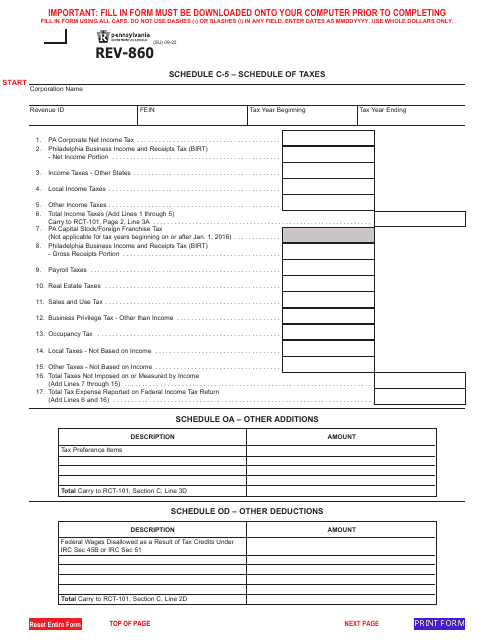

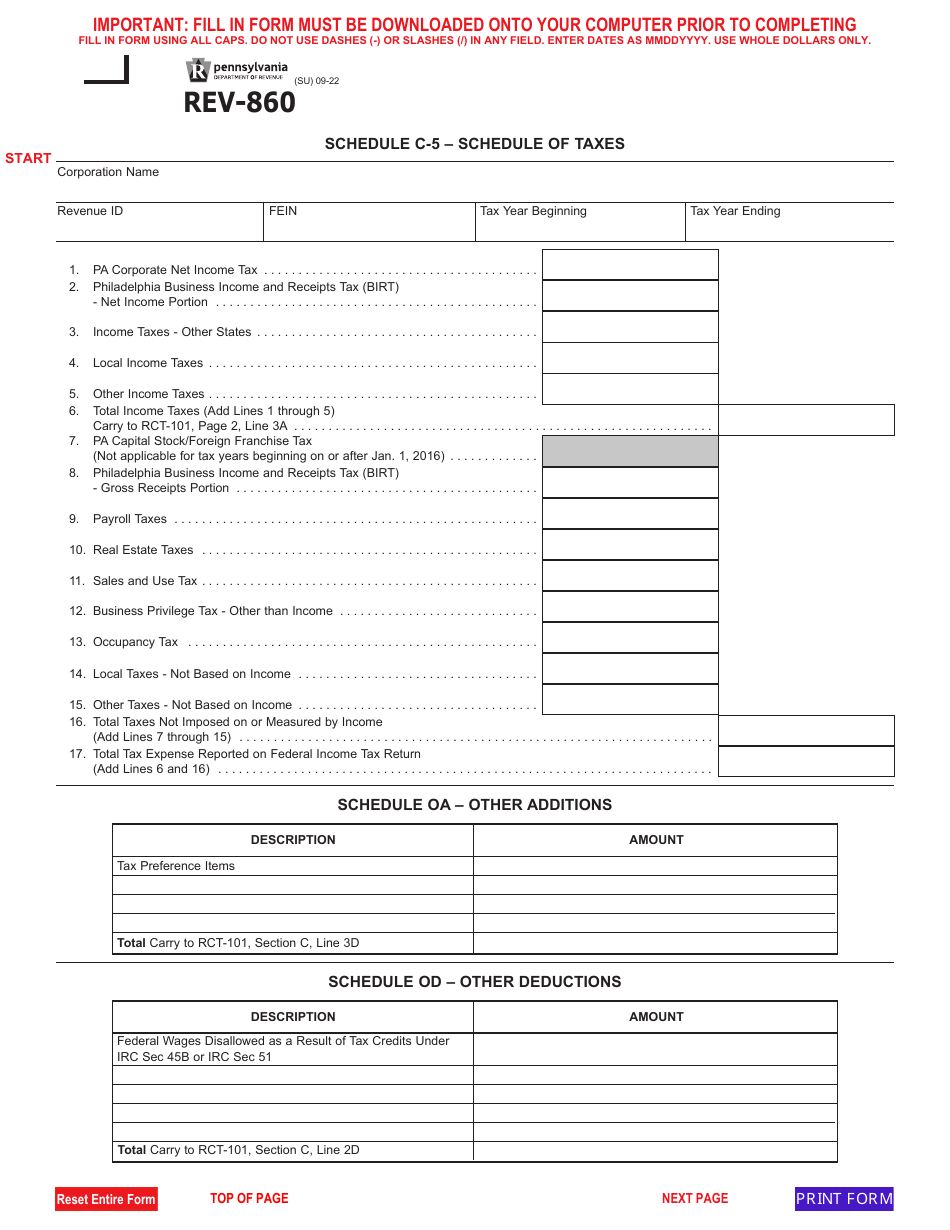

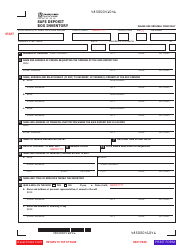

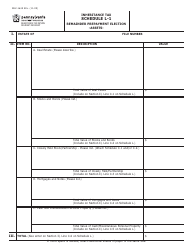

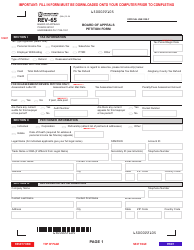

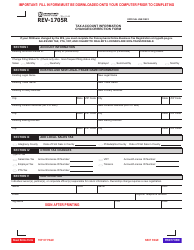

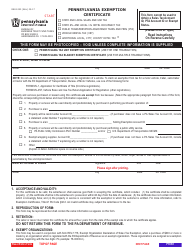

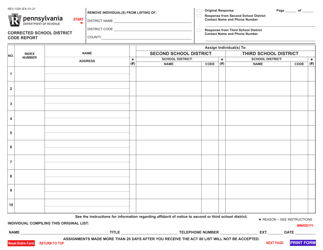

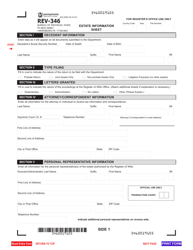

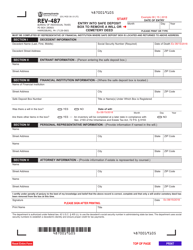

Form REV-860 Schedule C-5, OA, OD - Pennsylvania

What Is Form REV-860 Schedule C-5, OA, OD?

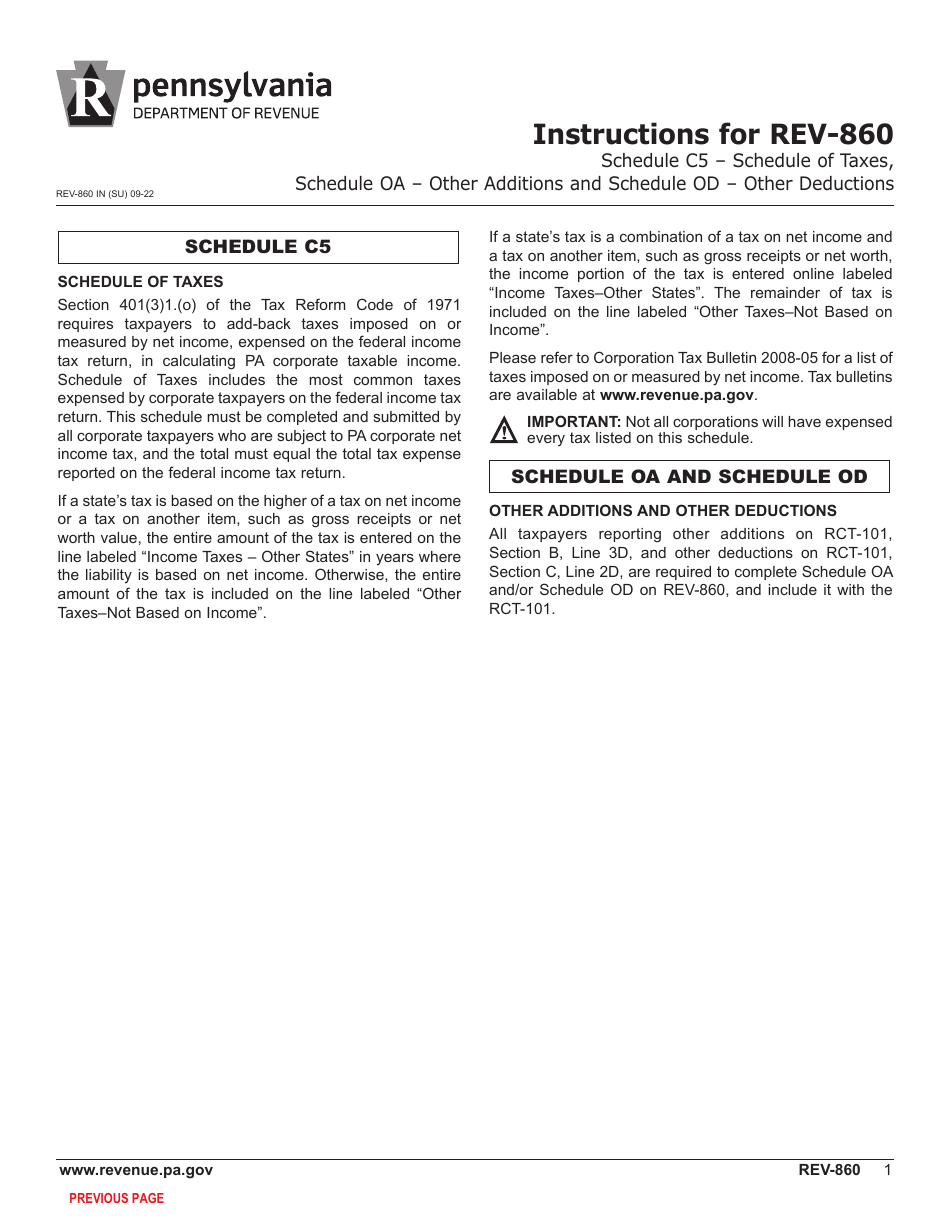

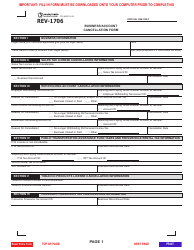

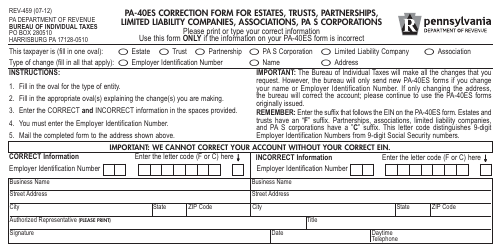

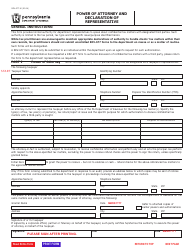

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form REV-860, C-5 Schedule of Taxes. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-860 Schedule C-5, OA, OD?

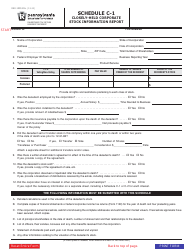

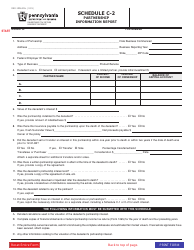

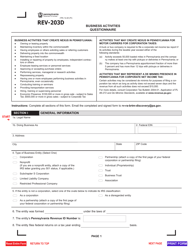

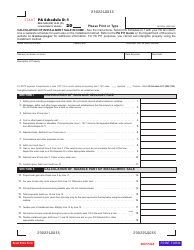

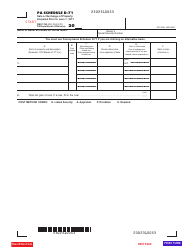

A: Form REV-860 Schedule C-5, OA, OD is a tax form used in Pennsylvania for reporting miscellaneous business income and expenses.

Q: Who needs to file Form REV-860 Schedule C-5, OA, OD?

A: Individuals and businesses in Pennsylvania who have miscellaneous business income and expenses need to file Form REV-860 Schedule C-5, OA, OD.

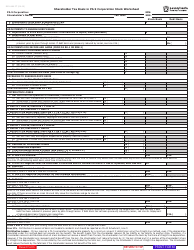

Q: What type of income and expenses are reported on Form REV-860 Schedule C-5, OA, OD?

A: Form REV-860 Schedule C-5, OA, OD is used to report income and expenses from sources such as freelance work, rental properties, and self-employment.

Q: When is the deadline for filing Form REV-860 Schedule C-5, OA, OD?

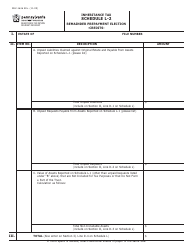

A: The deadline for filing Form REV-860 Schedule C-5, OA, OD is typically April 15th of each year, unless an extension has been granted.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-860 Schedule C-5, OA, OD by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.