?

A: Yes, Form 3-Q (COM4596) can be filed electronically.

Q: Are there any exemptions from filing Form 3-Q (COM4596)?

A: Yes, there are certain exemptions from filing Form 3-Q (COM4596) based on the type of securities being sold and the amount of the sale.

Form Details:

- Released on April 11, 2019;

- The latest edition provided by the Ohio Department of Commerce;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3-Q (COM4596) by clicking the link below or browse more documents and templates provided by the Ohio Department of Commerce.