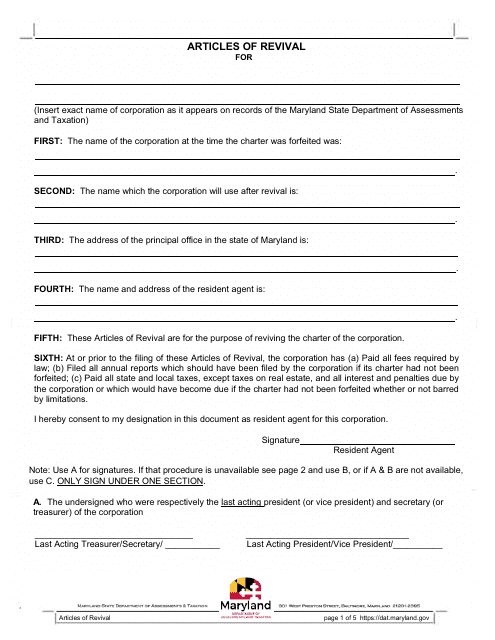

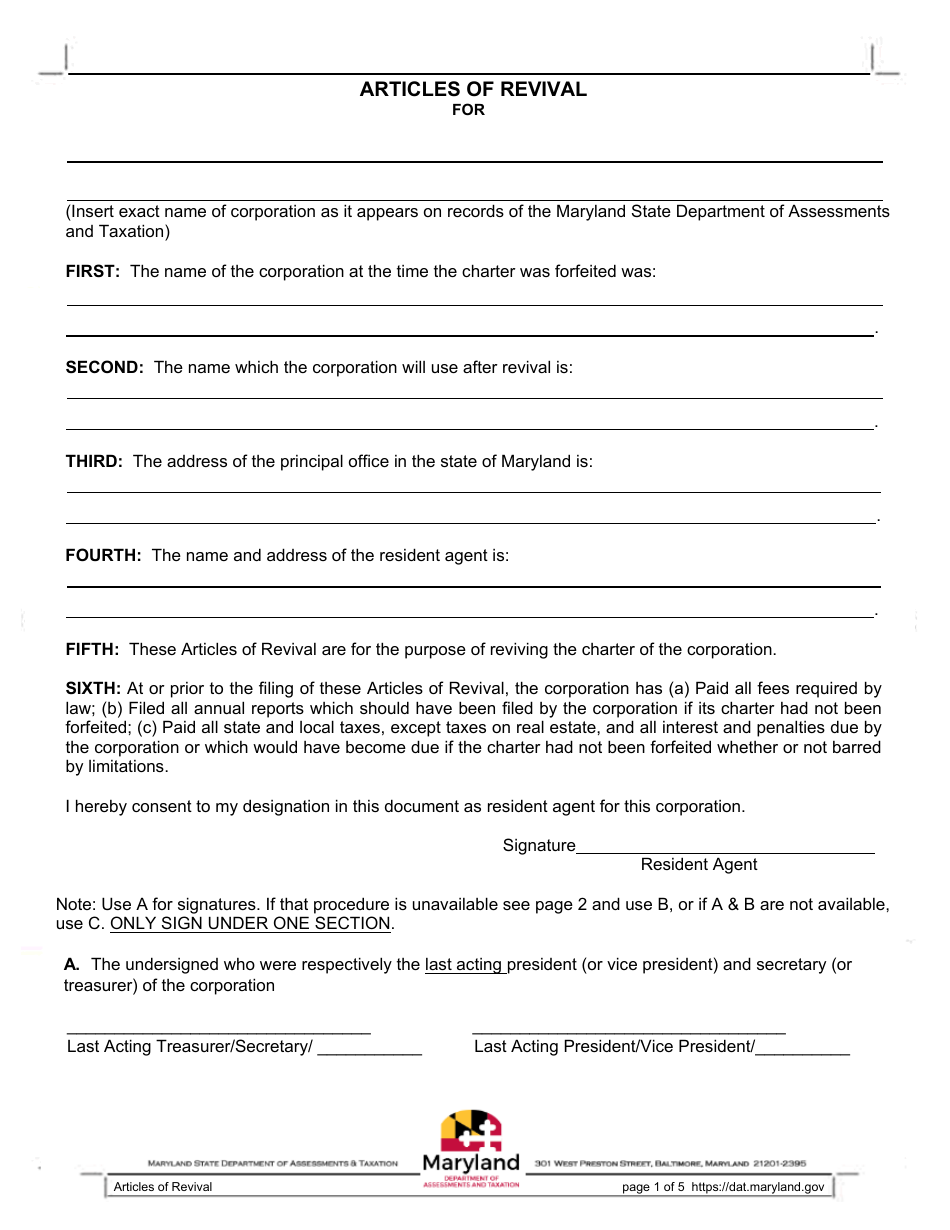

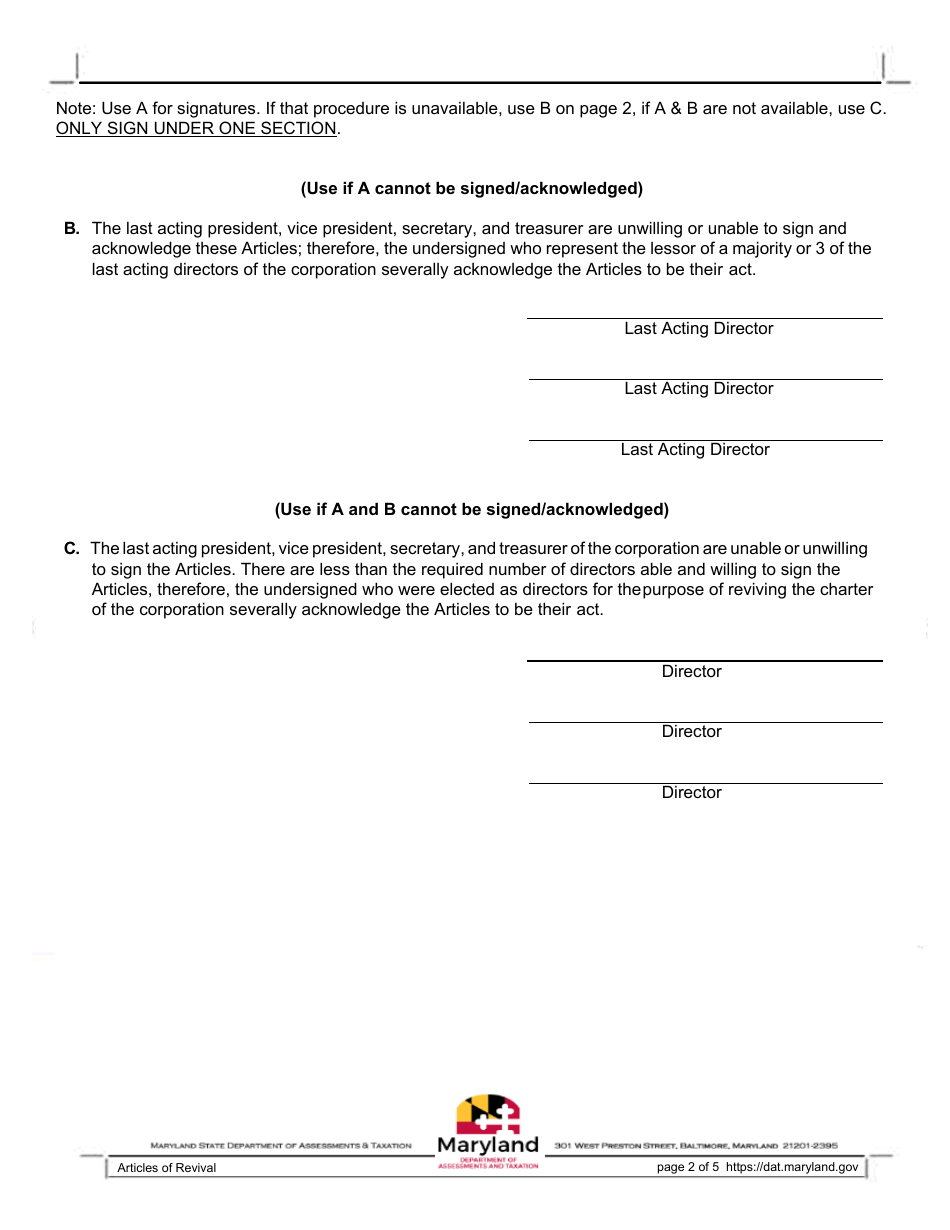

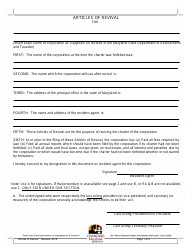

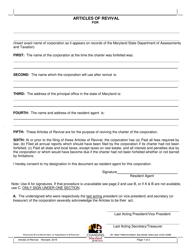

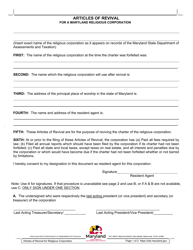

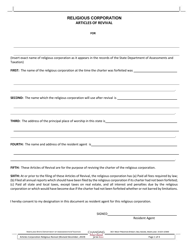

Articles of Revival for the Charter of a Maryland Corporatio - Maryland

Articles of Revival for the Charter of a Maryland Corporatio is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What is the purpose of the Articles of Revival?

A: The purpose of the Articles of Revival is to reinstate a Maryland corporation that has been forfeited or dissolved.

Q: How can I revive a forfeited or dissolved Maryland corporation?

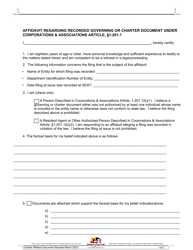

A: To revive a forfeited or dissolved Maryland corporation, you need to file Articles of Revival with the State Department of Assessments and Taxation.

Q: What information is required in the Articles of Revival?

A: The Articles of Revival require information such as the name and identification number of the corporation, the reason for dissolution, and the date of dissolution.

Q: Are there any fees for filing the Articles of Revival?

A: Yes, there is a filing fee associated with the Articles of Revival. The amount may vary, so it's advisable to check the current fee schedule.

Q: Can I revive a Maryland corporation that has been administratively dissolved?

A: Yes, you can revive a Maryland corporation that has been administratively dissolved by filing Articles of Revival and paying any outstanding fees or penalties.

Q: Is there a deadline for filing the Articles of Revival?

A: There is no specific deadline for filing the Articles of Revival, but it is recommended to take prompt action to avoid any further complications.

Form Details:

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.