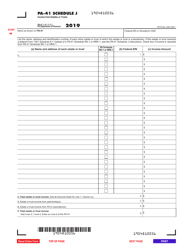

This version of the form is not currently in use and is provided for reference only. Download this version of

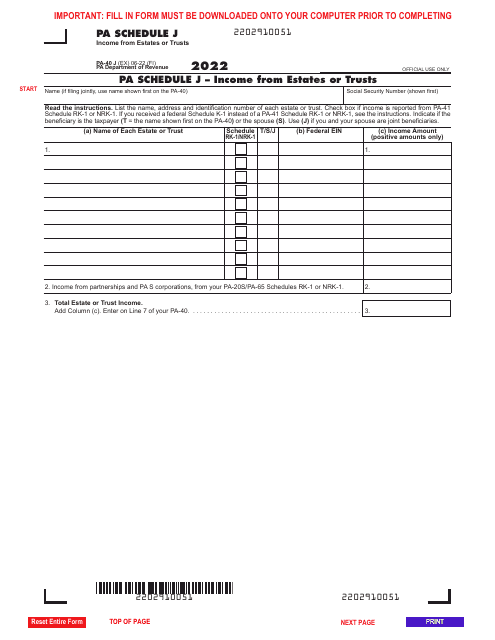

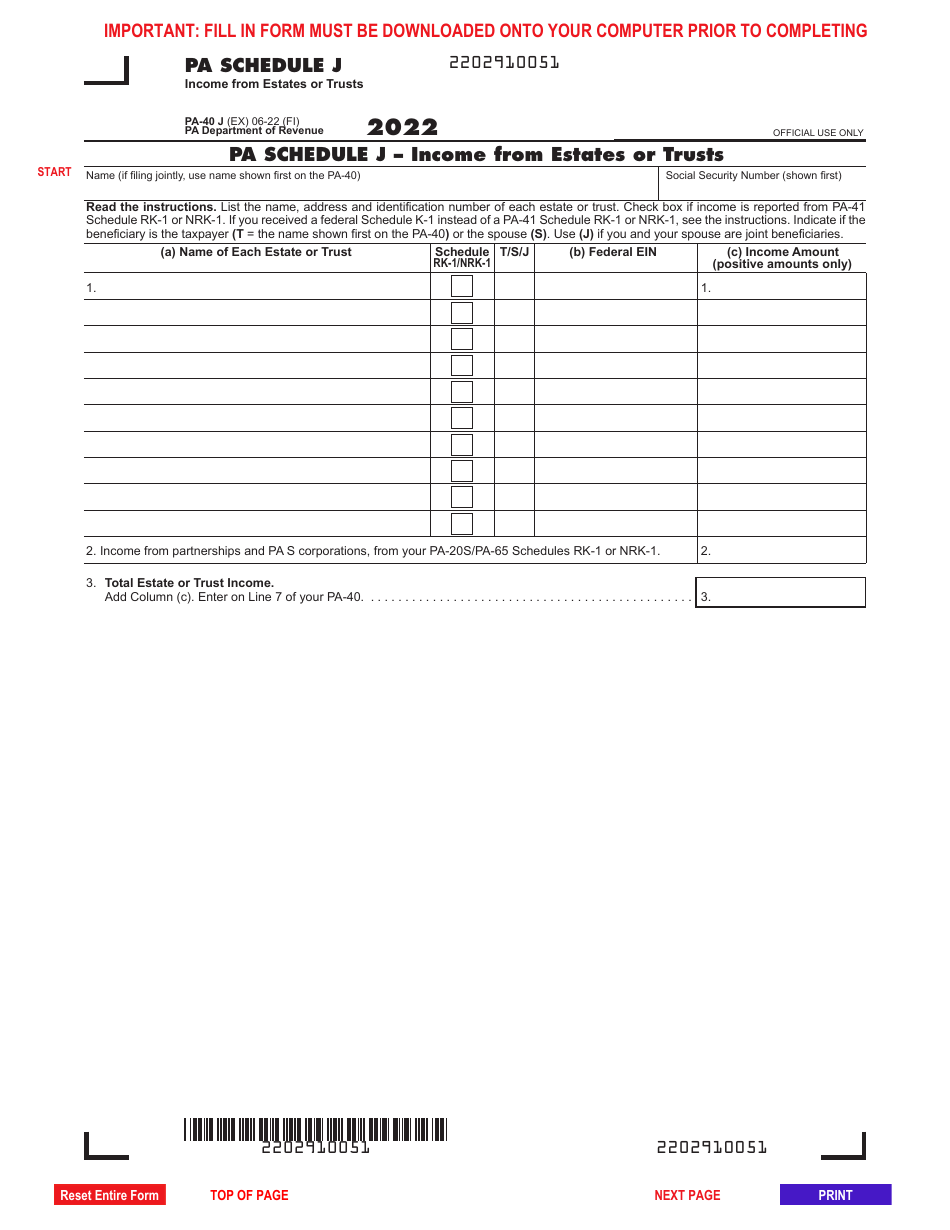

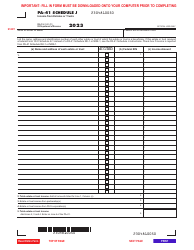

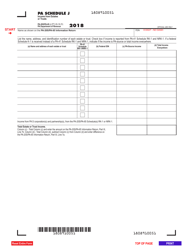

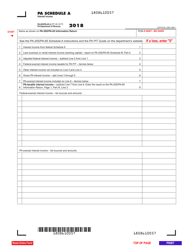

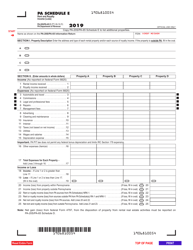

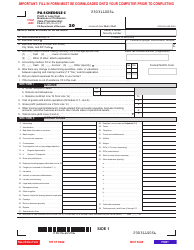

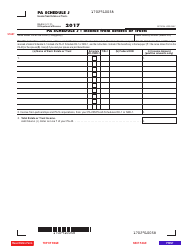

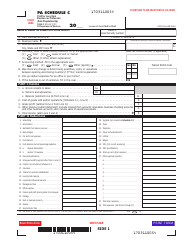

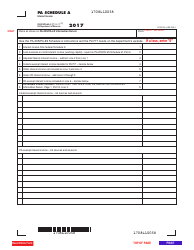

Form PA-40 Schedule J

for the current year.

Form PA-40 Schedule J Income From Estates or Trusts - Pennsylvania

What Is Form PA-40 Schedule J?

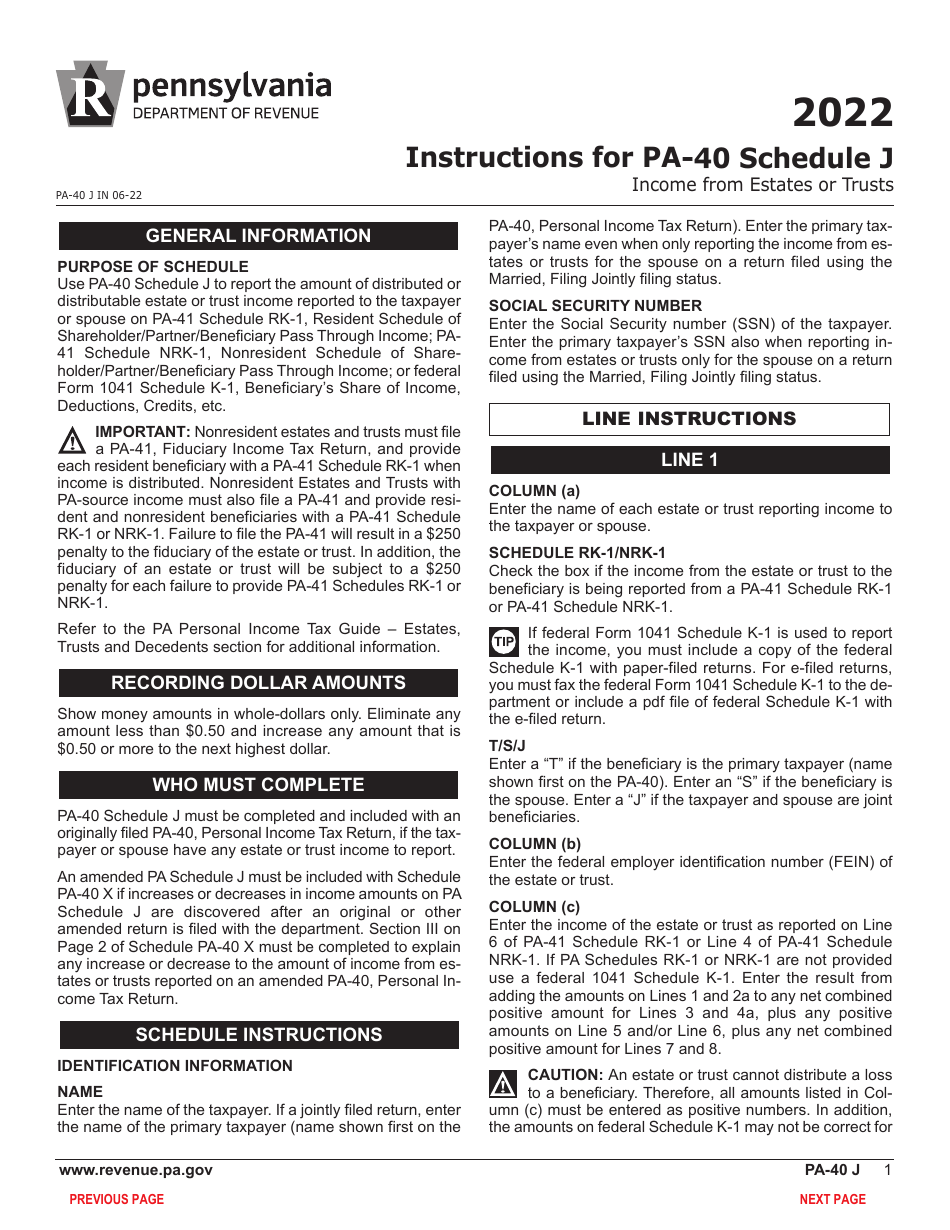

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule J?

A: Form PA-40 Schedule J is a form used to report income from estates or trusts in the state of Pennsylvania.

Q: Who needs to file Form PA-40 Schedule J?

A: Anyone who received income from an estate or trust in Pennsylvania needs to file Form PA-40 Schedule J.

Q: What type of income should be reported on Form PA-40 Schedule J?

A: Any income received from an estate or trust should be reported on Form PA-40 Schedule J.

Q: When is the deadline to file Form PA-40 Schedule J?

A: Form PA-40 Schedule J is generally due on the same date as the Pennsylvania personal income tax return, which is usually April 15th.

Q: Is there a fee to file Form PA-40 Schedule J?

A: There is no fee to file Form PA-40 Schedule J.

Q: What if I have multiple sources of income from estates or trusts?

A: If you have multiple sources of income from estates or trusts, you may need to fill out multiple copies of Form PA-40 Schedule J.

Q: Do I need to attach any additional documents when filing Form PA-40 Schedule J?

A: You may need to attach additional documents, such as a copy of the estate or trust tax return, when filing Form PA-40 Schedule J. Check the instructions for more information.

Q: Can I e-file Form PA-40 Schedule J?

A: Yes, you can e-file Form PA-40 Schedule J if you are filing your Pennsylvania personal income tax return electronically.

Q: What if I made a mistake on my Form PA-40 Schedule J?

A: If you made a mistake on your Form PA-40 Schedule J, you can file an amended return using Form PA-40X.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule J by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.