This version of the form is not currently in use and is provided for reference only. Download this version of

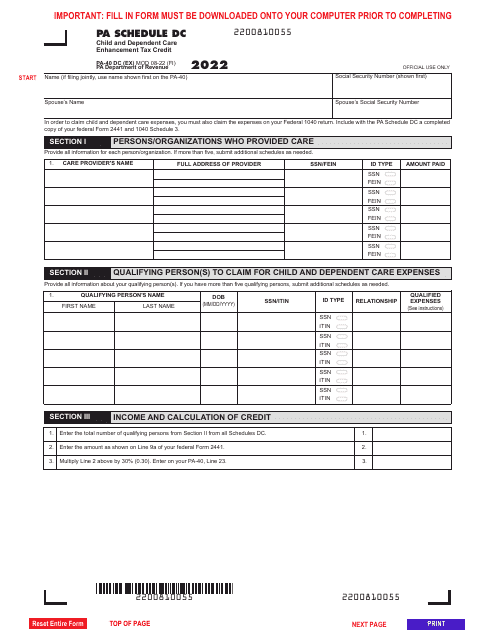

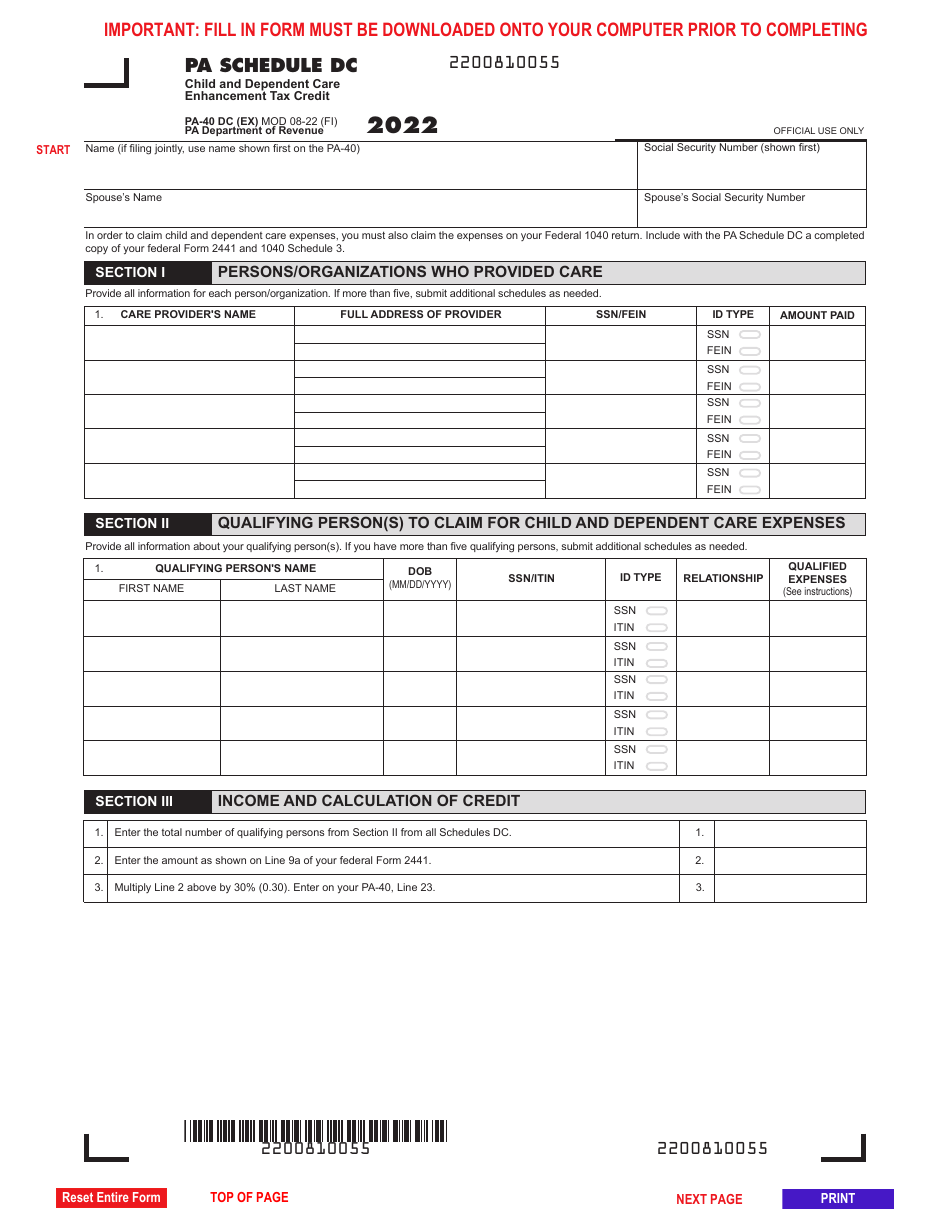

Form PA-40 Schedule DC

for the current year.

Form PA-40 Schedule DC Child and Dependent Care Enhancement Tax Credit - Pennsylvania

What Is Form PA-40 Schedule DC?

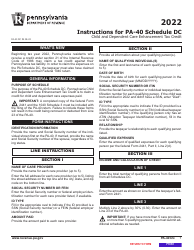

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule DC?

A: Form PA-40 Schedule DC is a form used by Pennsylvania residents to claim the Child and Dependent Care Enhancement Tax Credit.

Q: What is the Child and Dependent Care Enhancement Tax Credit?

A: The Child and Dependent Care Enhancement Tax Credit is a tax credit that can be claimed by Pennsylvania residents who have incurred expenses for child and dependent care services.

Q: Who is eligible to claim the Child and Dependent Care Enhancement Tax Credit?

A: Pennsylvania residents who have incurred expenses for child and dependent care services and meet certain income and eligibility criteria are eligible to claim the tax credit.

Q: What expenses qualify for the tax credit?

A: Expenses for child and dependent care services provided by a licensed provider or a relative may qualify for the tax credit.

Q: How much is the tax credit?

A: The amount of the tax credit depends on various factors, including the taxpayer's income and the amount of eligible expenses incurred.

Q: How do I claim the tax credit?

A: To claim the tax credit, you need to complete and file Form PA-40 Schedule DC along with your Pennsylvania income tax return.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule DC by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.