This version of the form is not currently in use and is provided for reference only. Download this version of

Form 2

for the current year.

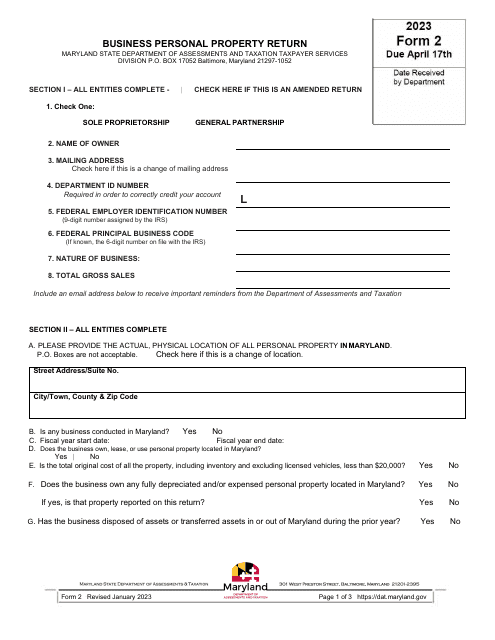

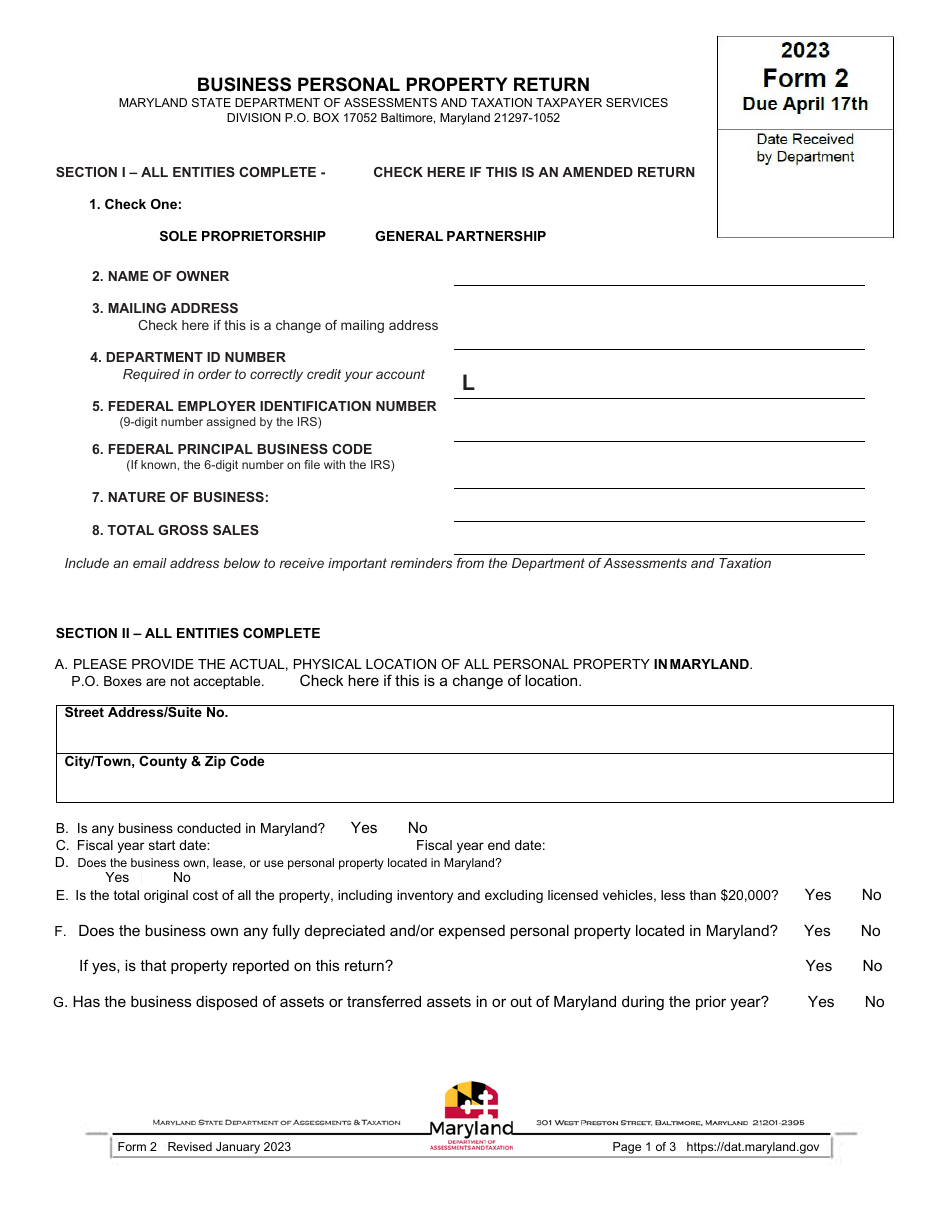

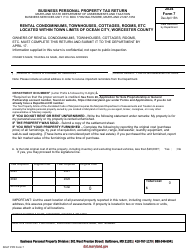

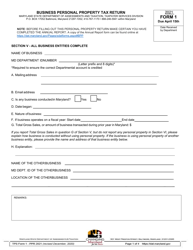

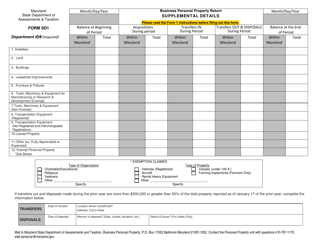

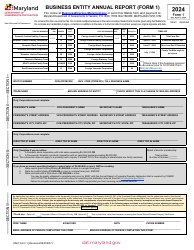

Form 2 Business Personal Property Return - Sole Proprietorship and General Partnerships - Maryland

What Is Form 2?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. Check the official instructions before completing and submitting the form.

FAQ

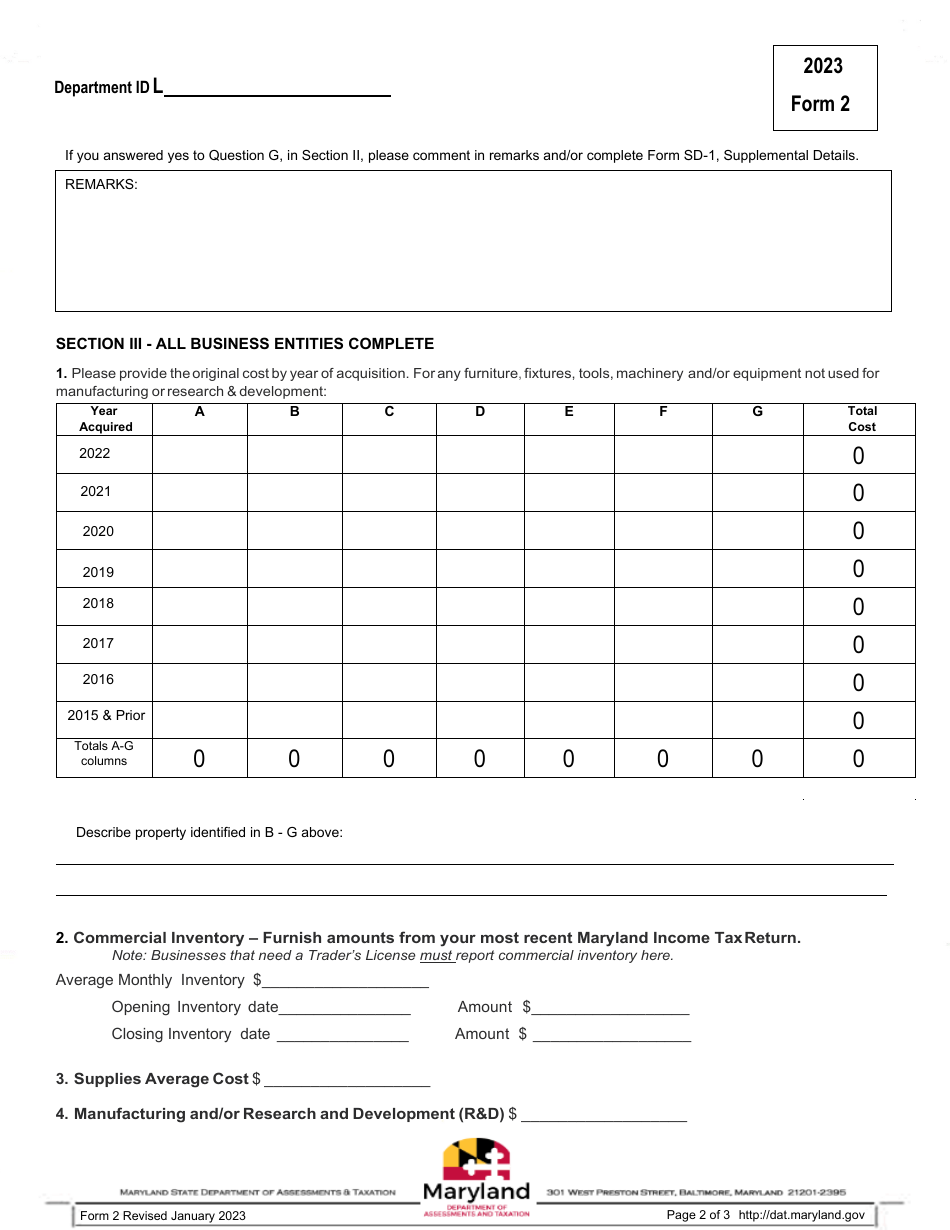

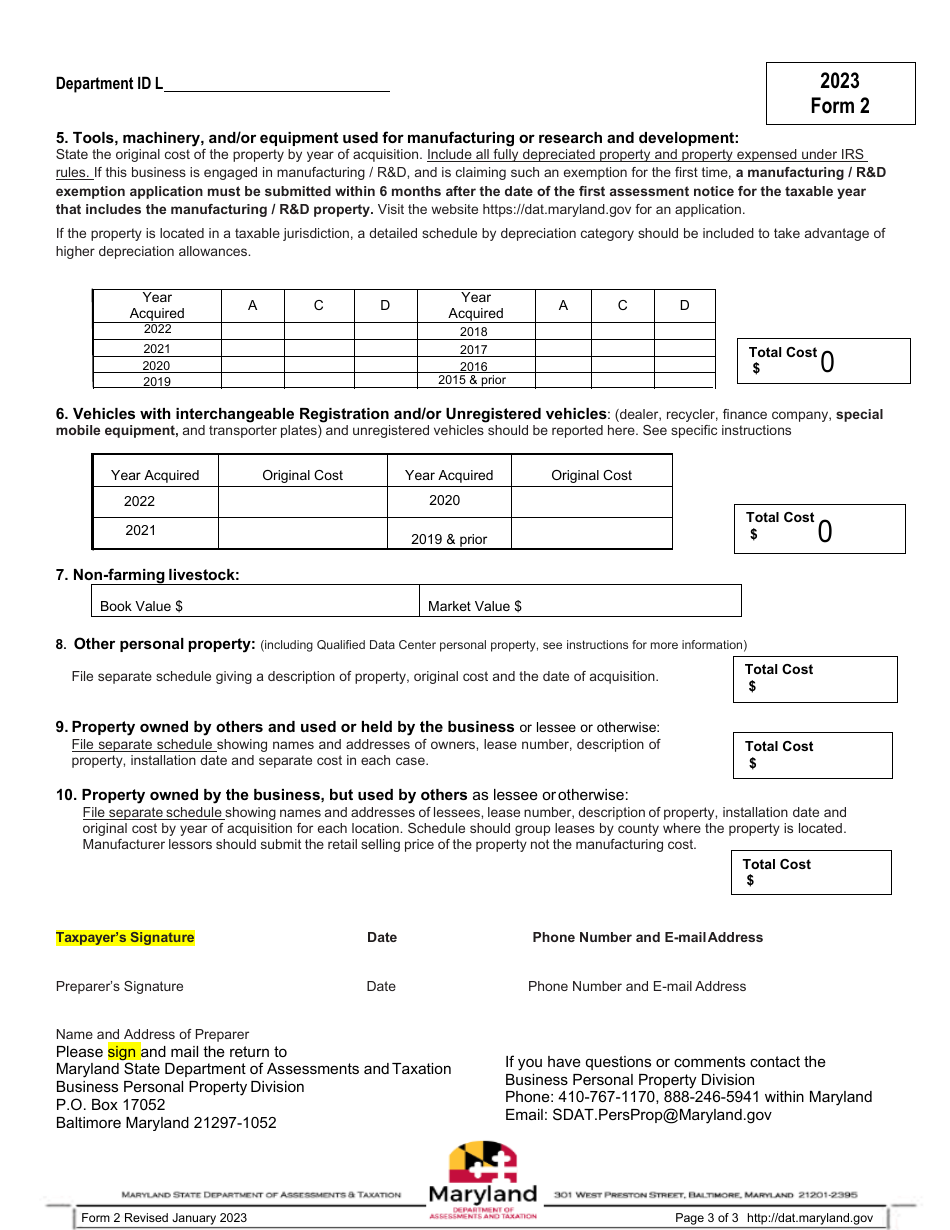

Q: What is a Form 2 Business Personal Property Return?

A: Form 2 Business Personal Property Return is a document used by sole proprietors and general partnerships in Maryland to report their business personal property.

Q: Who needs to file a Form 2 Business Personal Property Return?

A: Sole proprietors and general partnerships in Maryland need to file a Form 2 Business Personal Property Return.

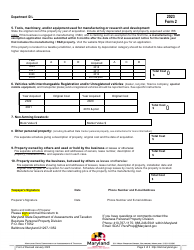

Q: What is considered business personal property?

A: Business personal property includes furniture, fixtures, equipment, machinery, and other tangible assets used in a business.

Q: When is the deadline to file a Form 2 Business Personal Property Return?

A: The deadline to file a Form 2 Business Personal Property Return in Maryland is April 15th.

Q: Is there a penalty for late filing?

A: Yes, there is a penalty for late filing of a Form 2 Business Personal Property Return in Maryland.

Q: Is there a fee for filing a Form 2 Business Personal Property Return?

A: No, there is no fee for filing a Form 2 Business Personal Property Return in Maryland.

Q: Do I need to include an inventory with my Form 2 Business Personal Property Return?

A: No, you do not need to include an inventory with your Form 2 Business Personal Property Return.

Q: What if I no longer have any business personal property?

A: If you no longer have any business personal property, you still need to file a Form 2 Business Personal Property Return and indicate that you have no assets.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.