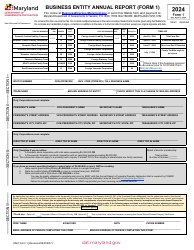

This version of the form is not currently in use and is provided for reference only. Download this version of

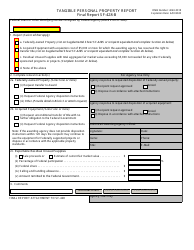

Form 5

for the current year.

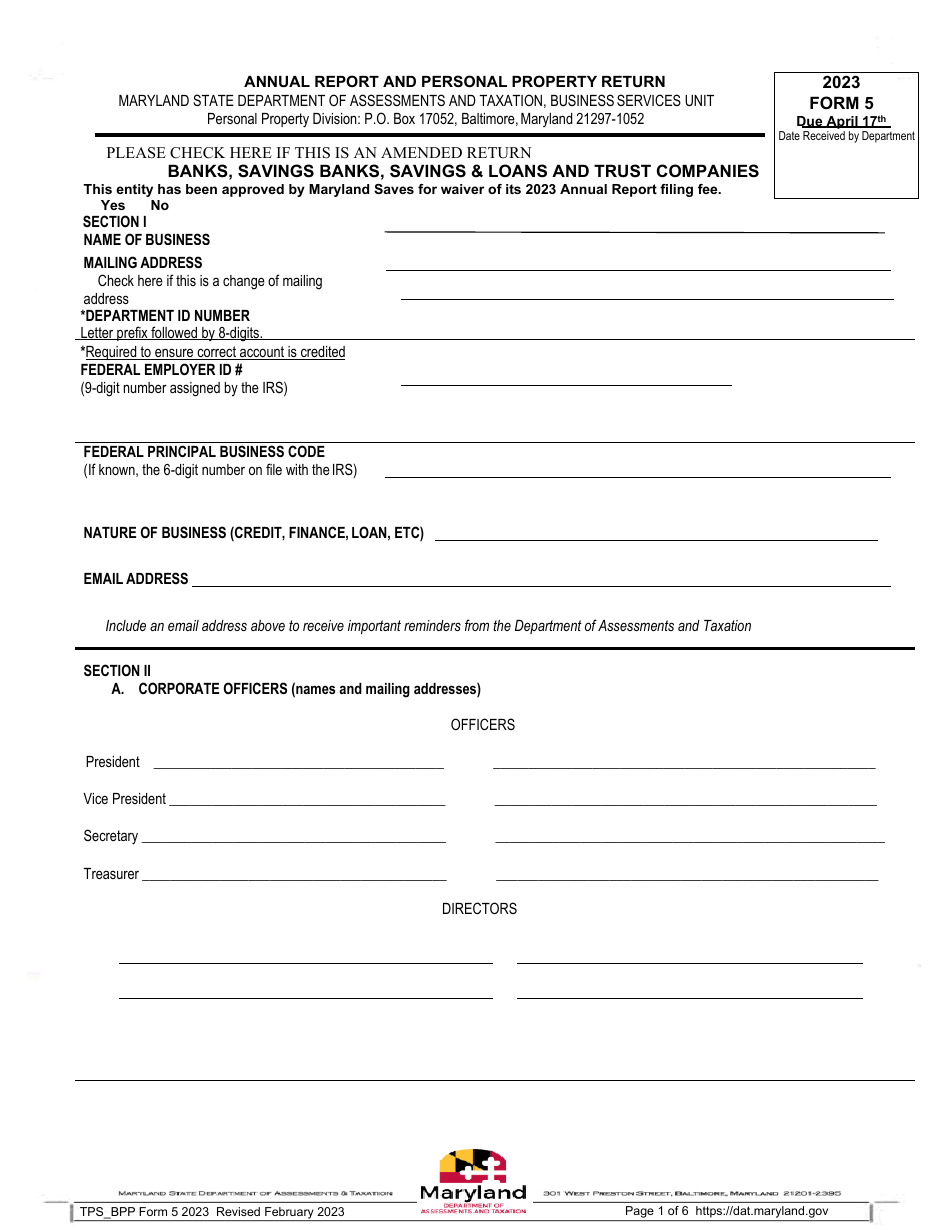

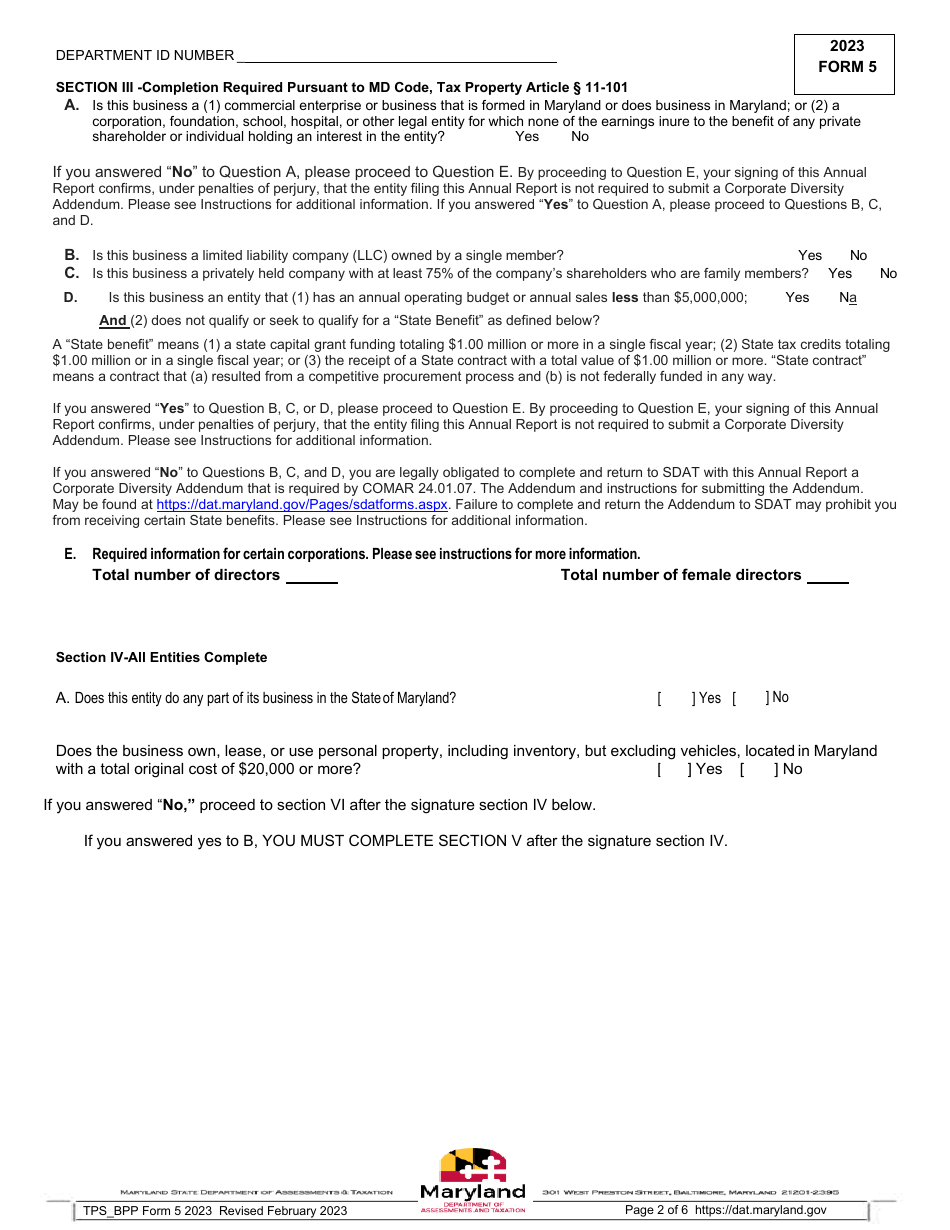

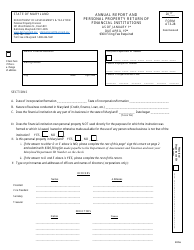

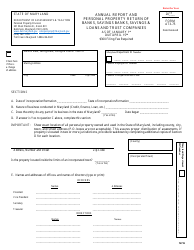

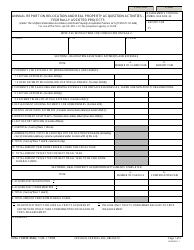

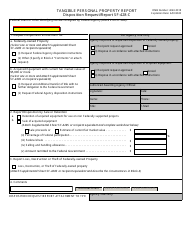

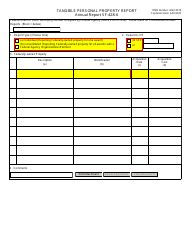

Form 5 Annual Report and Personal Property Return - Maryland

What Is Form 5?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

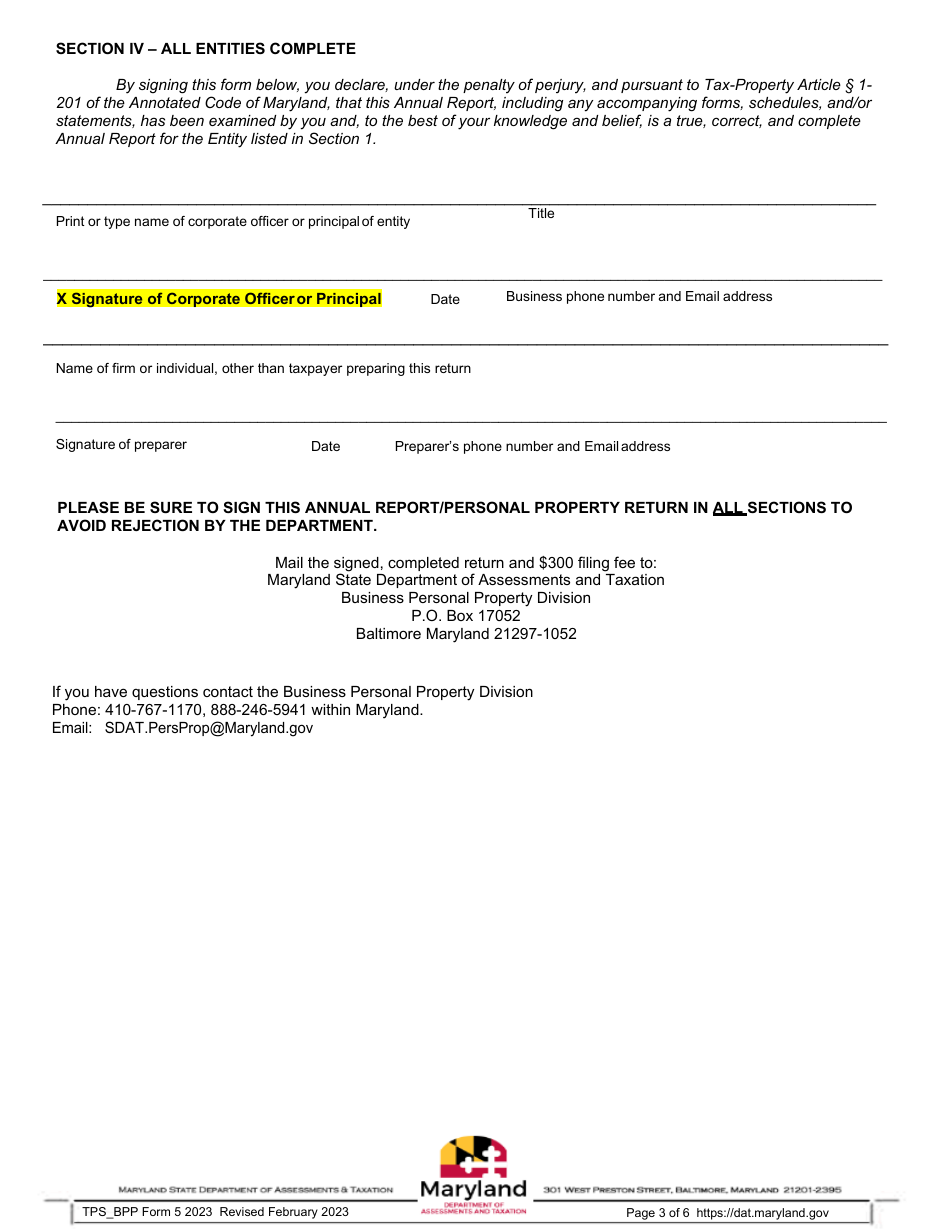

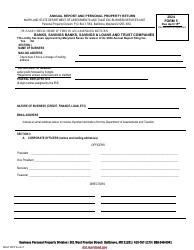

Q: What is the Form 5 Annual Report and Personal Property Return?

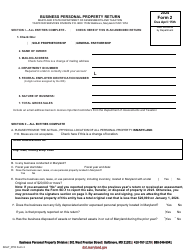

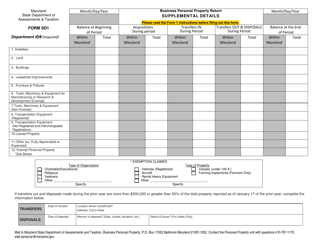

A: The Form 5 Annual Report and Personal Property Return is a document required by the state of Maryland to report personal property owned by businesses and individuals.

Q: Who needs to file the Form 5 Annual Report and Personal Property Return?

A: All businesses and individuals who own taxable personal property in Maryland need to file the Form 5 Annual Report and Personal Property Return.

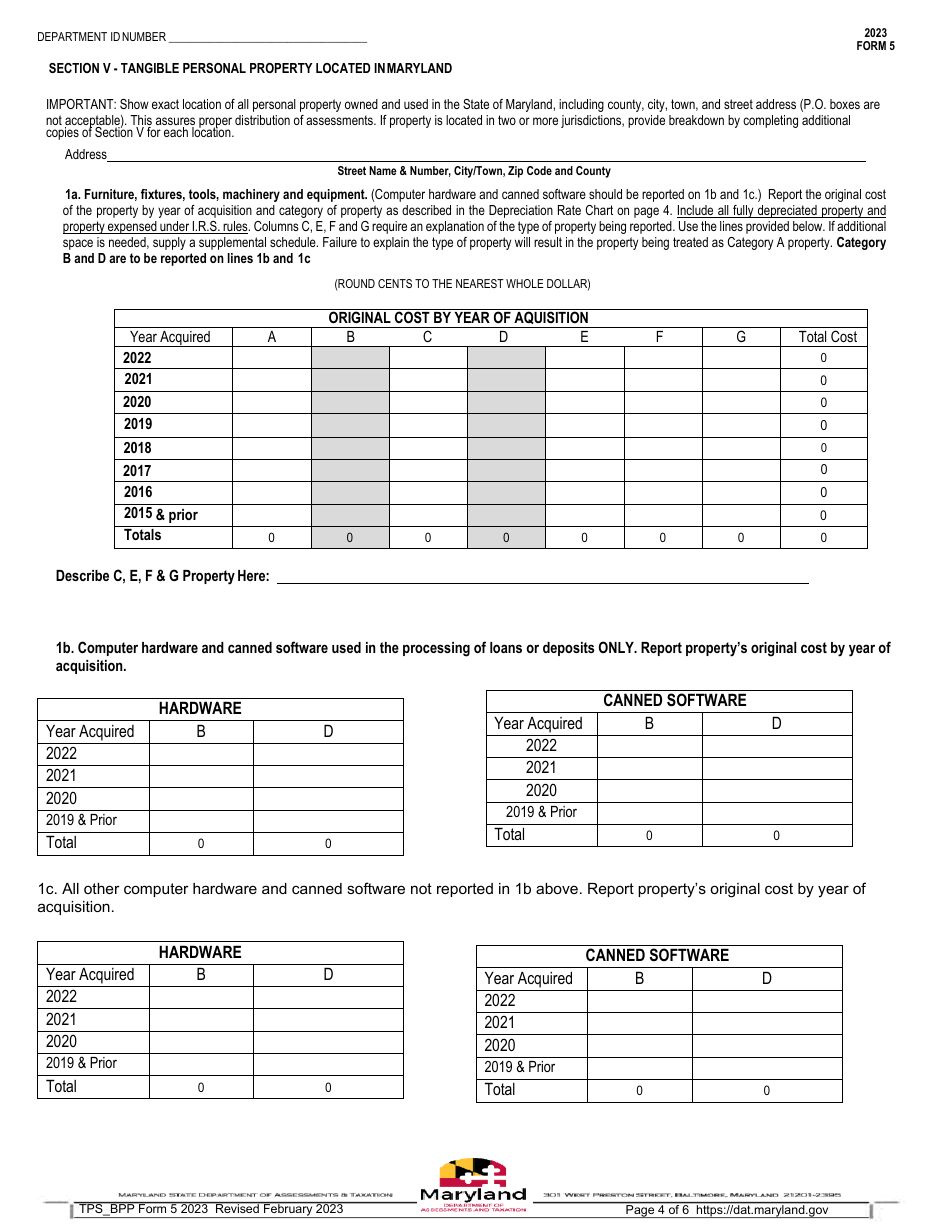

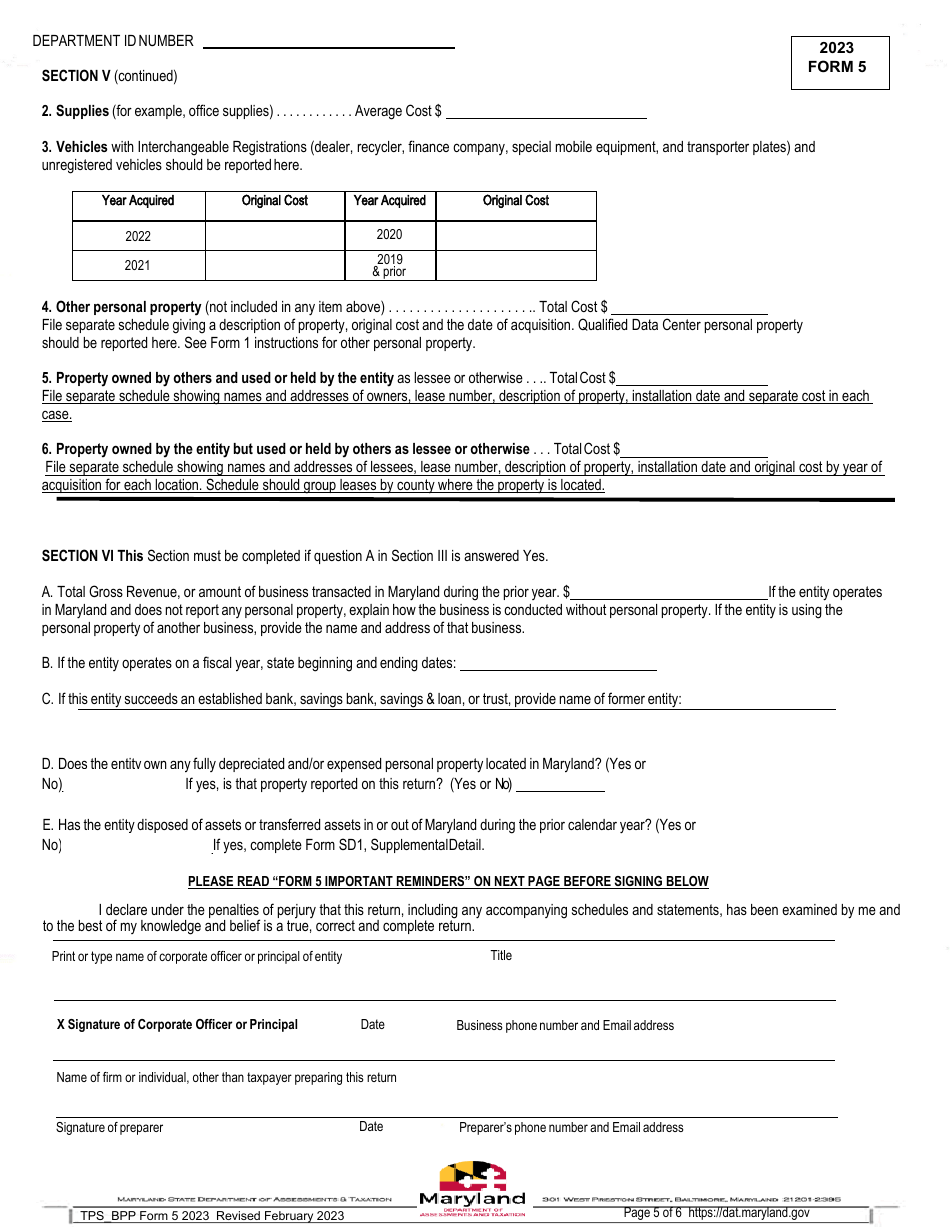

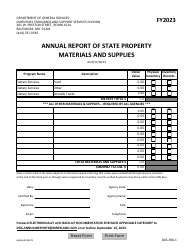

Q: What is considered taxable personal property in Maryland?

A: Taxable personal property in Maryland includes furniture, equipment, machinery, inventory, supplies, and other tangible property used for business purposes.

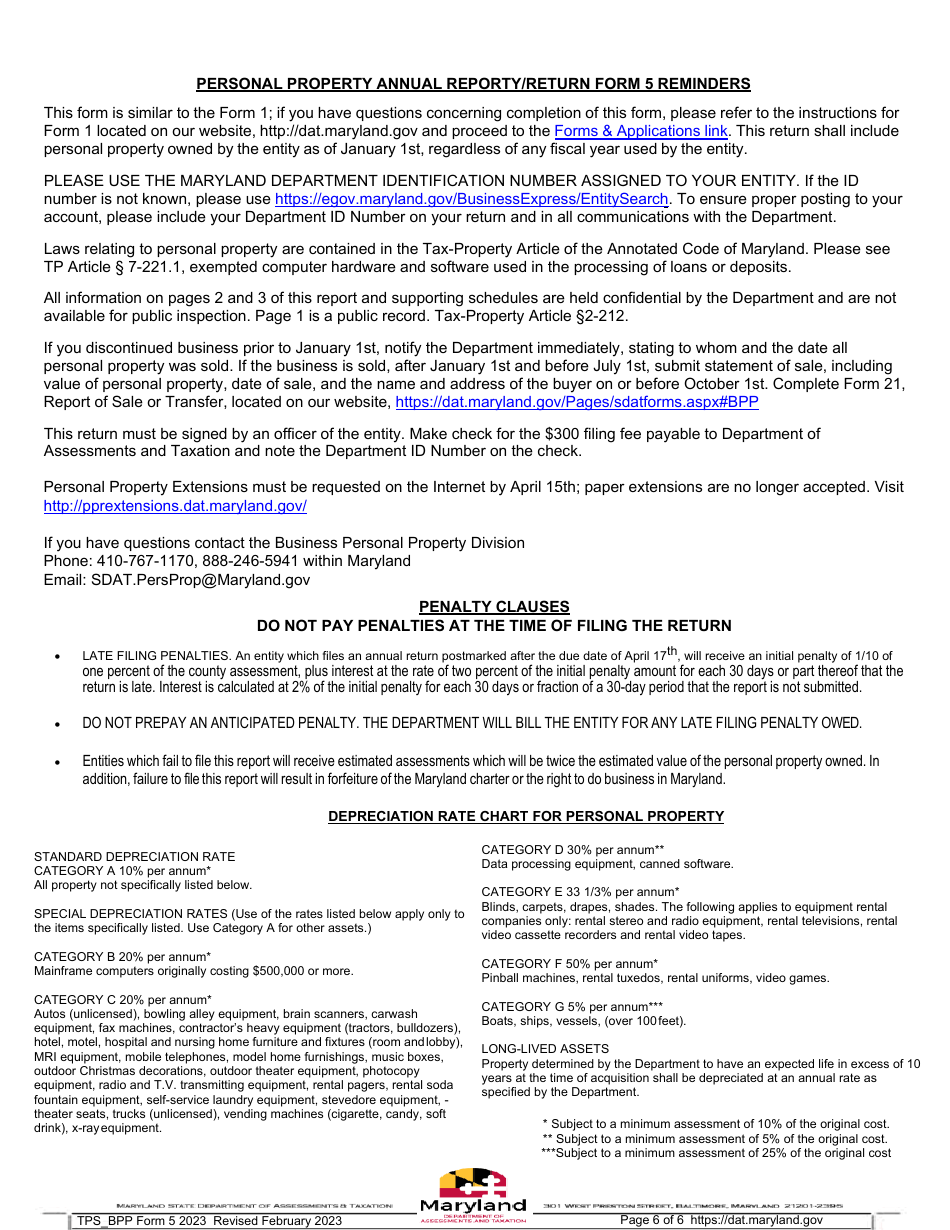

Q: When is the deadline to file the Form 5 Annual Report and Personal Property Return?

A: The deadline to file the Form 5 Annual Report and Personal Property Return is April 15th of each year.

Q: What happens if I don't file the Form 5 Annual Report and Personal Property Return?

A: Failure to file the Form 5 Annual Report and Personal Property Return may result in penalties and interest charges.

Q: Are there any exemptions to filing the Form 5 Annual Report and Personal Property Return?

A: Yes, there are exemptions available for certain types of property and businesses. It is best to consult the Maryland Comptroller's office for more information.

Q: Is there a fee to file the Form 5 Annual Report and Personal Property Return?

A: Yes, there is a filing fee associated with the Form 5 Annual Report and Personal Property Return. The fee amount varies depending on the value of the personal property owned.

Q: Can I amend my Form 5 Annual Report and Personal Property Return?

A: Yes, you can amend your Form 5 Annual Report and Personal Property Return if you need to make changes or corrections to the original filing.

Form Details:

- Released on February 1, 2023;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.