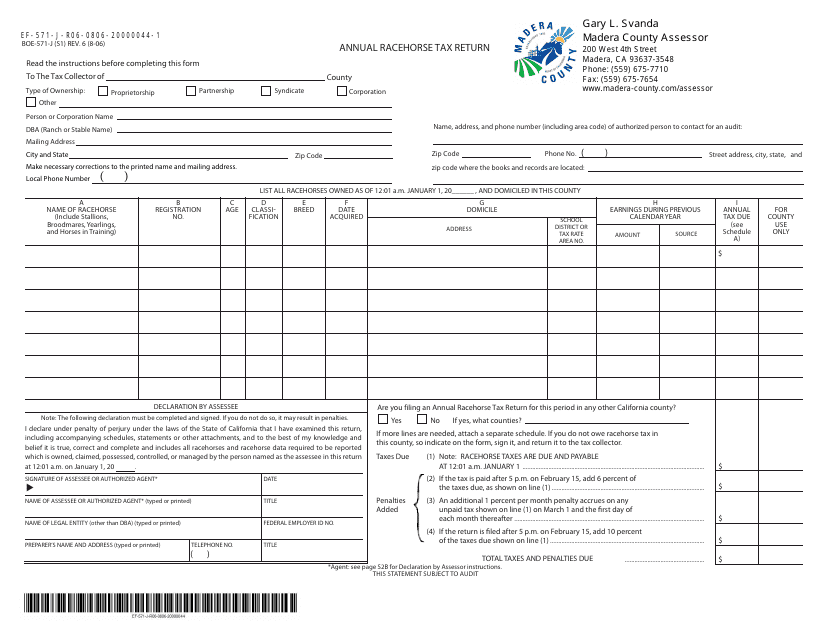

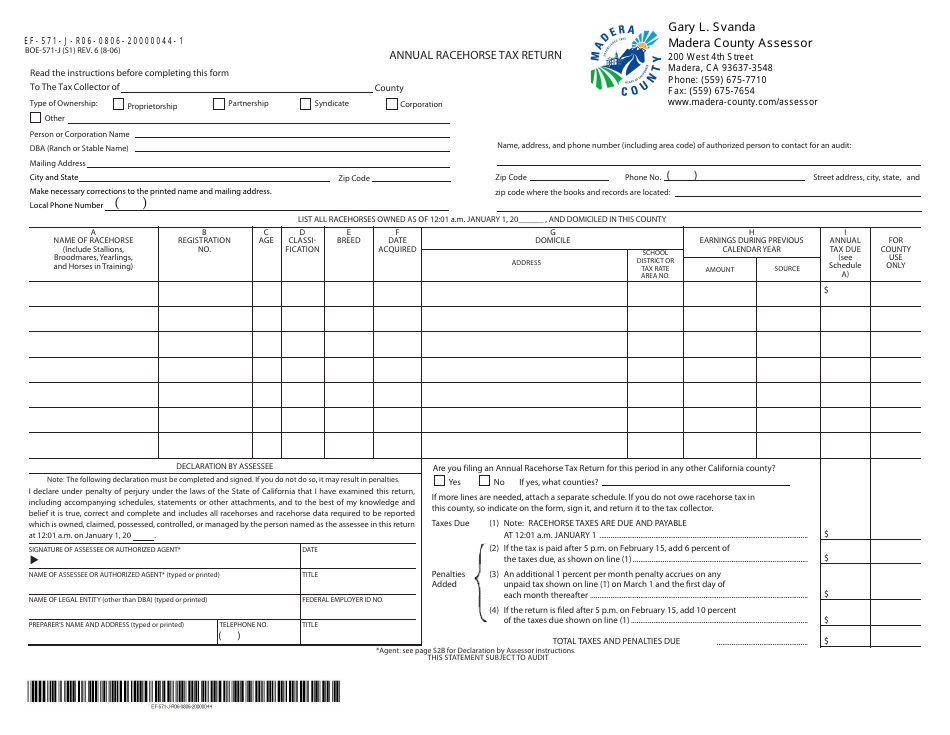

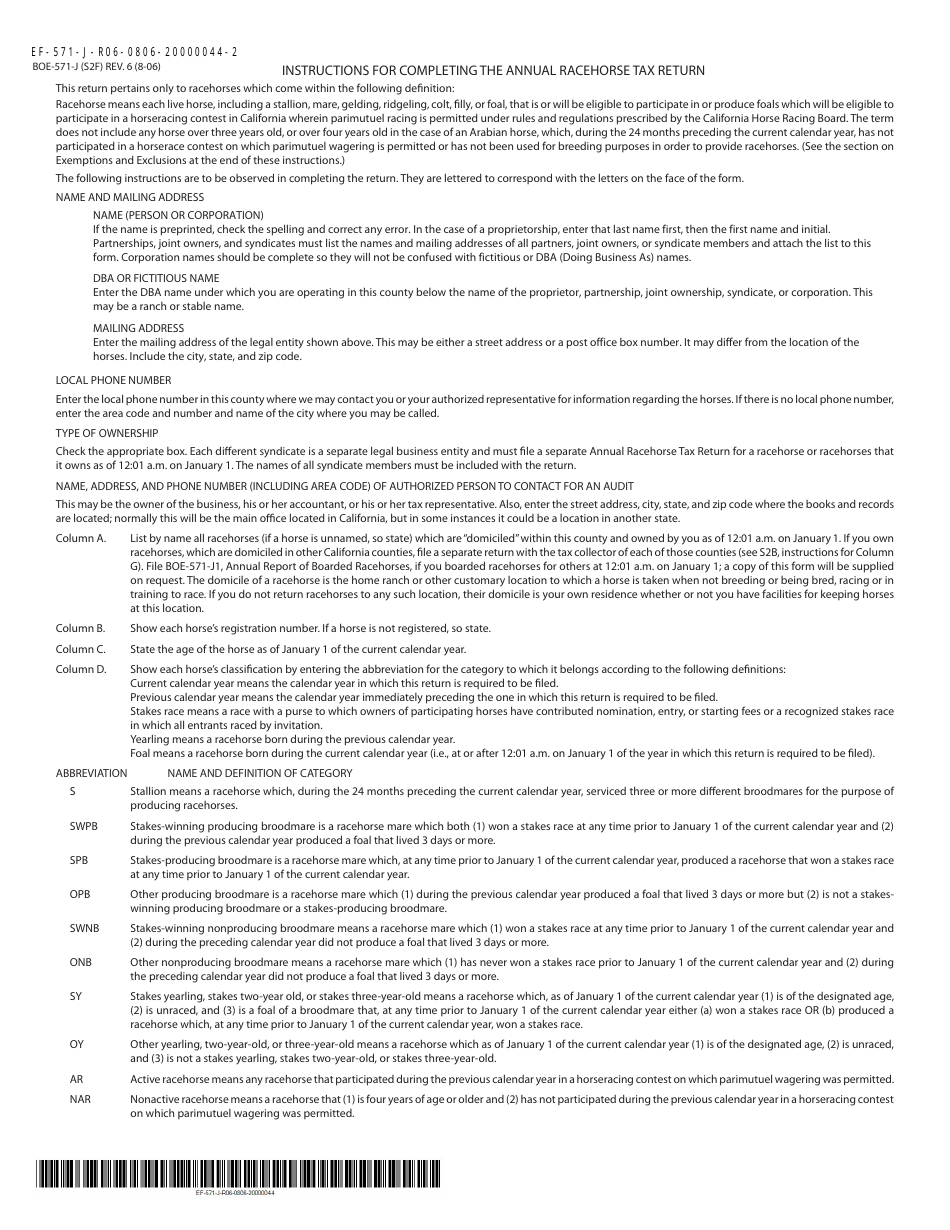

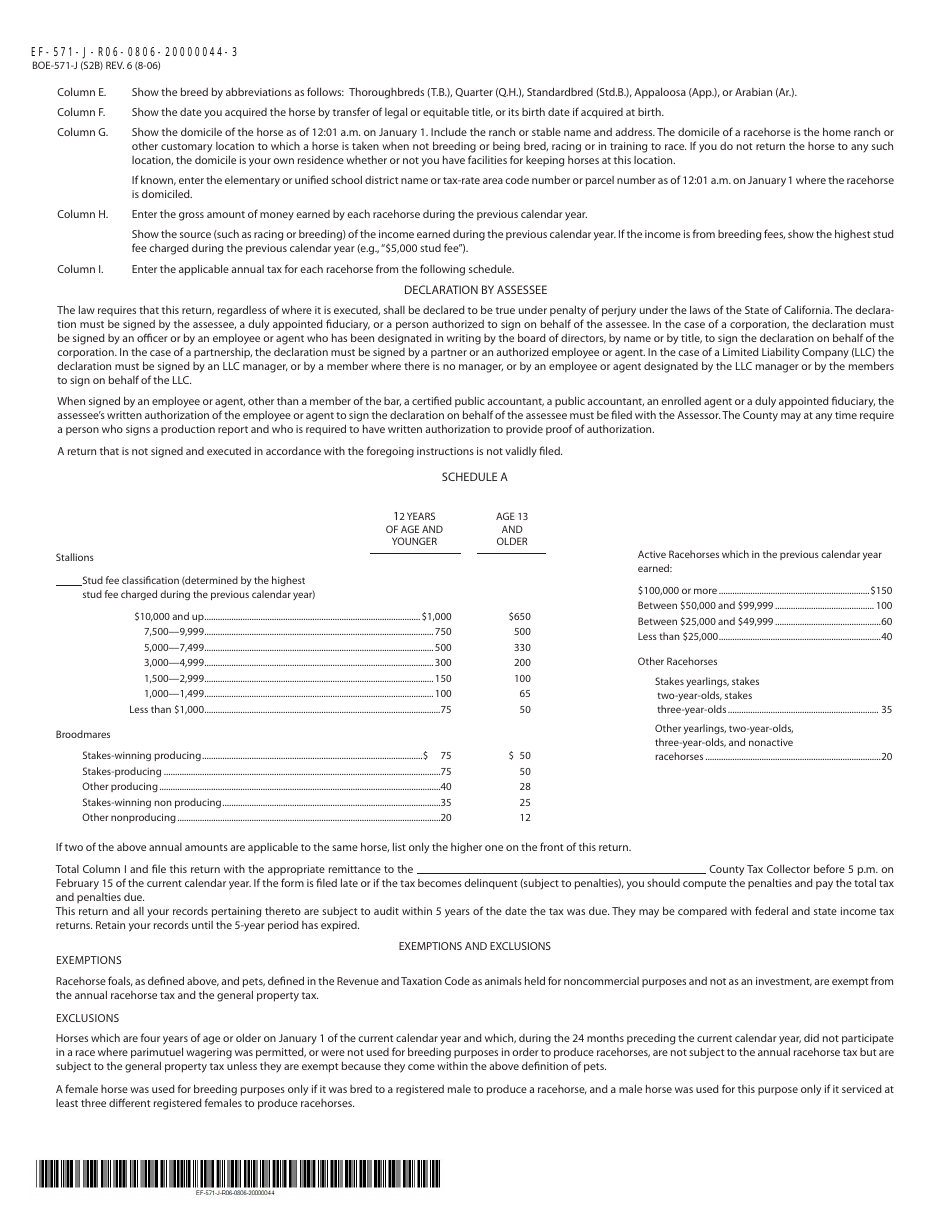

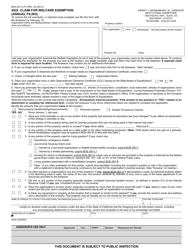

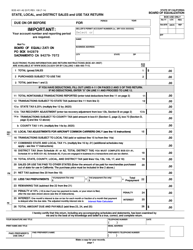

Form BOE-571-J Annual Racehorse Tax Return - Madera County, California

What Is Form BOE-571-J?

This is a legal form that was released by the Assessor's Office - Madera County, California - a government authority operating within California. The form may be used strictly within Madera County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-571-J?

A: BOE-571-J is the Annual Racehorse Tax Return form.

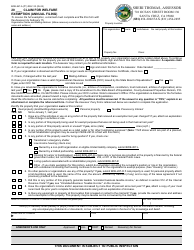

Q: Who needs to file BOE-571-J?

A: Any individual or company who owns or leases racehorses in Madera County, California needs to file BOE-571-J.

Q: What is the purpose of BOE-571-J?

A: The purpose of BOE-571-J is to report the number of racehorses owned or leased in Madera County and calculate the racehorse tax due.

Q: When is the deadline to file BOE-571-J?

A: The deadline to file BOE-571-J is on or before January 1st of each year.

Q: Are there any penalties for late filing of BOE-571-J?

A: Yes, late filing of BOE-571-J may result in penalties and interest charges.

Q: How can I contact the Madera County Assessor's Office for more information?

A: You can contact the Madera County Assessor's Office at [insert contact information] for more information regarding BOE-571-J.

Form Details:

- Released on August 1, 2006;

- The latest edition provided by the Assessor's Office - Madera County, California;

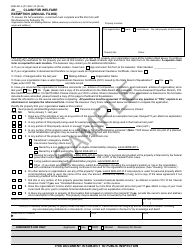

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-571-J by clicking the link below or browse more documents and templates provided by the Assessor's Office - Madera County, California.