This version of the form is not currently in use and is provided for reference only. Download this version of

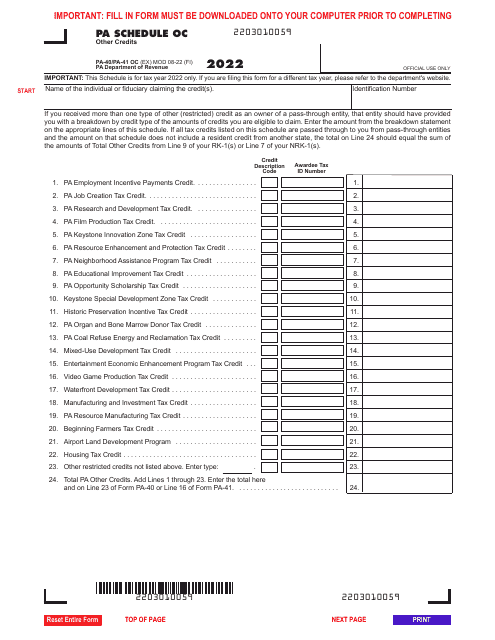

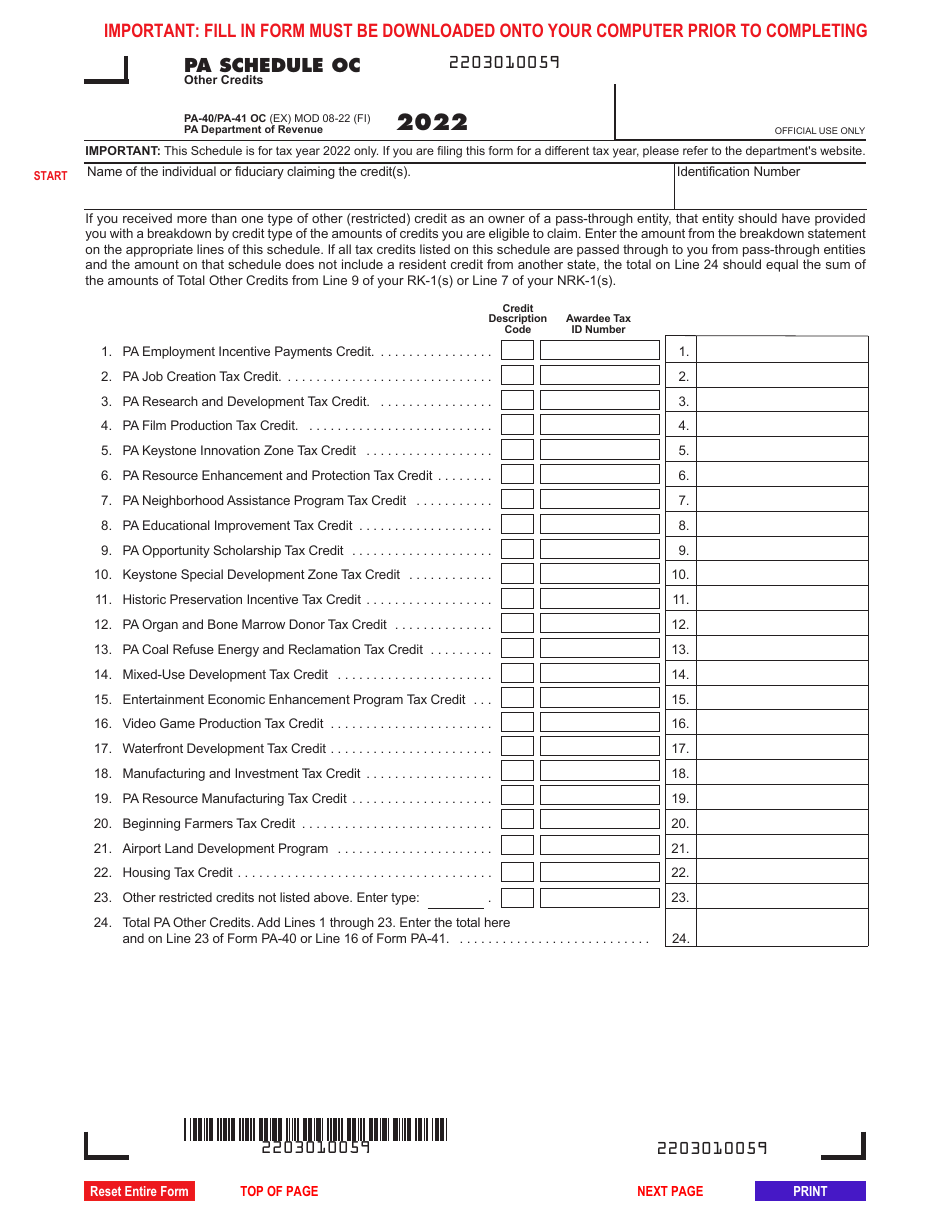

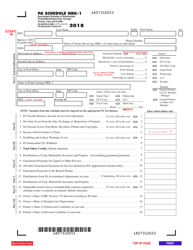

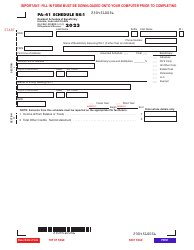

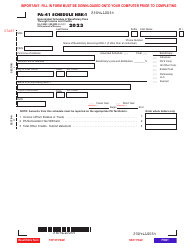

Form PA-40 (PA-41) Schedule OC

for the current year.

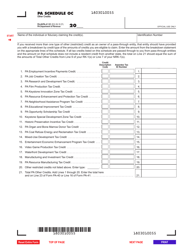

Form PA-40 (PA-41) Schedule OC Other Credits - Pennsylvania

What Is Form PA-40 (PA-41) Schedule OC?

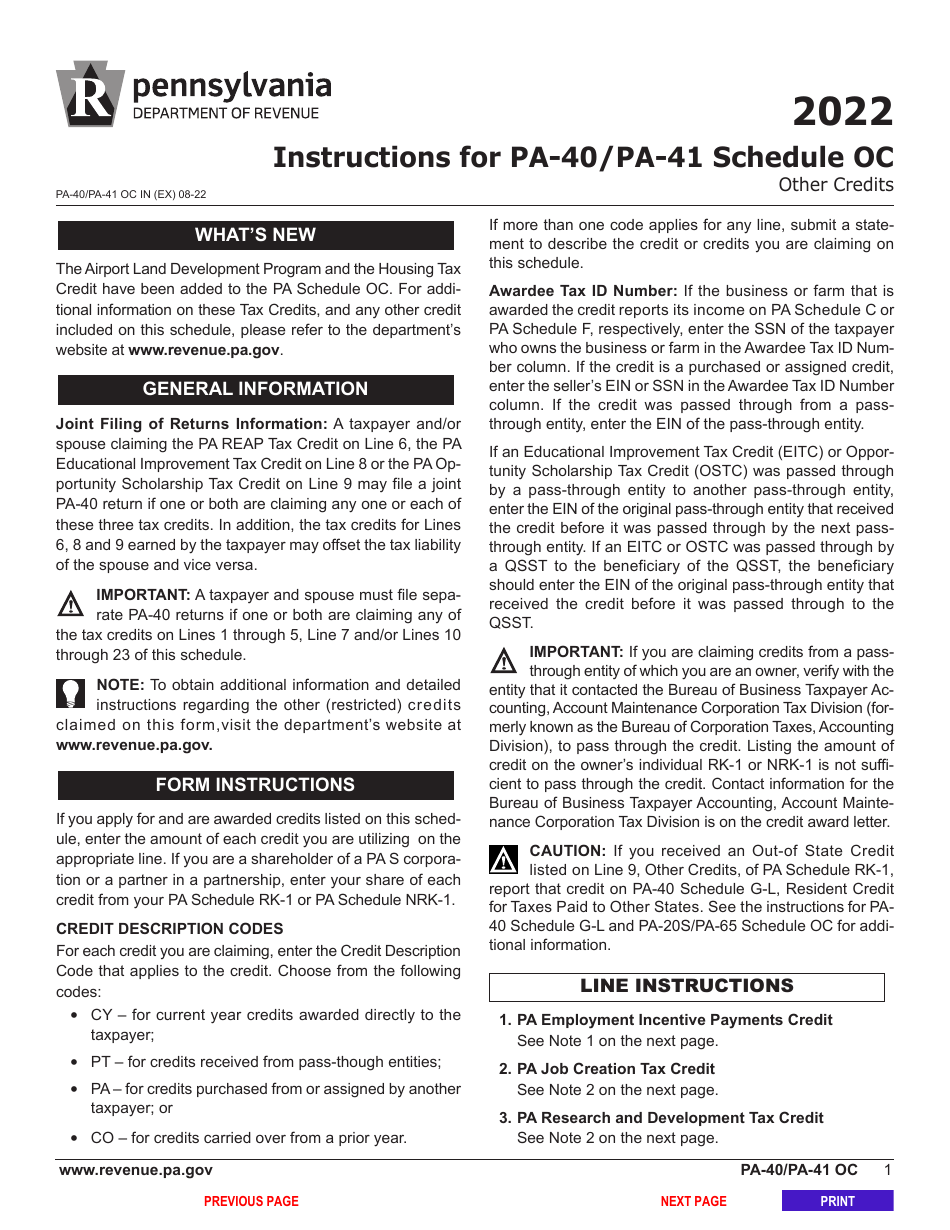

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, and Form PA-41. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 (PA-41) Schedule OC?

A: Form PA-40 (PA-41) Schedule OC is a form used in Pennsylvania to report other tax credits.

Q: What are other tax credits?

A: Other tax credits are credits that taxpayers may be eligible for in addition to the standard tax credits.

Q: What is the purpose of Form PA-40 (PA-41) Schedule OC?

A: The purpose of Form PA-40 (PA-41) Schedule OC is to allow taxpayers to claim these other tax credits.

Q: What types of credits can be claimed on Form PA-40 (PA-41) Schedule OC?

A: Some examples of credits that can be claimed include the Educational Improvement Tax Credit, the Film Production Tax Credit, and the Research and Development Tax Credit.

Q: How do I file Form PA-40 (PA-41) Schedule OC?

A: Form PA-40 (PA-41) Schedule OC should be included with your Pennsylvania tax return (Form PA-40 or PA-41) when filing.

Q: Is there a deadline for filing Form PA-40 (PA-41) Schedule OC?

A: The deadline for filing Form PA-40 (PA-41) Schedule OC is the same as the deadline for filing your Pennsylvania tax return, which is usually April 15th.

Q: Are there any specific requirements for claiming other tax credits?

A: Yes, each tax credit has its own specific requirements and eligibility criteria. It is important to review the instructions for Form PA-40 (PA-41) Schedule OC and the specific tax credit you are claiming.

Q: Can I claim multiple tax credits on Form PA-40 (PA-41) Schedule OC?

A: Yes, you can claim multiple tax credits on Form PA-40 (PA-41) Schedule OC as long as you meet the requirements for each credit.

Q: What should I do if I need help filling out Form PA-40 (PA-41) Schedule OC?

A: If you need assistance with filling out Form PA-40 (PA-41) Schedule OC, you can consult the instructions provided by the Pennsylvania Department of Revenue or seek assistance from a tax professional.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 (PA-41) Schedule OC by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.