This version of the form is not currently in use and is provided for reference only. Download this version of

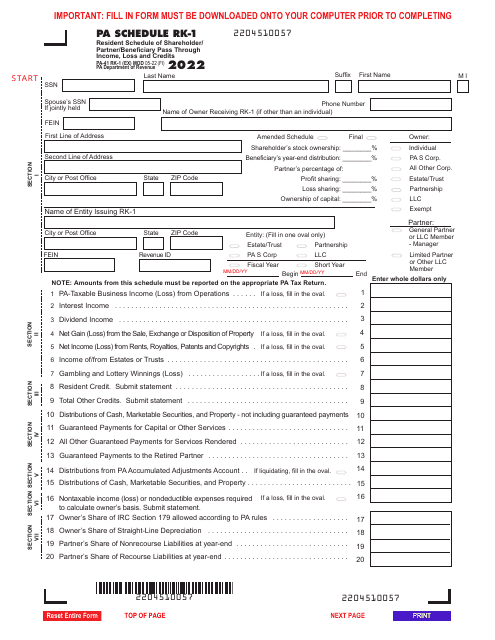

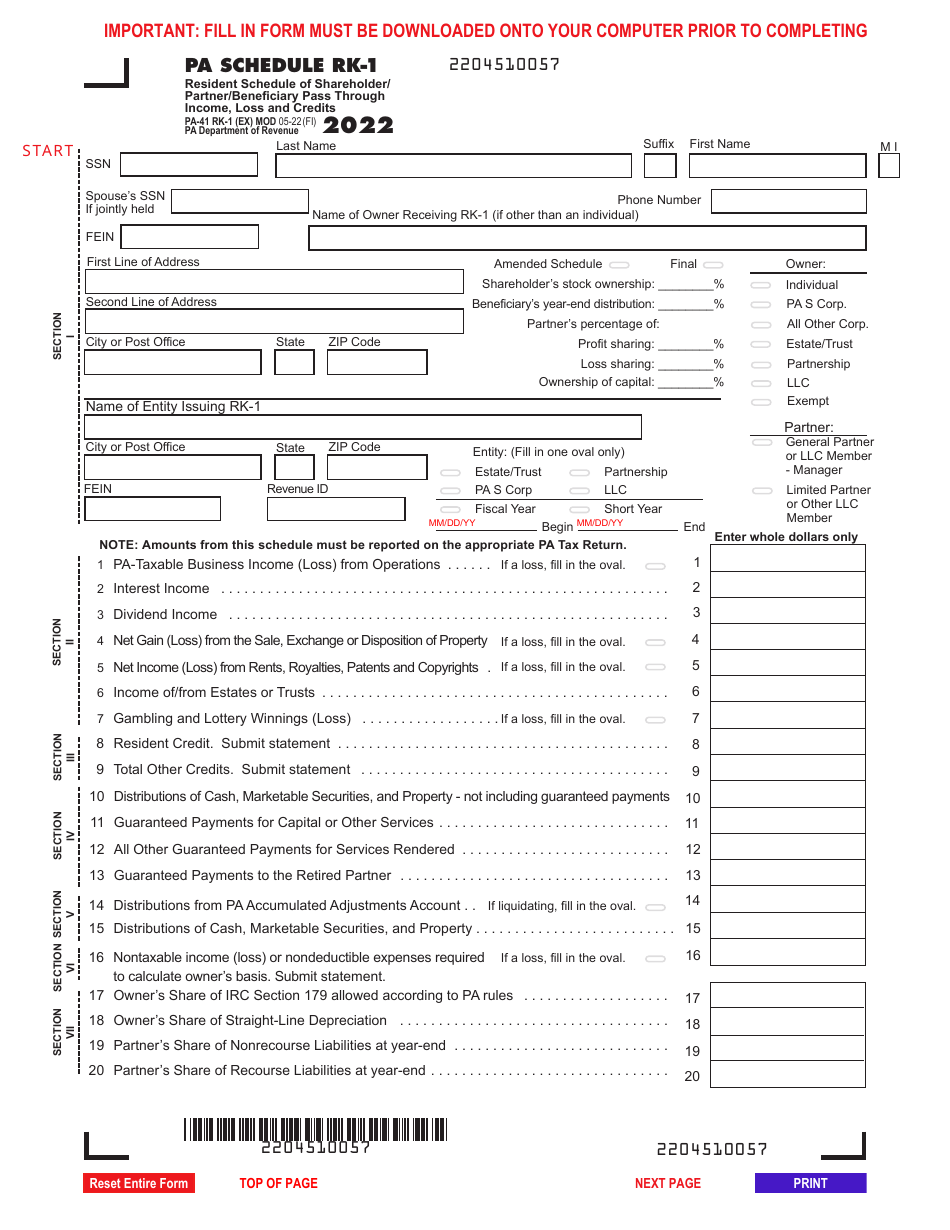

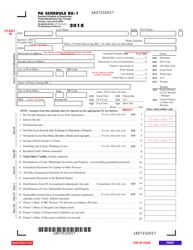

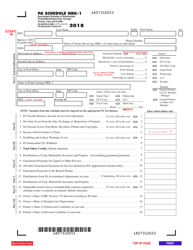

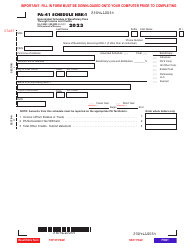

Form PA-41 Schedule RK-1

for the current year.

Form PA-41 Schedule RK-1 Resident Schedule of Shareholder / Partner / Beneficiary Pass Through Income, Loss and Credits - Pennsylvania

What Is Form PA-41 Schedule RK-1?

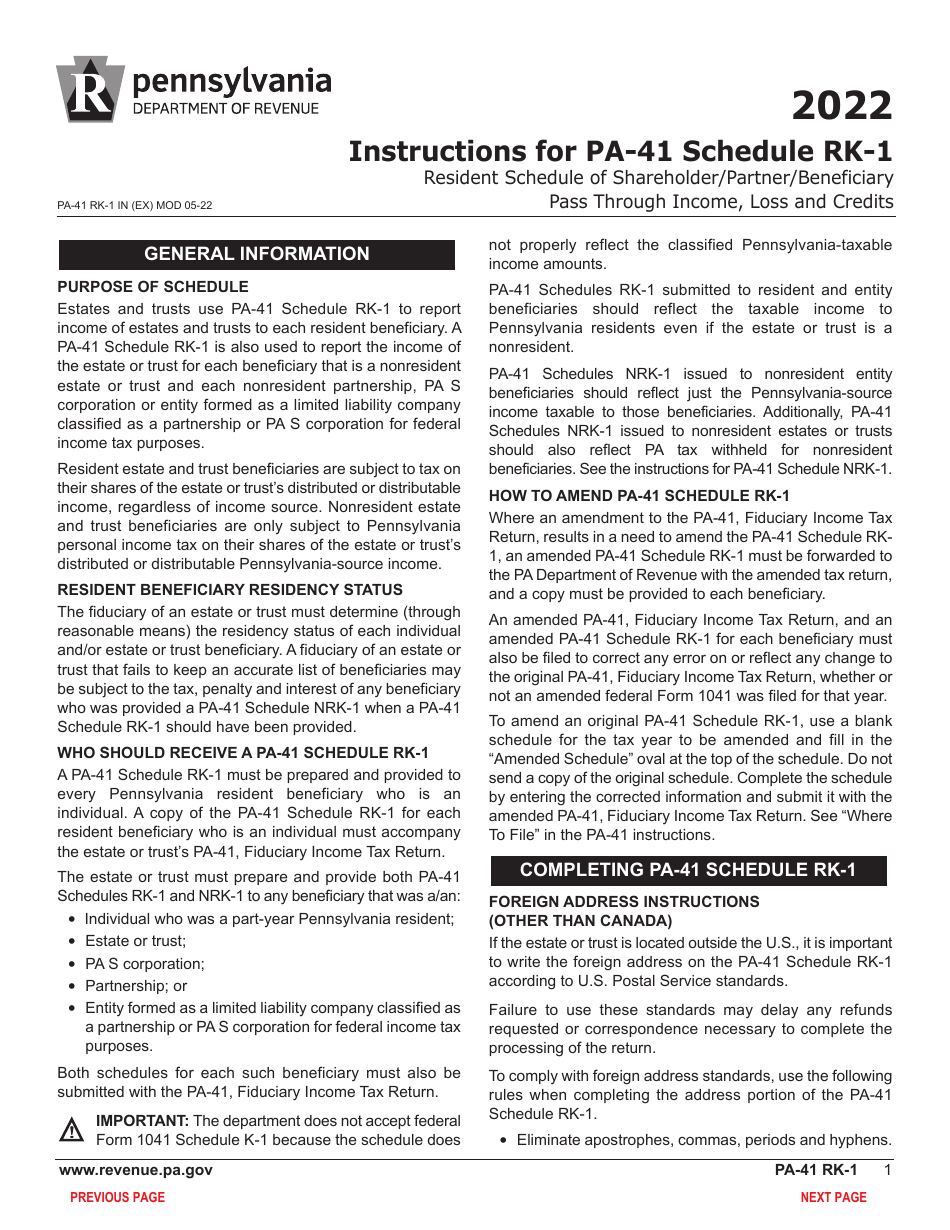

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-41 Schedule RK-1?

A: Form PA-41 Schedule RK-1 is the Resident Schedule of Shareholder/Partner/Beneficiary Pass Through Income, Loss and Credits for residents of Pennsylvania.

Q: Who needs to file Form PA-41 Schedule RK-1?

A: Form PA-41 Schedule RK-1 is typically filed by individuals who are residents of Pennsylvania and have income, losses, or credits from partnerships, S corporations, trusts, or estates.

Q: What information is included on Form PA-41 Schedule RK-1?

A: Form PA-41 Schedule RK-1 includes details of the income, losses, and credits allocated to the resident taxpayer from partnerships, S corporations, trusts, or estates.

Q: When is Form PA-41 Schedule RK-1 due?

A: Form PA-41 Schedule RK-1 is generally due on or before the same date as the Pennsylvania personal income tax return, which is April 15th of each year.

Q: Do I need to include supporting documents with Form PA-41 Schedule RK-1?

A: Yes, you may need to attach supporting documents such as K-1 forms received from partnerships, S corporations, trusts, or estates, depending on the specific instructions and requirements of the form.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule RK-1 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.