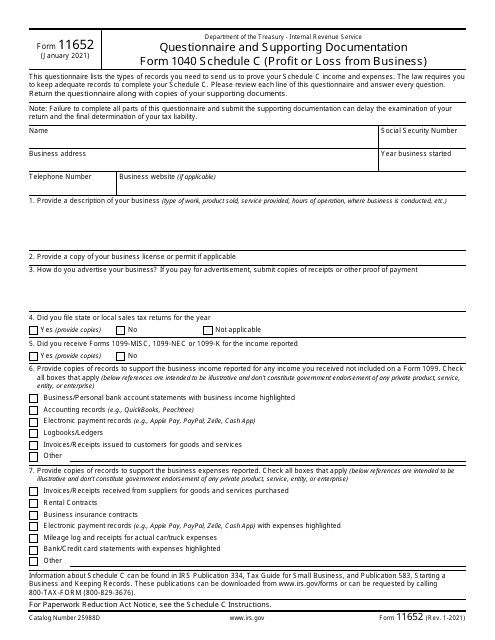

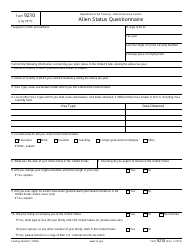

IRS Form 11652 Questionnaire and Supporting Documentation Form 1040 Schedule C (Profit or Loss From Business)

What Is IRS Form 11652?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2021. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

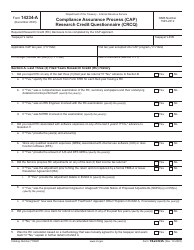

Q: What is IRS Form 11652?

A: IRS Form 11652 is a questionnaire and supporting documentation form.

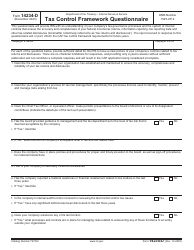

Q: What is the purpose of IRS Form 11652?

A: The purpose of IRS Form 11652 is to provide additional information and supporting documents for Form 1040 Schedule C.

Q: What is Form 1040 Schedule C?

A: Form 1040 Schedule C is used to report profits or losses from a business.

Q: Why do I need to fill out IRS Form 11652?

A: You may need to fill out IRS Form 11652 if the IRS requests additional information or supporting documents for your business income reported on Form 1040 Schedule C.

Q: Is IRS Form 11652 required for everyone who files Form 1040 Schedule C?

A: No, IRS Form 11652 is only required if the IRS specifically requests it.

Q: What kind of supporting documents should I include with IRS Form 11652?

A: You should include any documents that support the income and expenses reported on your Form 1040 Schedule C, such as receipts, invoices, and bank statements.

Q: Can I e-file IRS Form 11652?

A: As of now, IRS Form 11652 cannot be e-filed. You must mail it to the IRS along with any supporting documents.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 11652 through the link below or browse more documents in our library of IRS Forms.