This version of the form is not currently in use and is provided for reference only. Download this version of

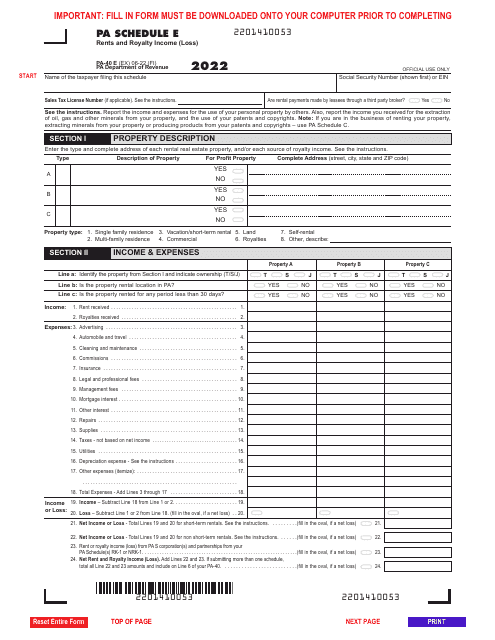

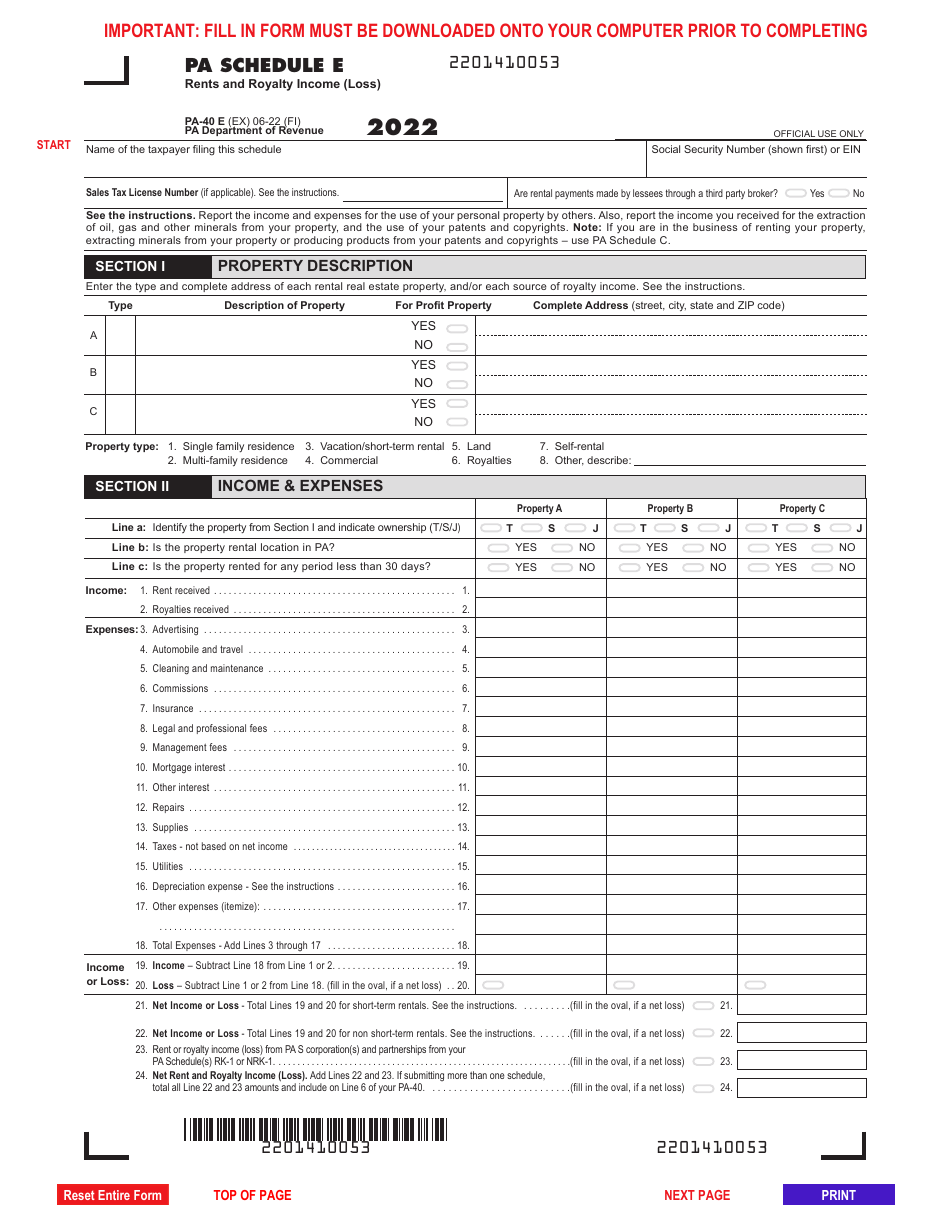

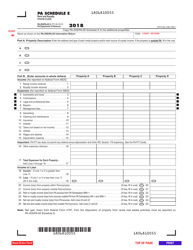

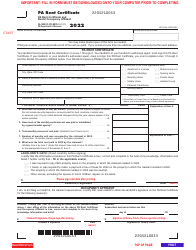

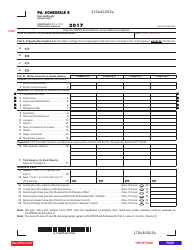

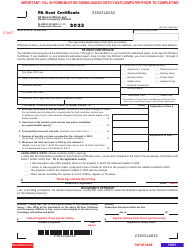

Form PA-40 Schedule E

for the current year.

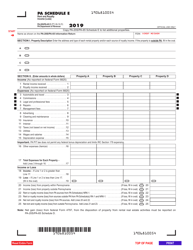

Form PA-40 Schedule E Rents and Royalty Income (Loss) - Pennsylvania

What Is Form PA-40 Schedule E?

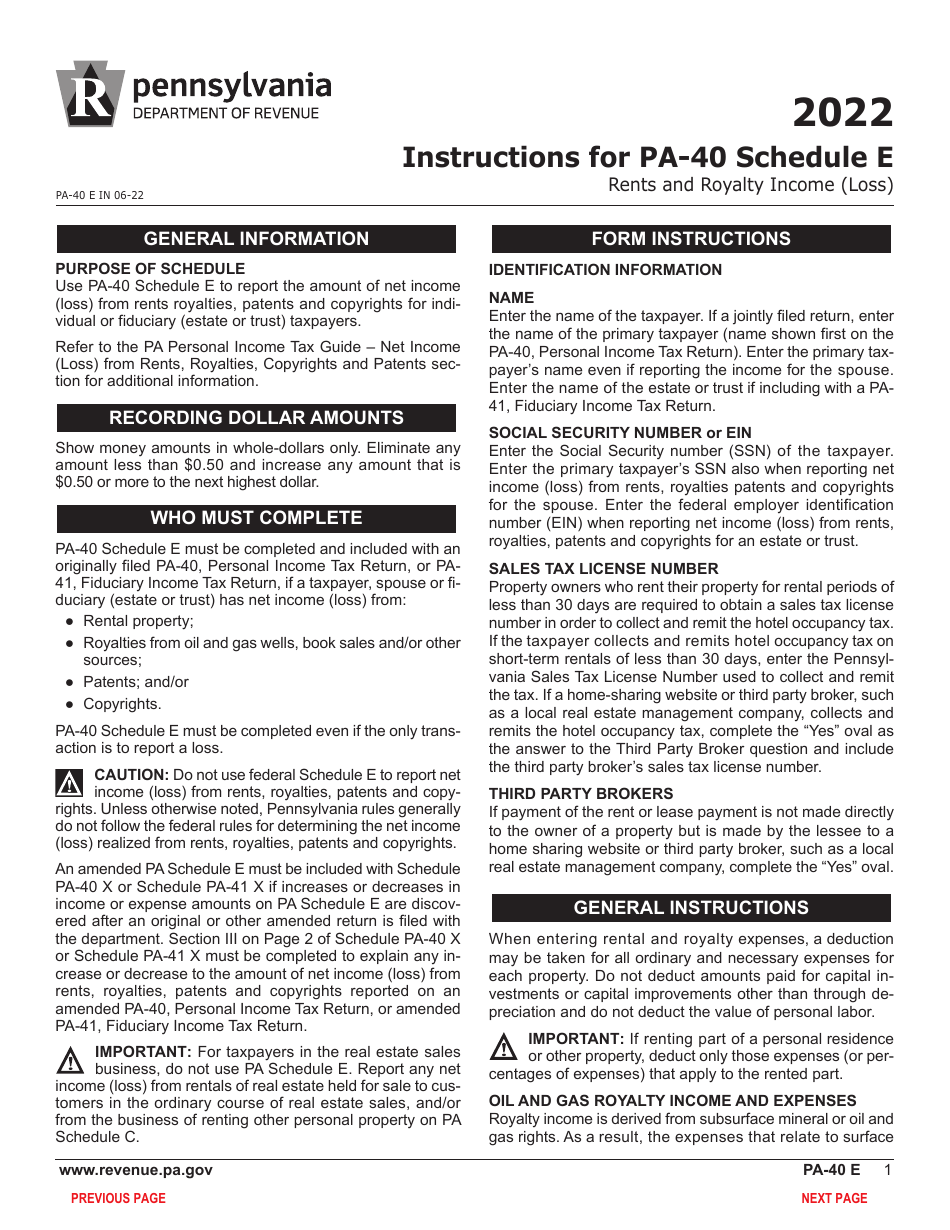

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule E?

A: Form PA-40 Schedule E is a Pennsylvania state tax form used to report rents and royalty income (or loss).

Q: Who needs to file Form PA-40 Schedule E?

A: Individuals and businesses who receive rents and royalties from properties located in Pennsylvania need to file Form PA-40 Schedule E.

Q: What does Form PA-40 Schedule E report?

A: Form PA-40 Schedule E reports the income or loss from rental properties and royalties received in Pennsylvania.

Q: How do I complete Form PA-40 Schedule E?

A: To complete Form PA-40 Schedule E, you will need to provide details about your rental income or loss, including the property addresses and amounts received.

Q: Is Form PA-40 Schedule E the same as Schedule E on the federal tax return?

A: No, Form PA-40 Schedule E is specific to Pennsylvania state taxes and is used to report Pennsylvania-based rental income or loss.

Q: When is the deadline to file Form PA-40 Schedule E?

A: The deadline to file Form PA-40 Schedule E is generally the same as the deadline for filing your Pennsylvania state tax return, which is April 15th, or the next business day if April 15th falls on a weekend or holiday.

Q: Are there any specific rules or guidelines that I need to follow when completing Form PA-40 Schedule E?

A: Yes, it is important to follow the instructions provided with the form to ensure accurate completion. You may also want to consult with a tax professional for guidance.

Q: Can I e-file Form PA-40 Schedule E?

A: Yes, Pennsylvania allows taxpayers to e-file their state tax returns, including Form PA-40 Schedule E.

Q: What should I do if I have additional questions or need help with Form PA-40 Schedule E?

A: If you have additional questions or need help with Form PA-40 Schedule E, you can contact the Pennsylvania Department of Revenue or consult with a tax professional for assistance.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule E by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.