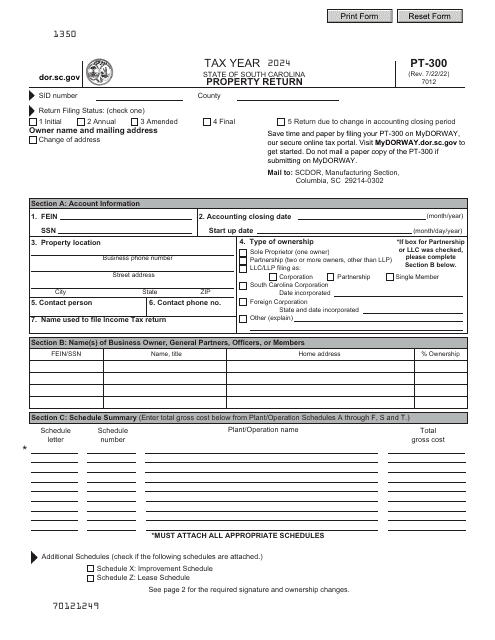

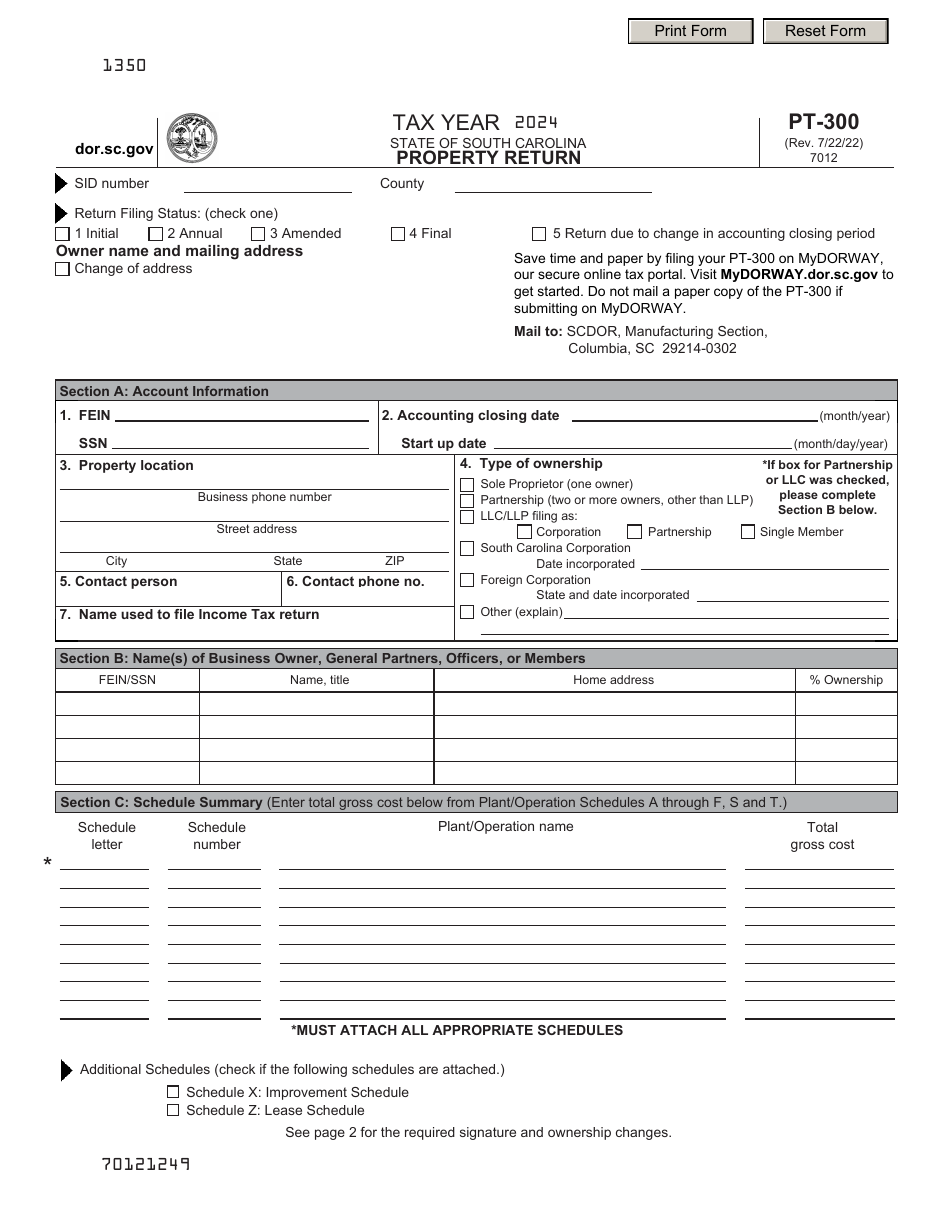

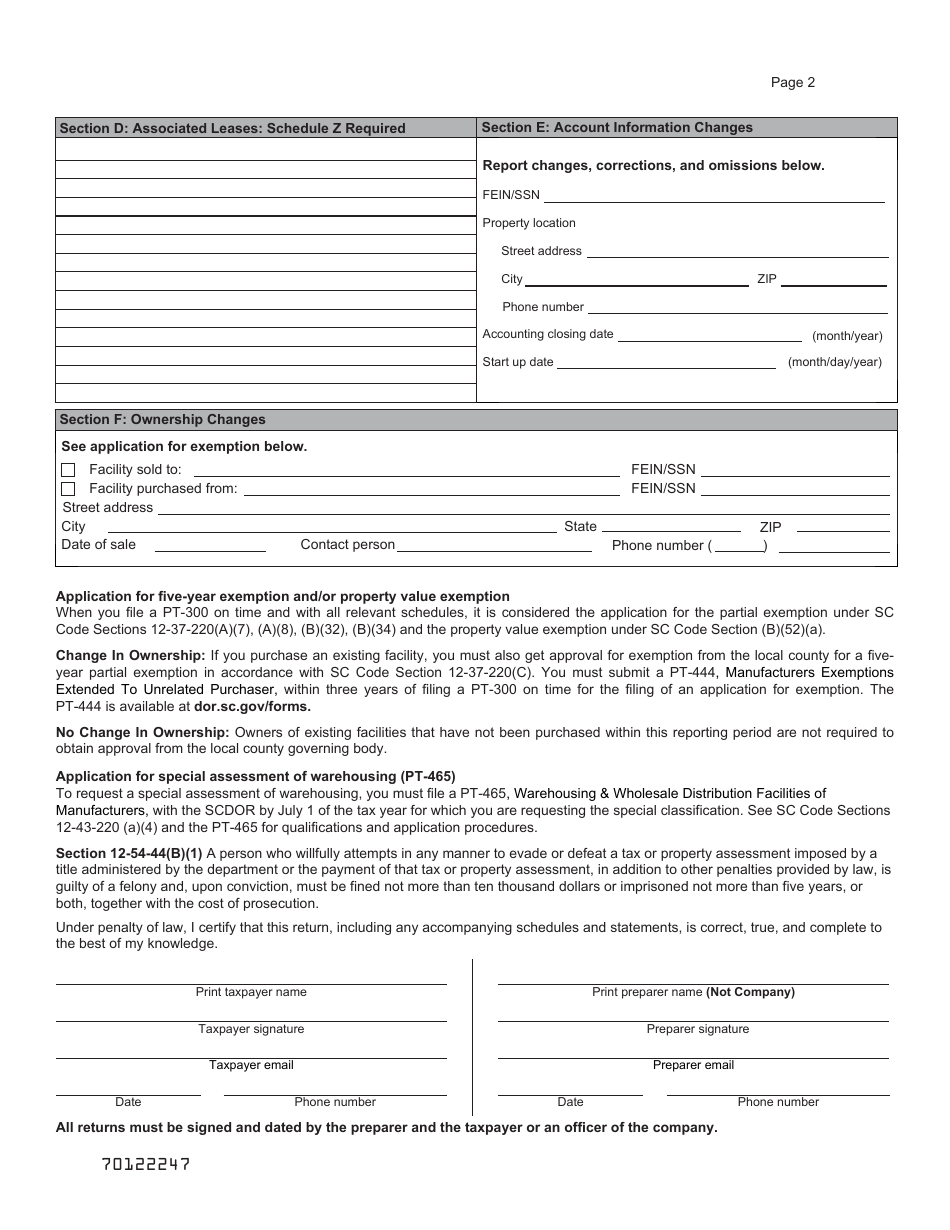

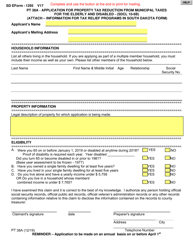

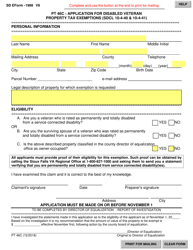

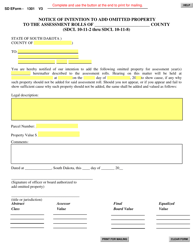

Form PT-300 Property Return - South Dakota

What Is Form PT-300?

This is a legal form that was released by the South Dakota Department of Revenue - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-300?

A: Form PT-300 is a property return form used in South Dakota.

Q: Who needs to file Form PT-300?

A: Owners of taxable property in South Dakota need to file Form PT-300.

Q: What is the purpose of filing Form PT-300?

A: The purpose of filing Form PT-300 is to report taxable property and determine property tax liabilities in South Dakota.

Q: When is Form PT-300 due?

A: Form PT-300 is due annually by March 1st.

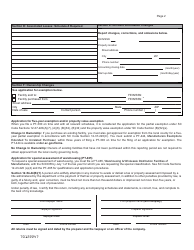

Q: Are there any penalties for late filing of Form PT-300?

A: Yes, there may be penalties for late filing or failure to file Form PT-300 in South Dakota. It is important to submit the form on time to avoid penalties.

Q: What information is required to complete Form PT-300?

A: The required information to complete Form PT-300 includes property details, such as property location, description, and value.

Q: Are there any exemptions or deductions available on Form PT-300?

A: Yes, there are exemptions and deductions available on Form PT-300 for certain types of property. Consult the instructions or contact the South Dakota Department of Revenue for more information.

Q: Who should I contact for assistance with filing Form PT-300?

A: For assistance with filing Form PT-300 or any questions related to property taxes in South Dakota, contact the South Dakota Department of Revenue.

Form Details:

- Released on July 22, 2022;

- The latest edition provided by the South Dakota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PT-300 by clicking the link below or browse more documents and templates provided by the South Dakota Department of Revenue.