This version of the form is not currently in use and is provided for reference only. Download this version of

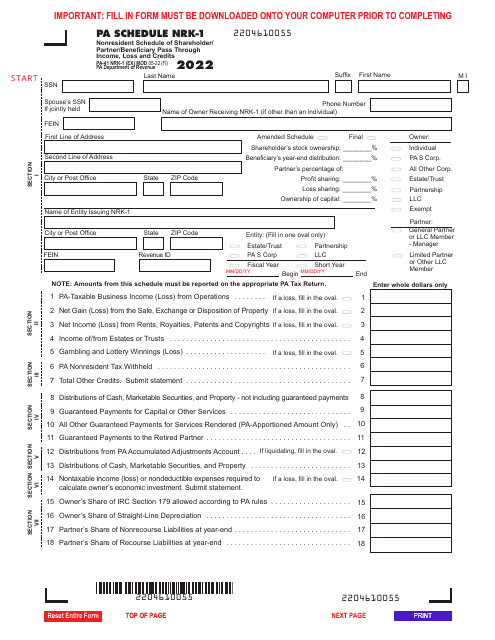

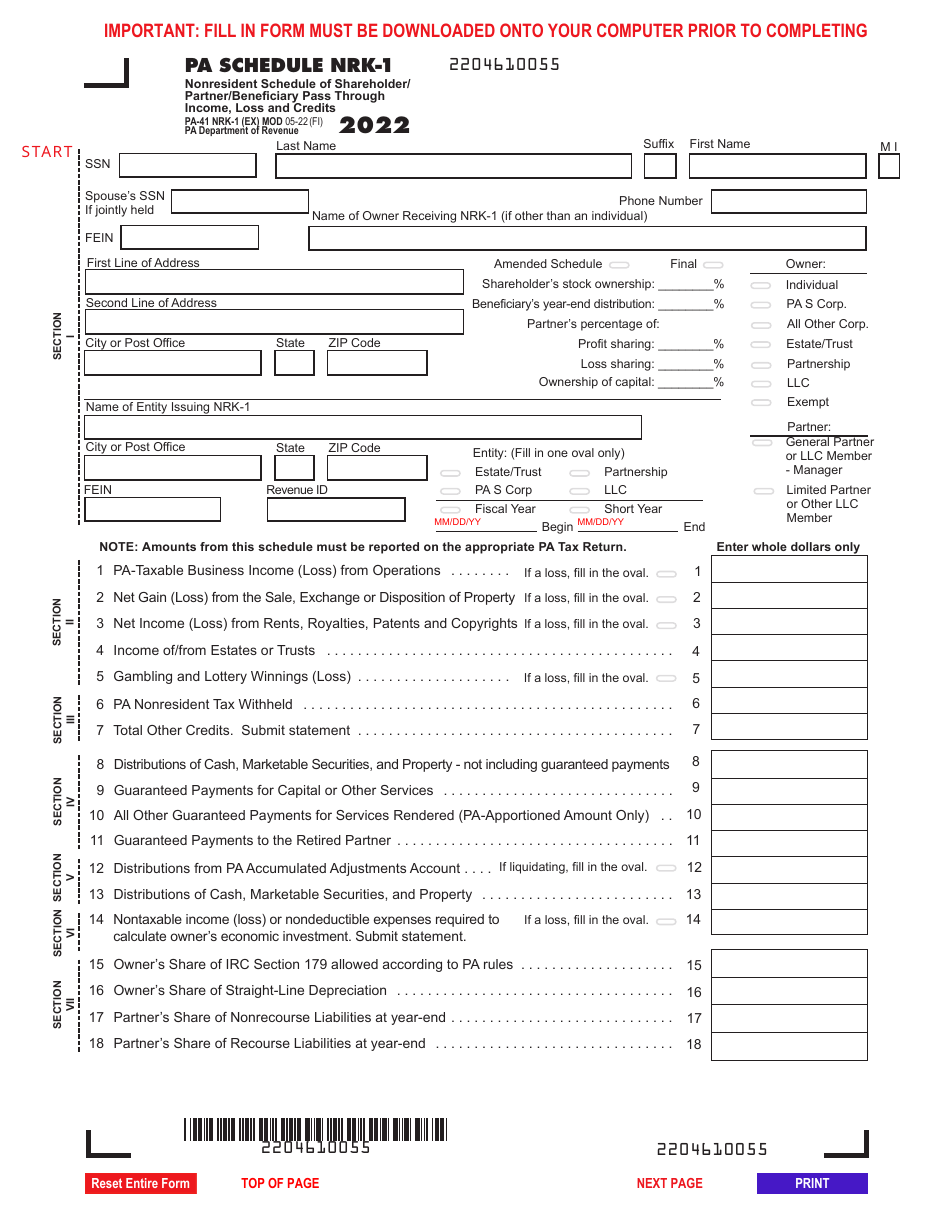

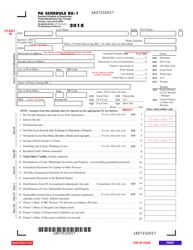

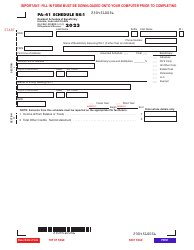

Form PA-41 Schedule NRK-1

for the current year.

Form PA-41 Schedule NRK-1 Nonresident Schedule of Shareholder / Partner / Beneficiary Pass Through Income, Loss and Credits - Pennsylvania

What Is Form PA-41 Schedule NRK-1?

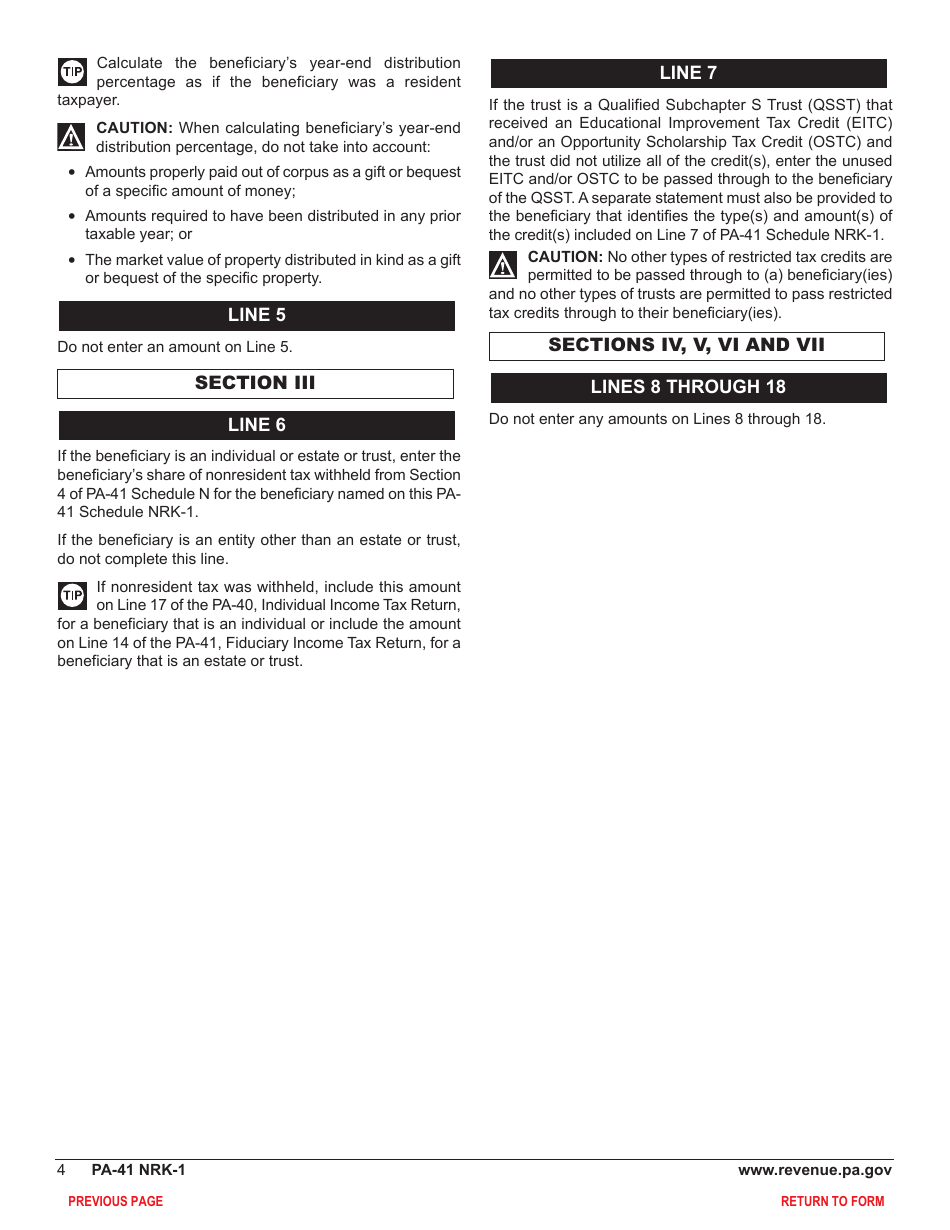

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PA-41 Schedule NRK-1?

A: PA-41 Schedule NRK-1 is a form used by nonresident shareholders, partners, and beneficiaries to report their pass-through income, loss, and credits in Pennsylvania.

Q: Who needs to file PA-41 Schedule NRK-1?

A: Nonresident shareholders, partners, and beneficiaries who have pass-through income, loss, or credits from Pennsylvania sources need to file PA-41 Schedule NRK-1.

Q: What information is required on PA-41 Schedule NRK-1?

A: PA-41 Schedule NRK-1 requires information about the nonresident's share of income, loss, and credits from partnerships, S corporations, estates, or trusts.

Q: When is the deadline to file PA-41 Schedule NRK-1?

A: The deadline to file PA-41 Schedule NRK-1 is usually the same as the deadline for filing your Pennsylvania personal income tax return.

Q: Are there any penalties for not filing PA-41 Schedule NRK-1?

A: Yes, if you are required to file PA-41 Schedule NRK-1 and you do not do so, you may face penalties and interest on any tax owed.

Q: Can I e-file PA-41 Schedule NRK-1?

A: Yes, you can e-file PA-41 Schedule NRK-1 if you are filing your Pennsylvania personal income tax return electronically.

Q: Do I need to include supporting documents with PA-41 Schedule NRK-1?

A: You do not need to include supporting documents with PA-41 Schedule NRK-1, but you should keep them for your records in case of an audit.

Q: Can I amend PA-41 Schedule NRK-1 if I made a mistake?

A: Yes, you can file an amended PA-41 Schedule NRK-1 to correct any errors or omissions that you made on your original filing.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule NRK-1 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.