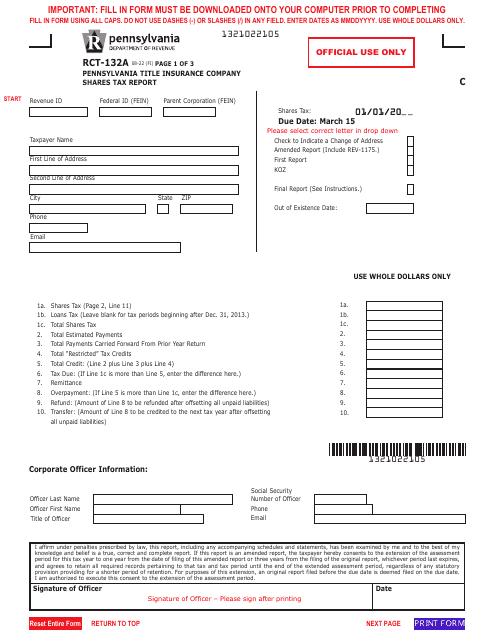

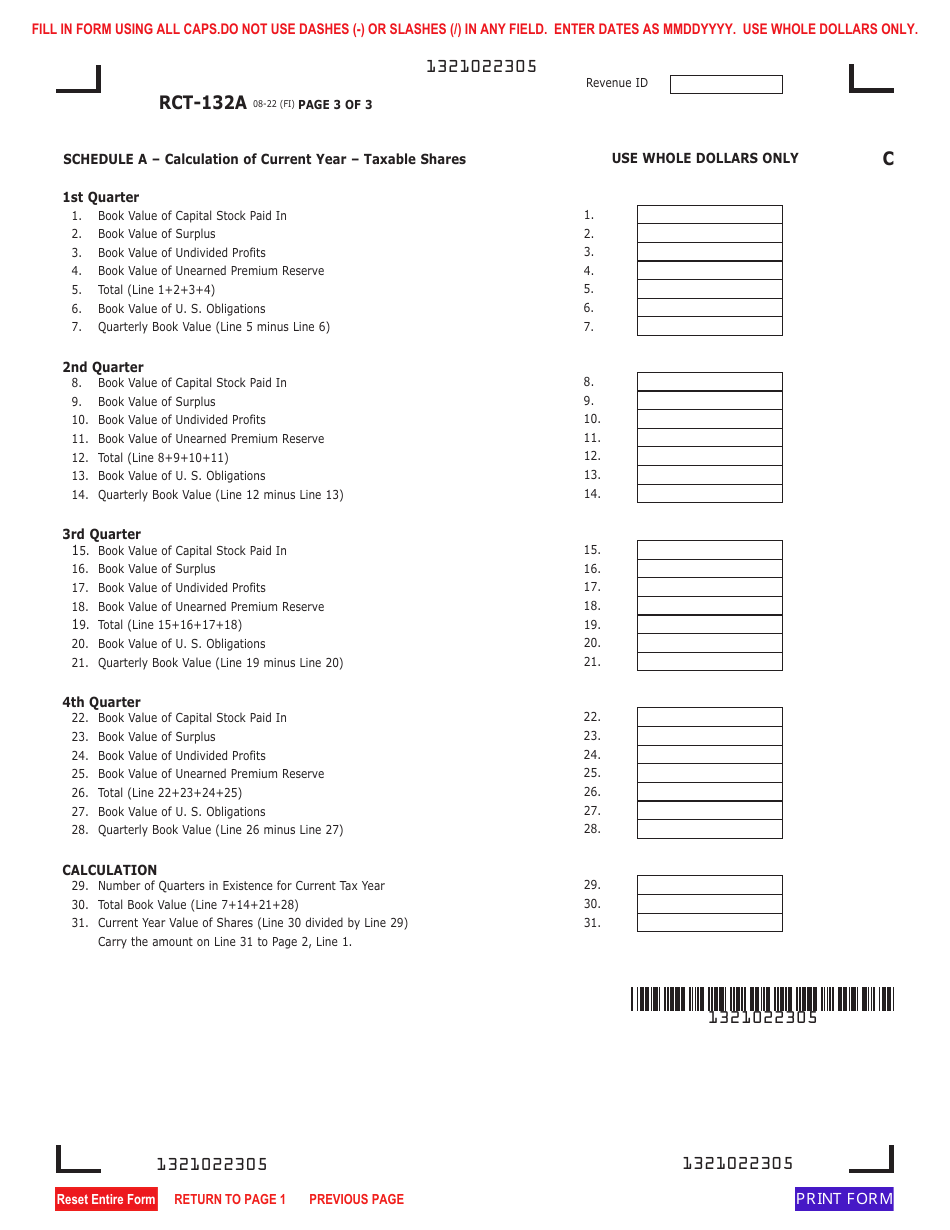

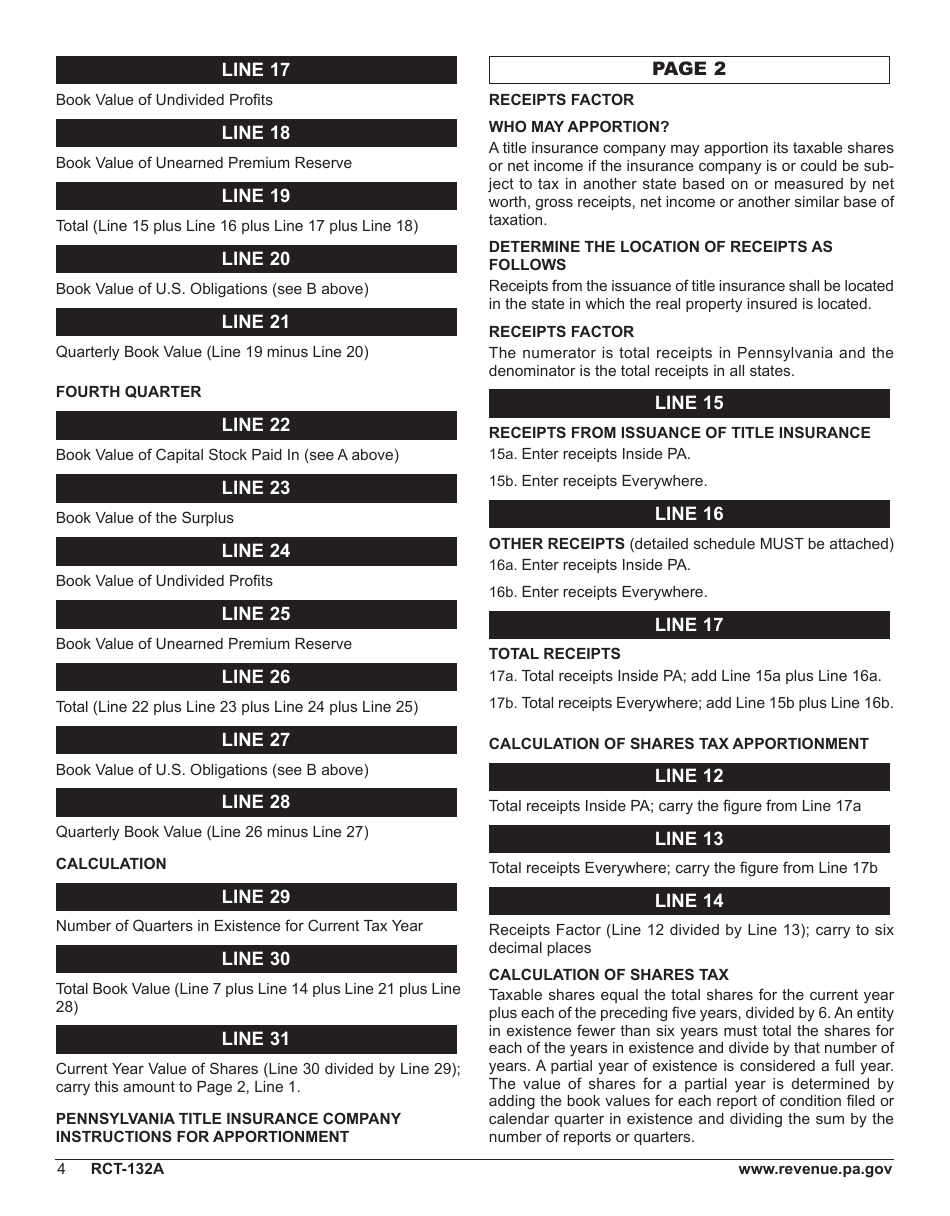

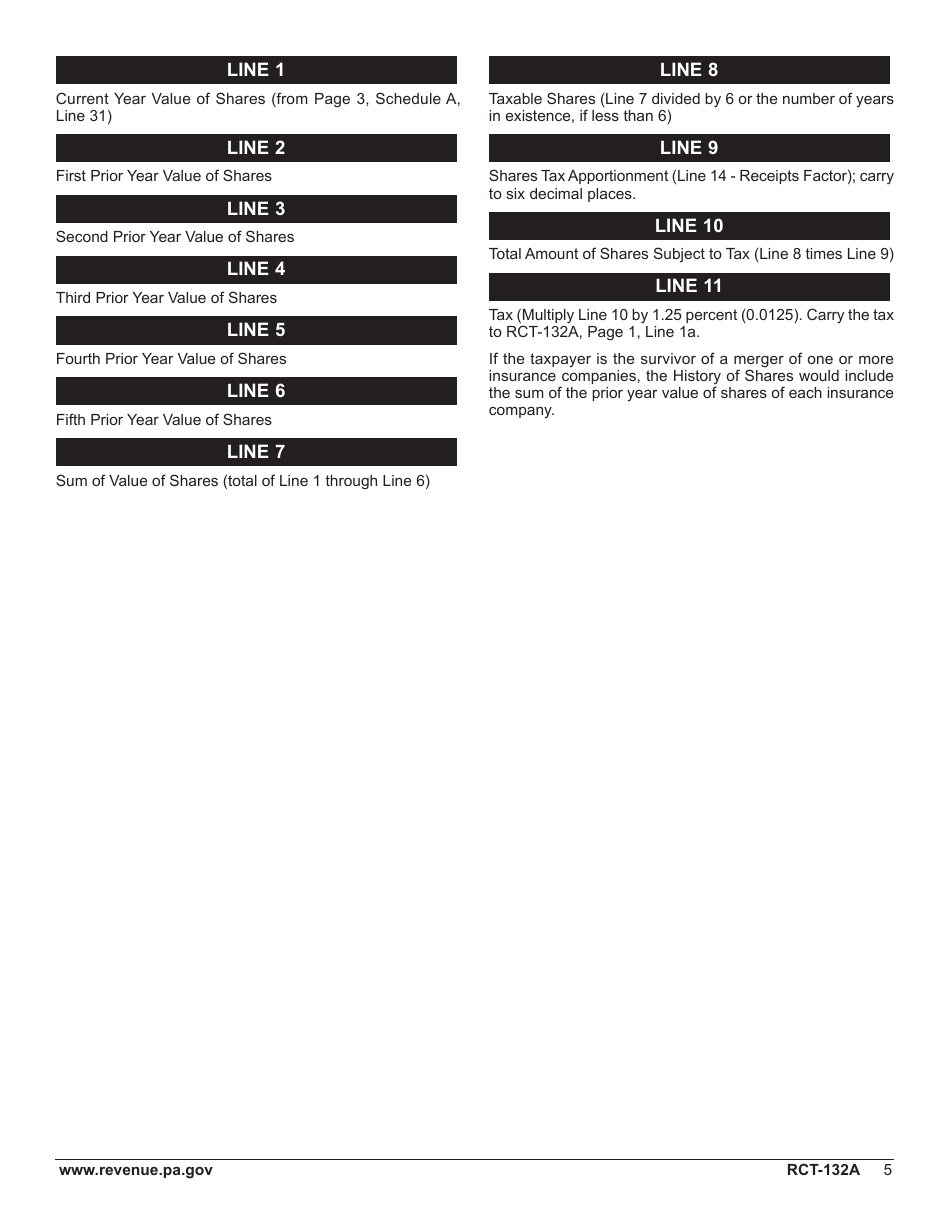

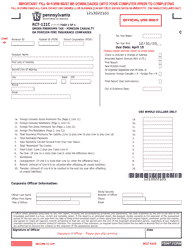

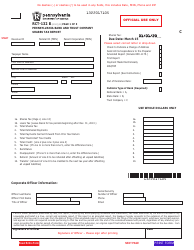

Form RCT-132A Pennsylvania Title Insurance Company Shares Tax Report - Pennsylvania

What Is Form RCT-132A?

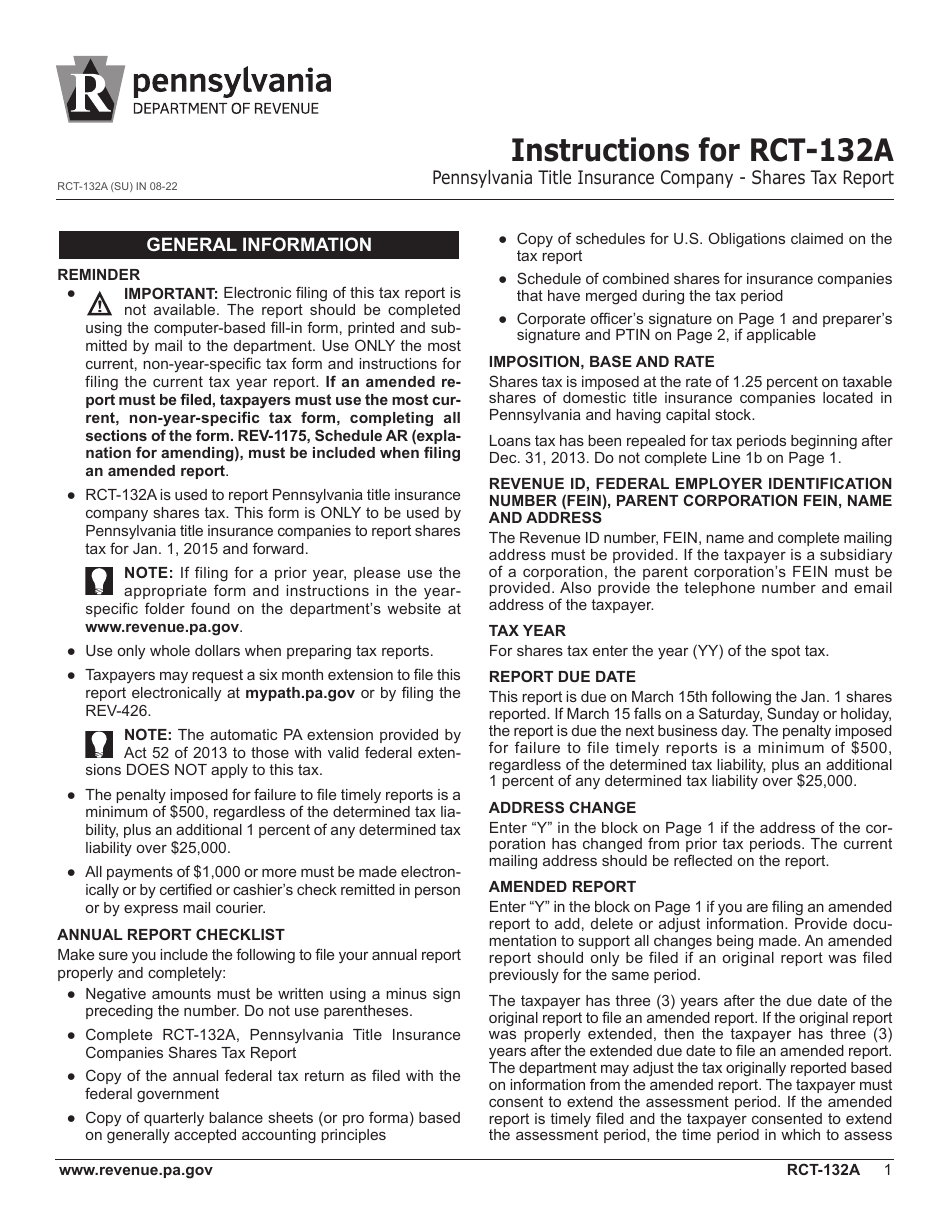

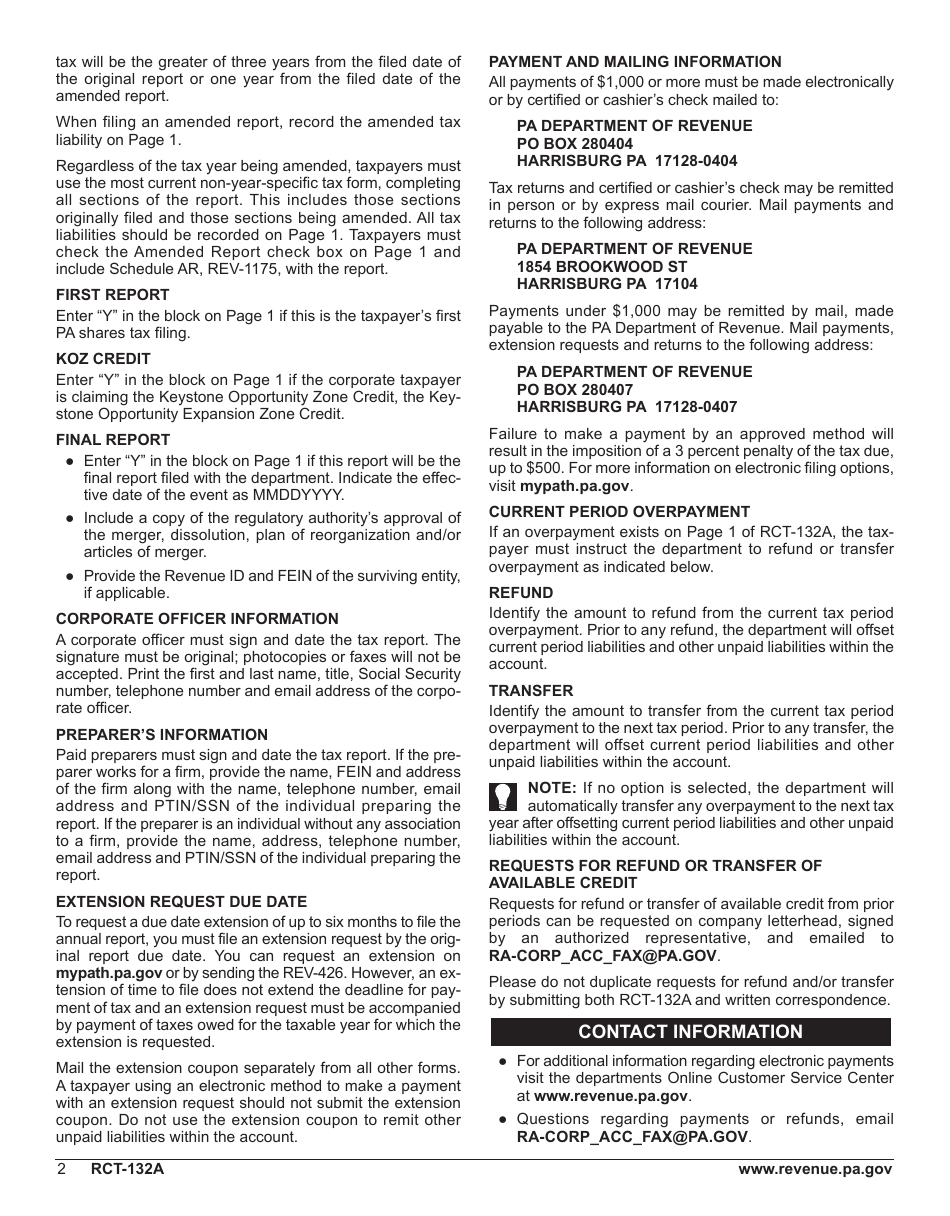

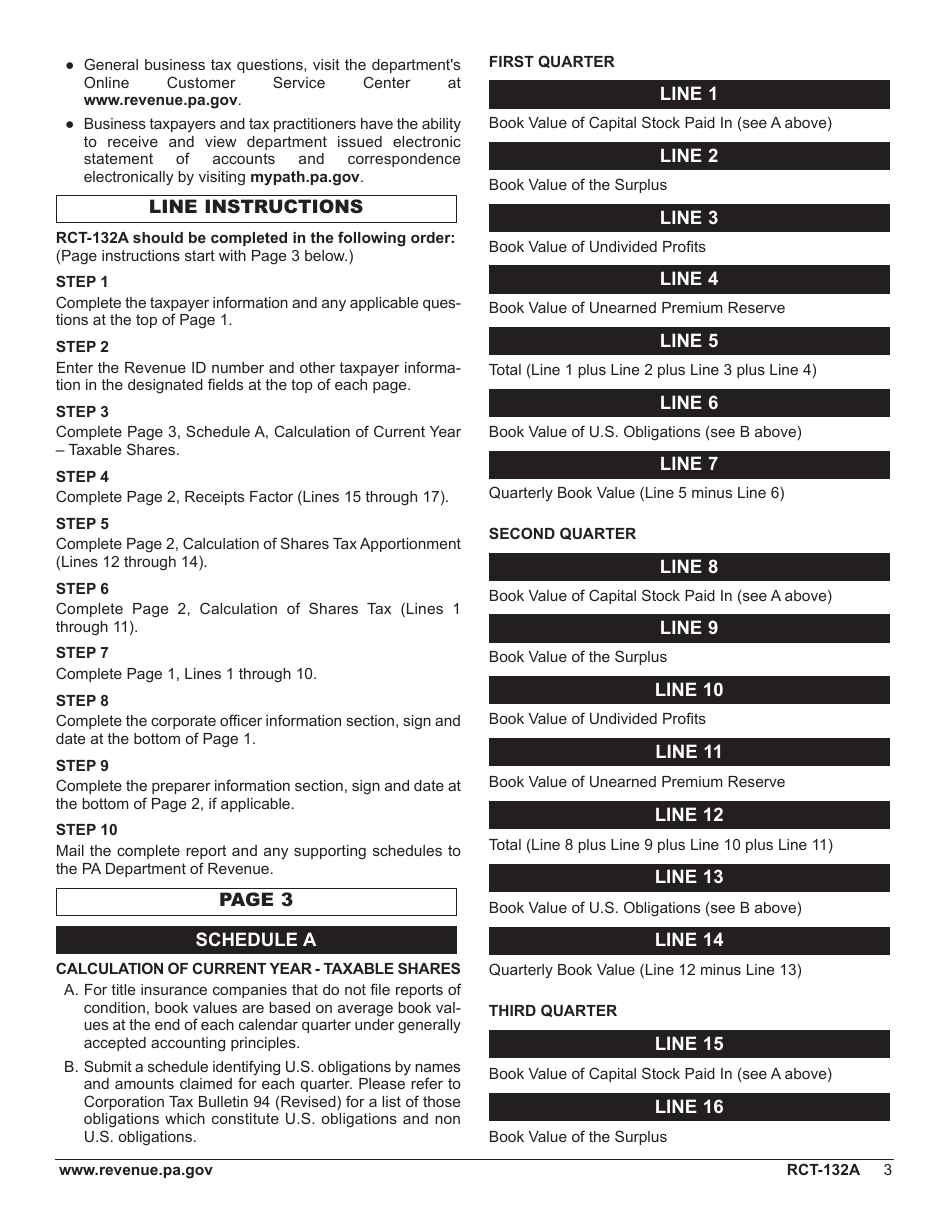

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RCT-132A?

A: Form RCT-132A is the Pennsylvania Title Insurance Company Shares Tax Report.

Q: Who needs to file Form RCT-132A?

A: Pennsylvania title insurance companies need to file Form RCT-132A.

Q: What is the purpose of Form RCT-132A?

A: The purpose of Form RCT-132A is to report and pay the Pennsylvania Title Insurance Company Shares Tax.

Q: When is Form RCT-132A due?

A: Form RCT-132A is due on or before March 15th of each year.

Q: Are there any penalties for late filing of Form RCT-132A?

A: Yes, there are penalties for late filing of Form RCT-132A, including interest and additional fees.

Q: Is Form RCT-132A applicable to individuals or only businesses?

A: Form RCT-132A is applicable only to Pennsylvania title insurance companies, not individuals.

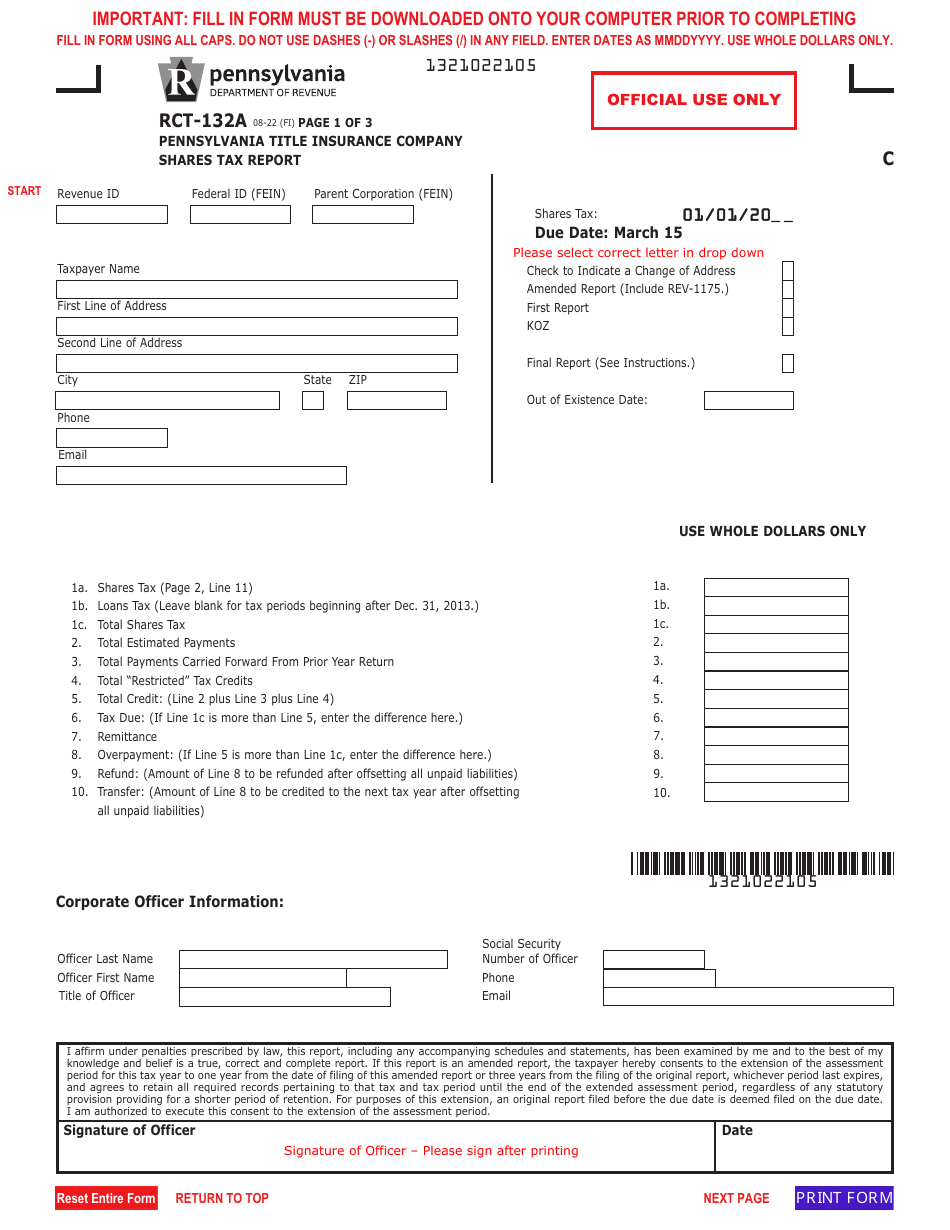

Q: What information is required to complete Form RCT-132A?

A: To complete Form RCT-132A, you will need information about your title insurance company's shares and any tax credits or deductions.

Q: Can Form RCT-132A be filed electronically?

A: Yes, Form RCT-132A can be filed electronically through the Pennsylvania Department of Revenue's e-TIDES system.

Q: Is there a fee for filing Form RCT-132A?

A: No, there is no fee for filing Form RCT-132A.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-132A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.