This version of the form is not currently in use and is provided for reference only. Download this version of

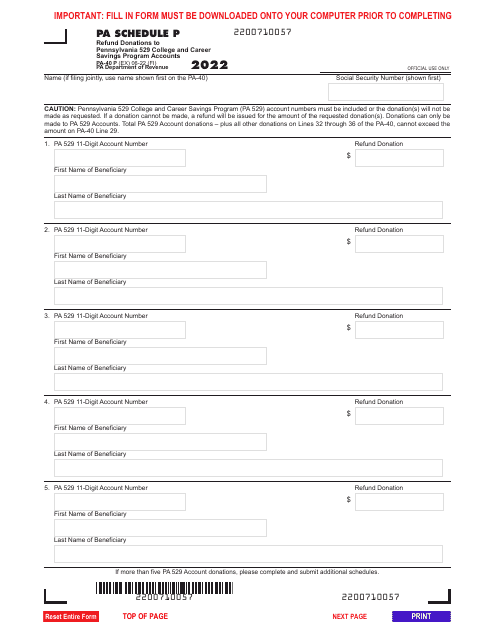

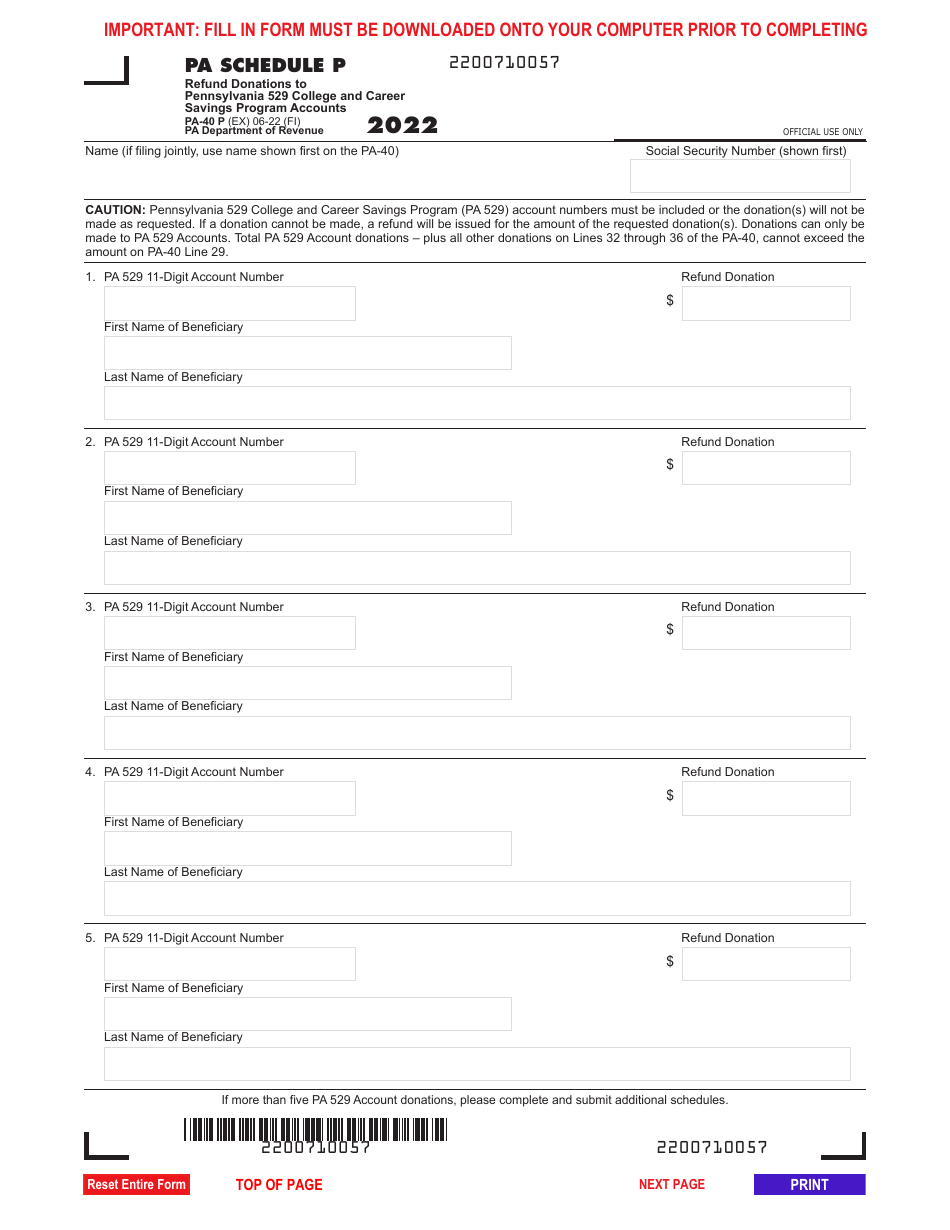

Form PA-40 Schedule P

for the current year.

Form PA-40 Schedule P Refund Donations to Pennsylvania 529 College and Career Savings Program Accounts - Pennsylvania

What Is Form PA-40 Schedule P?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule P?

A: Form PA-40 Schedule P is a supplementary form to the PA-40 Pennsylvania Personal Income Tax Return.

Q: What is the purpose of Form PA-40 Schedule P?

A: Form PA-40 Schedule P is used to report donations made to the Pennsylvania 529 College and Career Savings Program Accounts.

Q: What are Pennsylvania 529 College and Career Savings Program Accounts?

A: Pennsylvania 529 College and Career Savings Program Accounts are tax-advantaged savings accounts designed to help families save for higher education expenses.

Q: Who can claim a deduction on Form PA-40 Schedule P?

A: Any taxpayer who has made a donation to a Pennsylvania 529 College and Career Savings Program Account can claim a deduction on Form PA-40 Schedule P.

Q: What is the maximum deduction allowed on Form PA-40 Schedule P?

A: The maximum deduction allowed on Form PA-40 Schedule P is $15,000 per taxpayer or $30,000 per married couple filing jointly.

Q: What documents do I need to complete Form PA-40 Schedule P?

A: You will need your PA-40 Pennsylvania Personal Income Tax Return and any documents or receipts related to your donations to Pennsylvania 529 College and Career Savings Program Accounts.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule P by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.