This version of the form is not currently in use and is provided for reference only. Download this version of

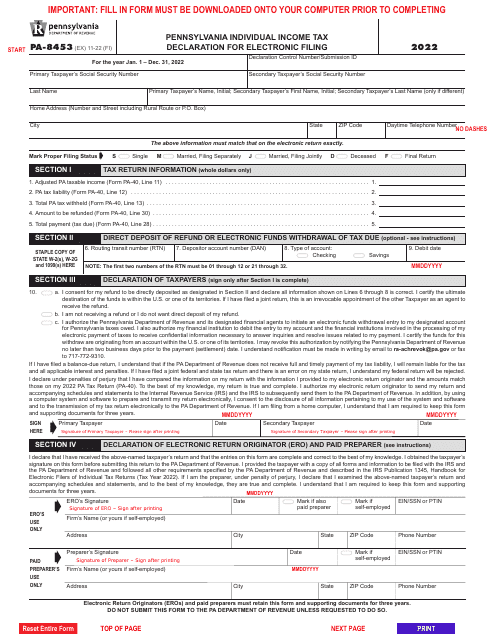

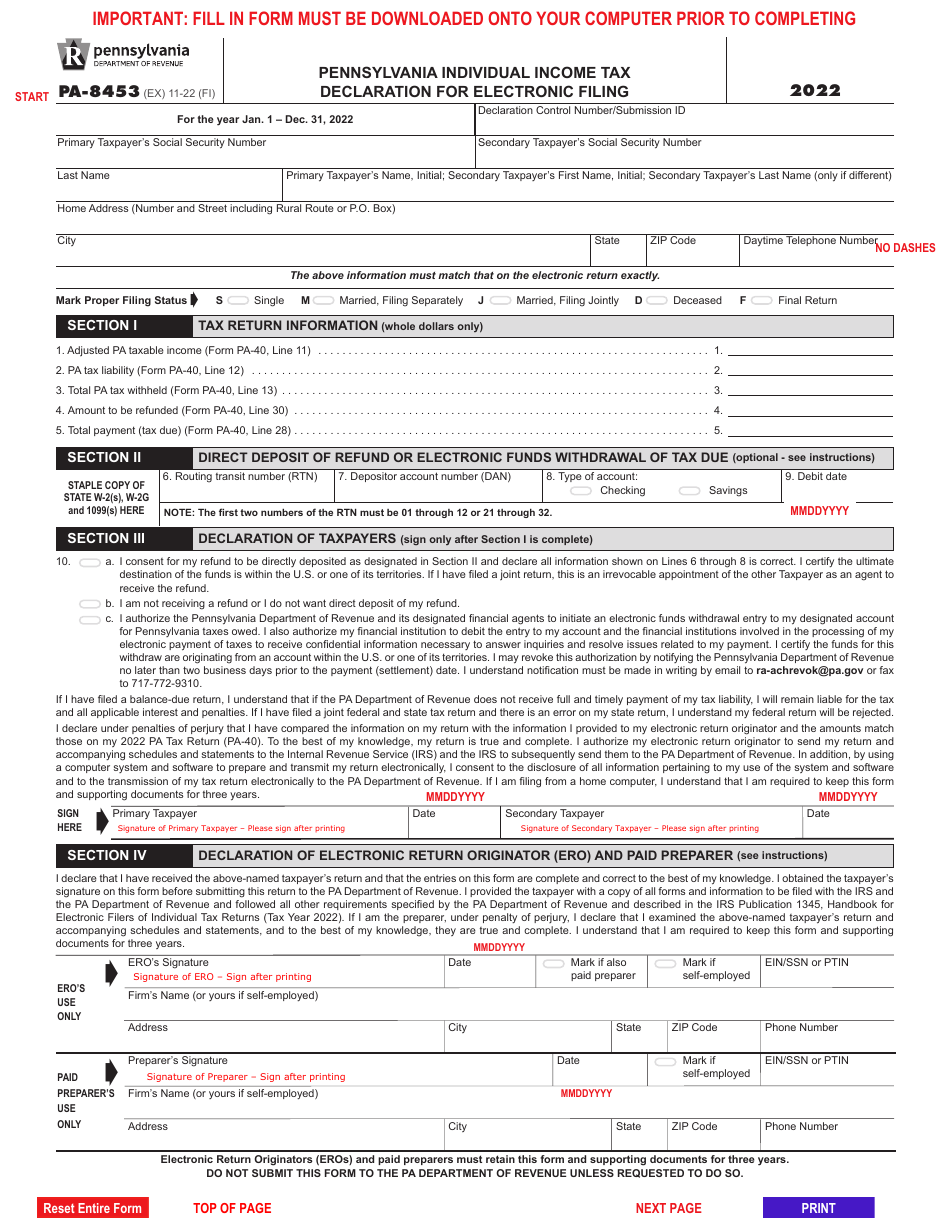

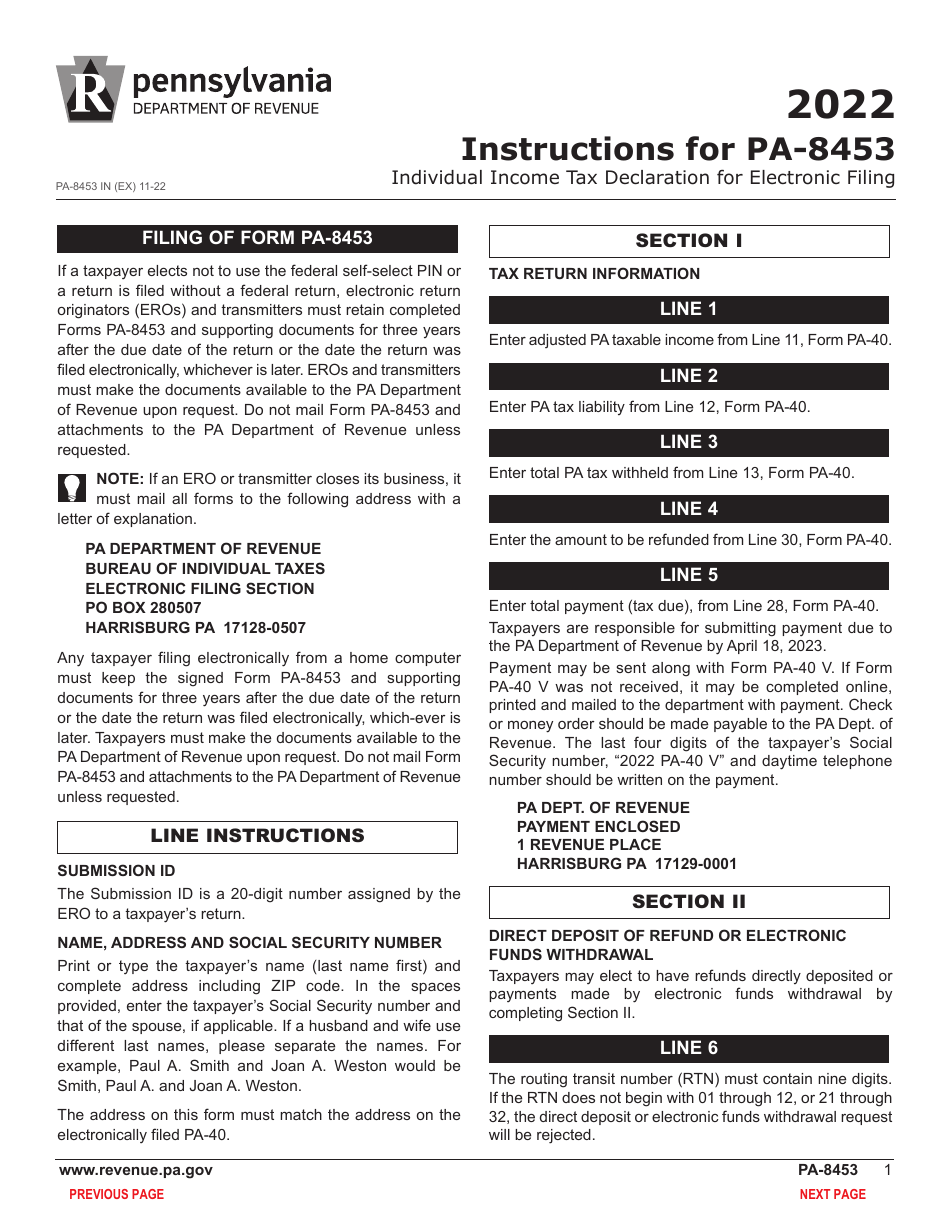

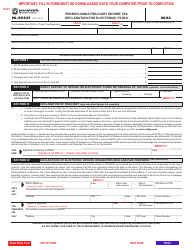

Form PA-8453

for the current year.

Form PA-8453 Pennsylvania Individual Income Tax Declaration for Electronic Filing - Pennsylvania

What Is Form PA-8453?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-8453?

A: Form PA-8453 is the Pennsylvania Individual Income Tax Declaration for Electronic Filing.

Q: What is the purpose of Form PA-8453?

A: The purpose of Form PA-8453 is to declare your Pennsylvania individual income tax for electronic filing.

Q: Who needs to file Form PA-8453?

A: Anyone who wants to electronically file their Pennsylvania individual income tax needs to file Form PA-8453.

Q: What information do I need to complete Form PA-8453?

A: You will need your personal information, income information, and any deductions or credits you are claiming.

Q: When is the deadline to file Form PA-8453?

A: The deadline to file Form PA-8453 is the same as the deadline to file your Pennsylvania individual income tax return, usually April 15th.

Q: Do I need to include any attachments with Form PA-8453?

A: Yes, you will need to attach copies of any required schedules or forms to Form PA-8453.

Q: Can I file Form PA-8453 if I am mailing in my tax return?

A: No, Form PA-8453 is only for electronic filing. If you are mailing in your tax return, you do not need to file Form PA-8453.

Q: What happens after I file Form PA-8453?

A: After you file Form PA-8453, you will receive a confirmation that your electronic filing has been successful.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-8453 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.