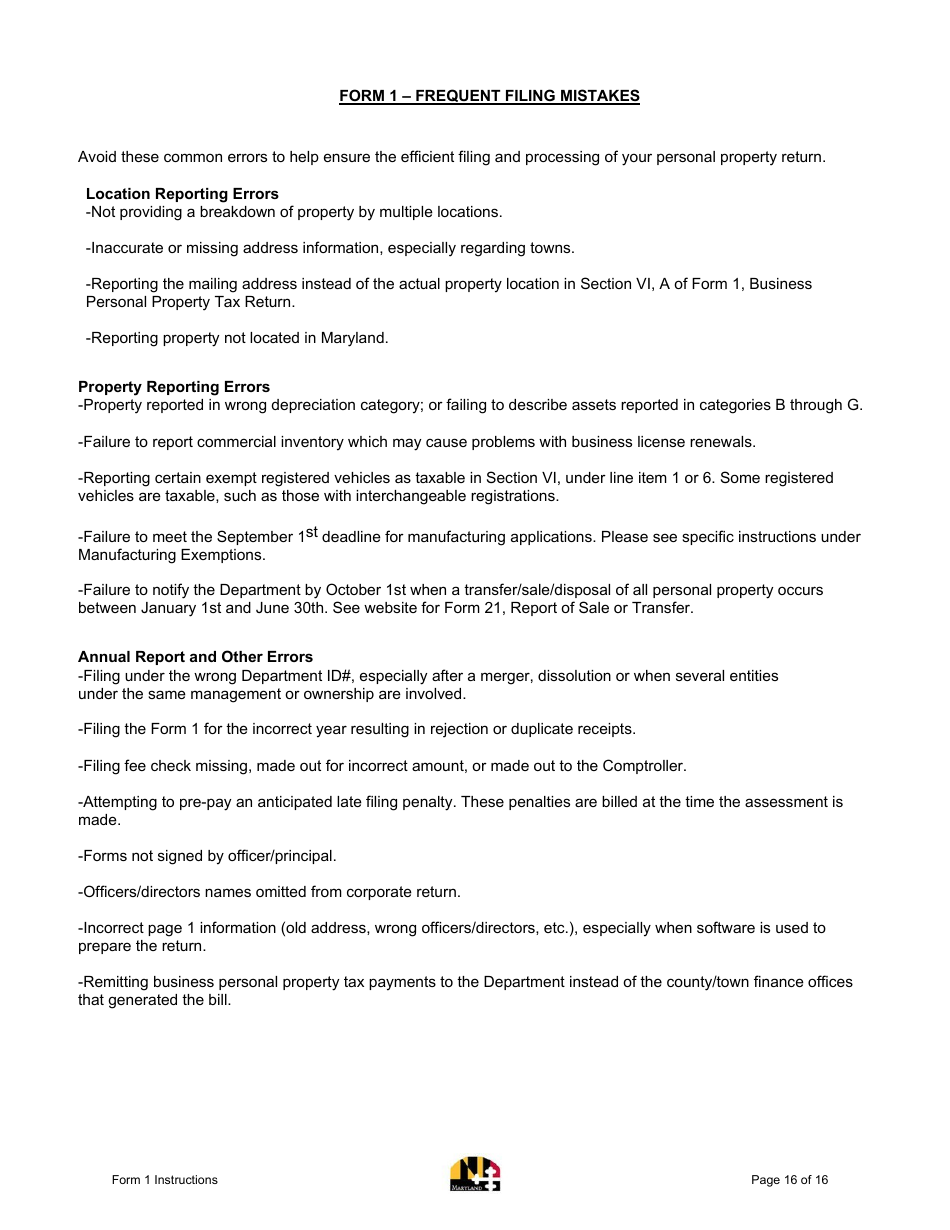

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 1

for the current year.

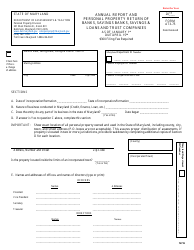

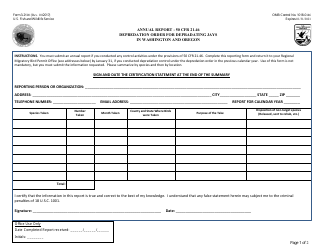

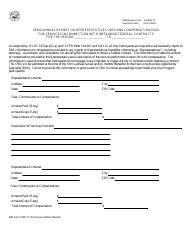

Instructions for Form 1 Annual Report - Maryland

This document contains official instructions for Form 1 , Annual Report - a form released and collected by the Maryland Department of Assessments and Taxation. An up-to-date fillable Form 1 is available for download through this link.

FAQ

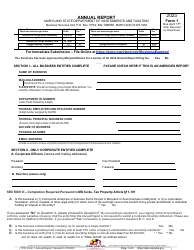

Q: What is Form 1 Annual Report?

A: Form 1 Annual Report is a document filed by businesses operating in Maryland to provide information about their annual financial and operational activities.

Q: Who is required to file Form 1 Annual Report?

A: All businesses, including corporations, LLCs, and nonprofits, registered or authorized to do business in Maryland are required to file Form 1 Annual Report.

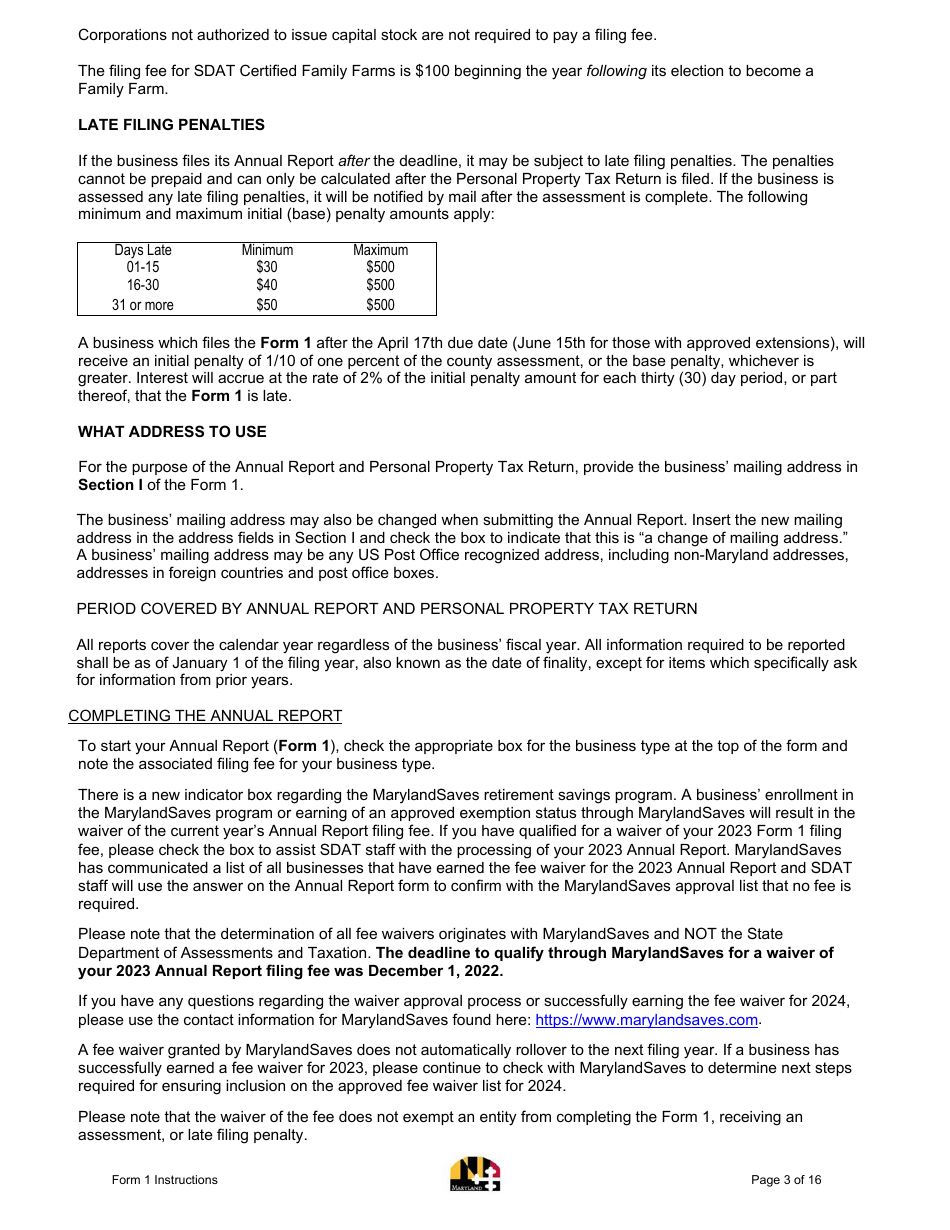

Q: When is the deadline to file Form 1 Annual Report?

A: The deadline to file Form 1 Annual Report is April 15th each year.

Q: What information is required to be included in Form 1 Annual Report?

A: Form 1 Annual Report requires businesses to provide general information about their organization, including company name, address, principal office, registered agent, officers, and directors.

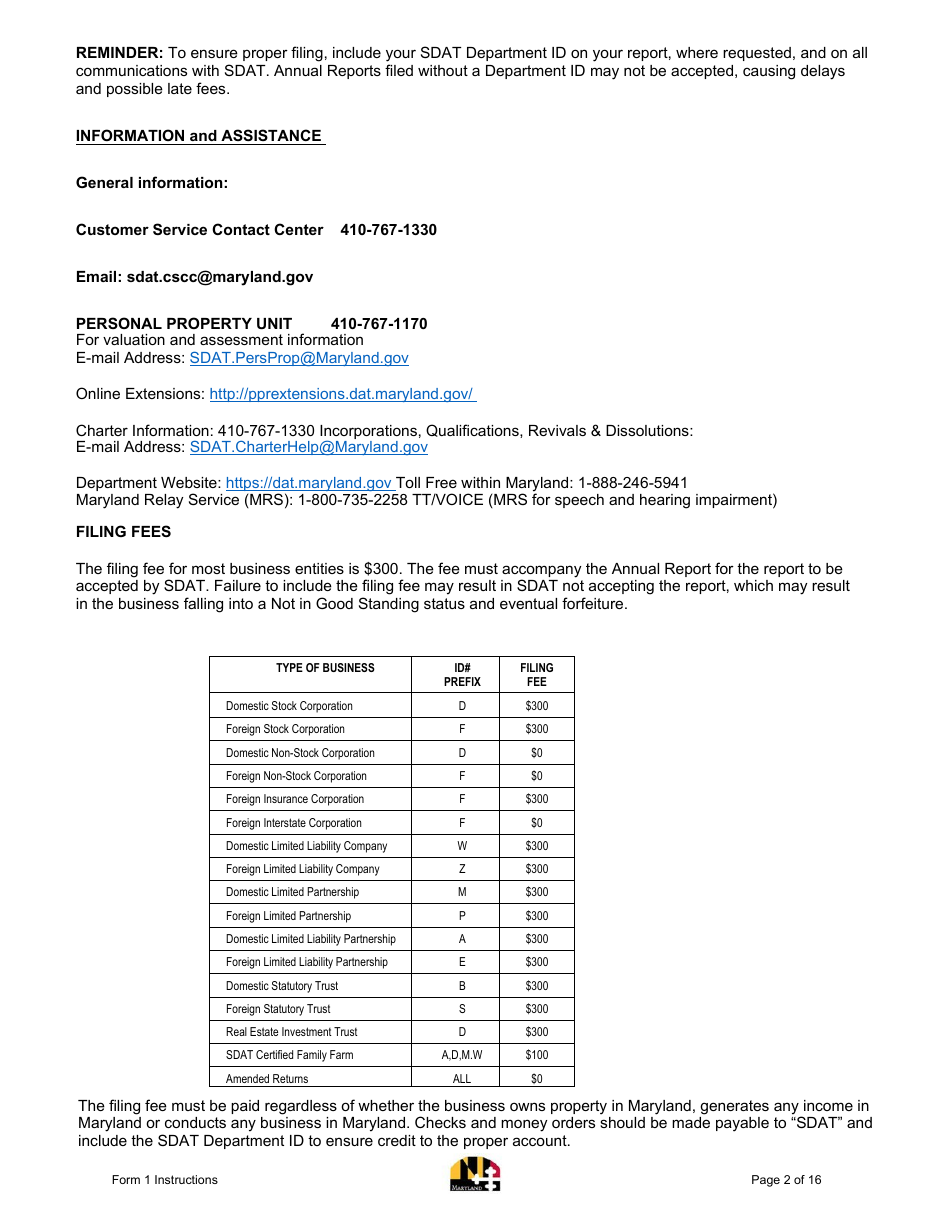

Q: Is there a fee to file Form 1 Annual Report?

A: Yes, there is a filing fee to submit Form 1 Annual Report. The fee varies depending on the type of business entity.

Q: What happens if I fail to file Form 1 Annual Report?

A: Failure to file Form 1 Annual Report may result in penalties, late fees, and the potential loss of good standing for your business in Maryland.

Q: Can I request an extension to file Form 1 Annual Report?

A: No, Maryland does not grant extensions for filing Form 1 Annual Report. It must be filed by the April 15th deadline.

Instruction Details:

- This 16-page document is available for download in PDF;

- Might not be applicable for the current year. Choose an older version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Maryland Department of Assessments and Taxation.