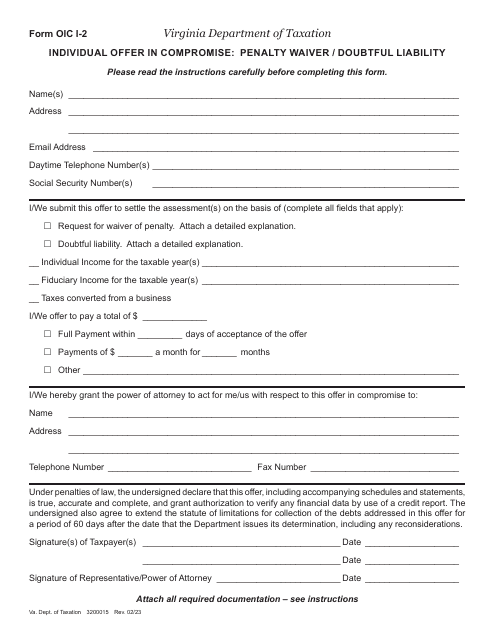

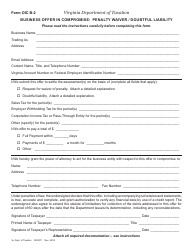

Form OIC I-2 Individual Offer in Compromise: Penalty Waiver / Doubtful Liability - Virginia

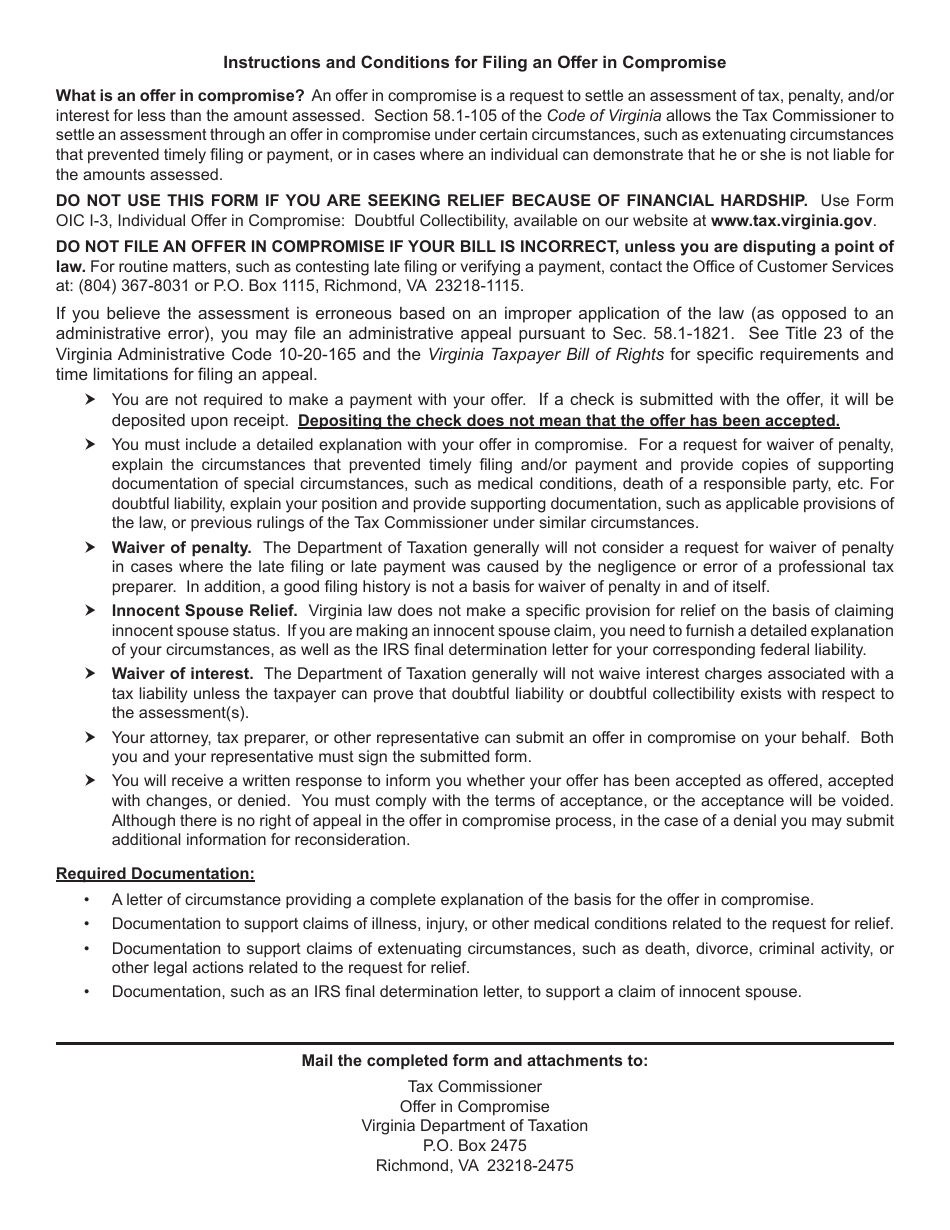

What Is Form OIC I-2?

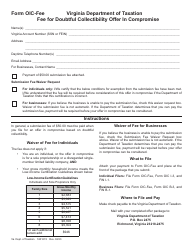

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

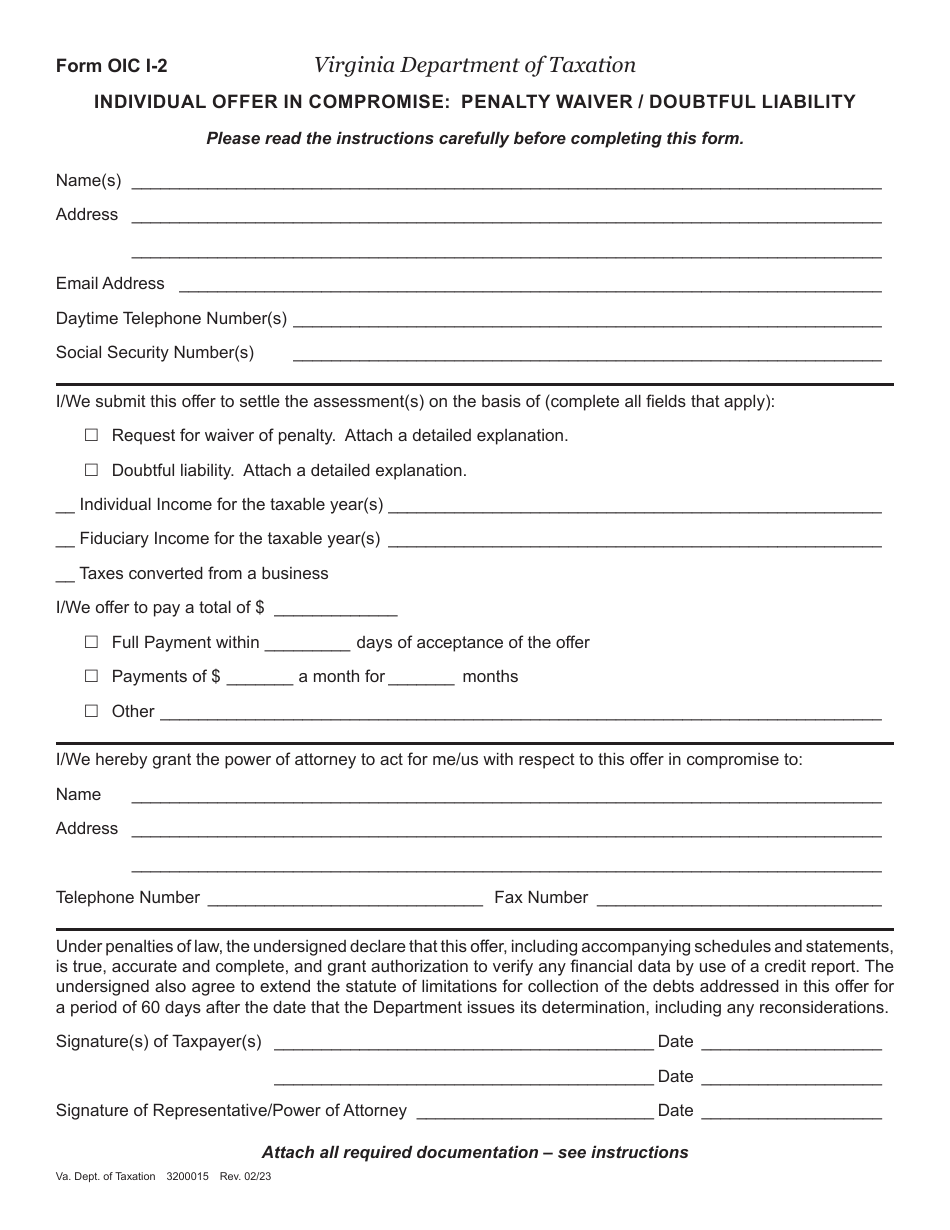

Q: What is Form OIC I-2?

A: Form OIC I-2 is the Individual Offer in Compromise: Penalty Waiver/Doubtful Liability form.

Q: What is the purpose of Form OIC I-2?

A: The purpose of Form OIC I-2 is to request a penalty waiver or offer a settlement for a doubtful tax liability.

Q: Who can use Form OIC I-2?

A: Individual taxpayers can use Form OIC I-2.

Q: What does a penalty waiver mean?

A: A penalty waiver means that the taxpayer is requesting the IRS to waive the penalties associated with their tax liability.

Q: What is a doubtful liability?

A: A doubtful liability refers to a tax liability that the taxpayer believes they may not be able to pay in full.

Q: Is Form OIC I-2 specific to Virginia?

A: No, Form OIC I-2 is not specific to Virginia. It is used for federal tax purposes and can be used by taxpayers across the United States.

Q: Does Form OIC I-2 guarantee a penalty waiver or settlement?

A: No, submitting Form OIC I-2 does not guarantee a penalty waiver or settlement. The IRS will review the request and make a decision based on the taxpayer's individual circumstances.

Form Details:

- Released on February 1, 2023;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OIC I-2 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.