This version of the form is not currently in use and is provided for reference only. Download this version of

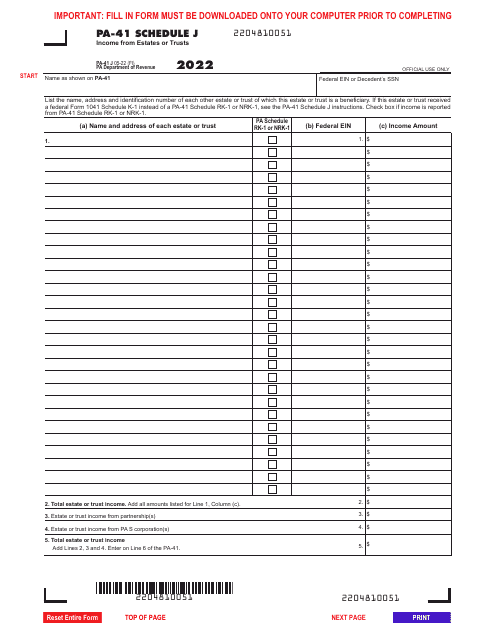

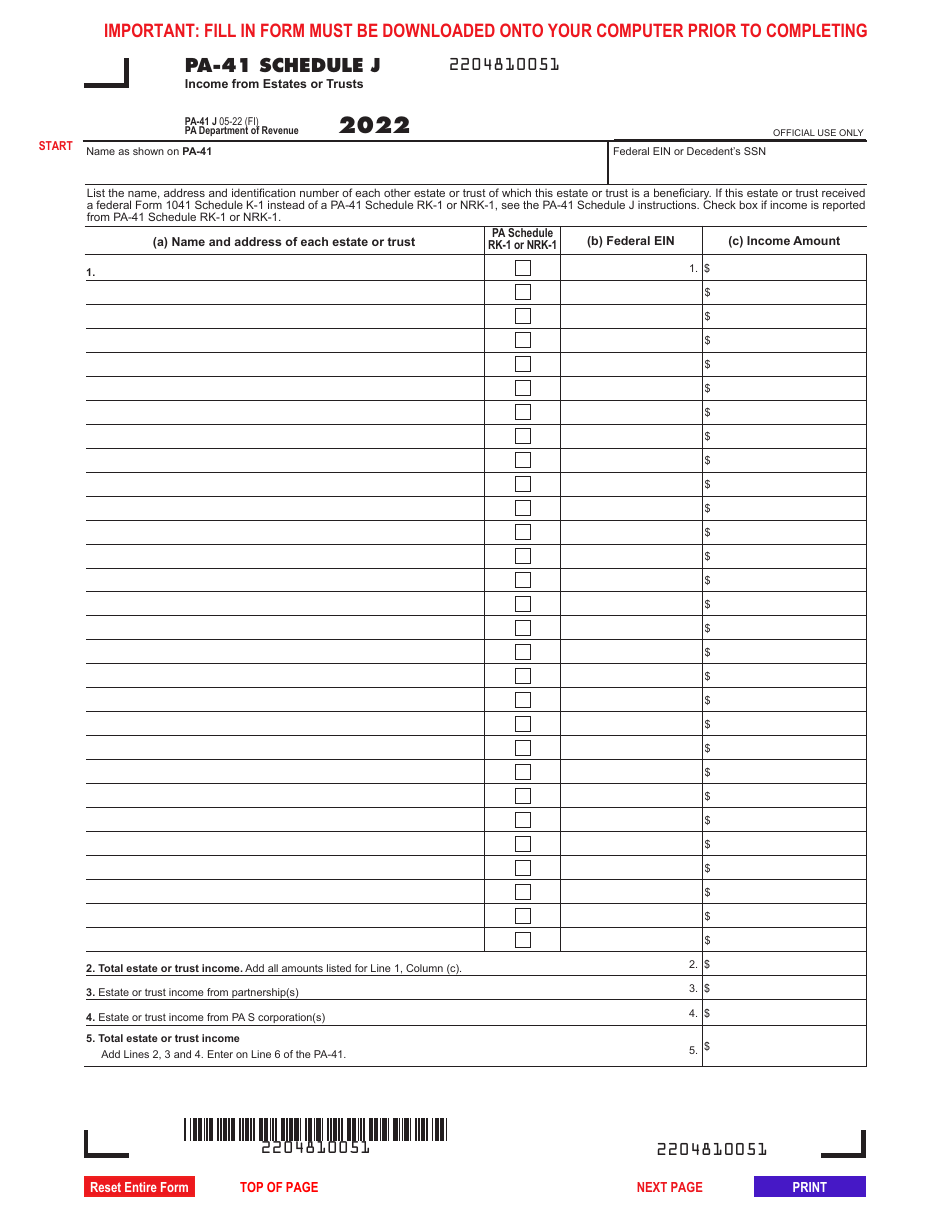

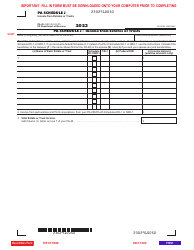

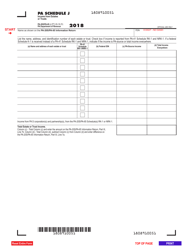

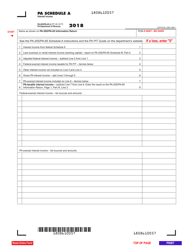

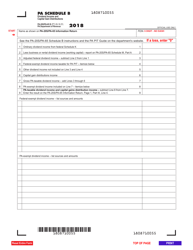

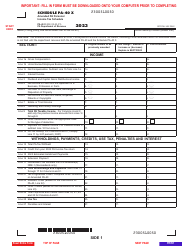

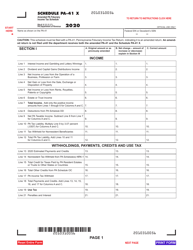

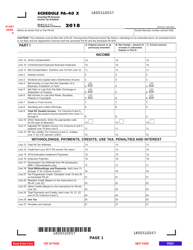

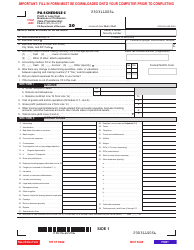

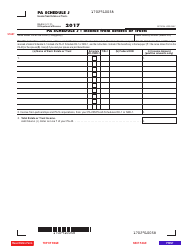

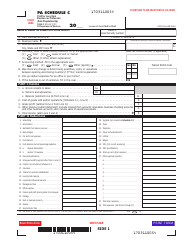

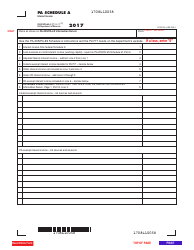

Form PA-41 Schedule J

for the current year.

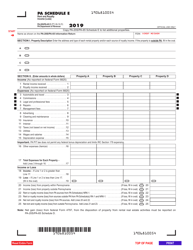

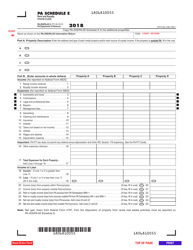

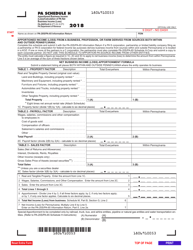

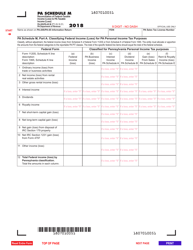

Form PA-41 Schedule J Income From Estates or Trusts - Pennsylvania

What Is Form PA-41 Schedule J?

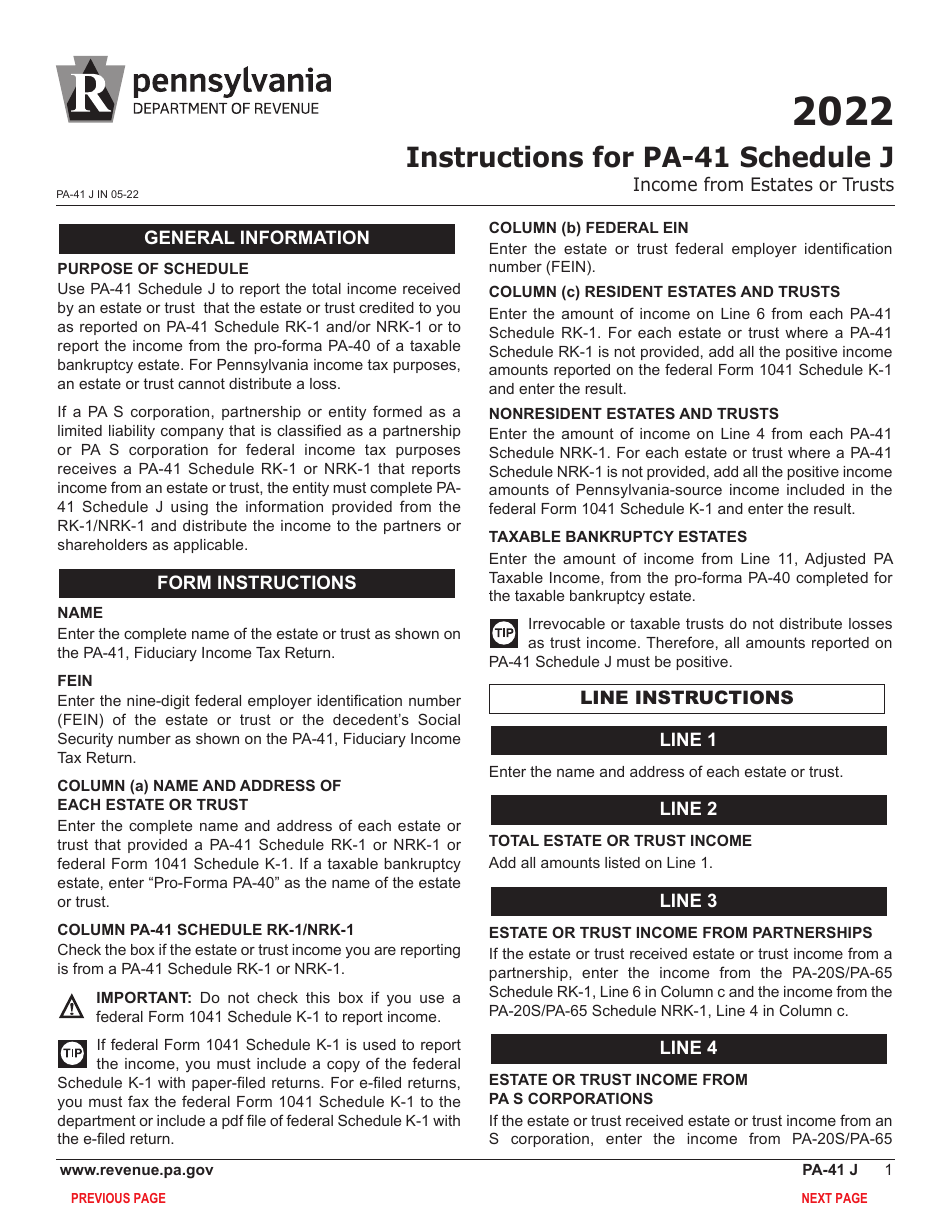

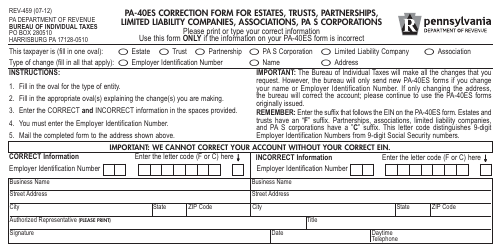

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-41 Schedule J?

A: Form PA-41 Schedule J is a tax form used in Pennsylvania to report income from estates or trusts.

Q: Who needs to file Form PA-41 Schedule J?

A: Individuals who receive income from estates or trusts in Pennsylvania need to file Form PA-41 Schedule J.

Q: What types of income should be reported on Form PA-41 Schedule J?

A: Any income received from estates or trusts, such as interest, dividends, and capital gains, should be reported on Form PA-41 Schedule J.

Q: Do I need to file Form PA-41 Schedule J if I didn't receive any income from estates or trusts?

A: No, you only need to file Form PA-41 Schedule J if you received income from estates or trusts in Pennsylvania.

Q: When is the deadline to file Form PA-41 Schedule J?

A: The deadline to file Form PA-41 Schedule J is typically the same as the deadline for filing your Pennsylvania state income tax return, which is April 15th.

Q: Are there any penalties for late or incorrect filing of Form PA-41 Schedule J?

A: Yes, there may be penalties for late or incorrect filing of Form PA-41 Schedule J, including potential interest charges and fines.

Q: Can I e-file Form PA-41 Schedule J?

A: Yes, you can e-file Form PA-41 Schedule J if you are filing your Pennsylvania state income tax return electronically.

Q: Do I need to include any supporting documents with Form PA-41 Schedule J?

A: Yes, you may need to include supporting documents, such as a copy of the estate or trust's Form 1041, with Form PA-41 Schedule J.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule J by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.