This version of the form is not currently in use and is provided for reference only. Download this version of

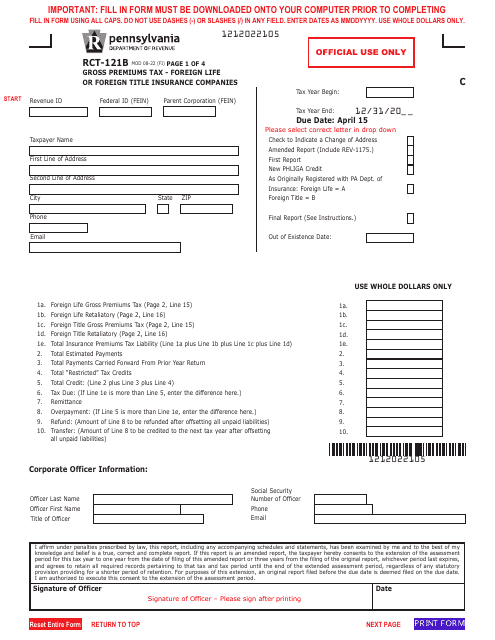

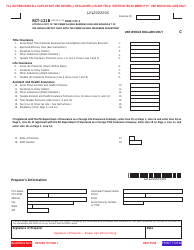

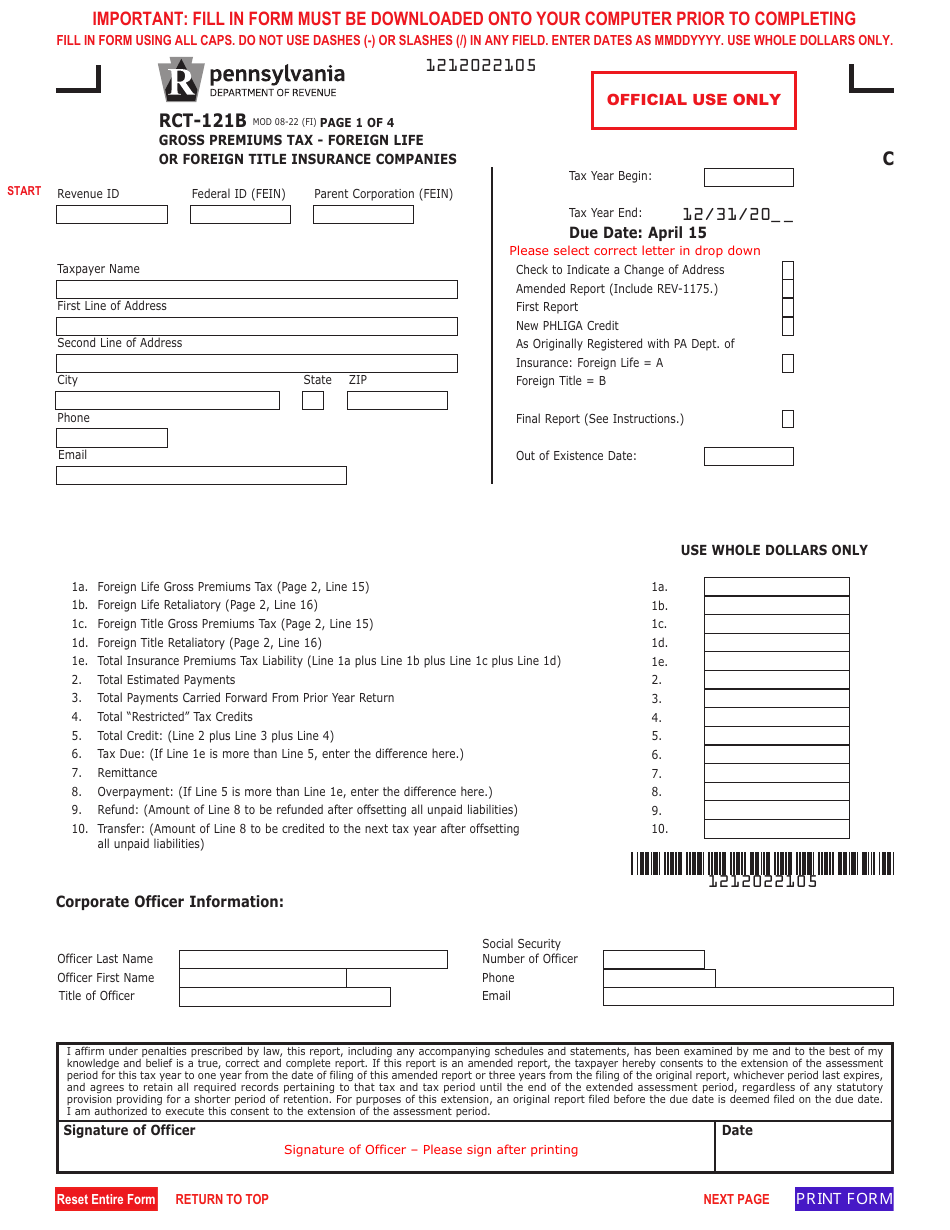

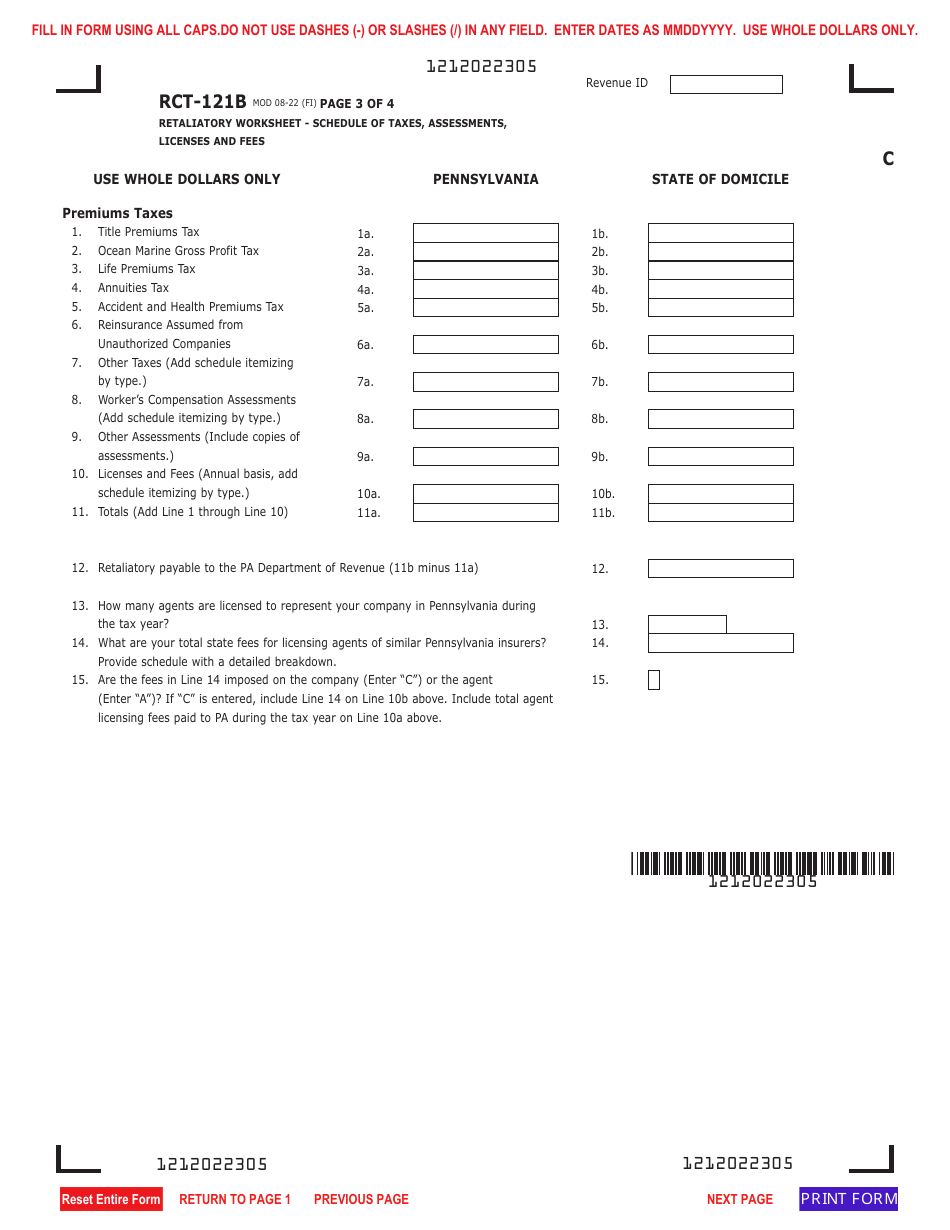

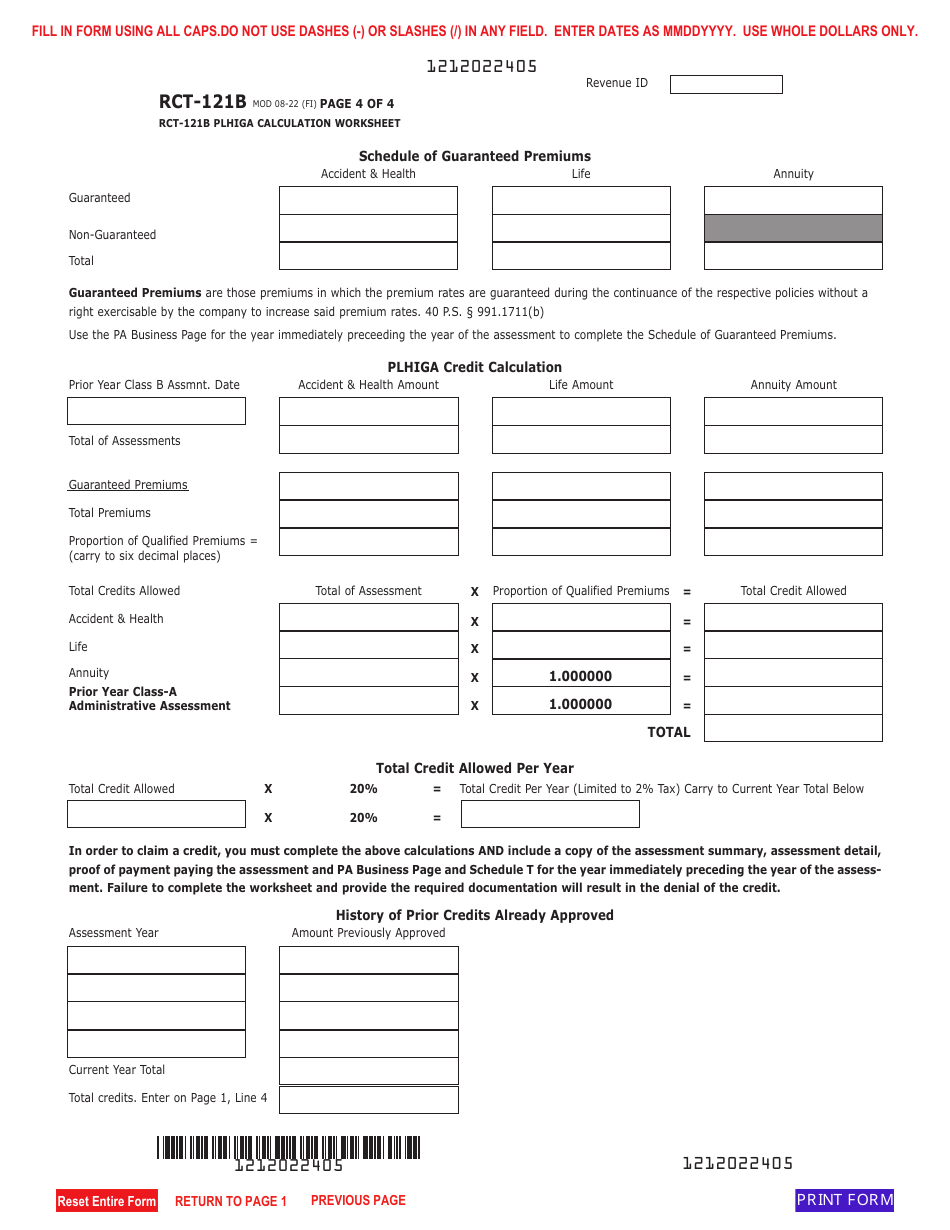

Form RCT-121B

for the current year.

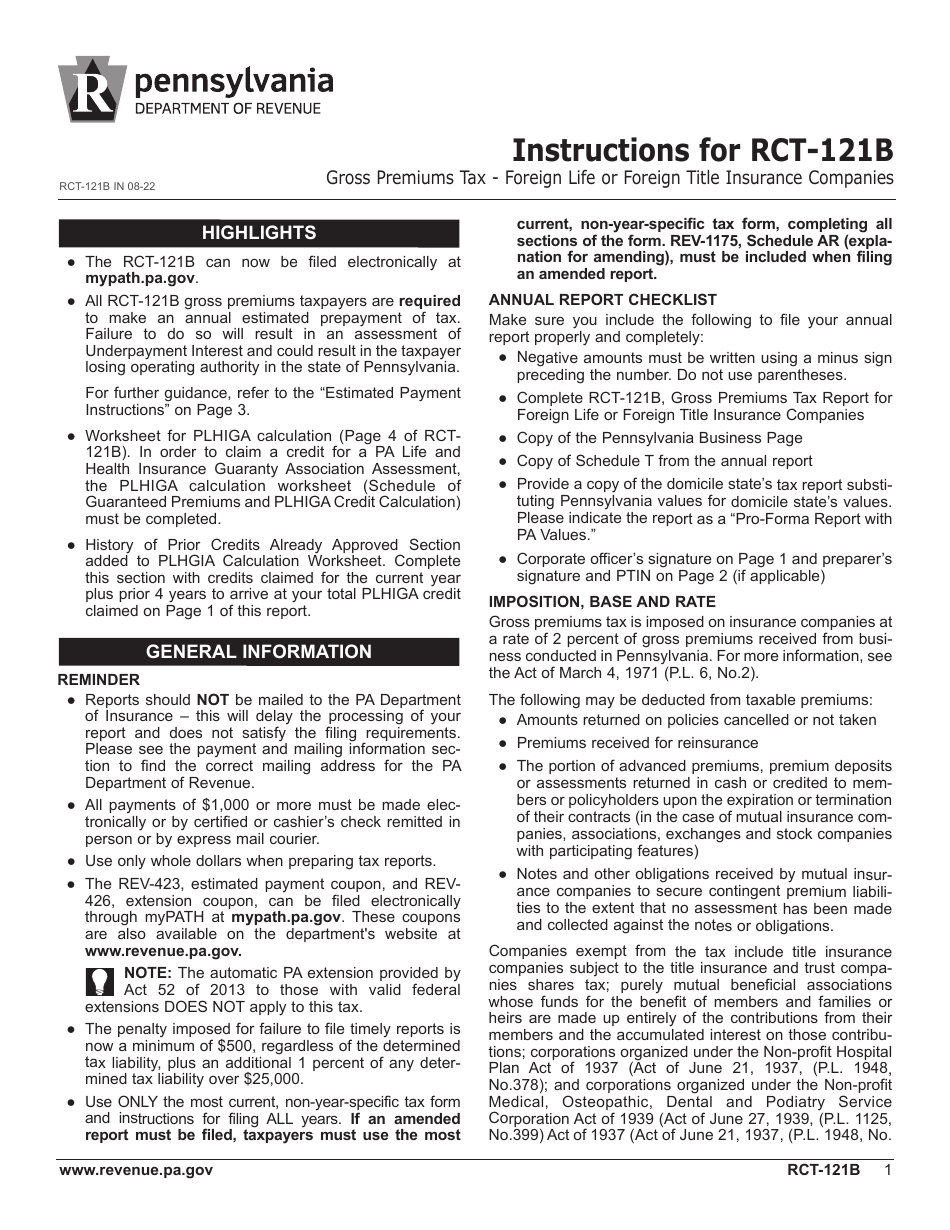

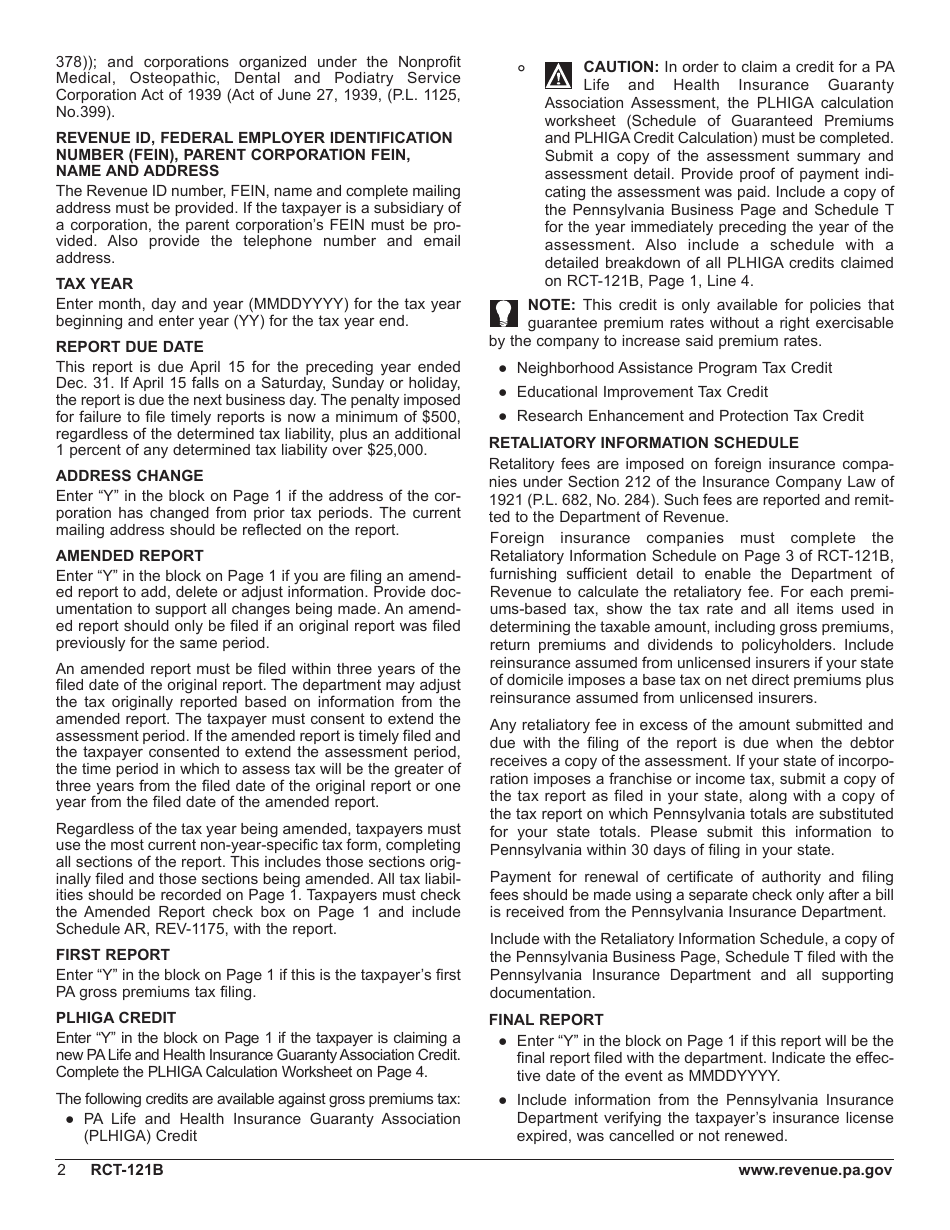

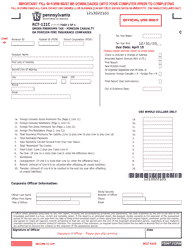

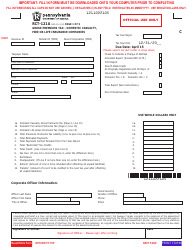

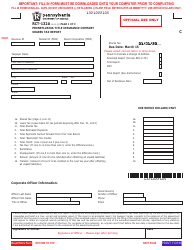

Form RCT-121B Gross Premiums Tax for Foreign Life or Foreign Title Insurance Companies - Pennsylvania

What Is Form RCT-121B?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RCT-121B?

A: RCT-121B is a form for reporting Gross Premiums Tax for foreign life or foreign title insurance companies in Pennsylvania.

Q: Who needs to file RCT-121B?

A: Foreign life insurance or foreign title insurance companies operating in Pennsylvania need to file RCT-121B.

Q: What is the purpose of RCT-121B?

A: The purpose of RCT-121B is to report and pay the Gross PremiumsTax owed by foreign life or foreign title insurance companies in Pennsylvania.

Q: How often should RCT-121B be filed?

A: RCT-121B needs to be filed annually.

Q: Are there any filing deadlines for RCT-121B?

A: Yes, RCT-121B must be filed and the payment must be made on or before the 15th day of the third month following the close of the taxable year.

Q: What happens if I don't file RCT-121B?

A: Failure to file RCT-121B may result in penalties and interest being assessed by the Pennsylvania Department of Revenue.

Q: Is there any way to request an extension for filing RCT-121B?

A: Yes, you can request an extension by submitting Form REV-860, Application for Extension of Time to File 120-day Extension.

Q: Are there any exemptions or deductions available for the Gross Premiums Tax?

A: There are no exemptions or deductions available for the Gross Premiums Tax.

Q: Who should I contact for more information regarding RCT-121B?

A: For more information about RCT-121B, you can contact the Pennsylvania Department of Revenue.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-121B by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.