This version of the form is not currently in use and is provided for reference only. Download this version of

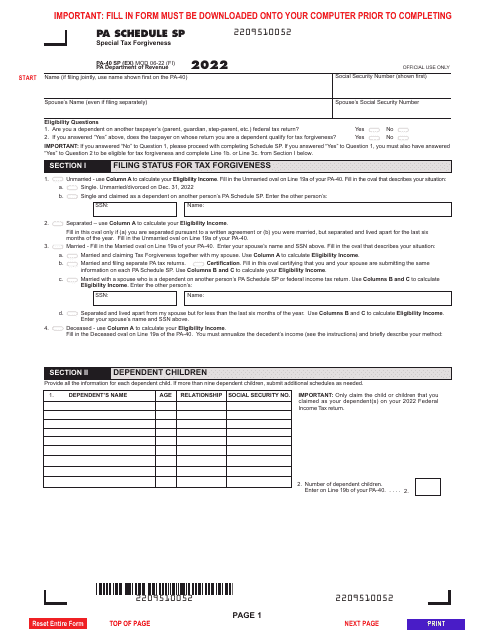

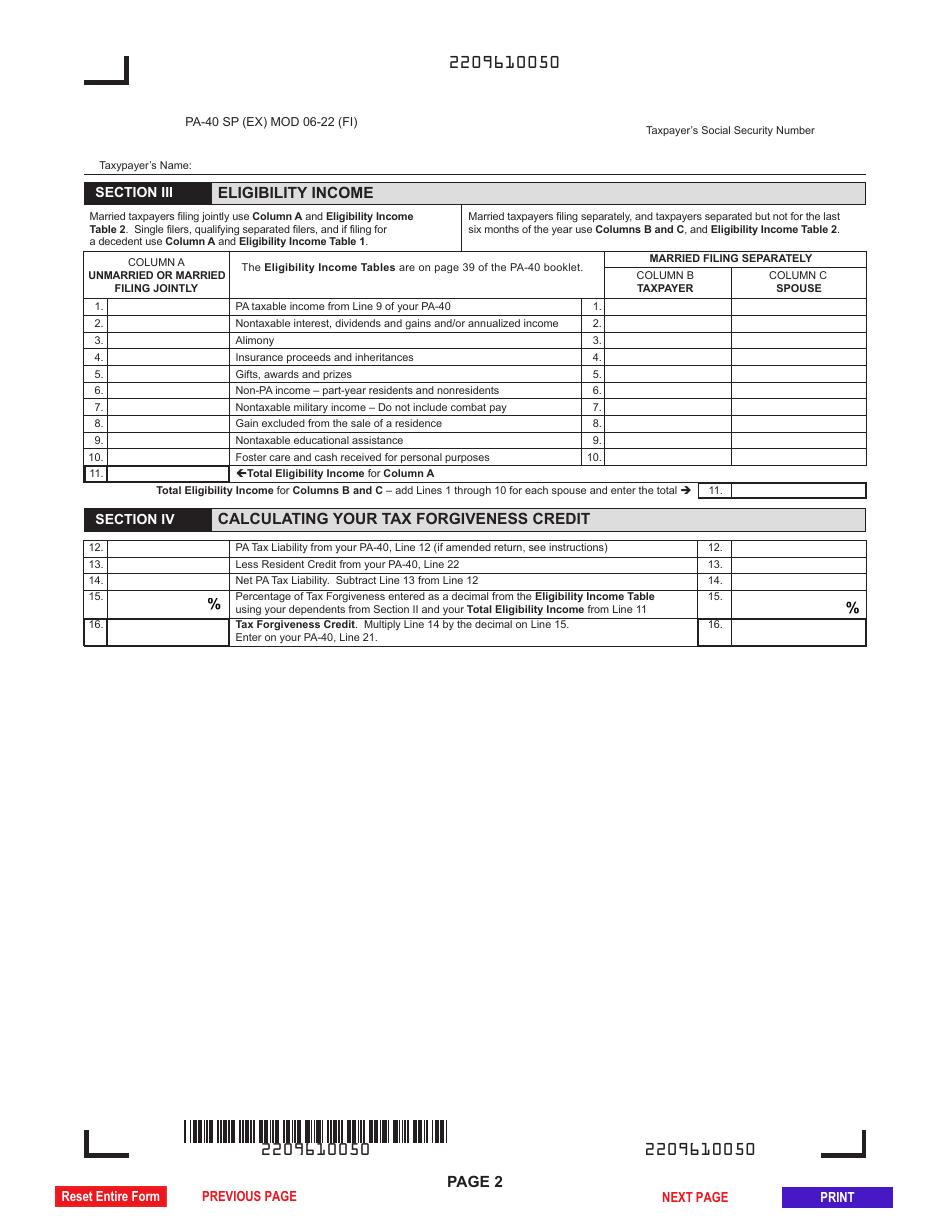

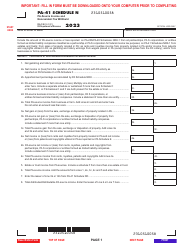

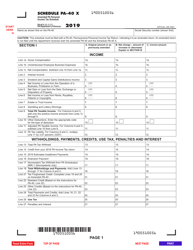

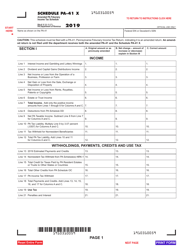

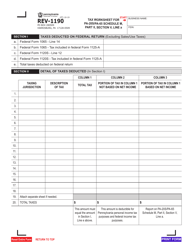

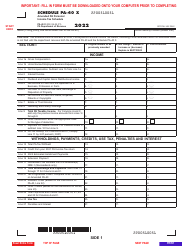

Form PA-40 Schedule SP

for the current year.

Form PA-40 Schedule SP Special Tax Forgiveness - Pennsylvania

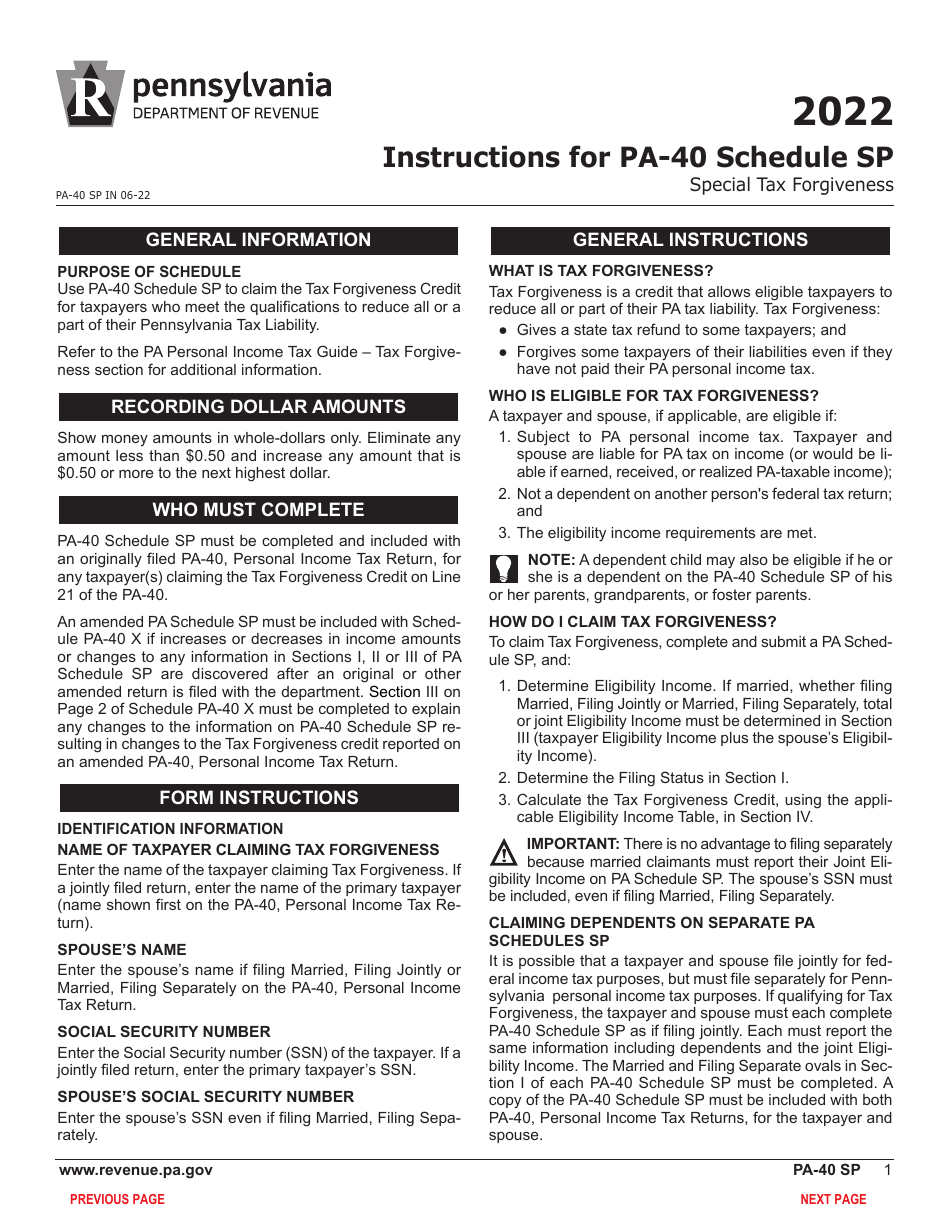

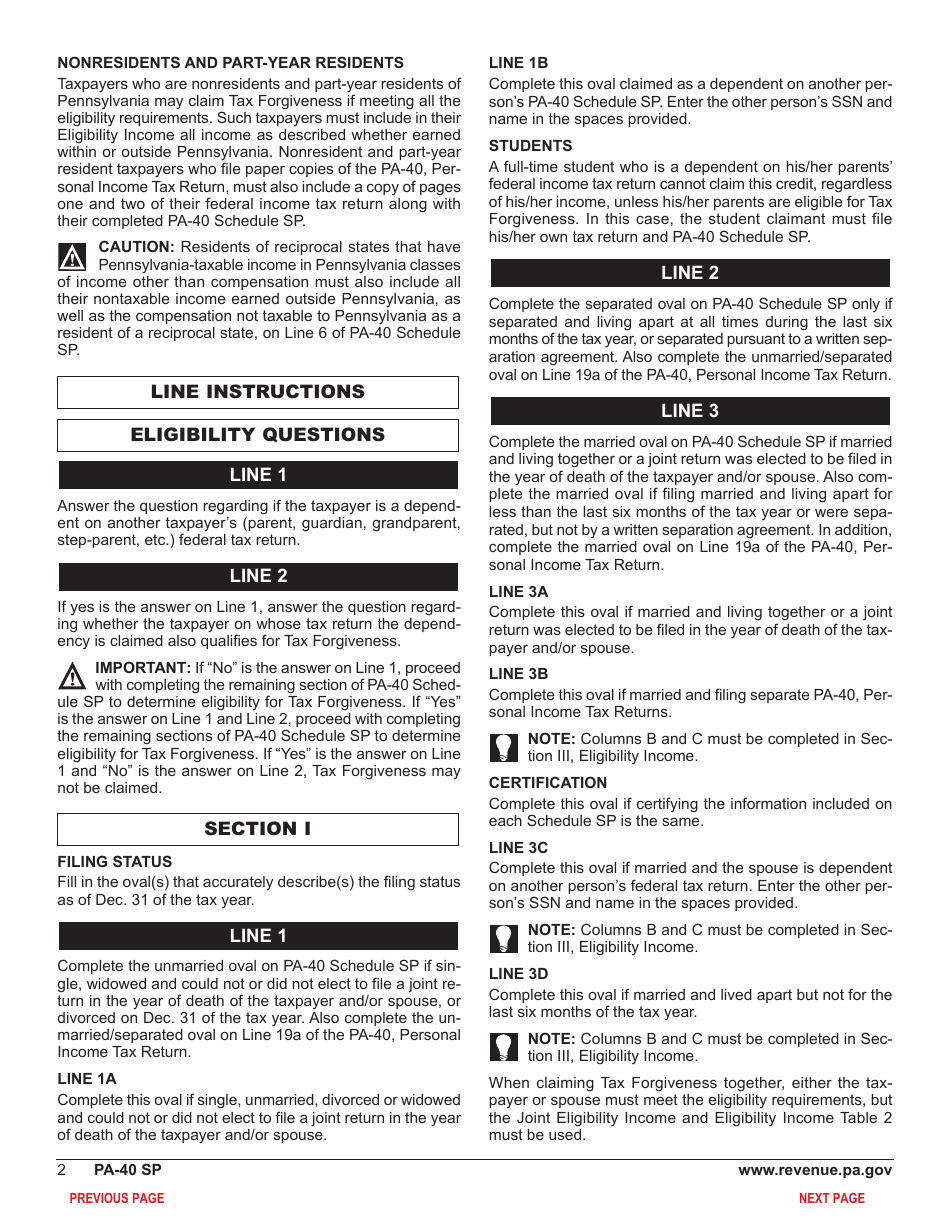

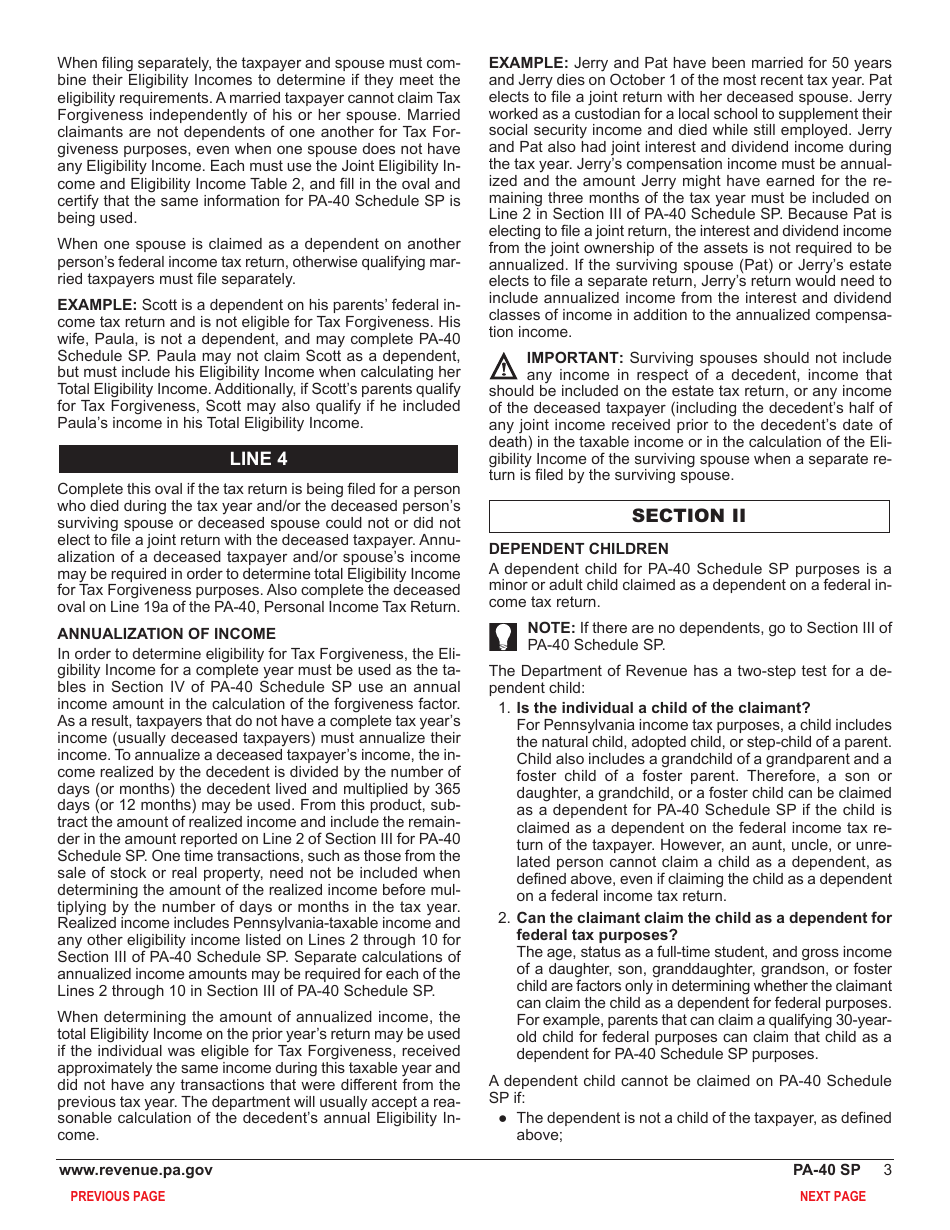

What Is Form PA-40 Schedule SP?

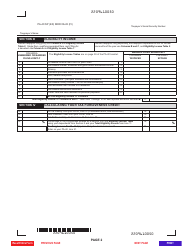

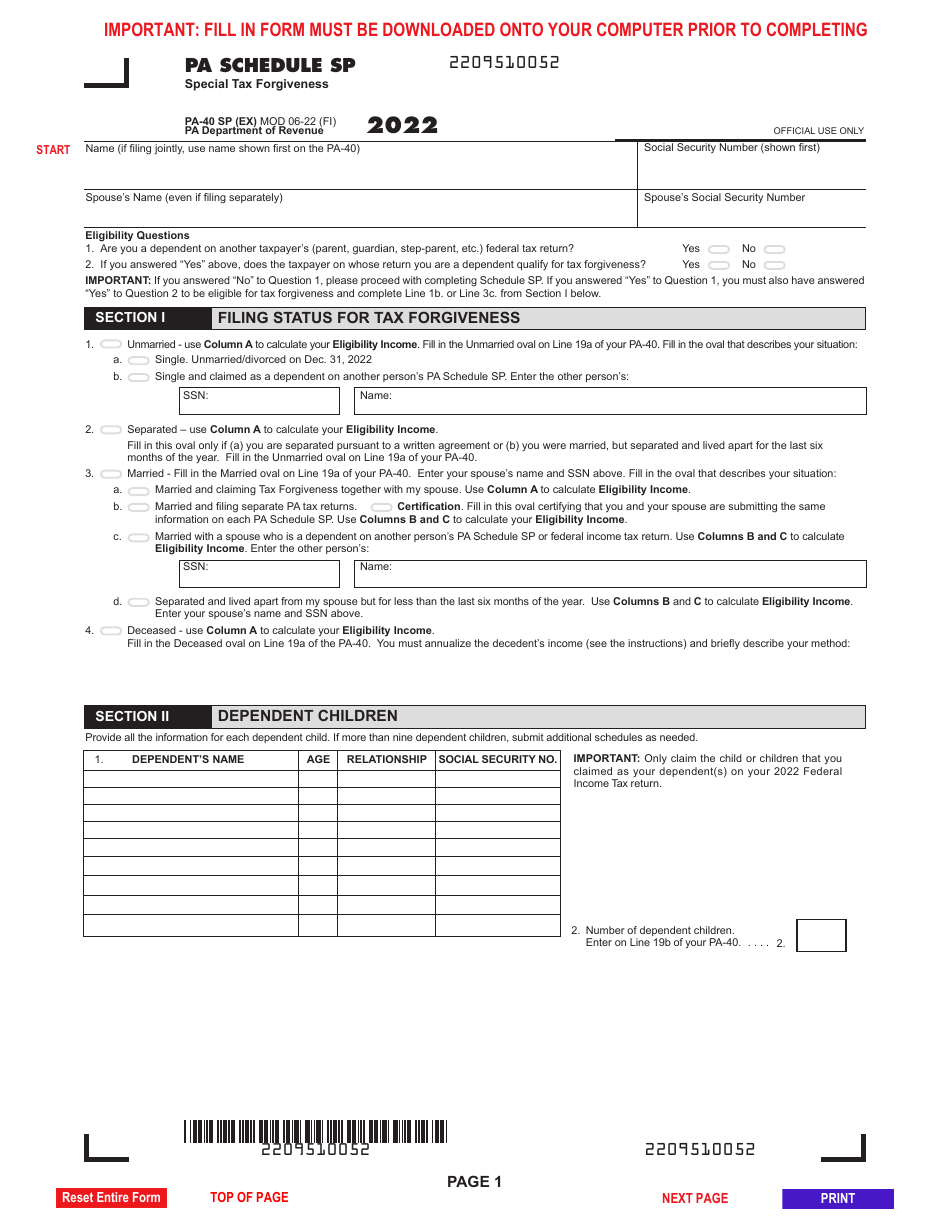

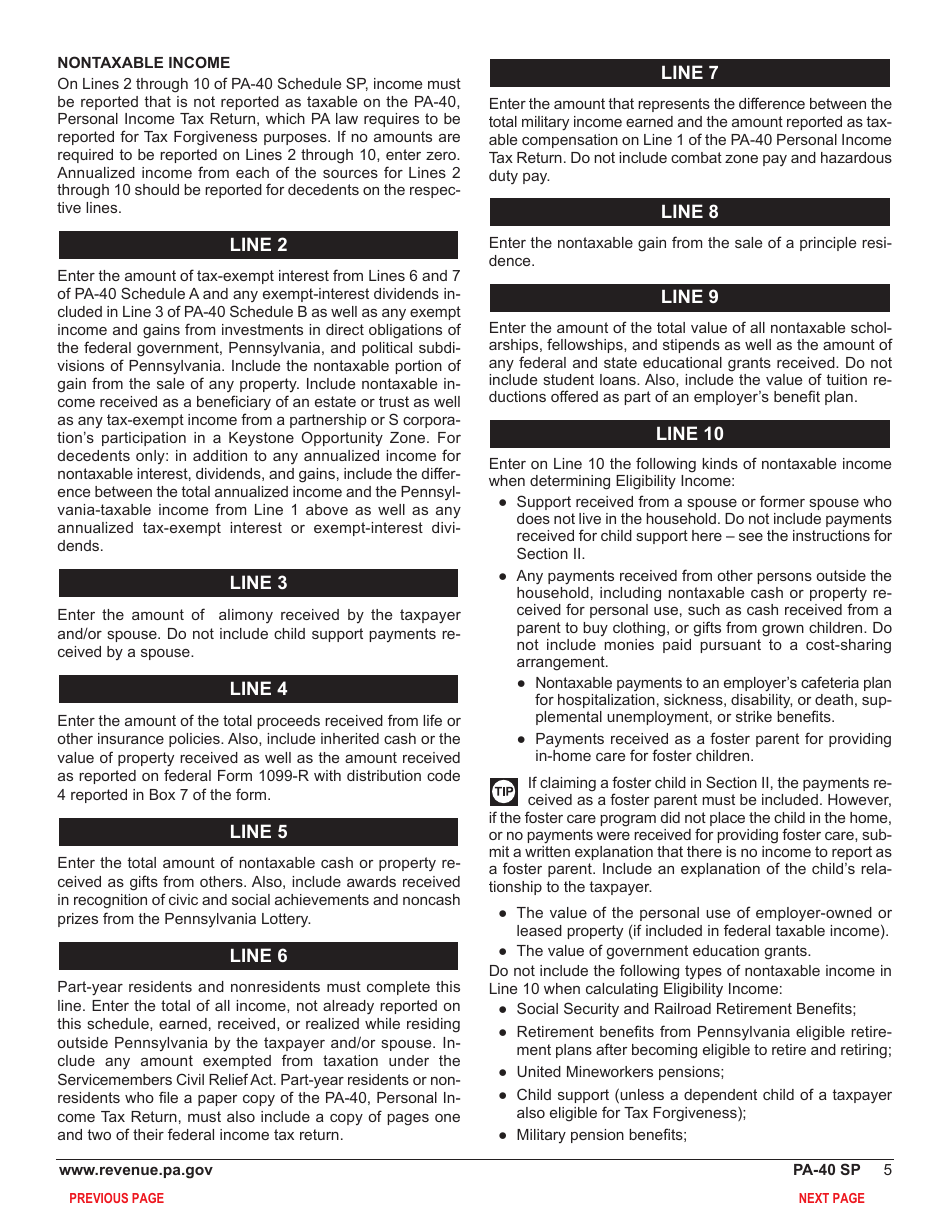

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule SP?

A: Form PA-40 Schedule SP is a form for claiming Special Tax Forgiveness in Pennsylvania.

Q: Who should use Form PA-40 Schedule SP?

A: Pennsylvania residents who qualify for Special Tax Forgiveness should use Form PA-40 Schedule SP.

Q: What is Special Tax Forgiveness?

A: Special Tax Forgiveness provides relief to eligible taxpayers who have a lower income and may owe tax.

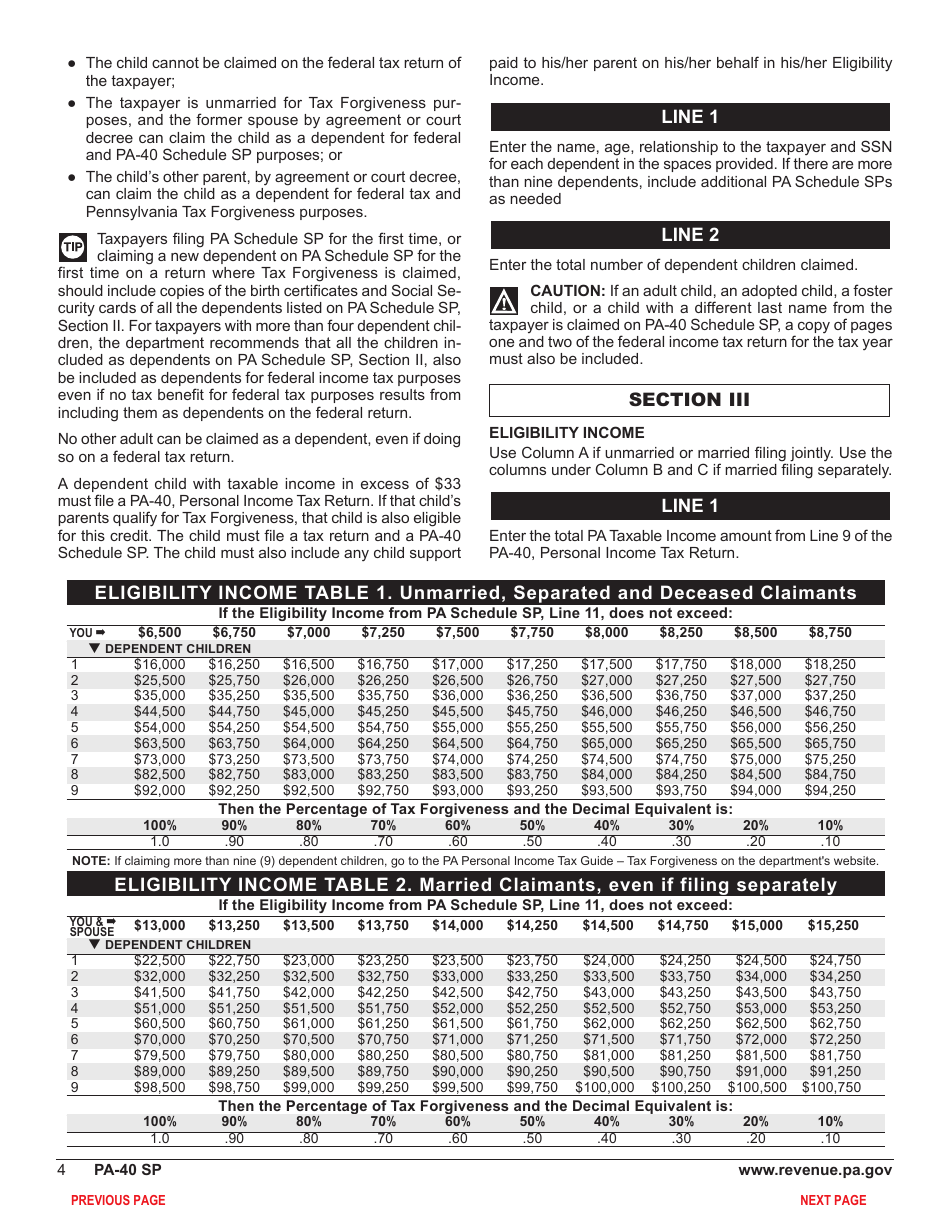

Q: How do I qualify for Special Tax Forgiveness?

A: To qualify for Special Tax Forgiveness, you must meet specific income requirements set by the state of Pennsylvania.

Q: Is there a deadline for filing Form PA-40 Schedule SP?

A: Yes, the deadline for filing Form PA-40 Schedule SP is the same as the deadline for filing your Pennsylvania state tax return.

Q: Can I file Form PA-40 Schedule SP electronically?

A: Yes, you can file Form PA-40 Schedule SP electronically if you are e-filing your Pennsylvania state tax return.

Q: Do I need to include any additional documents with Form PA-40 Schedule SP?

A: You may need to include supporting documentation, such as proof of income, with Form PA-40 Schedule SP.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule SP by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.