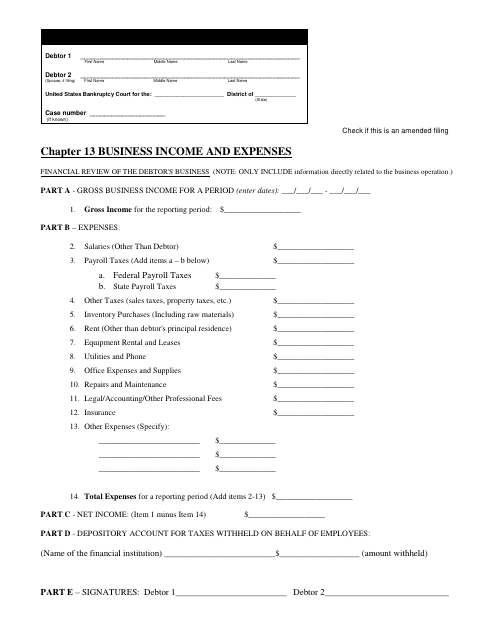

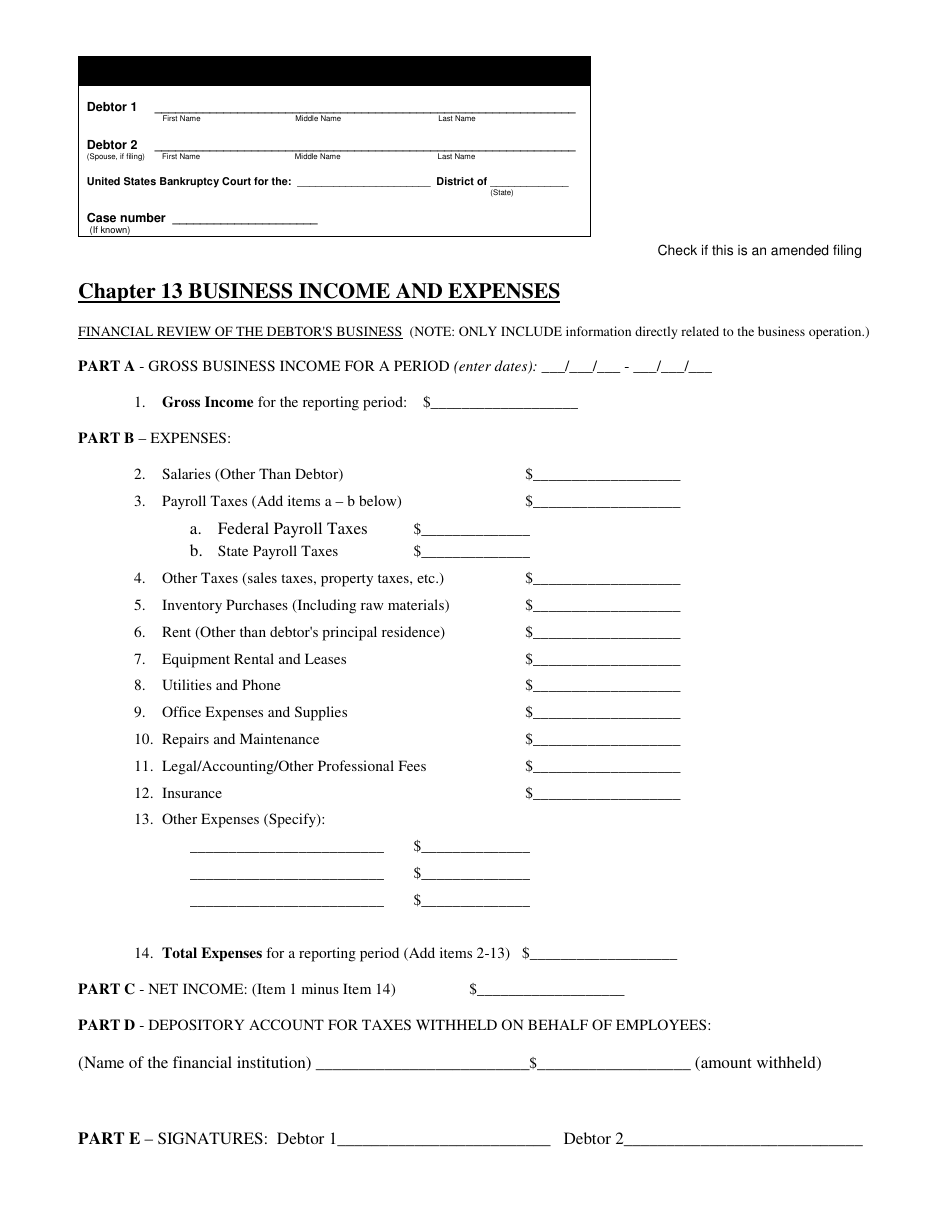

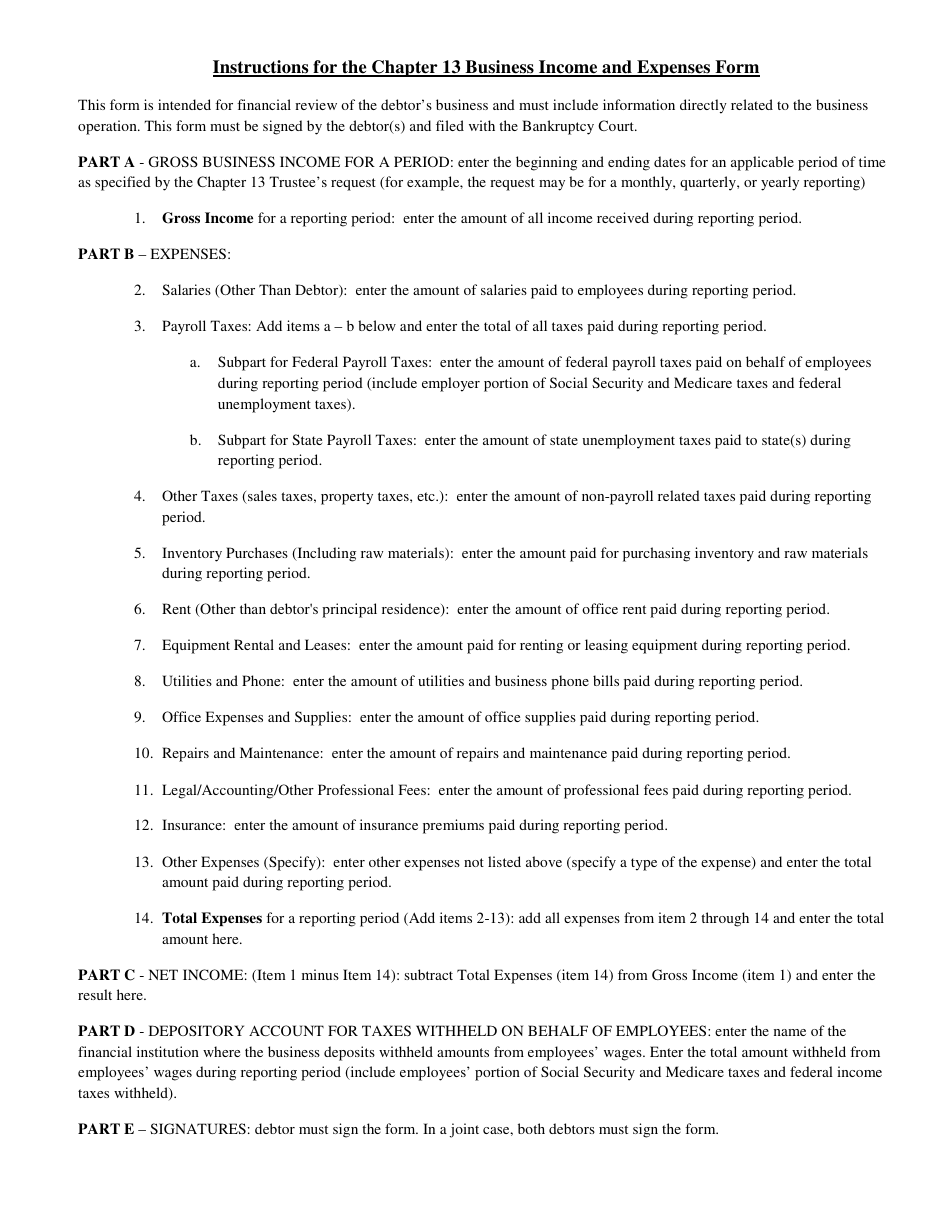

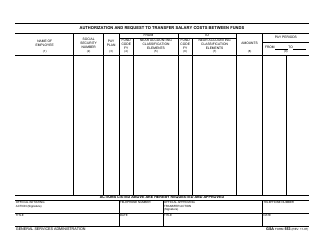

Form MOW3071-1 Chapter 13 Business Income and Expenses - Missouri

What Is Form MOW3071-1?

This is a legal form that was released by the United States District Court for the Western District of Missouri - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MOW3071-1?

A: Form MOW3071-1 is a tax form used in the state of Missouri to report business income and expenses.

Q: What does Chapter 13 refer to?

A: Chapter 13 refers to the specific section of the Missouri tax code that deals with business income and expenses.

Q: What is considered business income?

A: Business income includes any money earned from conducting a trade or business, such as sales revenue or service fees.

Q: What are business expenses?

A: Business expenses are the costs incurred in the operation of a trade or business, such as rent, utilities, and supplies.

Q: Who needs to file Form MOW3071-1?

A: Any individual or organization that operates a business in Missouri and has business income and expenses needs to file this form.

Q: Is this form only for residents of Missouri?

A: No, this form is used by both residents and non-residents who conduct business in Missouri.

Q: When is the deadline for filing Form MOW3071-1?

A: The deadline for filing this form is usually April 15th of the following year, unless an extension has been granted.

Q: Are there any penalties for late or incorrect filing?

A: Yes, there can be penalties for late or incorrect filing, including fines and interest on unpaid taxes.

Q: Is there any assistance available for completing this form?

A: Yes, the Missouri Department of Revenue provides resources and assistance to help individuals and businesses with filing their taxes.

Form Details:

- The latest edition provided by the United States District Court for the Western District of Missouri;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MOW3071-1 by clicking the link below or browse more documents and templates provided by the United States District Court for the Western District of Missouri.