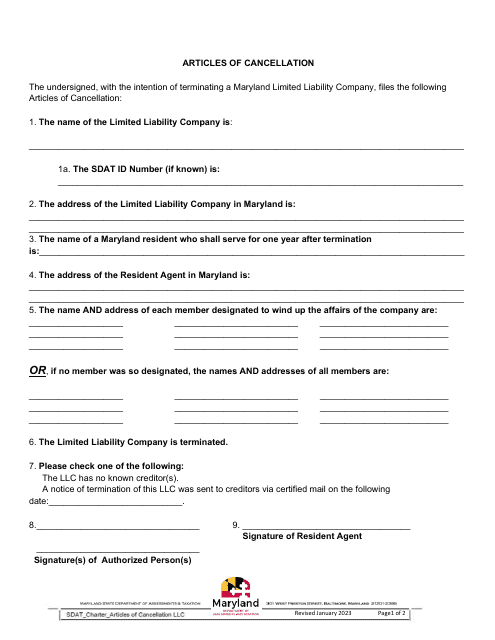

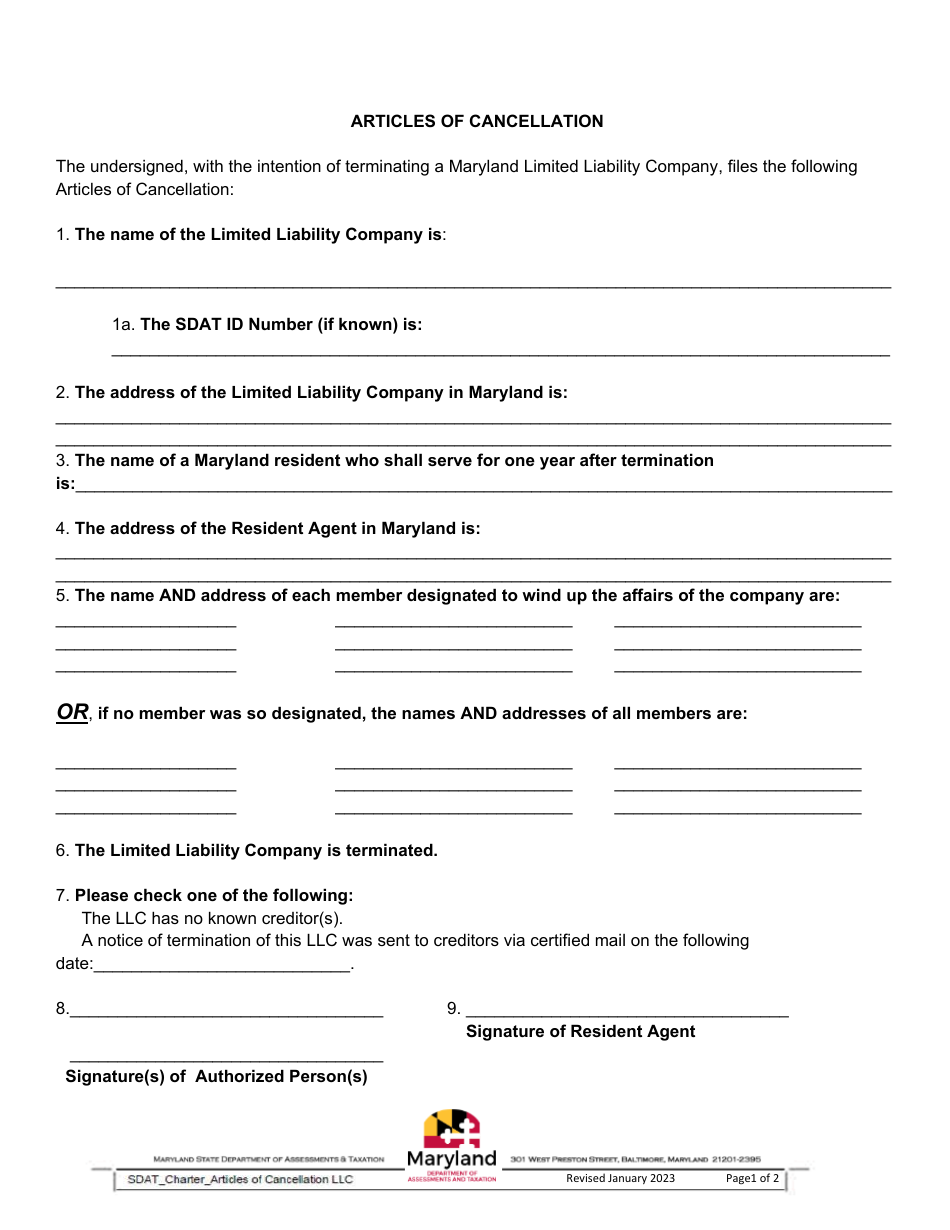

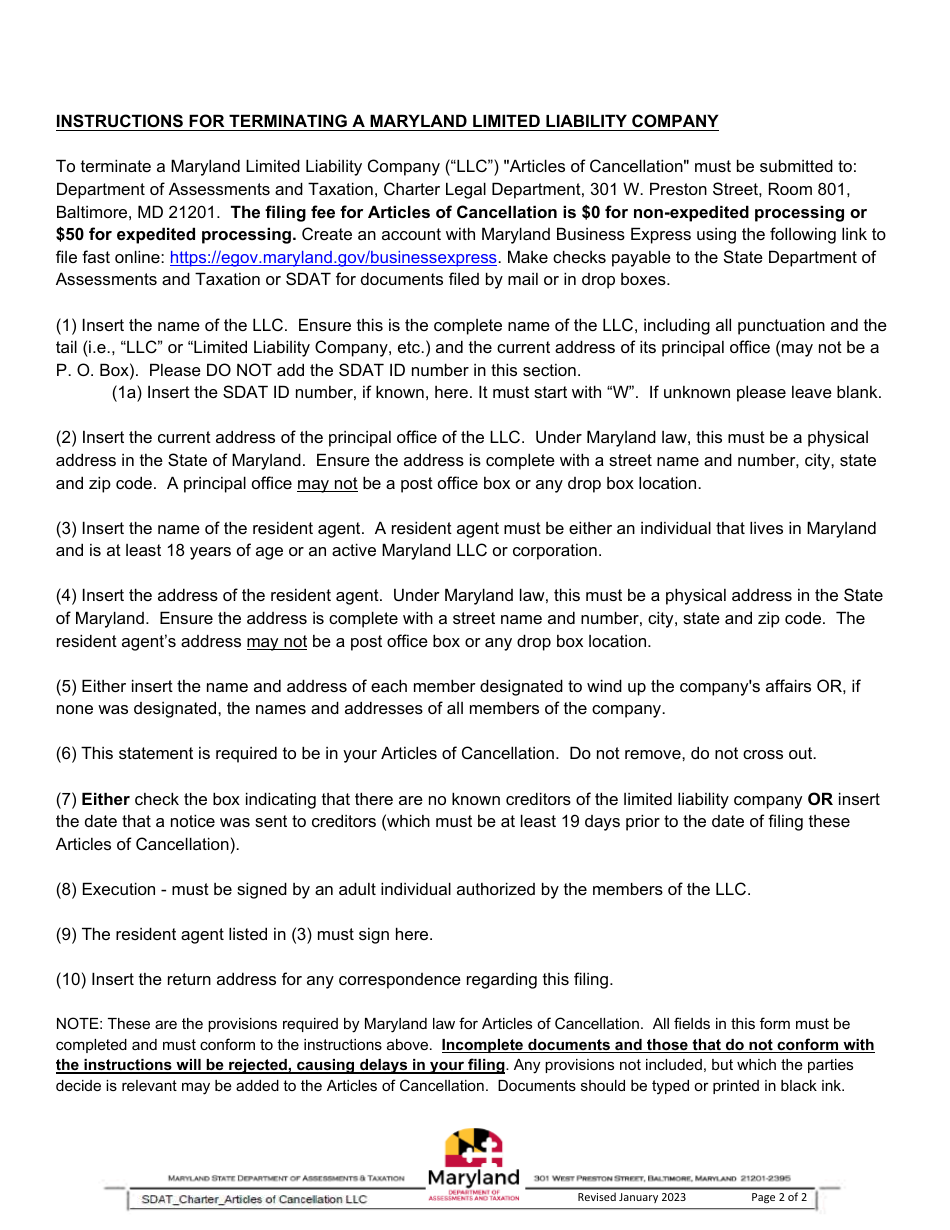

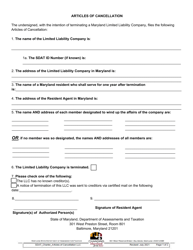

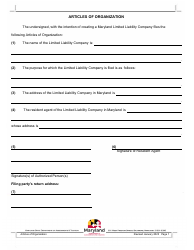

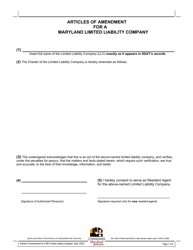

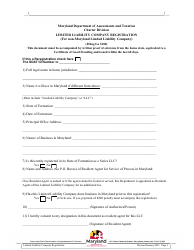

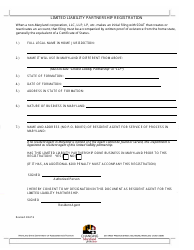

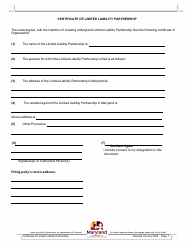

Articles of Cancellation - Maryland Limited Liability Company - Maryland

Articles of Cancellation - Maryland Limited Liability Company is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What is a Cancellation in the context of a Maryland Limited Liability Company?

A: A Cancellation is the official termination or dissolution of a Maryland Limited Liability Company.

Q: How can a Maryland Limited Liability Company be cancelled?

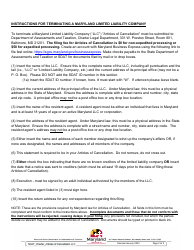

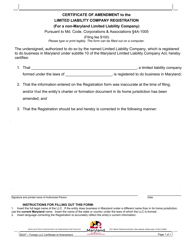

A: A Maryland Limited Liability Company can be cancelled by filing Articles of Cancellation with the Maryland Department of Assessments and Taxation.

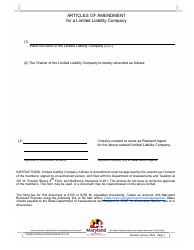

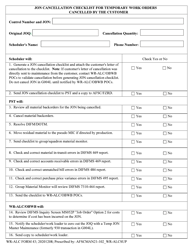

Q: What information is required in the Articles of Cancellation?

A: The Articles of Cancellation must include the name of the LLC, the date of its formation, a statement that the LLC is to be cancelled, and the effective date of the cancellation.

Q: Is there a fee for filing the Articles of Cancellation?

A: Yes, there is a fee for filing the Articles of Cancellation with the Maryland Department of Assessments and Taxation.

Q: What happens after the Articles of Cancellation are filed?

A: Once the Articles of Cancellation are filed and the fee is paid, the Maryland Limited Liability Company is considered officially cancelled and will no longer be active.

Q: Are there any additional steps required after filing the Articles of Cancellation?

A: It is recommended to notify any relevant parties, such as creditors and business partners, about the cancellation of the LLC to ensure that all obligations are properly handled.

Form Details:

- Released on January 1, 2023;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.