This version of the form is not currently in use and is provided for reference only. Download this version of

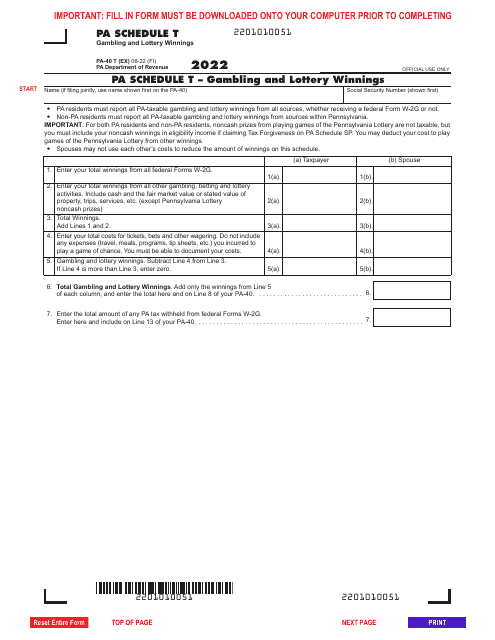

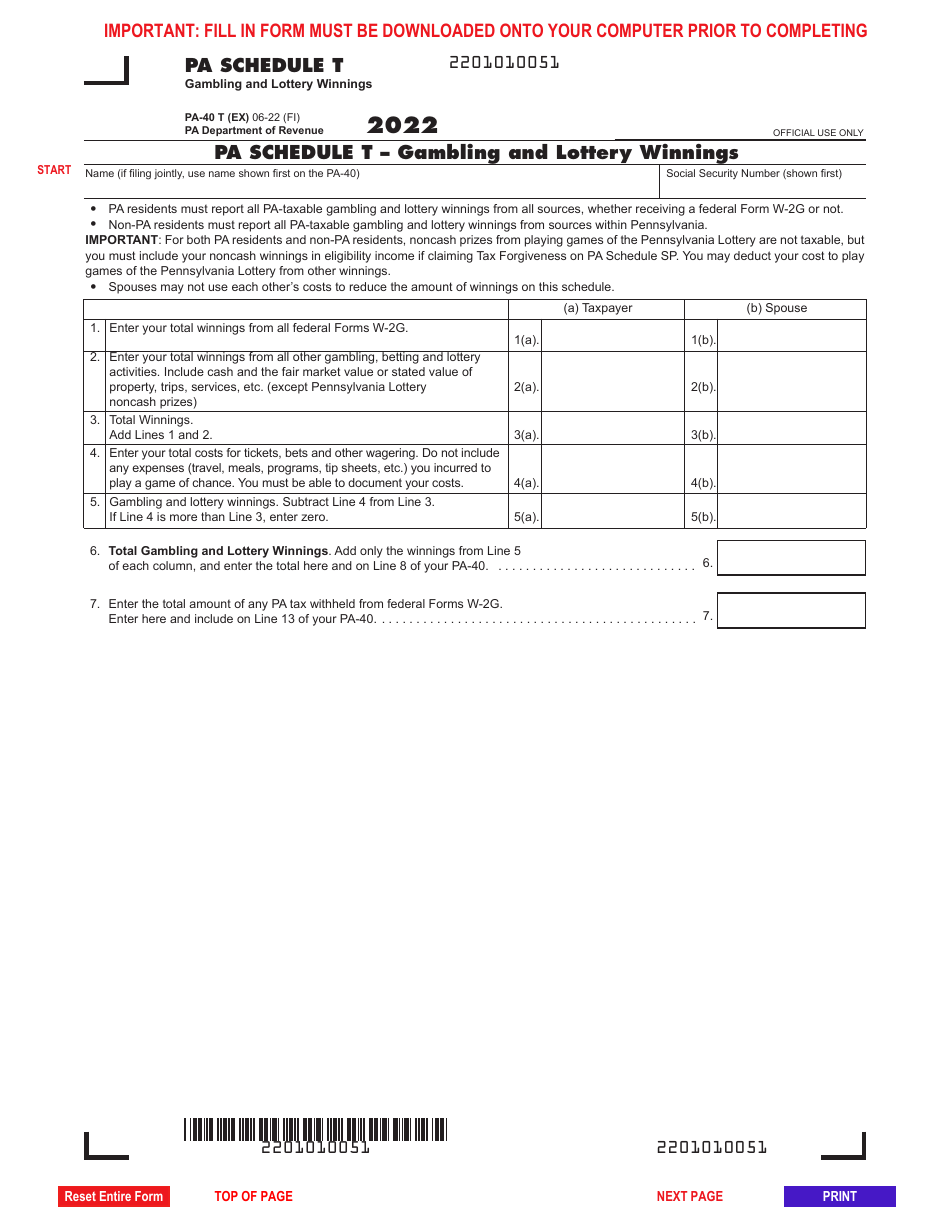

Form PA-40 Schedule T

for the current year.

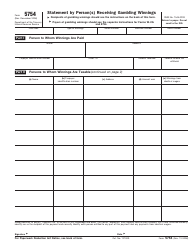

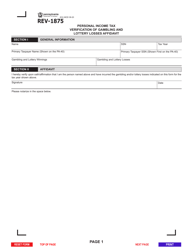

Form PA-40 Schedule T Gambling and Lottery Winnings - Pennsylvania

What Is Form PA-40 Schedule T?

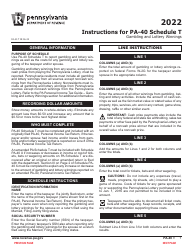

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule T?

A: Form PA-40 Schedule T is a tax form used by taxpayers in Pennsylvania to report gambling and lottery winnings.

Q: Who needs to file Form PA-40 Schedule T?

A: Any taxpayer who has received gambling or lottery winnings in Pennsylvania must file Form PA-40 Schedule T.

Q: What information is required on Form PA-40 Schedule T?

A: Form PA-40 Schedule T requires the taxpayer to provide details of their gambling or lottery winnings and any related expenses.

Q: When is the deadline to file Form PA-40 Schedule T?

A: Form PA-40 Schedule T must be filed by the same deadline as the taxpayer's annual state income tax return, which is usually April 15th.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule T by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.