This version of the form is not currently in use and is provided for reference only. Download this version of

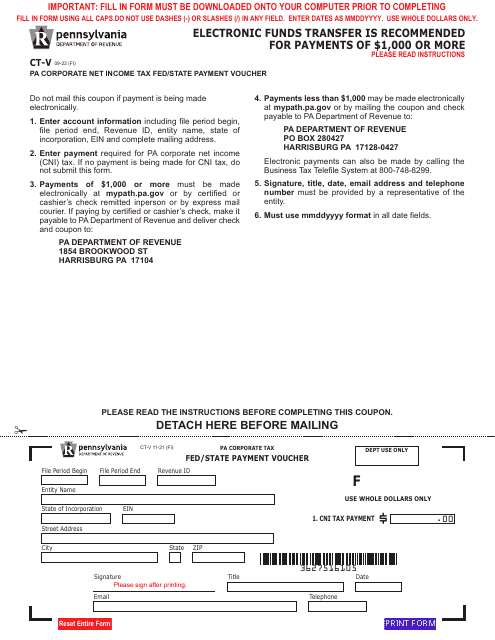

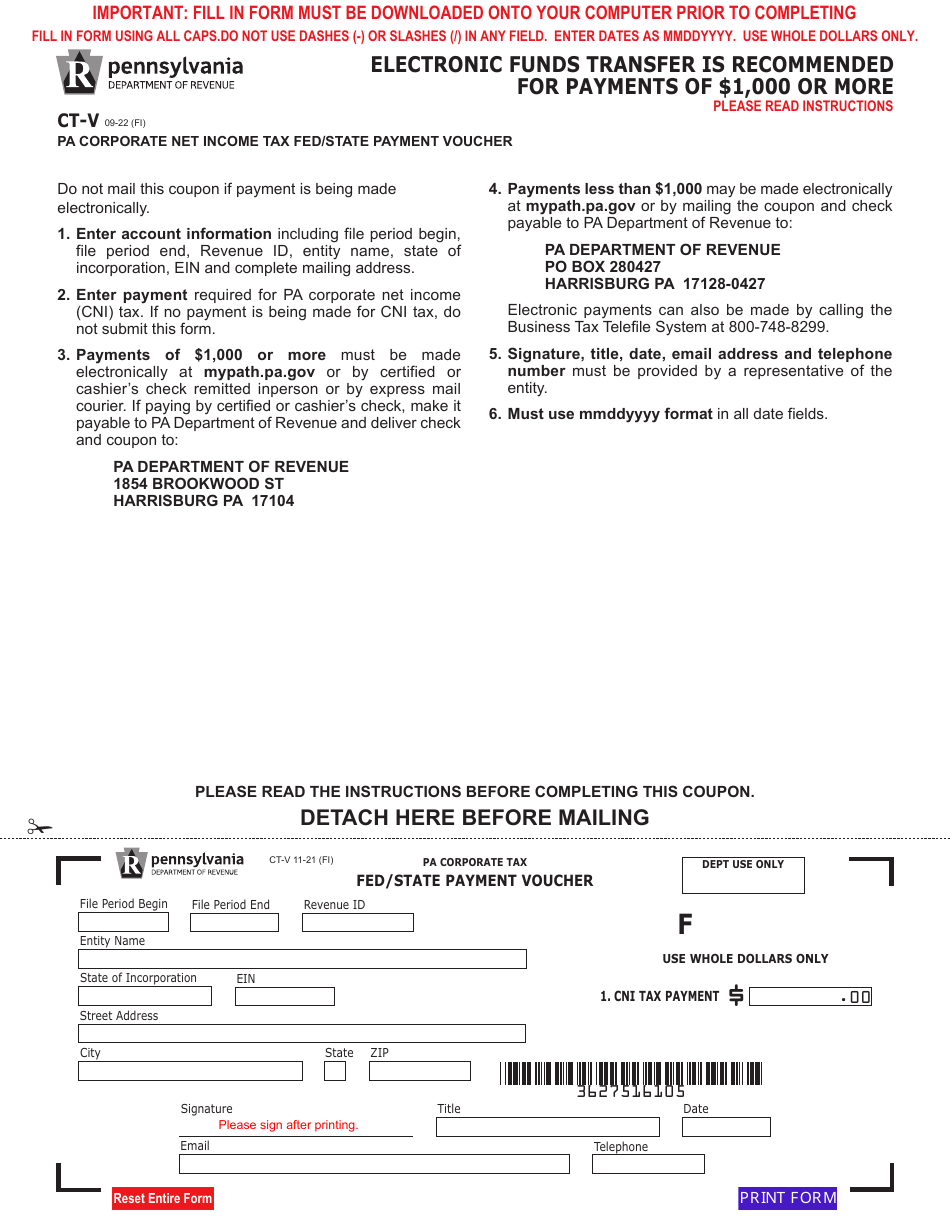

Form CT-V

for the current year.

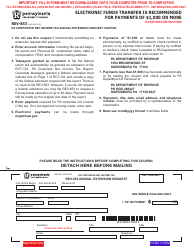

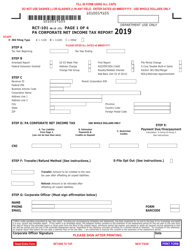

Form CT-V Pa Corporate Net Income Tax Fed / State Payment Voucher - Pennsylvania

What Is Form CT-V?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-V?

A: Form CT-V is the payment voucher for the Pennsylvania Corporate Net Income Tax.

Q: What is the purpose of Form CT-V?

A: The purpose of Form CT-V is to make a payment for the Pennsylvania Corporate Net Income Tax.

Q: What tax is Form CT-V used for?

A: Form CT-V is used for the Pennsylvania Corporate Net Income Tax.

Q: Who needs to file Form CT-V?

A: Any business entity subject to the Pennsylvania Corporate Net Income Tax needs to file Form CT-V.

Q: What information is required on Form CT-V?

A: Form CT-V requires the taxpayer's name, address, Social Security number or taxpayer identification number, and the amount being paid.

Q: Are there any deadlines for filing Form CT-V?

A: The deadline for filing Form CT-V varies depending on the tax year and the type of filer. It is important to check the instructions for the specific year and circumstances.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-V by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.