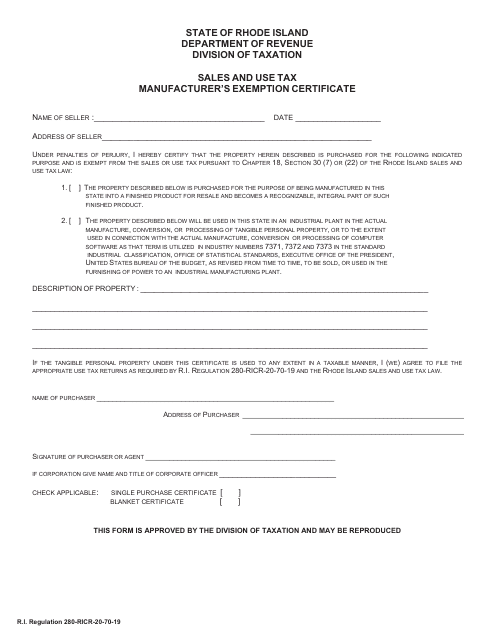

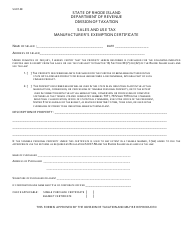

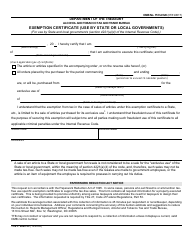

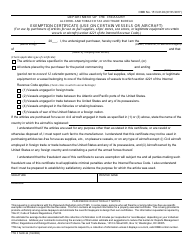

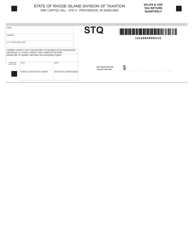

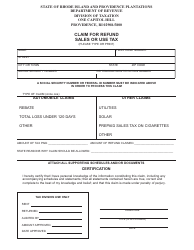

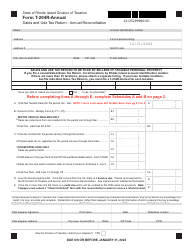

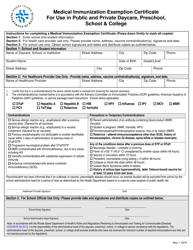

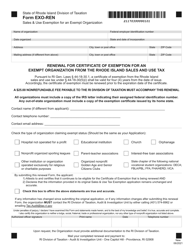

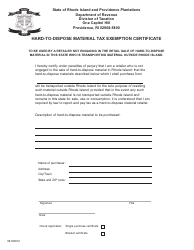

Sales and Use Tax Manufacturer's Exemption Certificate - Rhode Island

Sales and Use Tax Manufacturer's Exemption Certificate is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is the Sales and Use Tax Manufacturer's Exemption Certificate?

A: The Sales and Use Tax Manufacturer's Exemption Certificate is a document that allows manufacturers to exempt certain purchases from sales and use tax in Rhode Island.

Q: Who can use the Sales and Use Tax Manufacturer's Exemption Certificate?

A: Manufacturers in Rhode Island can use the Sales and Use Tax Manufacturer's Exemption Certificate.

Q: What purchases can be exempted with the Sales and Use Tax Manufacturer's Exemption Certificate?

A: Purchases of machinery, equipment, and materials used directly in the manufacturing process can be exempted with the Sales and Use Tax Manufacturer's Exemption Certificate.

Q: Is the Sales and Use Tax Manufacturer's Exemption Certificate permanent?

A: No, the Sales and Use Tax Manufacturer's Exemption Certificate is valid for two years from the date of issue and must be renewed.

Form Details:

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.