This version of the form is not currently in use and is provided for reference only. Download this version of

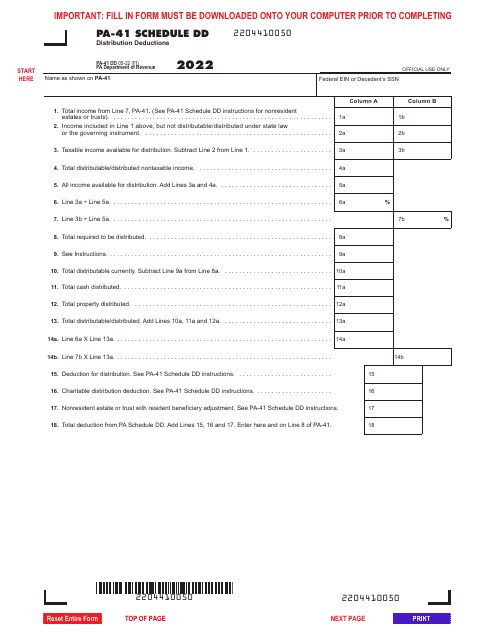

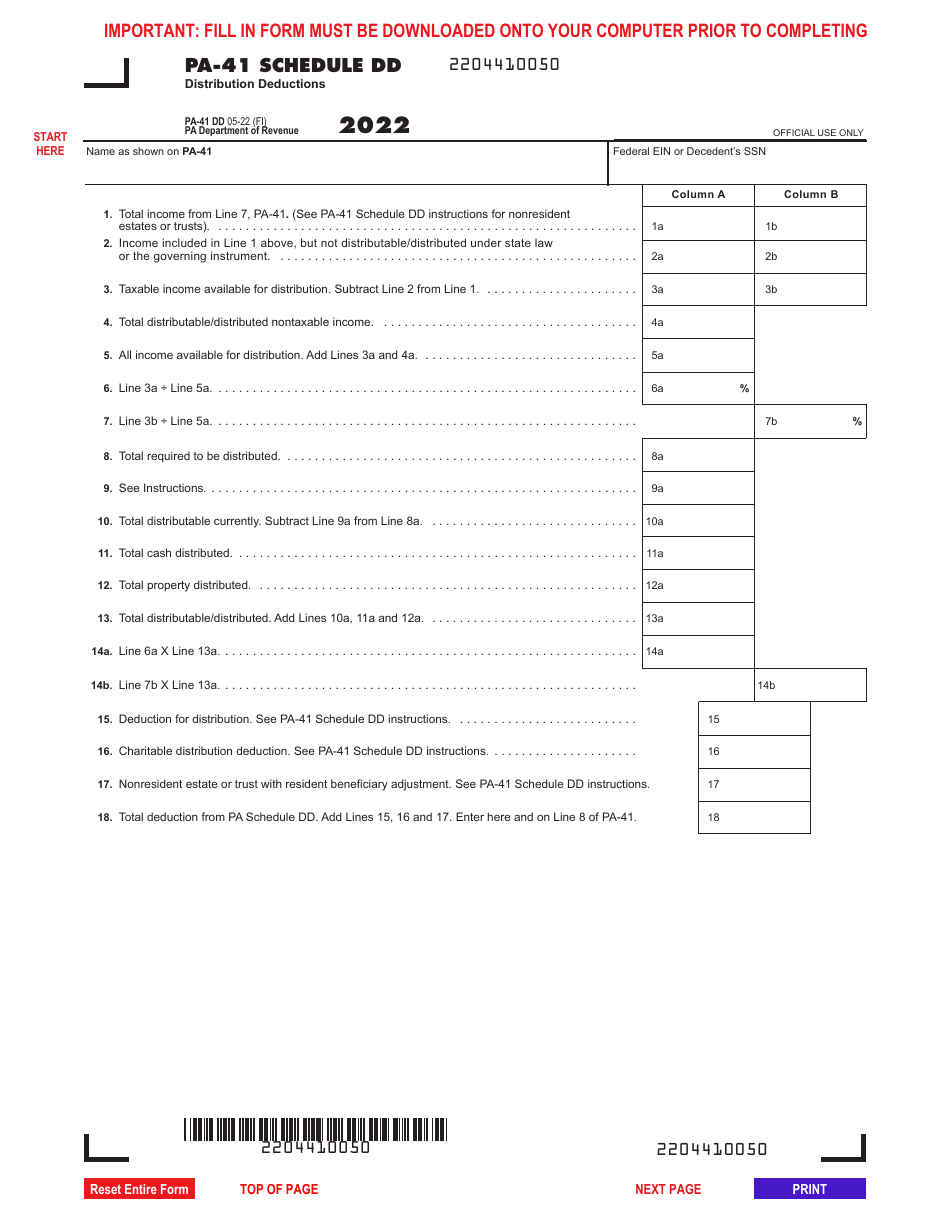

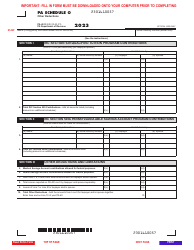

Form PA-41 Schedule DD

for the current year.

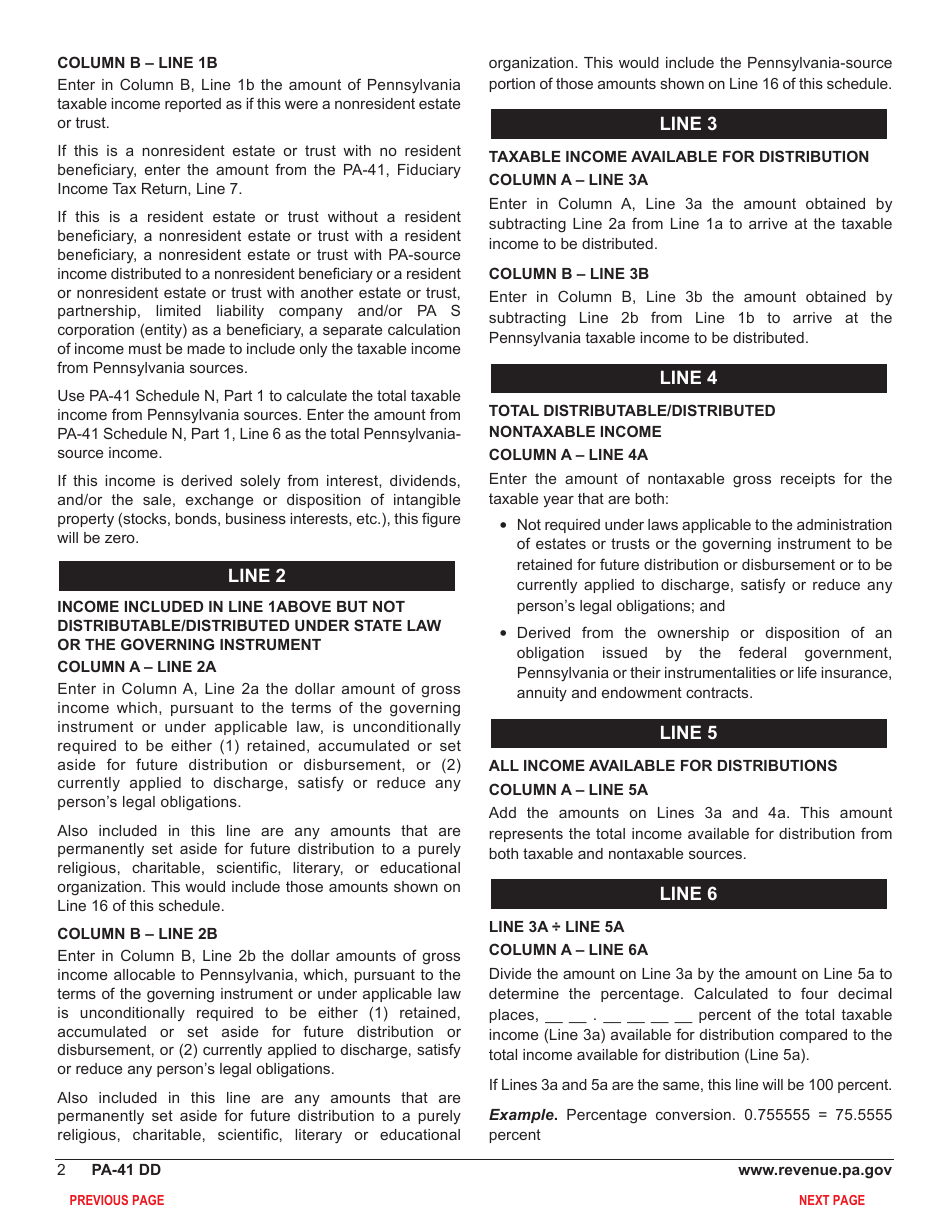

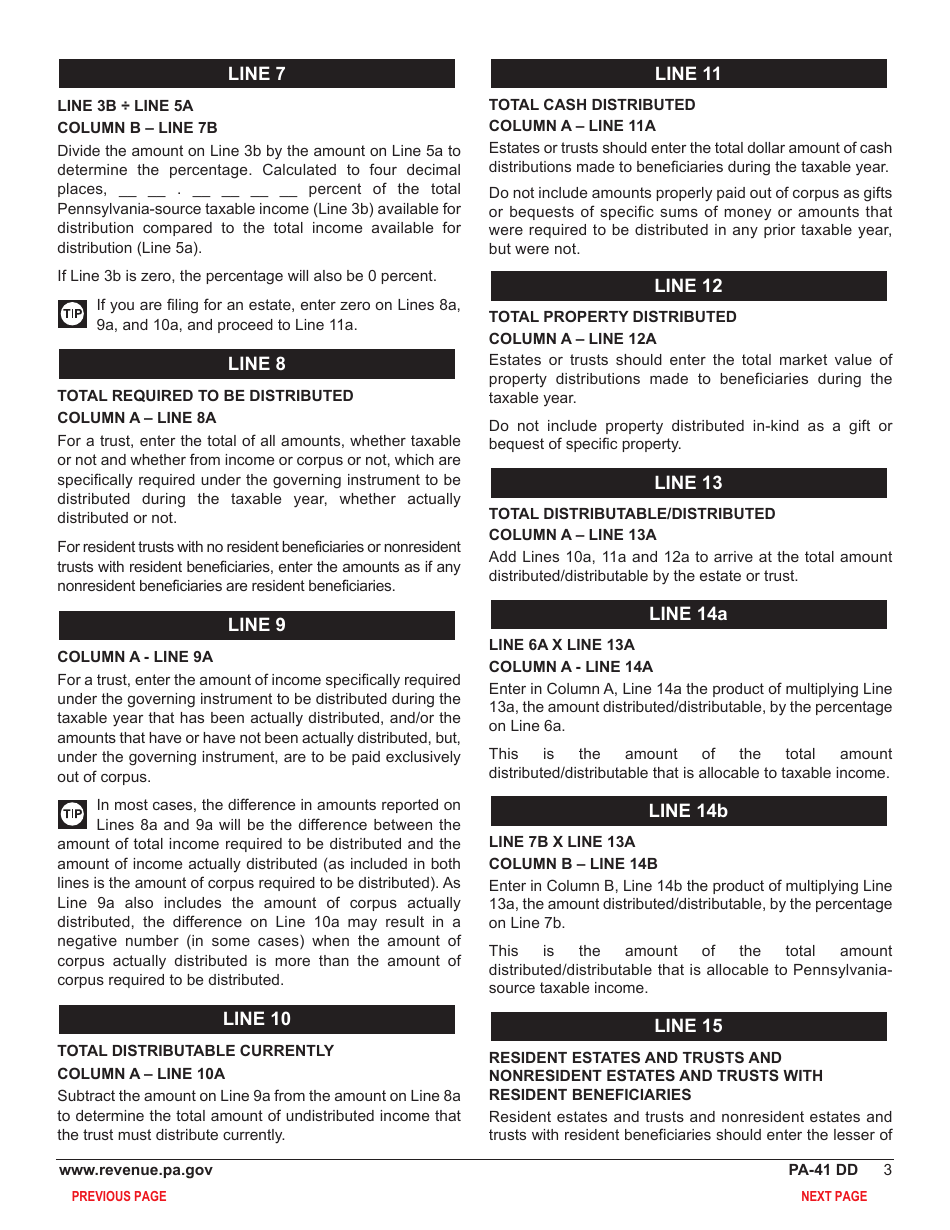

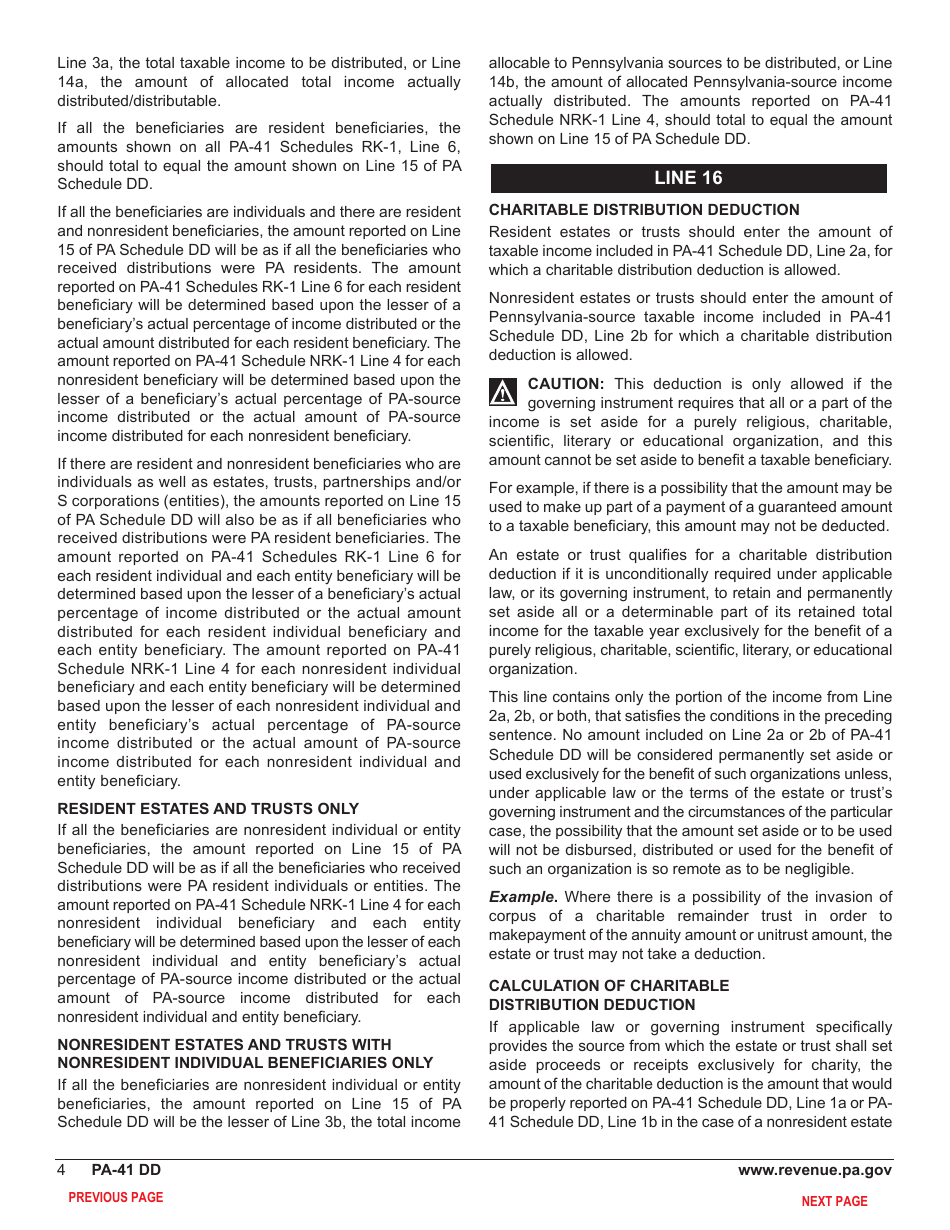

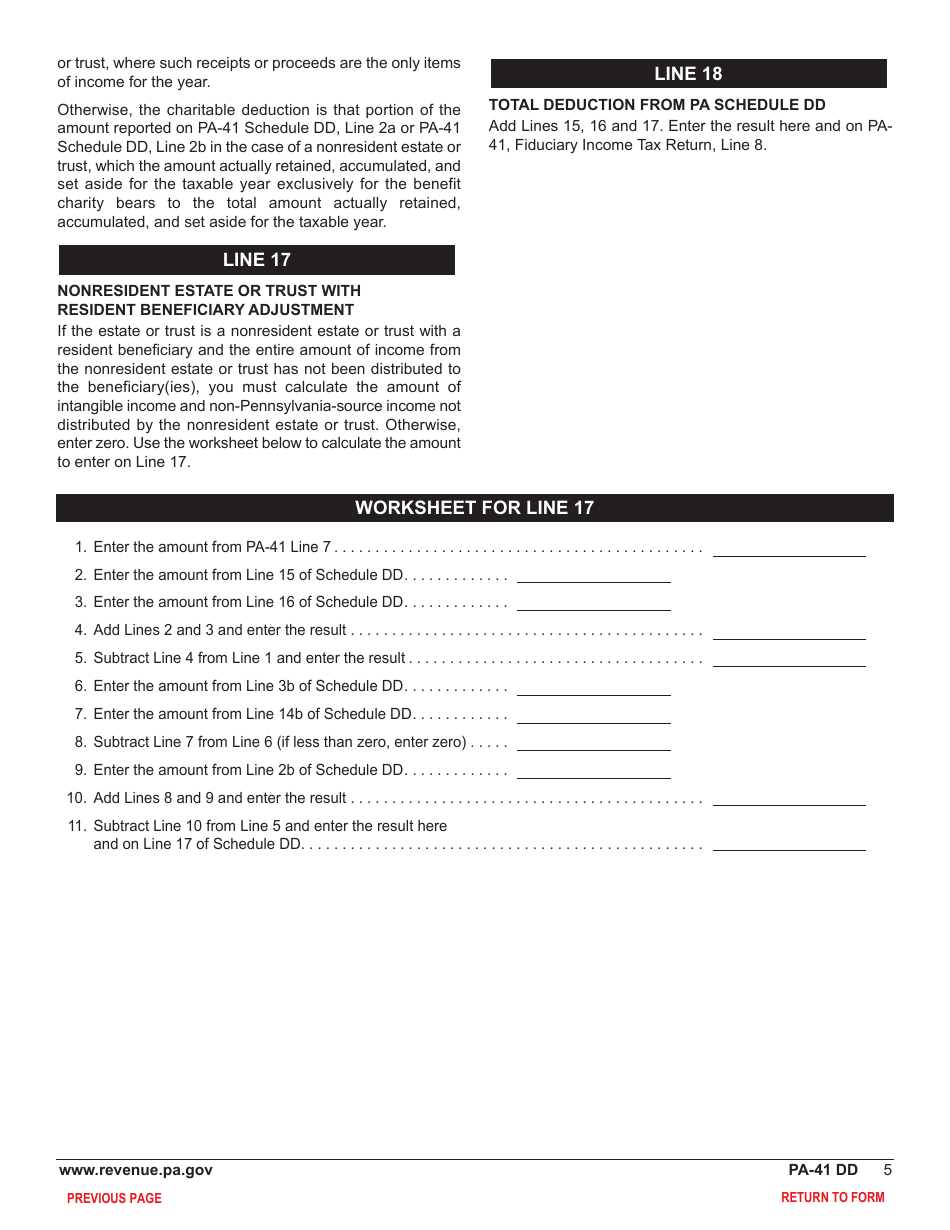

Form PA-41 Schedule DD Distribution Deductions - Pennsylvania

What Is Form PA-41 Schedule DD?

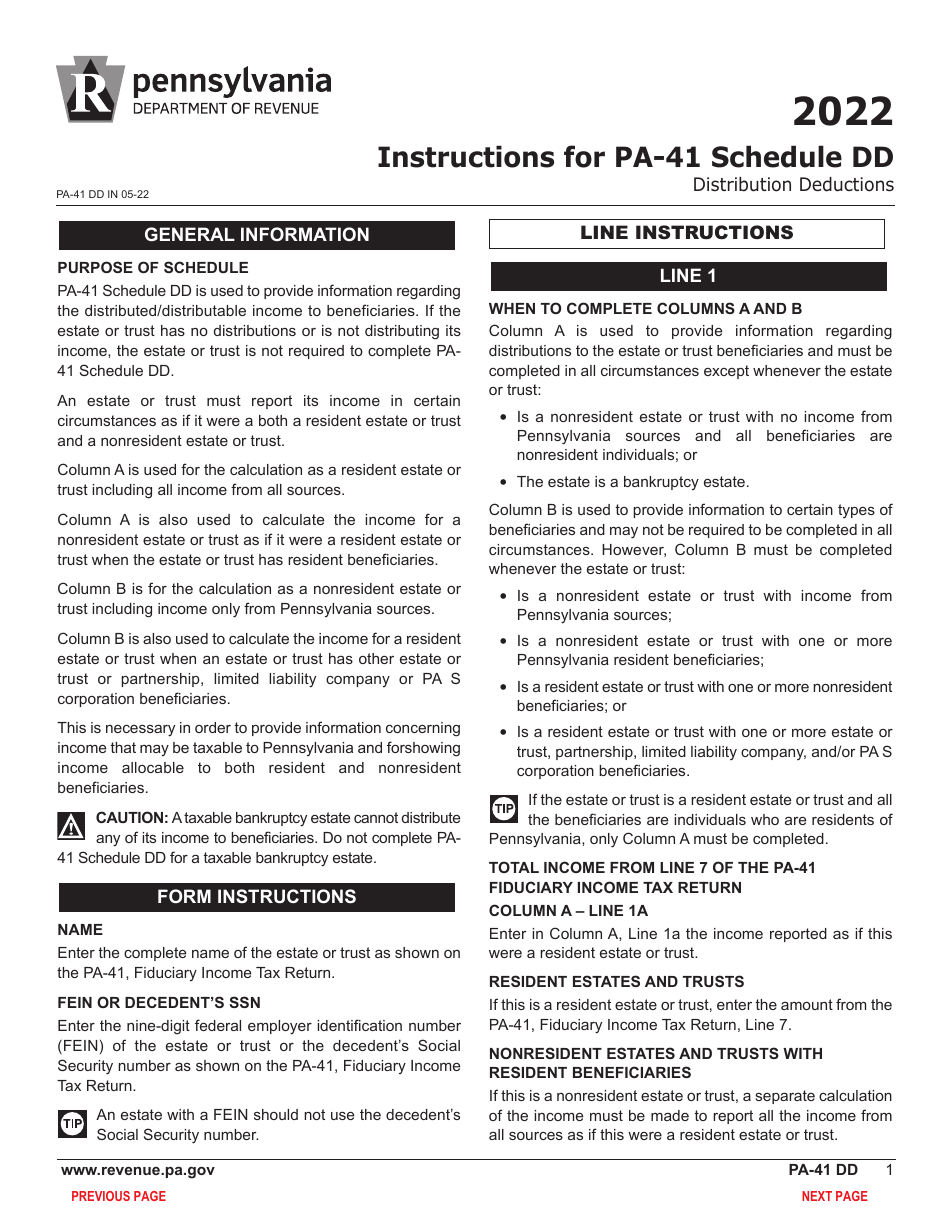

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-41 Schedule DD?

A: Form PA-41 Schedule DD is a tax form used in Pennsylvania to report distribution deductions.

Q: What are distribution deductions?

A: Distribution deductions are deductions that can be claimed for certain distributions received by a taxpayer in Pennsylvania.

Q: Who needs to file Form PA-41 Schedule DD?

A: Any taxpayer in Pennsylvania who has received distributions eligible for deductions needs to file Form PA-41 Schedule DD.

Q: Are there any specific requirements for claiming distribution deductions?

A: Yes, there are specific requirements that must be met to claim distribution deductions in Pennsylvania. It is recommended to review the instructions for Form PA-41 Schedule DD for more information.

Q: When is the deadline for filing Form PA-41 Schedule DD?

A: The deadline for filing Form PA-41 Schedule DD is the same as the deadline for filing your Pennsylvania income tax return, which is usually April 15th.

Q: What happens if I don't file Form PA-41 Schedule DD?

A: If you are required to file Form PA-41 Schedule DD and fail to do so, you may be subject to penalties and interest charges.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule DD by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.