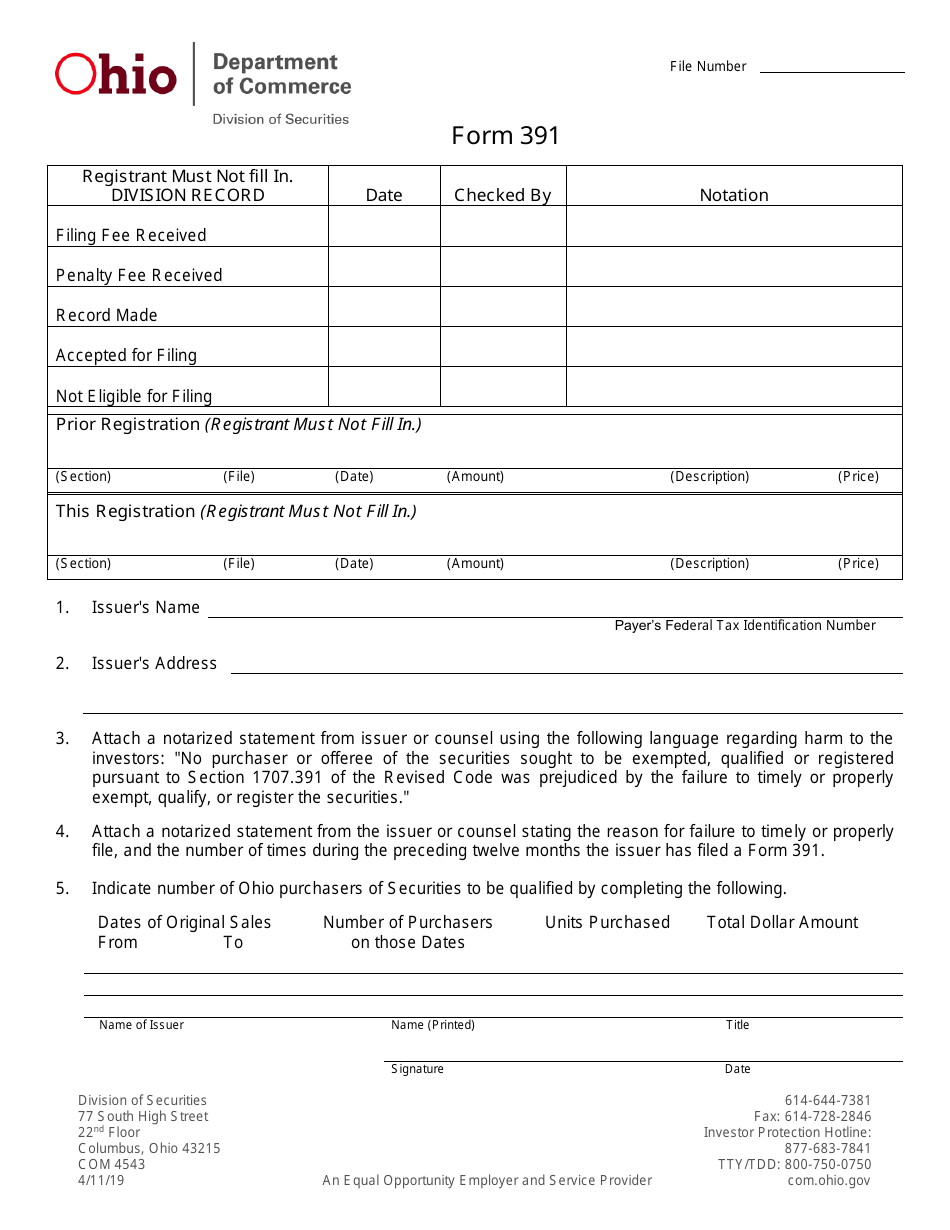

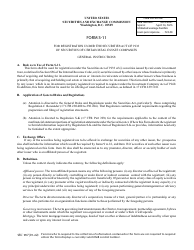

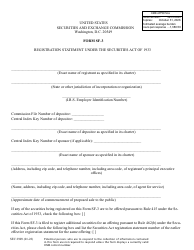

Form 391 (COM4543) Corrective Filings Under the Ohio Securities Act Second Form - Ohio

What Is Form 391 (COM4543)?

This is a legal form that was released by the Ohio Department of Commerce - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 391?

A: Form 391 is a corrective filing under the Ohio Securities Act.

Q: Who can file Form 391?

A: Any individual or entity who needs to make corrections under the Ohio Securities Act.

Q: What is the purpose of Form 391?

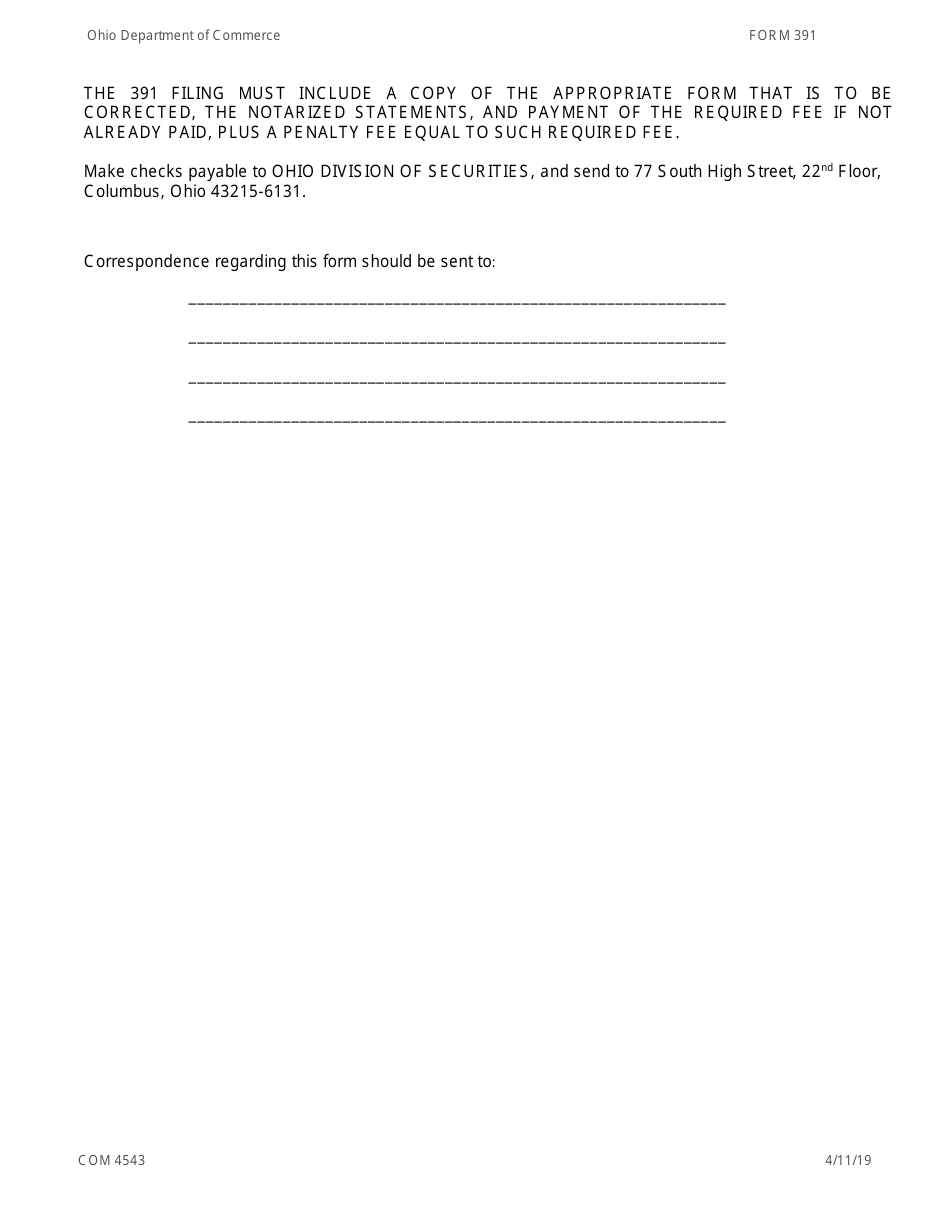

A: The purpose of Form 391 is to provide a means for making corrections to previously filed documents under the Ohio Securities Act.

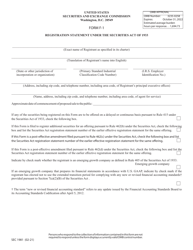

Q: What is the Second Form of Form 391?

A: The Second Form of Form 391 is used for additional corrective filings under the Ohio Securities Act.

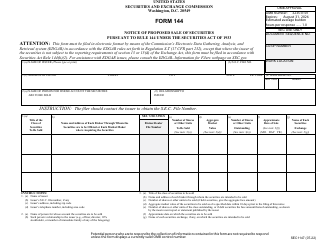

Q: Are there any specific requirements for filing Form 391?

A: Yes, filers must provide accurate and complete information regarding the correction being made.

Q: Is there a fee for filing Form 391?

A: Yes, there is a fee associated with filing Form 391.

Q: Who should I contact for more information about Form 391?

A: For more information about Form 391, you should contact the Ohio Division of Securities.

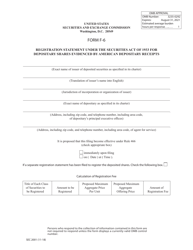

Form Details:

- Released on April 11, 2019;

- The latest edition provided by the Ohio Department of Commerce;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 391 (COM4543) by clicking the link below or browse more documents and templates provided by the Ohio Department of Commerce.