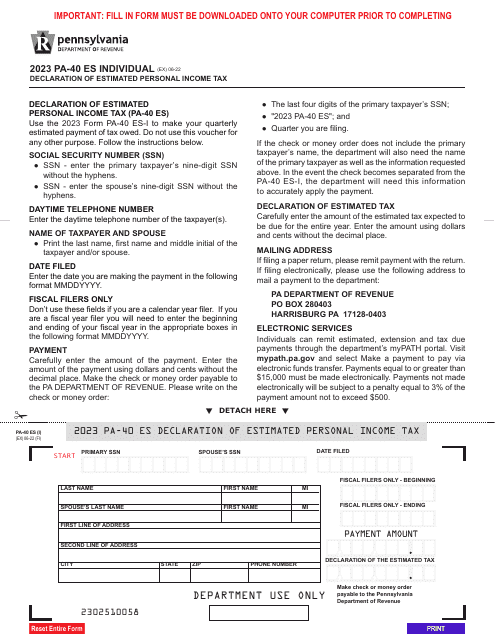

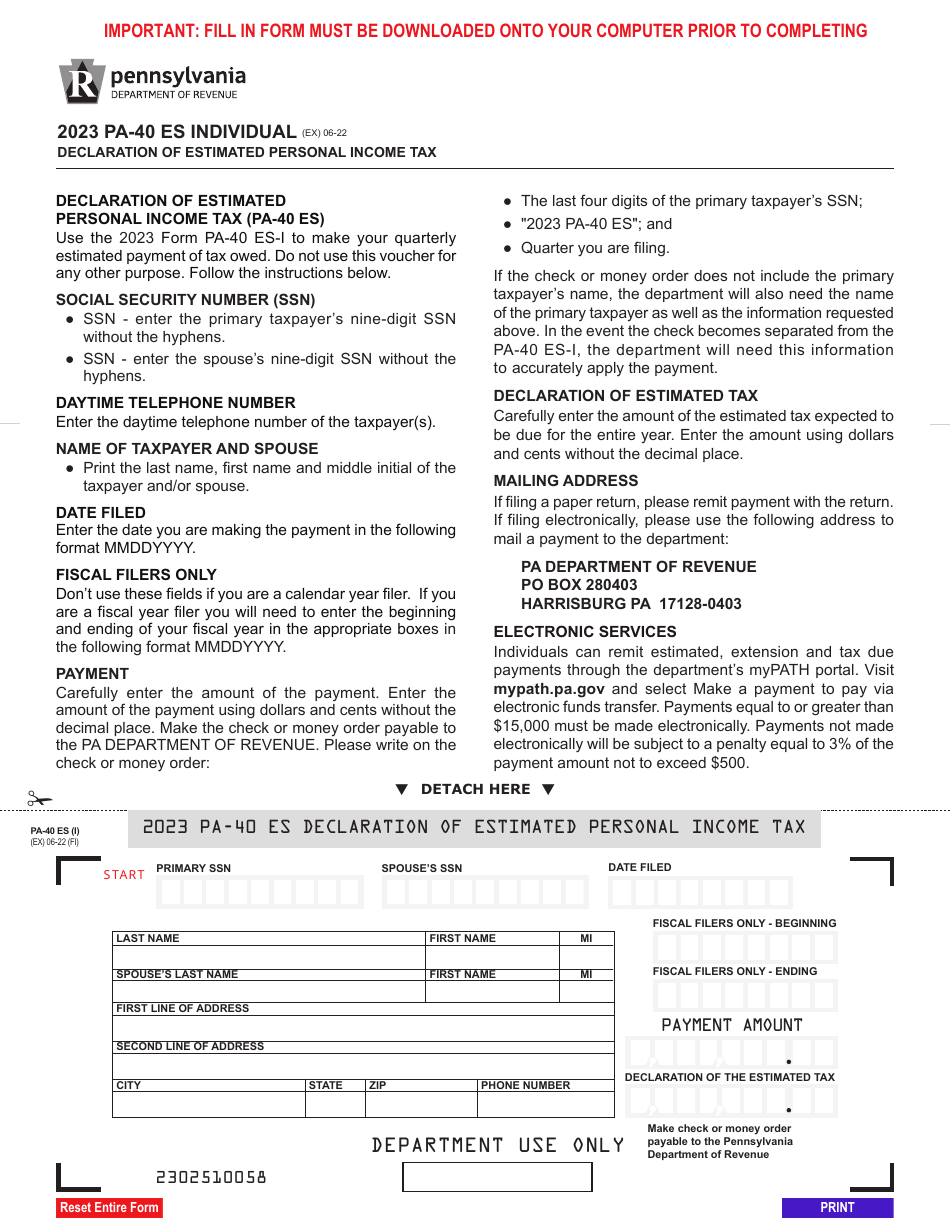

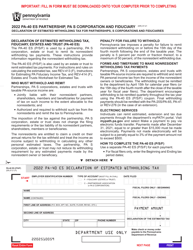

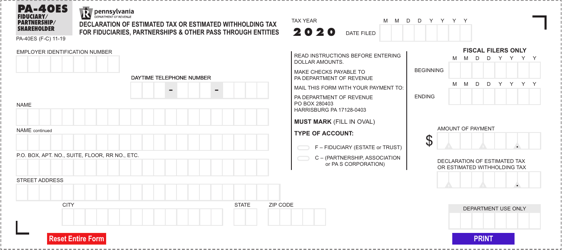

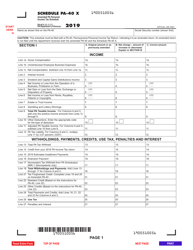

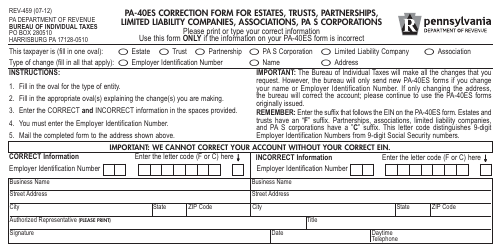

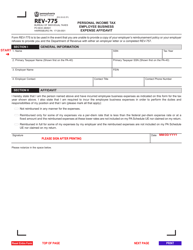

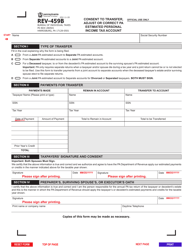

Form PA-40 ES (I) Declaration of Estimated Personal Income Tax - Pennsylvania

What Is Form PA-40 ES (I)?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form PA-40 ES (I)?

A: Form PA-40 ES (I) is the Declaration of Estimated Personal Income Tax for residents of Pennsylvania.

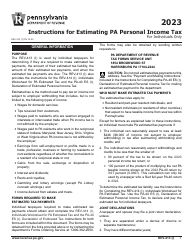

Q: Who needs to file Form PA-40 ES (I)?

A: Residents of Pennsylvania who expect to owe income tax must file Form PA-40 ES (I).

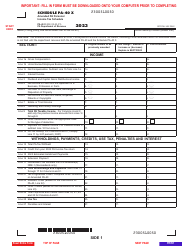

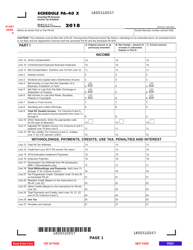

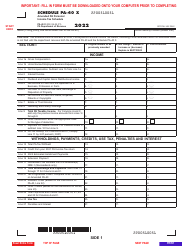

Q: What is the purpose of Form PA-40 ES (I)?

A: The purpose of Form PA-40 ES (I) is to report estimated income tax payments throughout the year.

Q: When is Form PA-40 ES (I) due?

A: Form PA-40 ES (I) is due on April 15th of each year.

Q: How often do I need to file Form PA-40 ES (I)?

A: Form PA-40 ES (I) is filed quarterly, with payment due on April 15th, June 15th, September 15th, and January 15th.

Q: What happens if I don't file Form PA-40 ES (I)?

A: If you don't file Form PA-40 ES (I) or underpay your estimated tax, you may owe penalties and interest on the amount due.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 ES (I) by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.