This version of the form is not currently in use and is provided for reference only. Download this version of

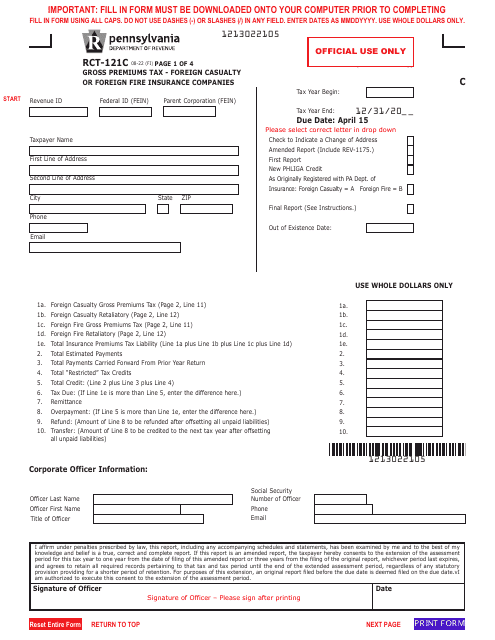

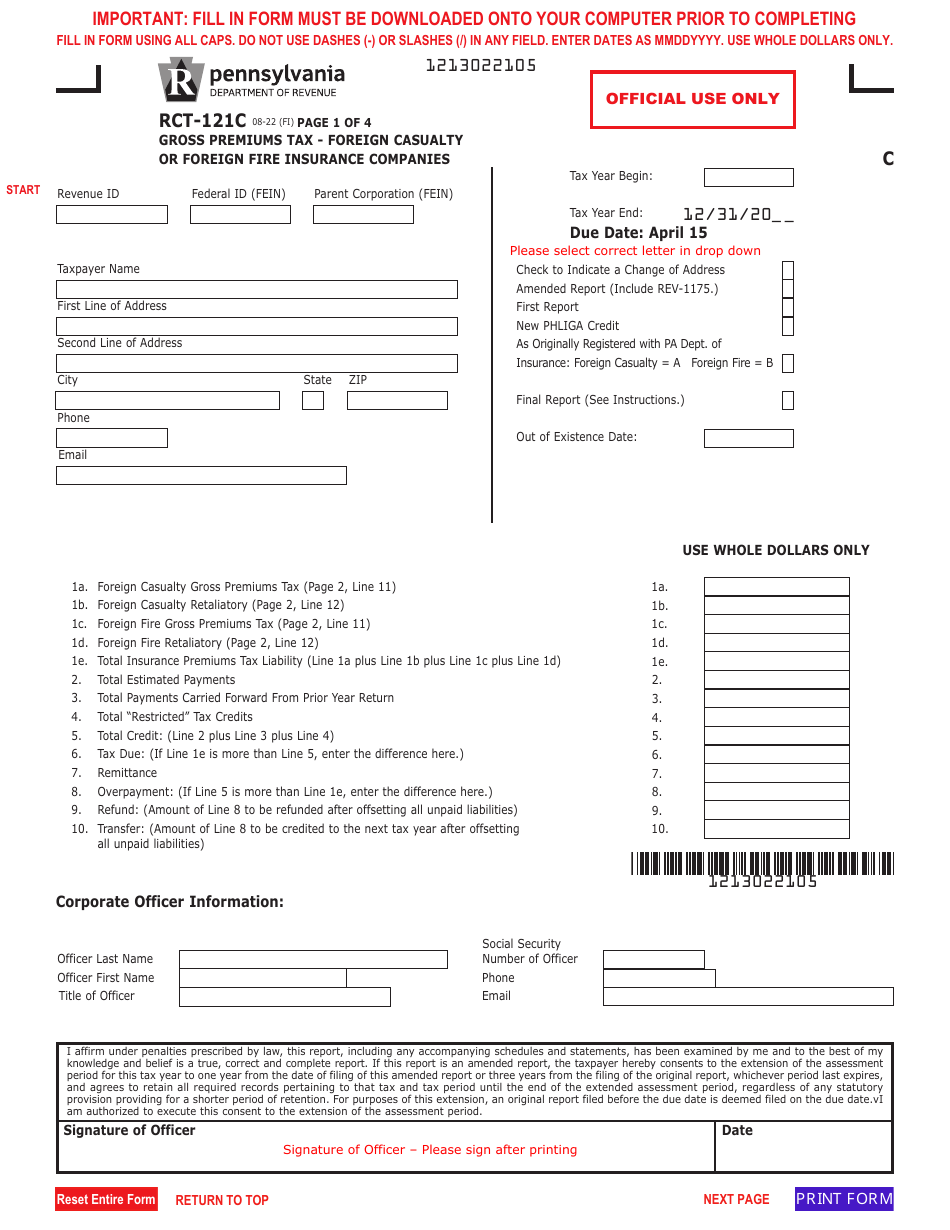

Form RCT-121C

for the current year.

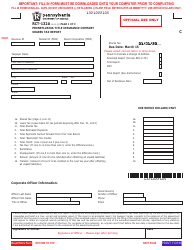

Form RCT-121C Gross Premiums Tax Report for Foreign Casualty or Foreign Fire Insurance Companies - Pennsylvania

What Is Form RCT-121C?

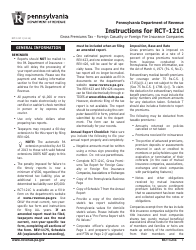

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the RCT-121C Gross Premiums Tax Report?

A: The RCT-121C is a tax report required for foreign casualty or foreign fire insurance companies operating in Pennsylvania.

Q: Who needs to file the RCT-121C Form?

A: Foreign casualty or foreign fire insurance companies doing business in Pennsylvania need to file the RCT-121C Form.

Q: When is the deadline to file the RCT-121C Form?

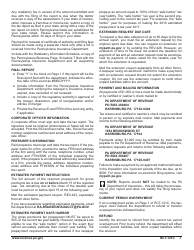

A: The RCT-121C Form must be filed annually by April 15th.

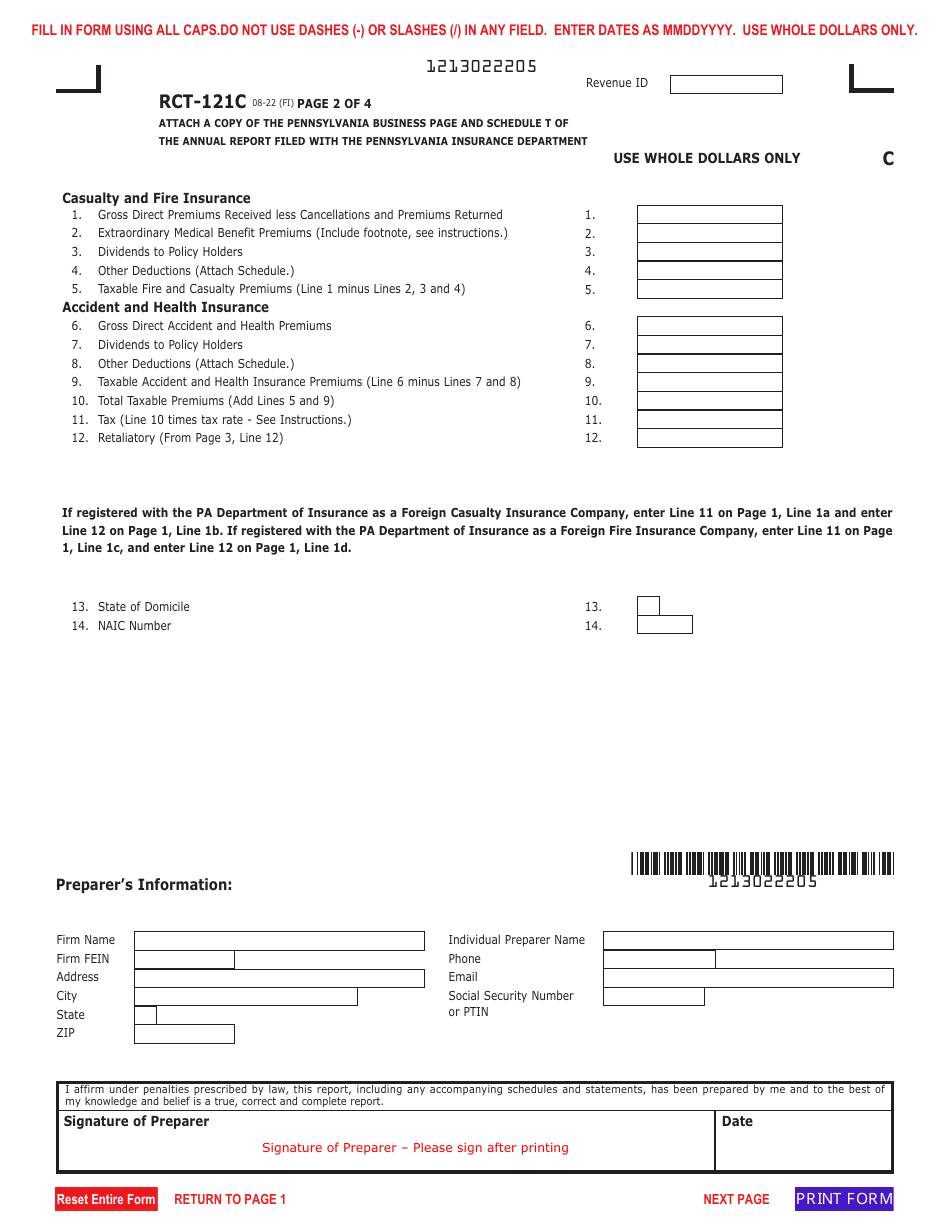

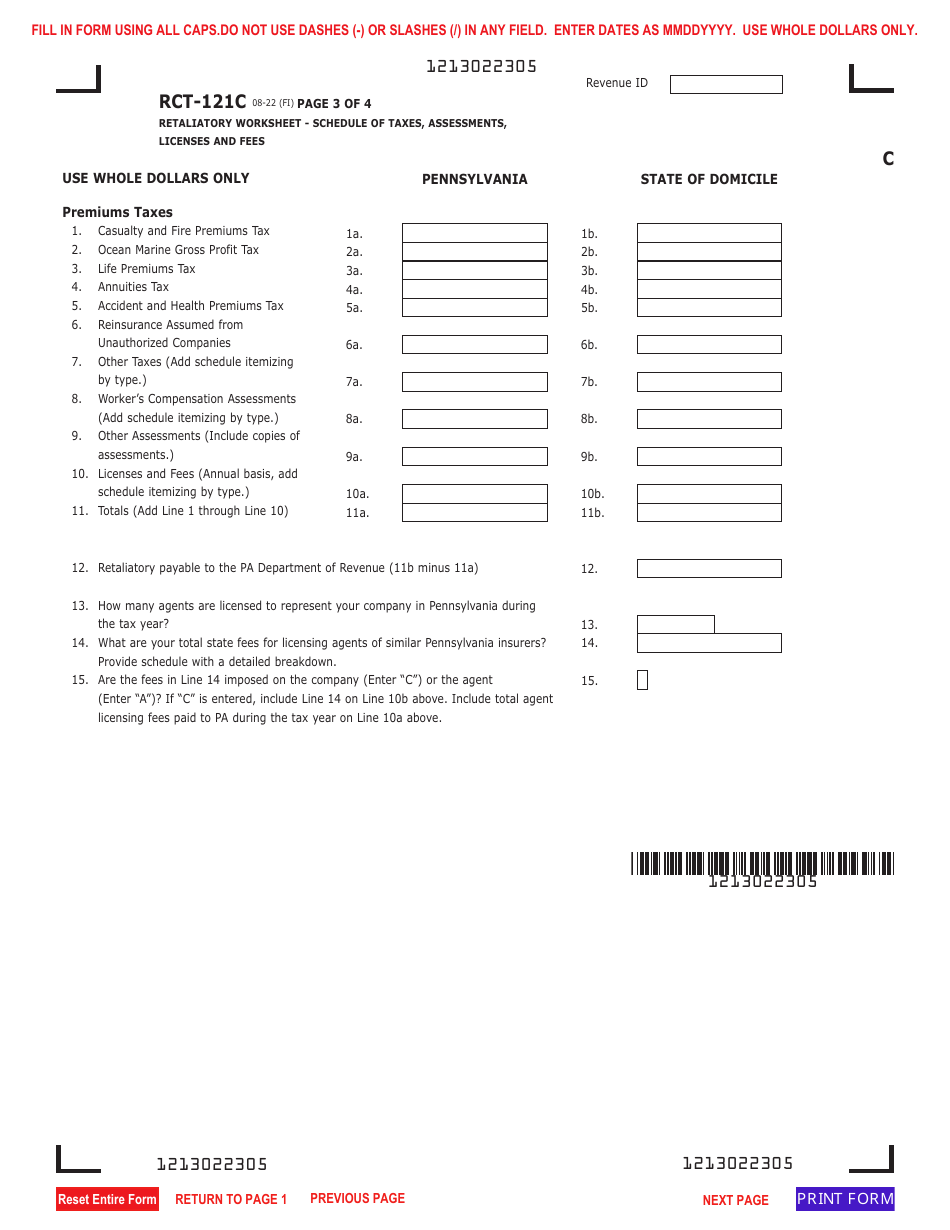

Q: What information is required on the RCT-121C Form?

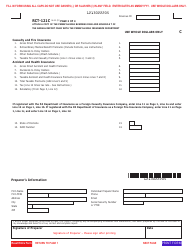

A: The RCT-121C Form requires details about the gross premiums collected in Pennsylvania, as well as other information related to the company's operations.

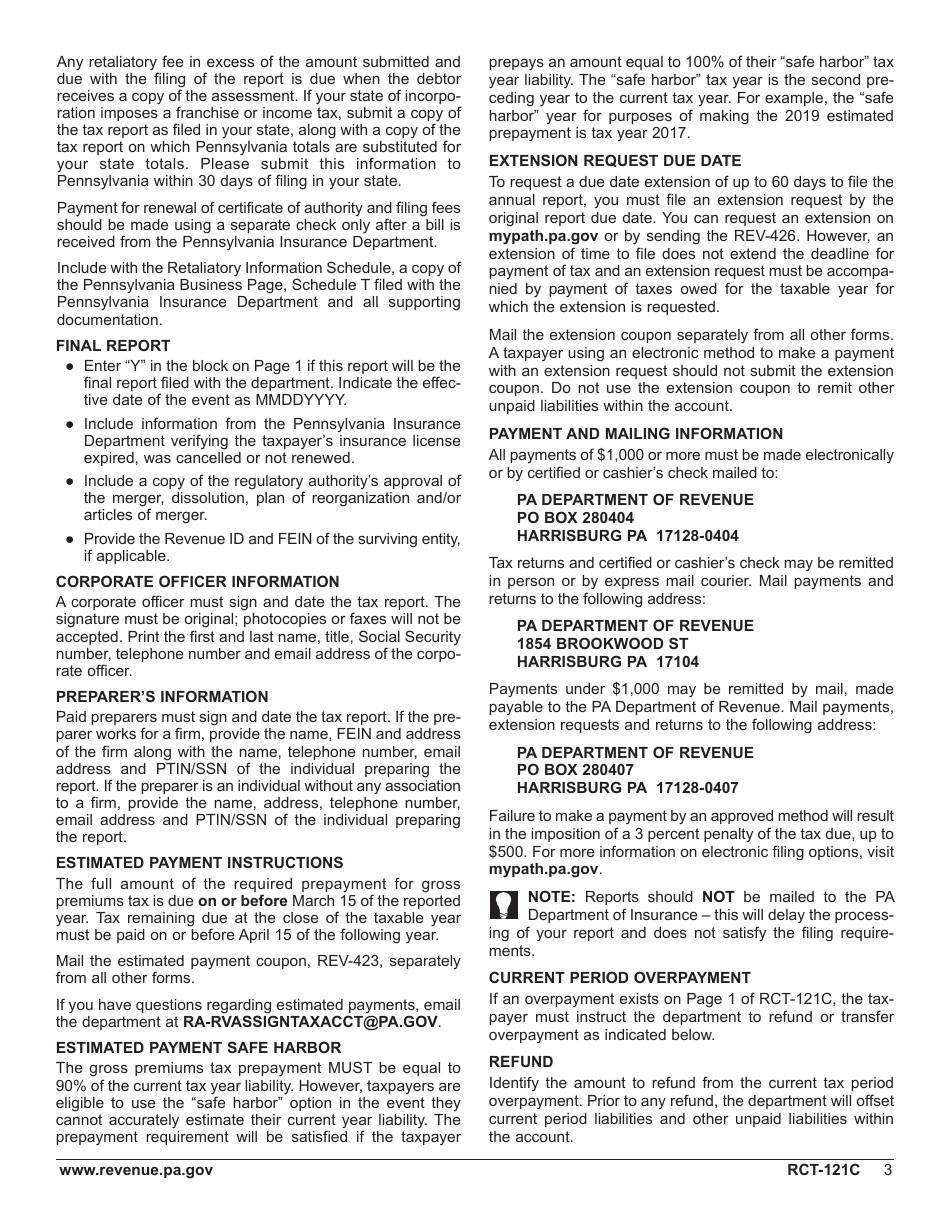

Q: How do I submit the RCT-121C Form?

A: The RCT-121C Form should be submitted electronically through the e-TIDES system of the Pennsylvania Department of Revenue.

Q: Are there any penalties for late or non-payment of the Gross Premiums Tax?

A: Yes, there may be penalties for late or non-payment of the Gross Premiums Tax. It is important to file and pay on time to avoid penalties.

Q: Can I request an extension to file the RCT-121C Form?

A: Yes, you can request an extension to file the RCT-121C Form. However, the request must be made before the original due date of April 15th.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-121C by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.