This version of the form is not currently in use and is provided for reference only. Download this version of

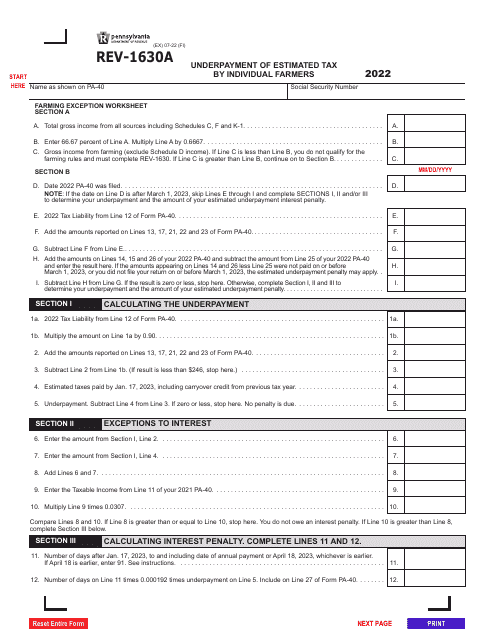

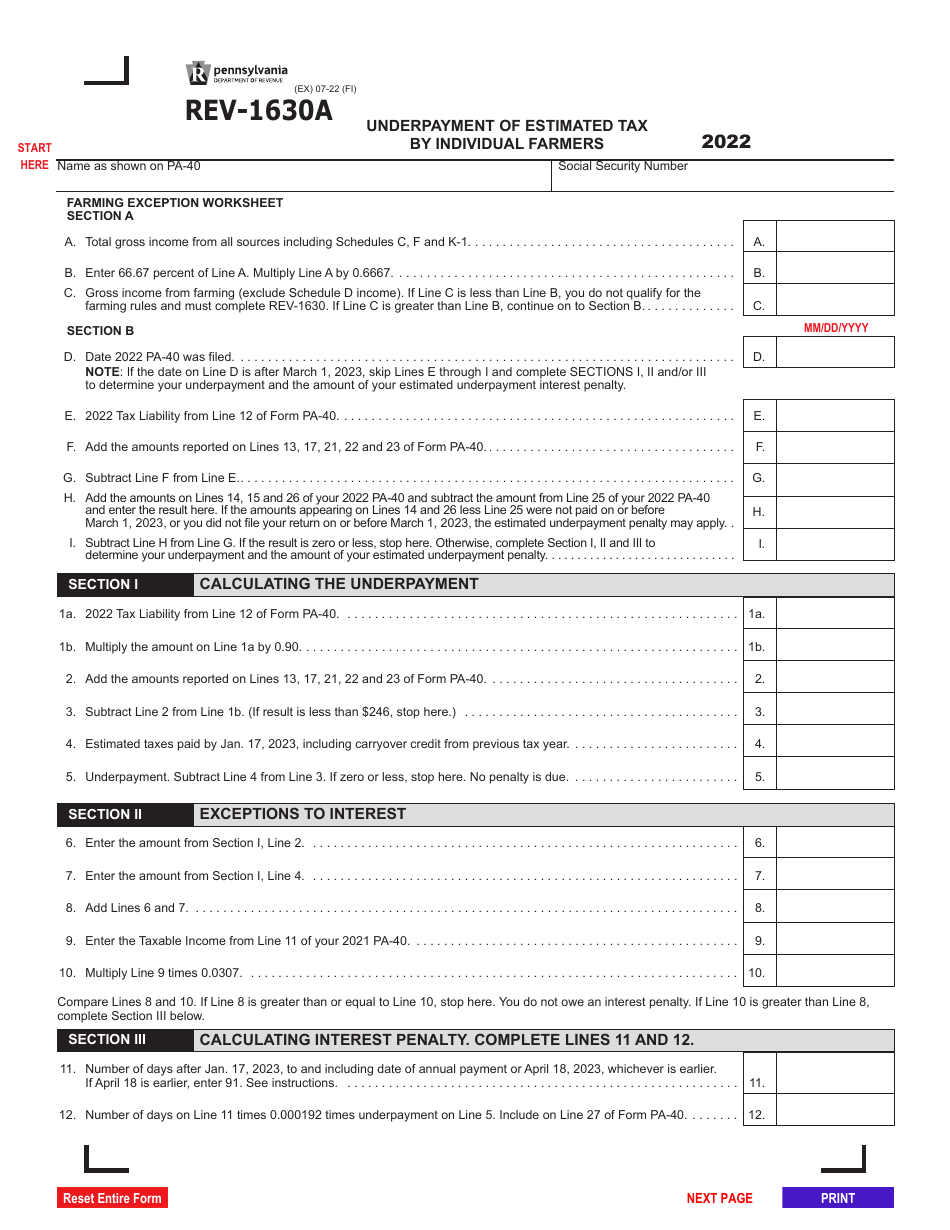

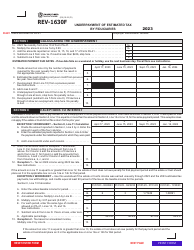

Form REV-1630A

for the current year.

Form REV-1630A Underpayment of Estimated Tax by Individual Farmers - Pennsylvania

What Is Form REV-1630A?

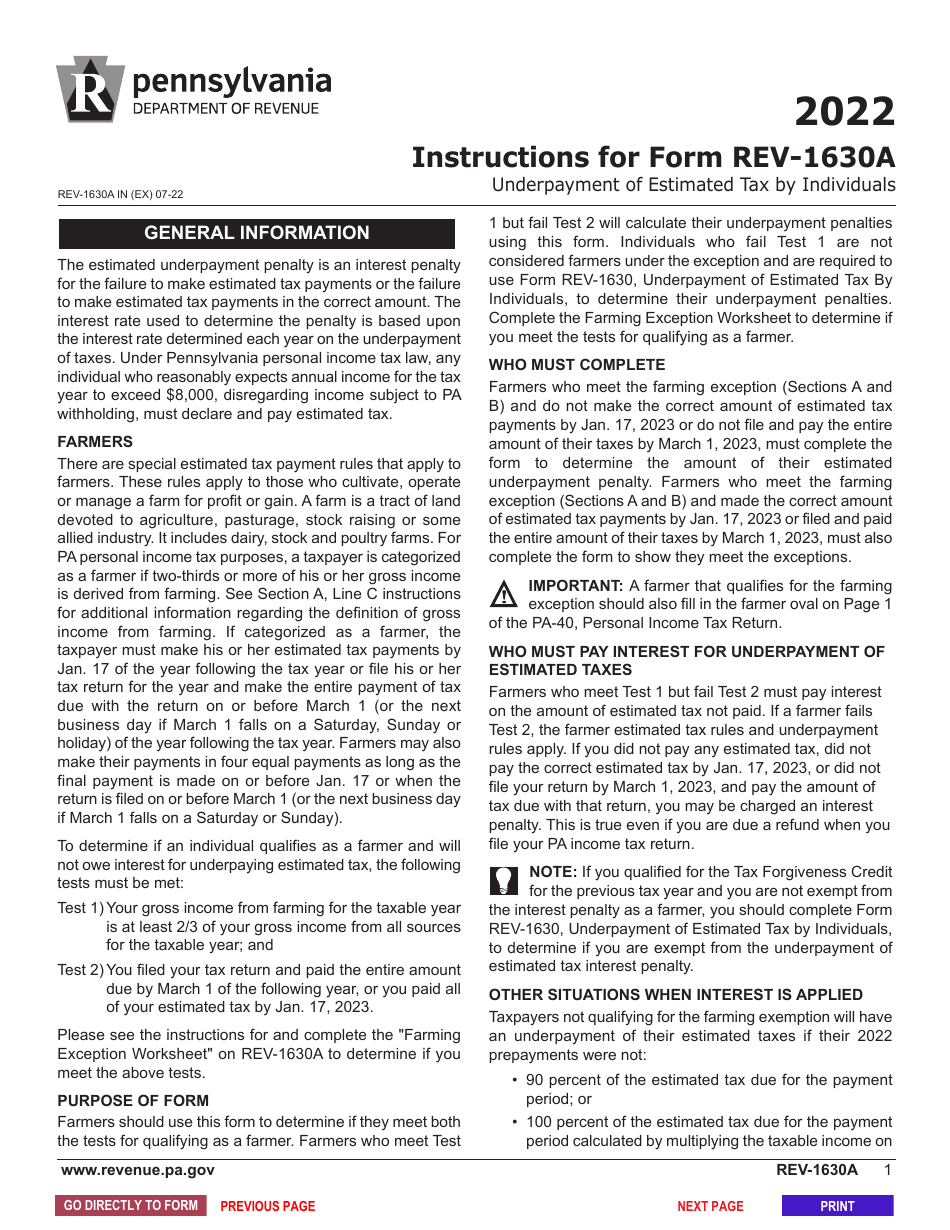

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1630A?

A: Form REV-1630A is a tax form used in Pennsylvania to report the underpayment of estimated tax by individual farmers.

Q: Who needs to file Form REV-1630A?

A: Individual farmers in Pennsylvania who have underpaid their estimated tax must file Form REV-1630A.

Q: What should I do if I have underpaid my estimated tax as an individual farmer in Pennsylvania?

A: If you have underpaid your estimated tax as an individual farmer in Pennsylvania, you should fill out and file Form REV-1630A to report the underpayment.

Q: Are there penalties for underpaying estimated tax as an individual farmer in Pennsylvania?

A: Yes, there may be penalties for underpaying estimated tax as an individual farmer in Pennsylvania. It is important to report the underpayment using Form REV-1630A to minimize penalties.

Q: When is the deadline for filing Form REV-1630A?

A: The deadline for filing Form REV-1630A for underpayment of estimated tax by individual farmers in Pennsylvania is typically April 15 of the following tax year.

Q: What information do I need to fill out Form REV-1630A?

A: To fill out Form REV-1630A, you will need information such as your income, deductions, and estimated tax payments made throughout the year.

Q: What if I still have questions about Form REV-1630A?

A: If you have further questions about Form REV-1630A, you can contact the Pennsylvania Department of Revenue or seek assistance from a tax professional.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1630A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.