This version of the form is not currently in use and is provided for reference only. Download this version of

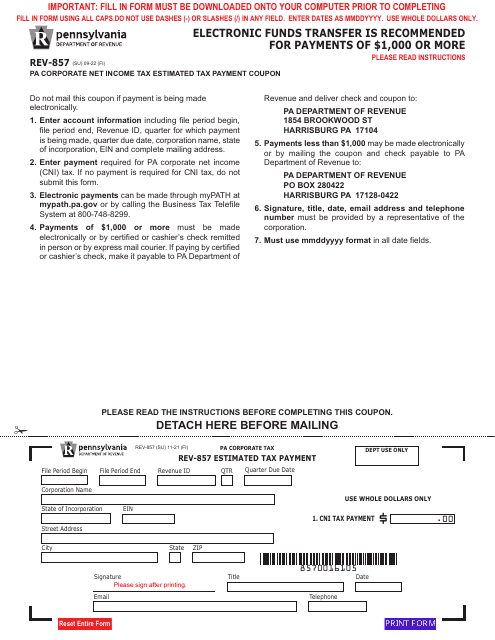

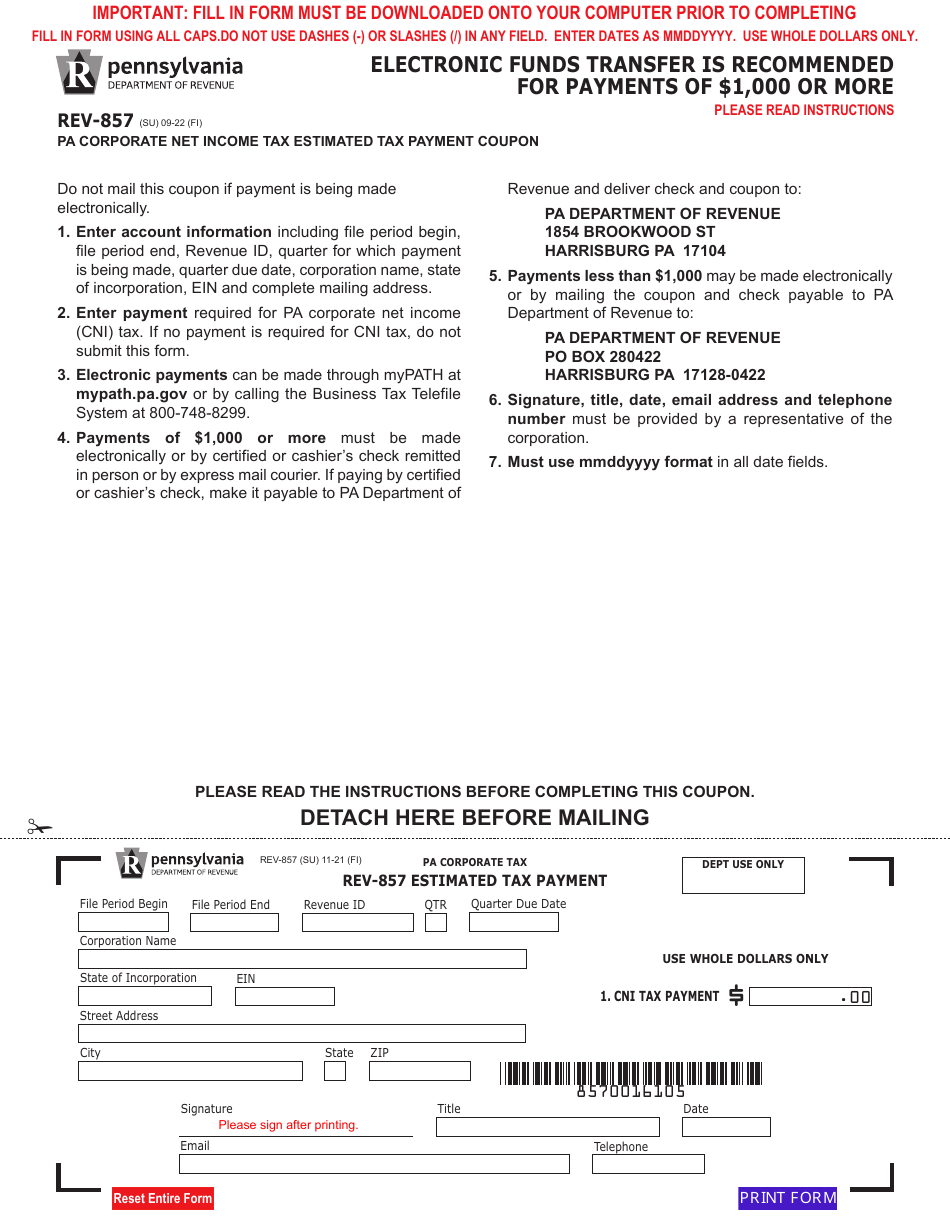

Form REV-857

for the current year.

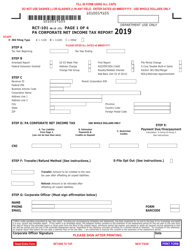

Form REV-857 Pa Corporate Net Income Tax Estimated Tax Payment Coupon - Pennsylvania

What Is Form REV-857?

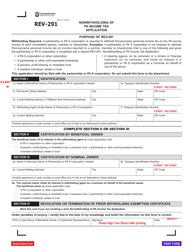

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-857?

A: Form REV-857 is a tax payment coupon used for making estimated tax payments for the Pennsylvania Corporate Net Income Tax.

Q: Who needs to use Form REV-857?

A: This form is used by corporations in Pennsylvania that are required to make estimated tax payments for the Corporate Net Income Tax.

Q: What is the purpose of Form REV-857?

A: The purpose of Form REV-857 is to allow corporations to submit their estimated tax payments for the Pennsylvania Corporate Net Income Tax.

Q: When should Form REV-857 be filed?

A: Form REV-857 should be filed quarterly, on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

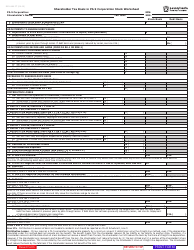

Q: What information is required on Form REV-857?

A: Form REV-857 requires the corporation's name, address, tax year, payment amount, and other identifying information.

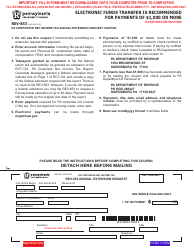

Q: Can Form REV-857 be filed electronically?

A: Yes, corporations can file Form REV-857 electronically through the PA Tax E-File system.

Q: Are there penalties for late or underpayment of estimated taxes?

A: Yes, there may be penalties for late or underpayment of estimated taxes. It is important to submit timely and accurate payments.

Q: Is Form REV-857 used for any other taxes in Pennsylvania?

A: No, Form REV-857 is specifically for the Pennsylvania Corporate Net Income Tax estimated payments.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-857 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.