This version of the form is not currently in use and is provided for reference only. Download this version of

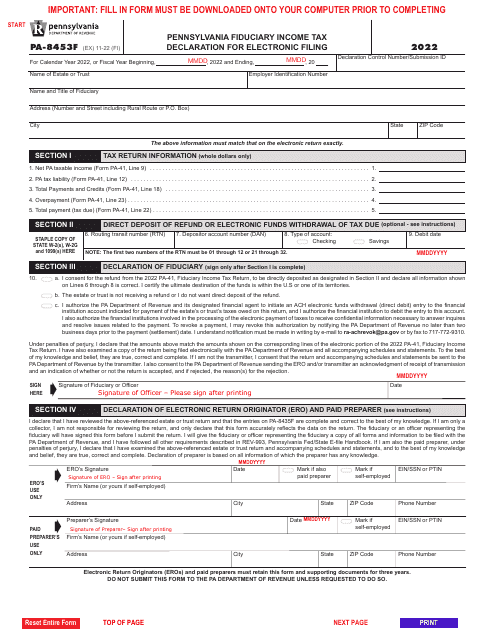

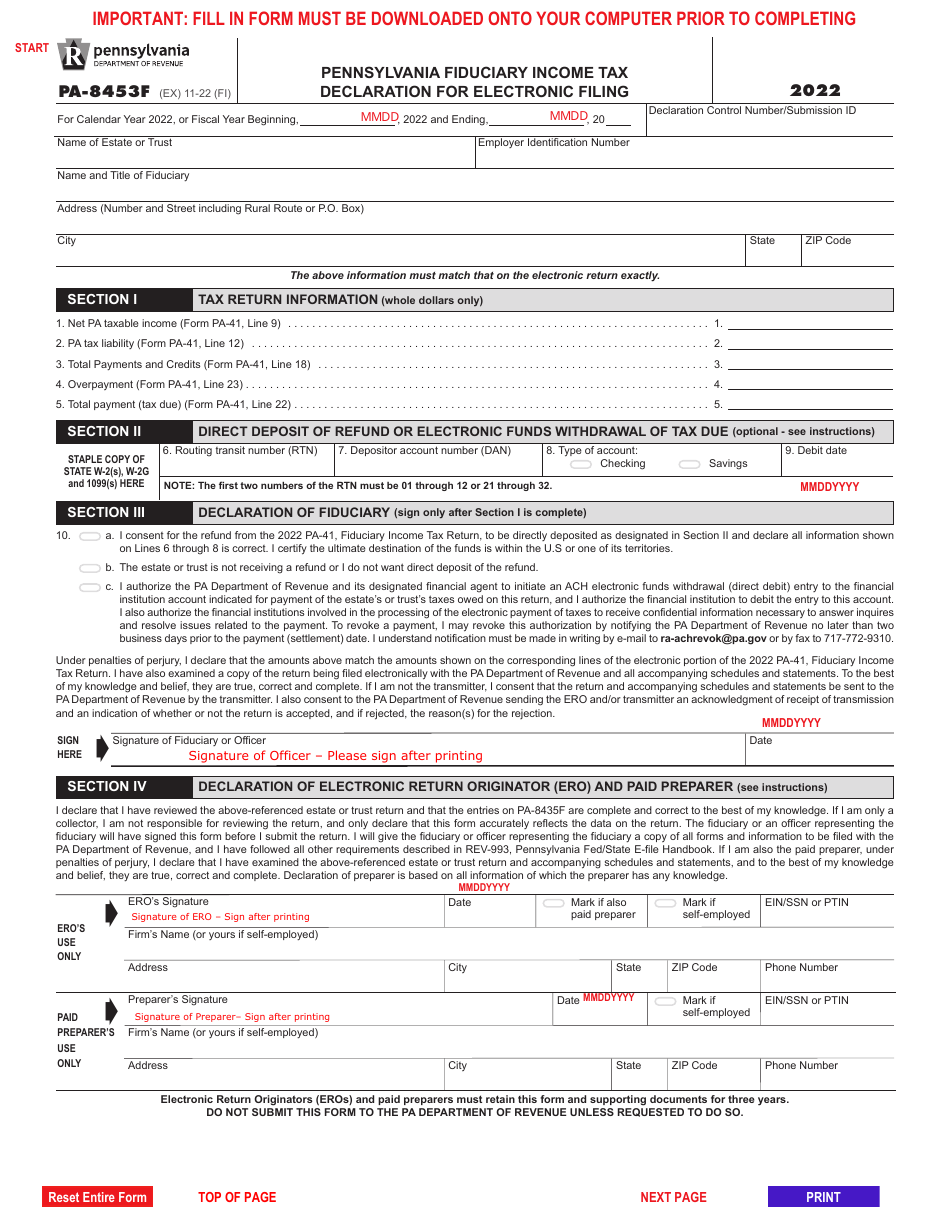

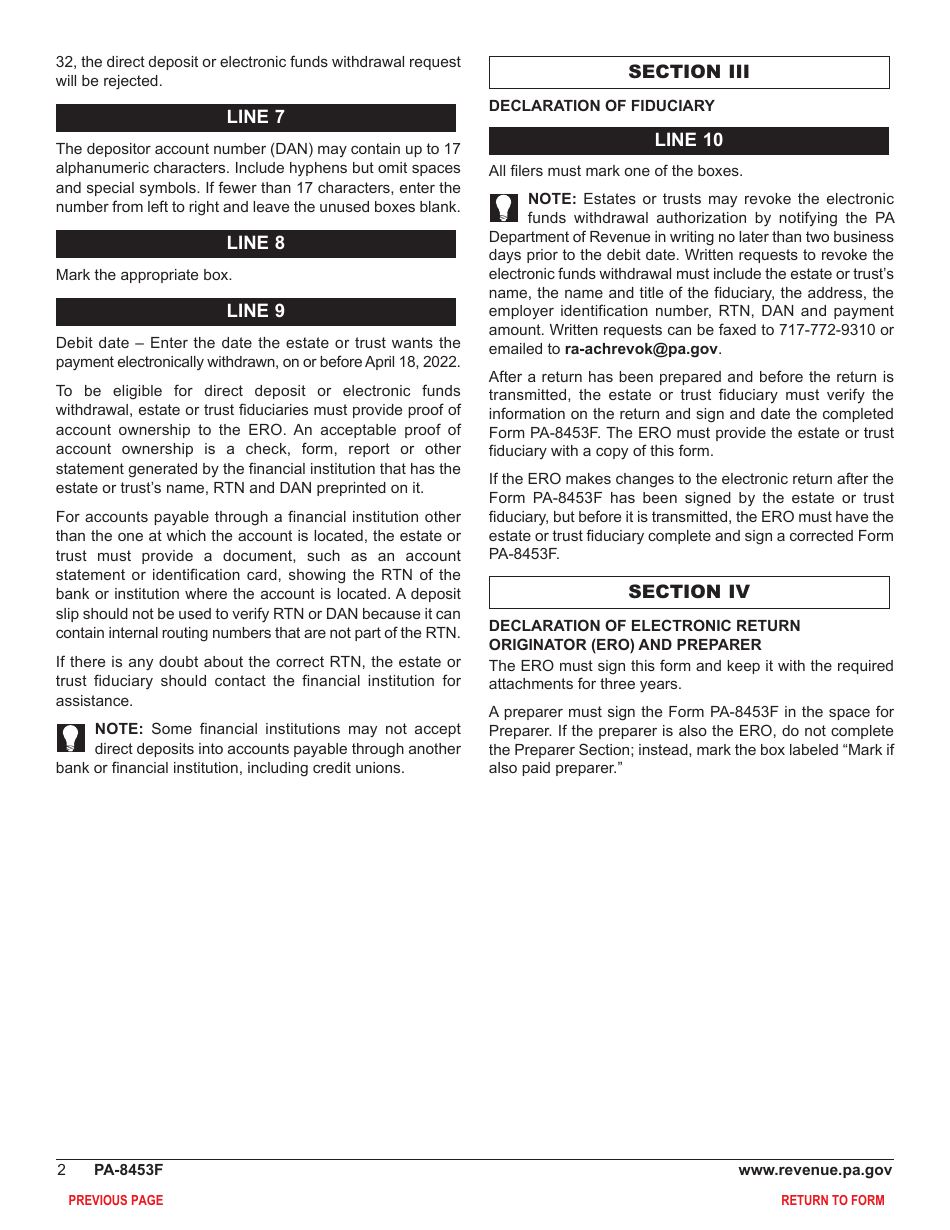

Form PA-8453F

for the current year.

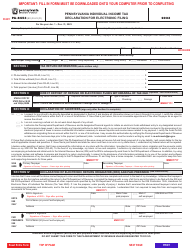

Form PA-8453F Pennsylvania Fiduciary Income Tax Declaration for Electronic Filing - Pennsylvania

What Is Form PA-8453F?

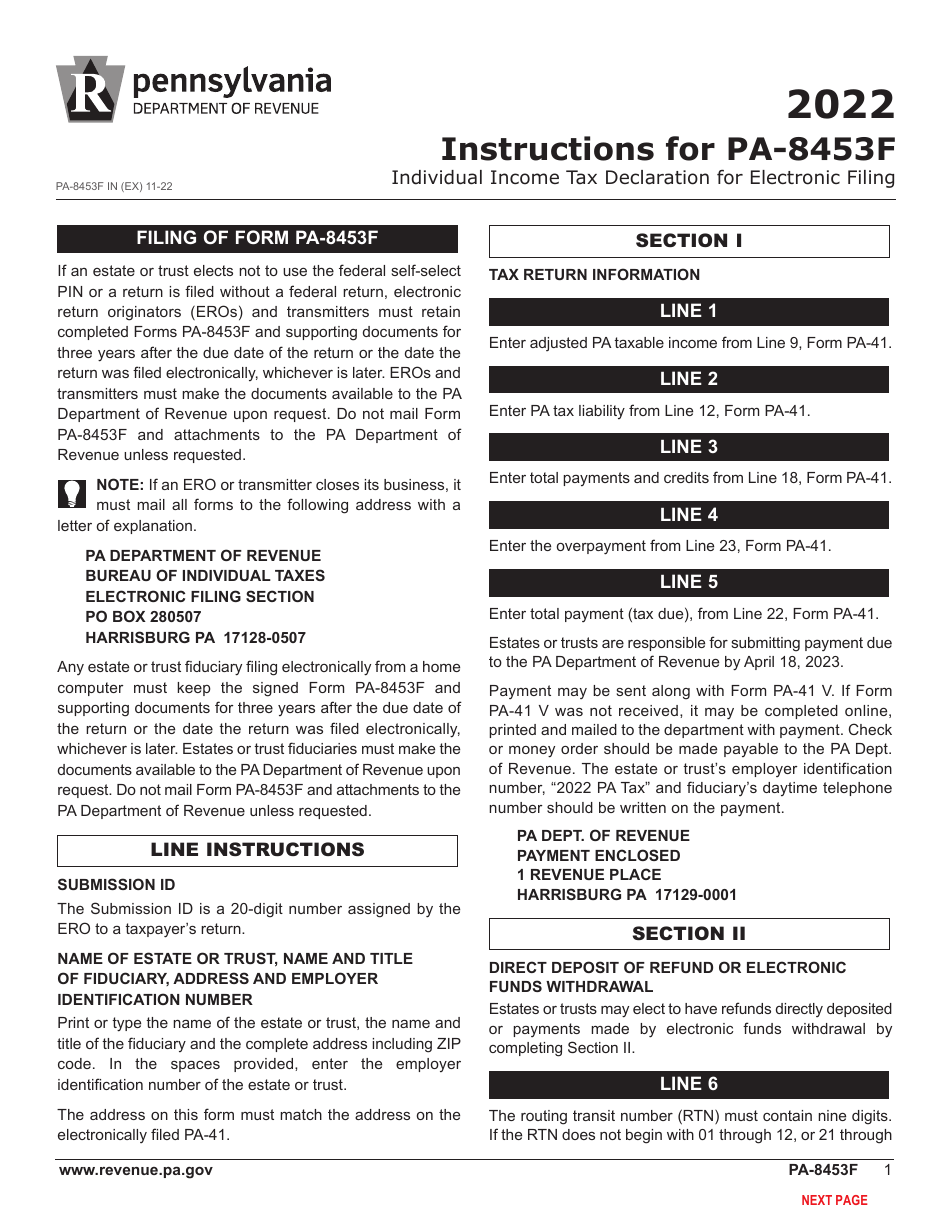

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-8453F?

A: Form PA-8453F is the Pennsylvania Fiduciary Income Tax Declaration for Electronic Filing.

Q: What is it used for?

A: It is used by fiduciaries to report income and expenses for a Pennsylvania estate or trust.

Q: Who needs to file Form PA-8453F?

A: Fiduciaries who have a Pennsylvania estate or trust that generated income or incurred expenses during the tax year.

Q: Can Form PA-8453F be filed electronically?

A: Yes, the form is specifically for electronic filing.

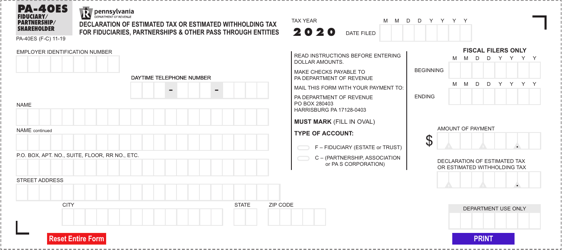

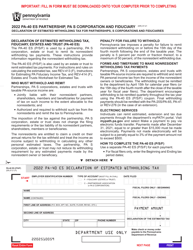

Q: What information is required on Form PA-8453F?

A: The form requires information such as the fiduciary's name, address, tax year, income, deductions, and tax payments made.

Q: When is the deadline for filing Form PA-8453F?

A: The deadline for filing Form PA-8453F is generally April 15th, or the 15th day of the 4th month following the close of the tax year.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing. It is important to file the form on time to avoid penalties.

Q: Can I file Form PA-8453F if I have a federal extension?

A: Yes, if you have a federal extension, you can also file Form PA-8453F using the extended due date.

Q: Can I make changes to Form PA-8453F after filing?

A: Once the form is filed, changes cannot be made electronically. You would need to file an amended paper return if changes are necessary.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-8453F by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.