This version of the form is not currently in use and is provided for reference only. Download this version of

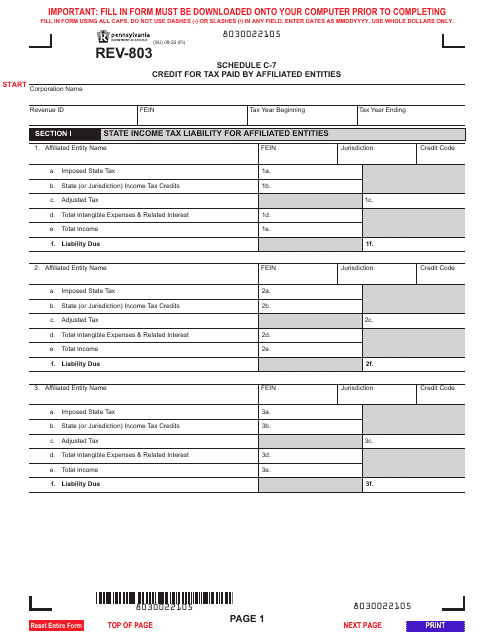

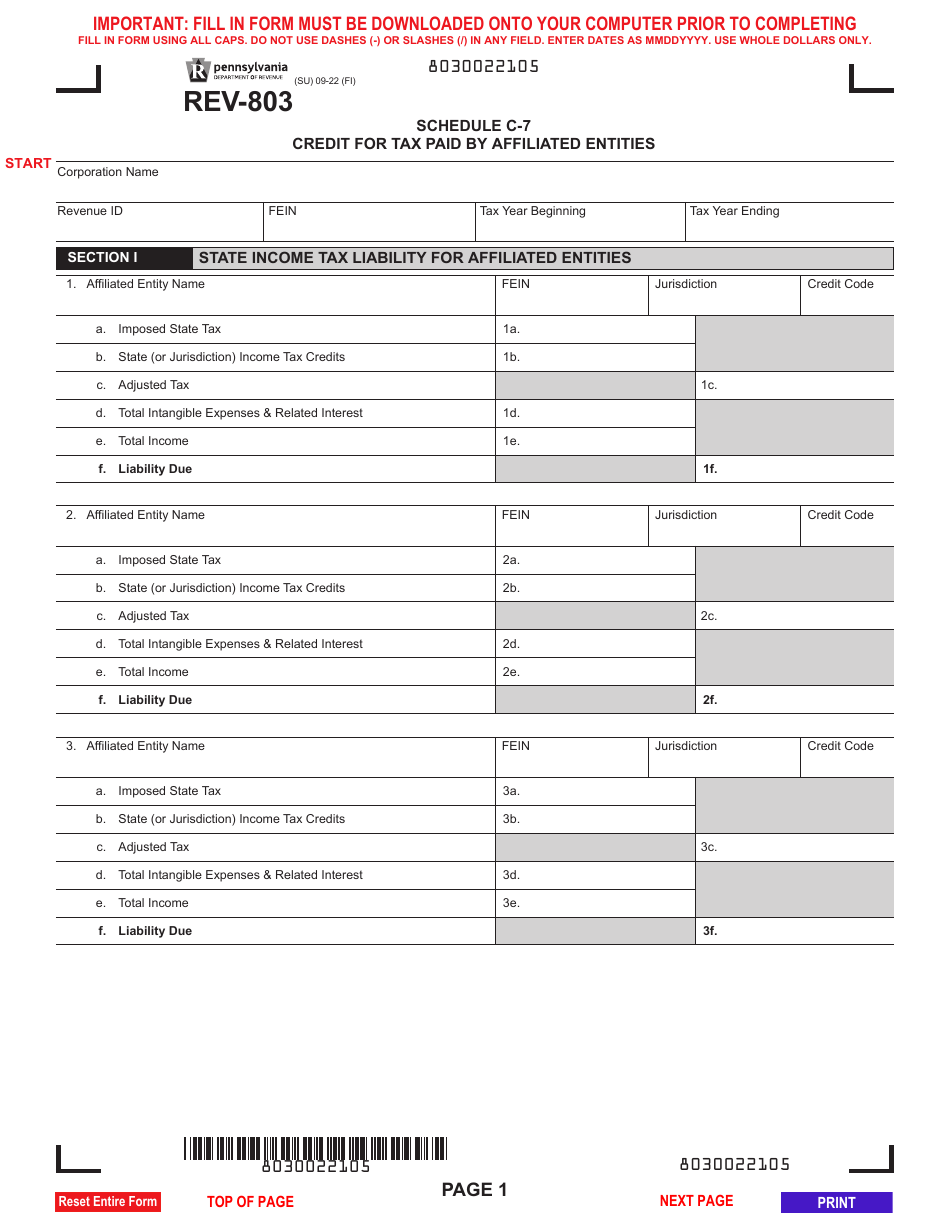

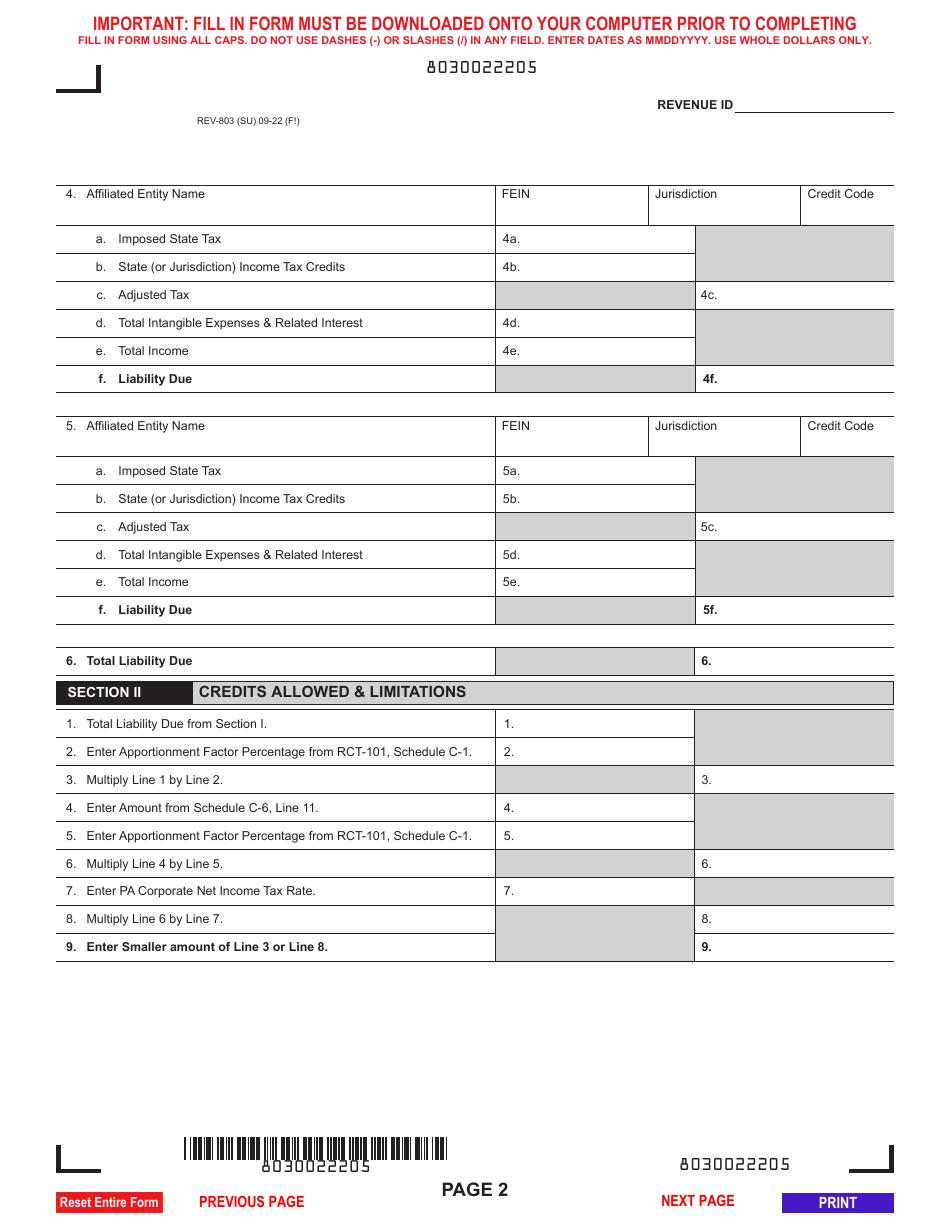

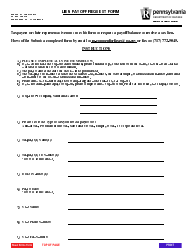

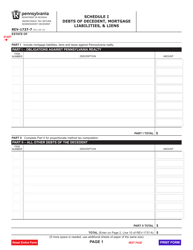

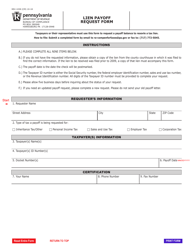

Form REV-803 Schedule C-7

for the current year.

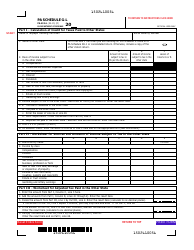

Form REV-803 Schedule C-7 Credit for Tax Paid by Affiliated Entities - Pennsylvania

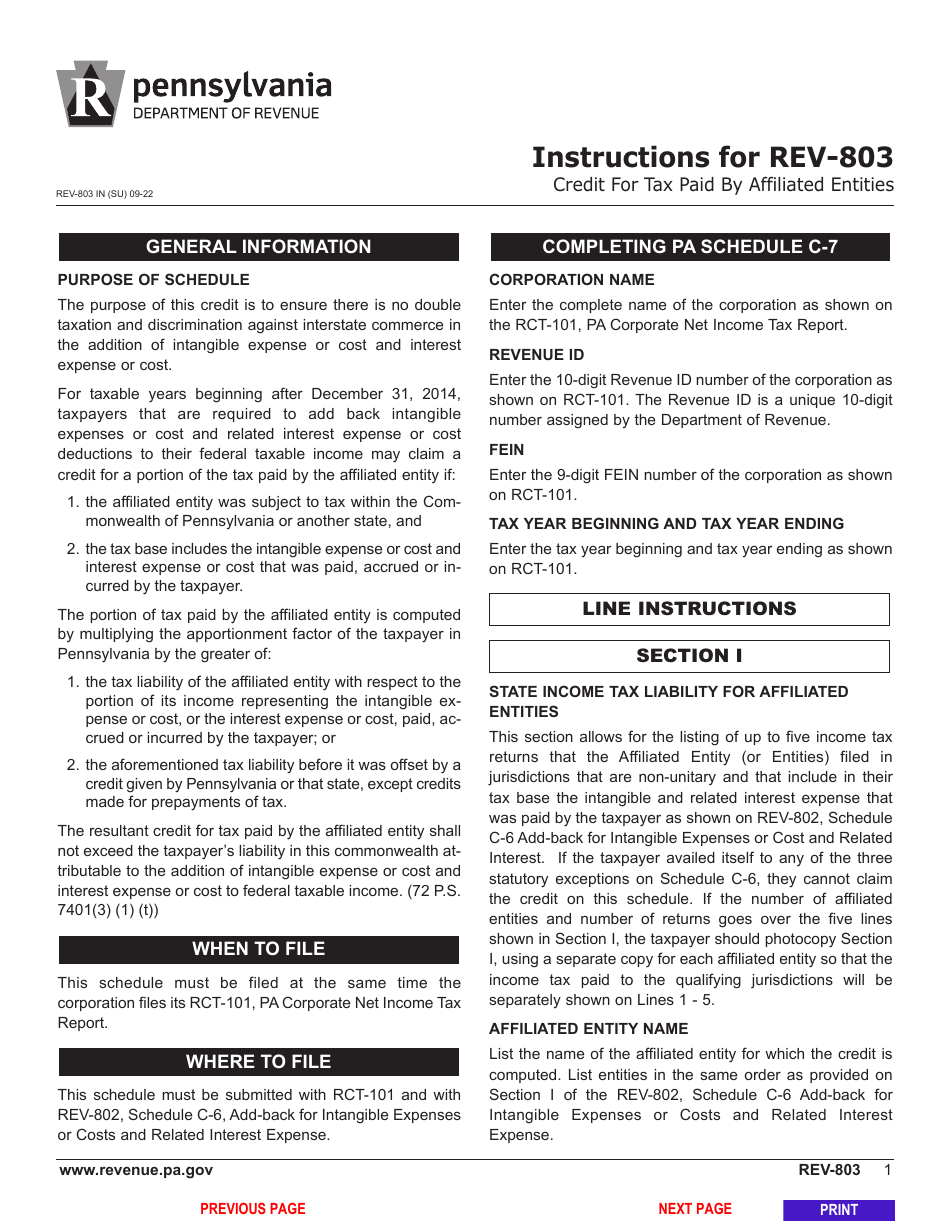

What Is Form REV-803 Schedule C-7?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-803 Schedule C-7?

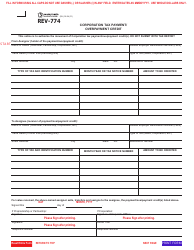

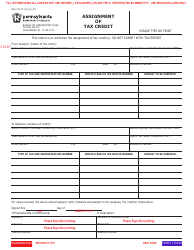

A: Form REV-803 Schedule C-7 is a tax form used in Pennsylvania to claim a credit for tax paid by affiliated entities.

Q: What is the purpose of Form REV-803 Schedule C-7?

A: The purpose of Form REV-803 Schedule C-7 is to calculate and claim a credit for tax paid by affiliated entities in Pennsylvania.

Q: Who needs to file Form REV-803 Schedule C-7?

A: Anyone who has paid taxes on behalf of affiliated entities in Pennsylvania may need to file Form REV-803 Schedule C-7 to claim a credit for those taxes.

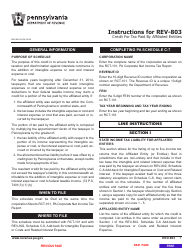

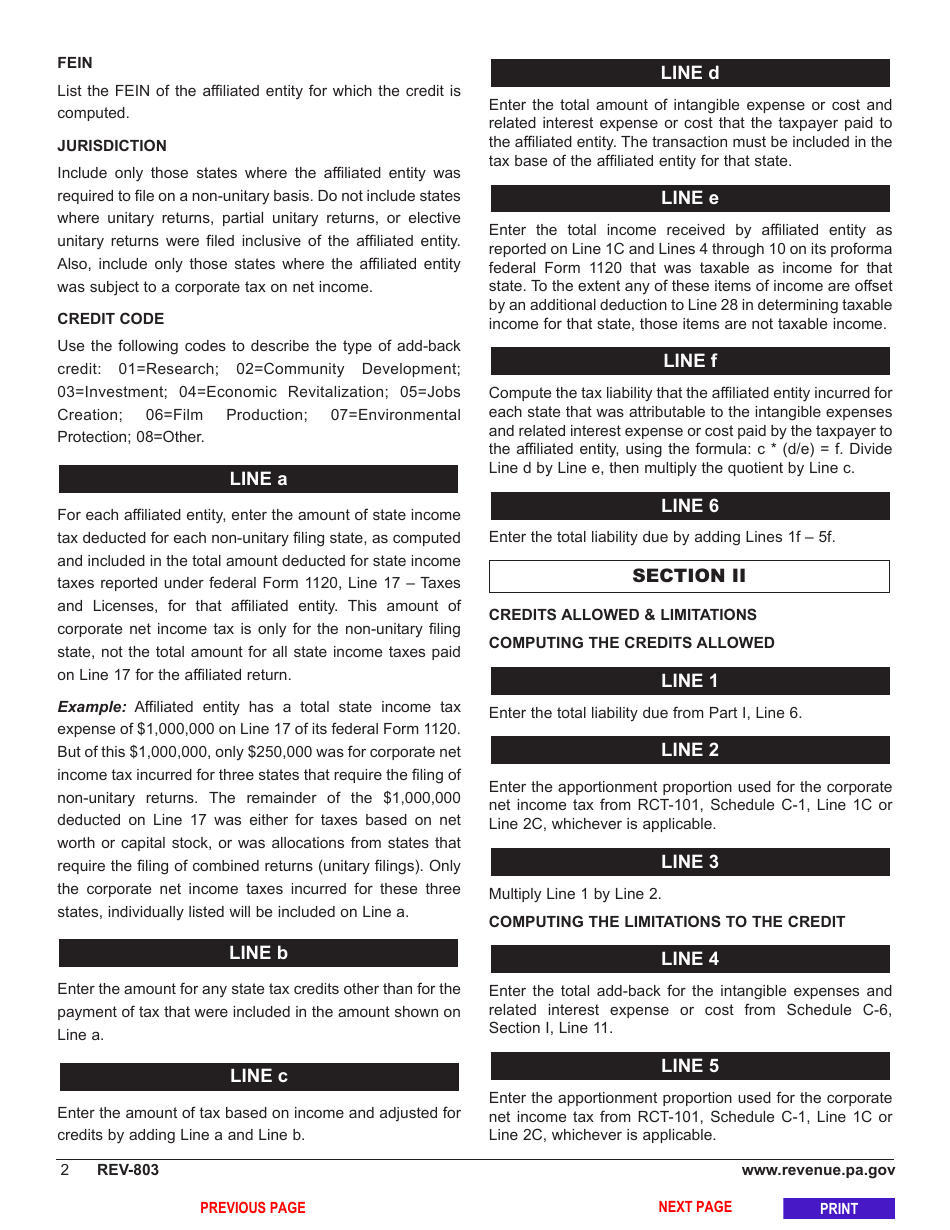

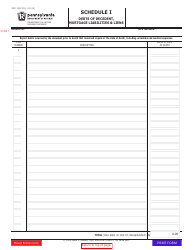

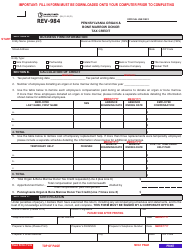

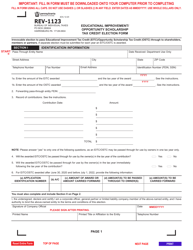

Q: What information is required to complete Form REV-803 Schedule C-7?

A: To complete Form REV-803 Schedule C-7, you will need to provide details about the affiliated entities and the taxes paid on their behalf.

Q: Are there any special considerations when filling out Form REV-803 Schedule C-7?

A: Yes, you should carefully review the instructions provided with the form to ensure accurate completion.

Q: When is the deadline to file Form REV-803 Schedule C-7?

A: The deadline to file Form REV-803 Schedule C-7 is usually the same as the deadline for filing your Pennsylvania tax return.

Q: Is Form REV-803 Schedule C-7 only applicable in Pennsylvania?

A: Yes, Form REV-803 Schedule C-7 is specific to Pennsylvania tax purposes only.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-803 Schedule C-7 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.