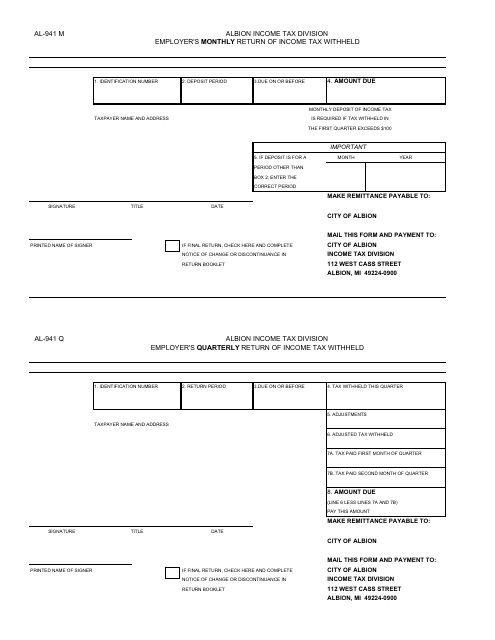

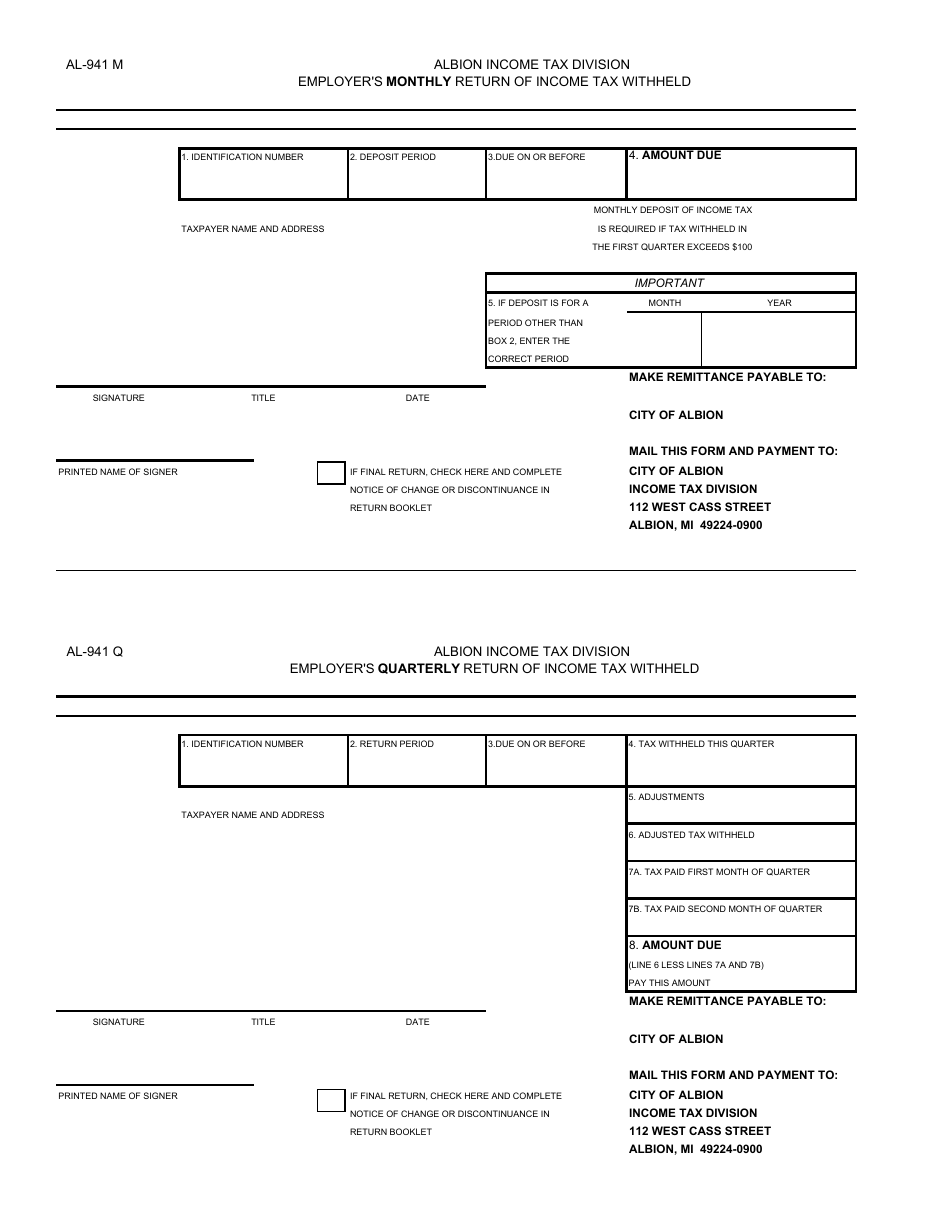

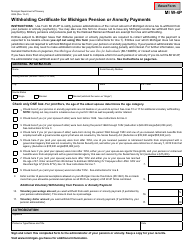

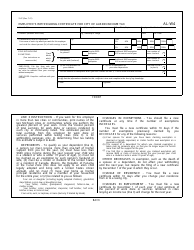

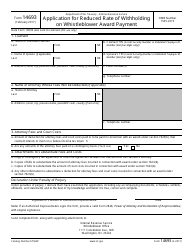

Form AL-941 Withholding Payment Voucher - City of Albion, Michigan

What Is Form AL-941?

This is a legal form that was released by the Finance & Treasury Department - City of Albion, Michigan - a government authority operating within Michigan. The form may be used strictly within City of Albion. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AL-941?

A: Form AL-941 is a withholding payment voucher used by employers in the City of Albion, Michigan.

Q: Who should use Form AL-941?

A: Employers in the City of Albion, Michigan should use Form AL-941.

Q: What is the purpose of Form AL-941?

A: Form AL-941 is used to report and remit withholding taxes for employees in the City of Albion, Michigan.

Q: When is Form AL-941 due?

A: Form AL-941 is due on a quarterly basis. The due dates are typically April 30, July 31, October 31, and January 31.

Q: What information do I need to complete Form AL-941?

A: To complete Form AL-941, you will need information about your employees' wages, withholding amounts, and any other applicable deductions or credits.

Q: Do I need to submit Form AL-941 even if I have no withholding taxes to remit?

A: Yes, even if you have no withholding taxes to remit, you are still required to submit a completed Form AL-941.

Q: Are there any penalties for late or incorrect filing of Form AL-941?

A: Yes, there may be penalties for late or incorrect filing of Form AL-941. It is important to file the form accurately and on time to avoid any penalties.

Form Details:

- The latest edition provided by the Finance & Treasury Department - City of Albion, Michigan;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AL-941 by clicking the link below or browse more documents and templates provided by the Finance & Treasury Department - City of Albion, Michigan.