This version of the form is not currently in use and is provided for reference only. Download this version of

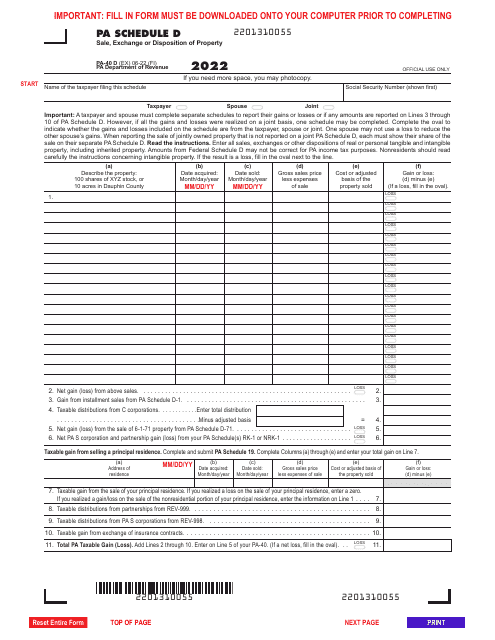

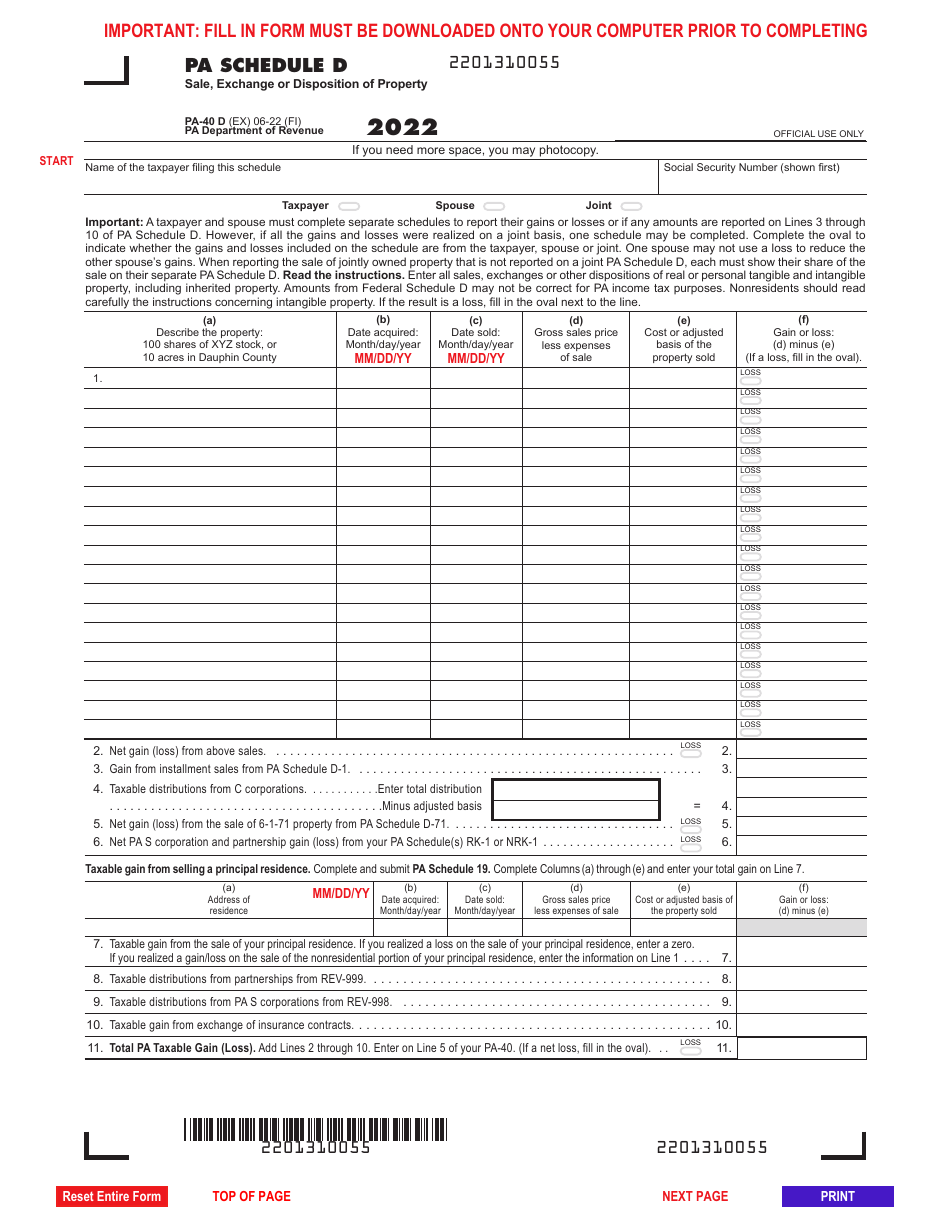

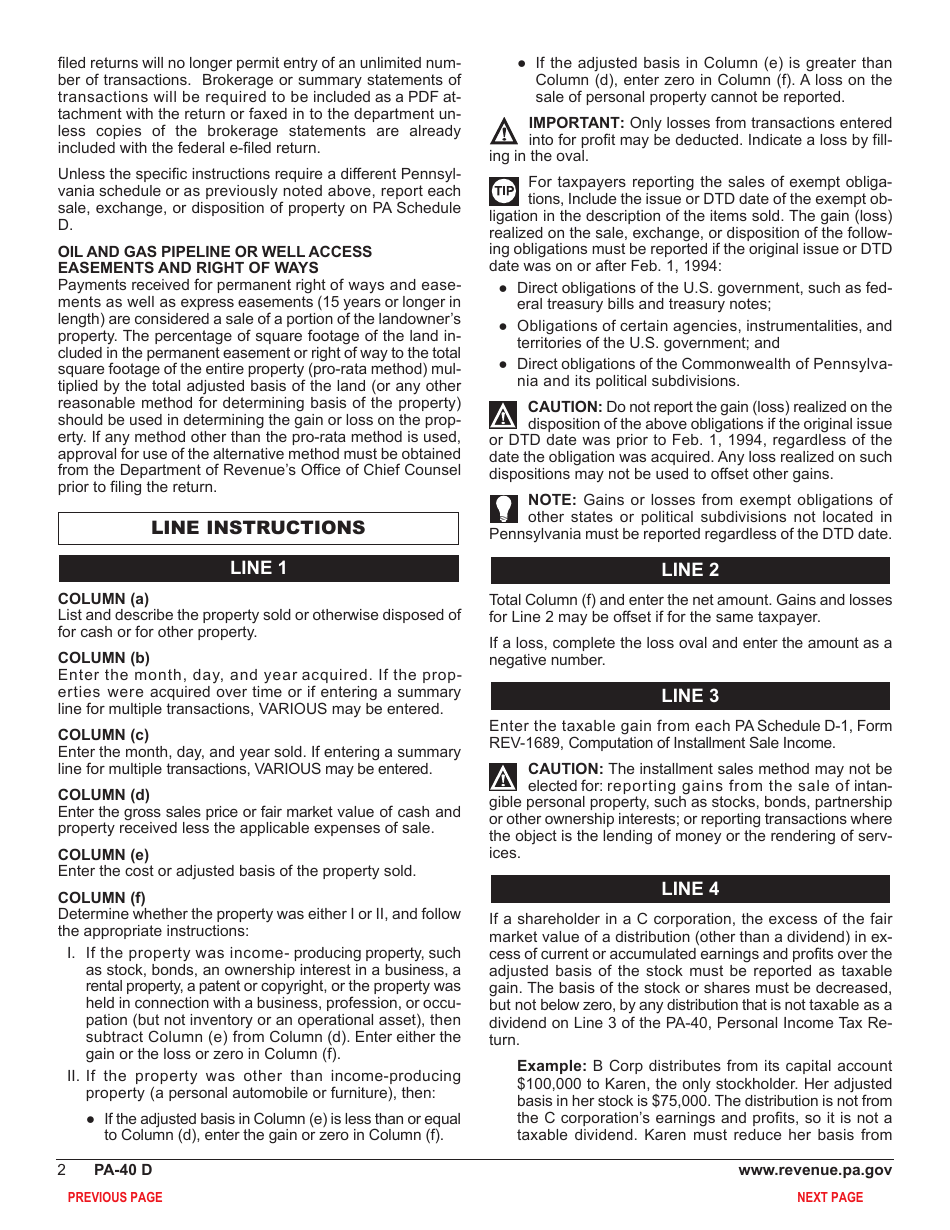

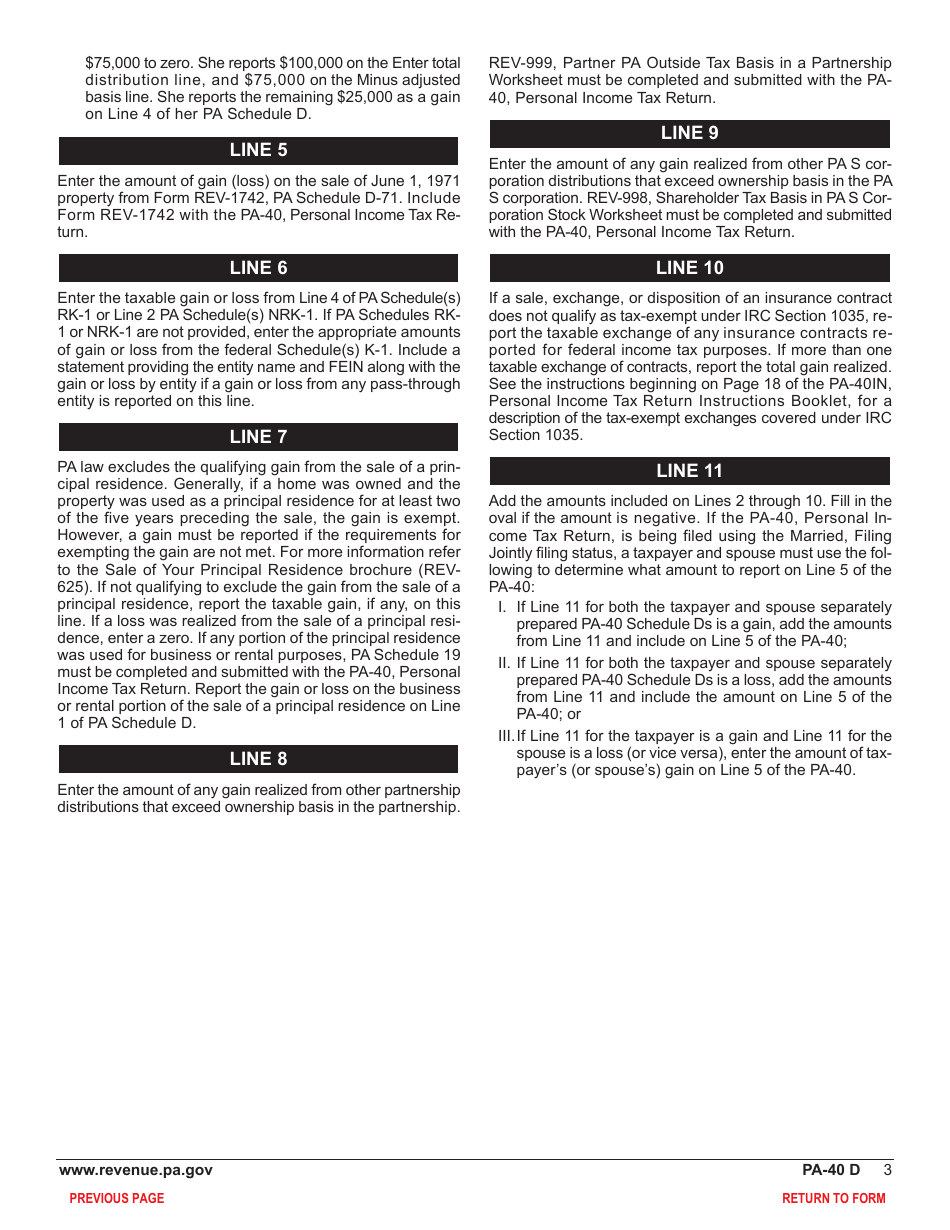

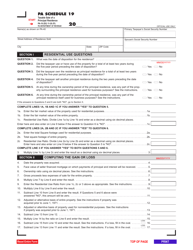

Form PA-40 Schedule D

for the current year.

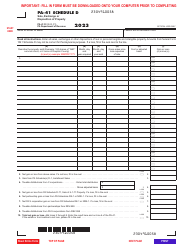

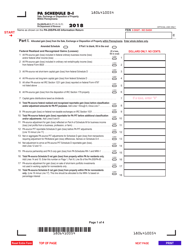

Form PA-40 Schedule D Sale, Exchange or Disposition of Property - Pennsylvania

What Is Form PA-40 Schedule D?

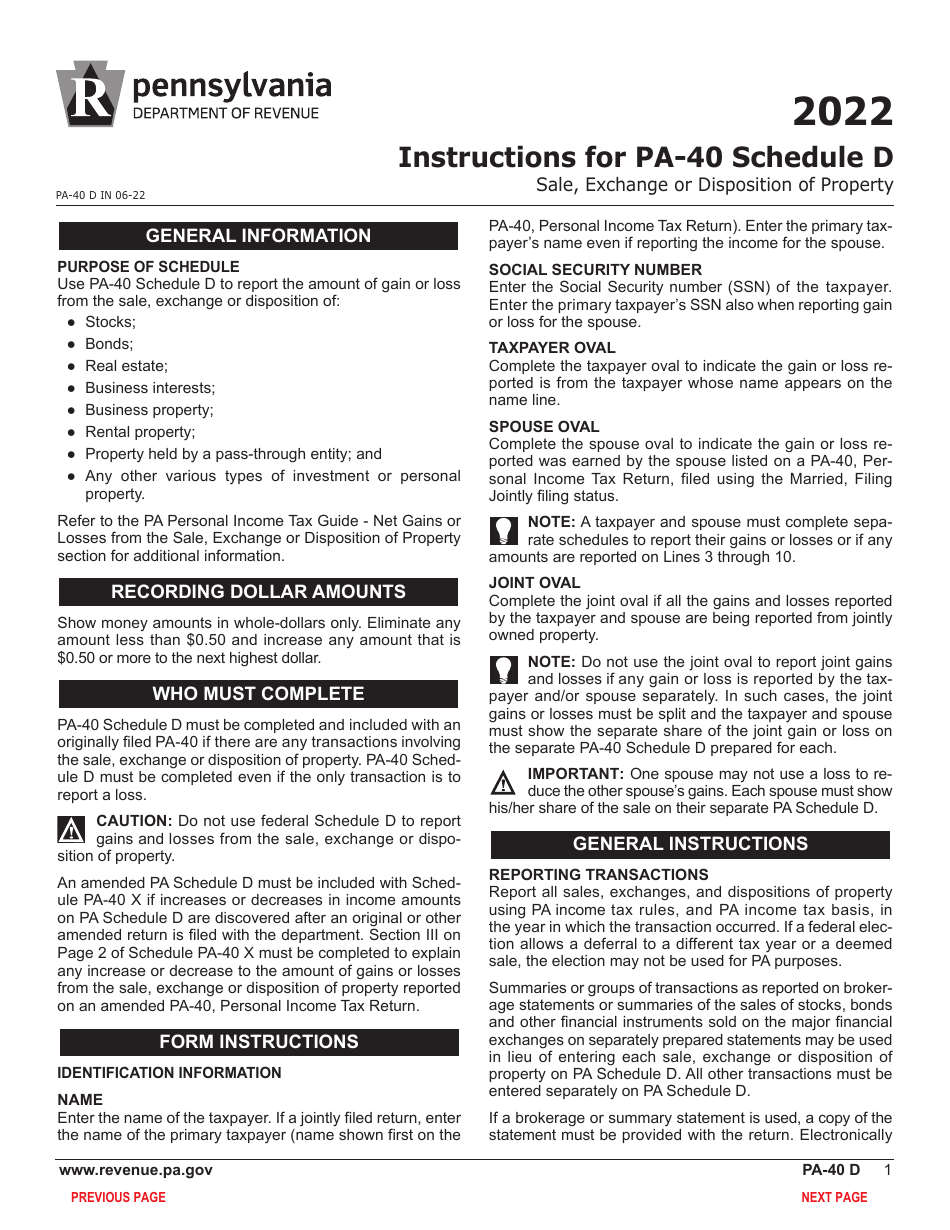

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule D?

A: Form PA-40 Schedule D is a tax form used in Pennsylvania to report the sale, exchange, or disposition of property.

Q: Who needs to file Form PA-40 Schedule D?

A: You need to file Form PA-40 Schedule D if you had a sale, exchange, or disposition of property in Pennsylvania during the tax year.

Q: What information do I need to complete Form PA-40 Schedule D?

A: To complete Form PA-40 Schedule D, you will need information about the property you sold or disposed of, including the date of sale, the sales price, and your basis in the property.

Q: When is the deadline to file Form PA-40 Schedule D?

A: The deadline to file Form PA-40 Schedule D is the same as the deadline to file your Pennsylvania state tax return, which is typically April 15th.

Q: Are there any special rules or considerations for reporting property sales in Pennsylvania?

A: Yes, there are certain rules and considerations for reporting property sales in Pennsylvania, such as reporting gains or losses on a separate line for each property sold and including any related forms or schedules.

Q: Do I need to include any supporting documentation with Form PA-40 Schedule D?

A: Yes, you may need to include supporting documentation, such as copies of your federal tax return and any relevant documents related to the sale or disposition of the property.

Q: What are the penalties for not filing Form PA-40 Schedule D?

A: The penalties for not filing Form PA-40 Schedule D or filing it late can vary depending on the circumstances, but you may be subject to penalties and interest on any unpaid tax. It's best to file the form on time to avoid any potential penalties.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule D by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.