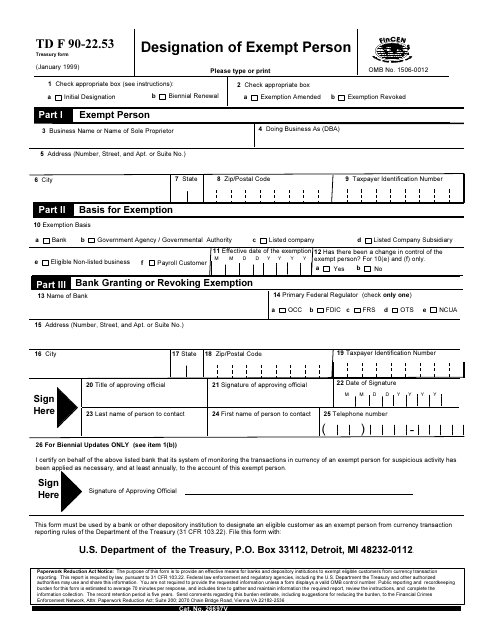

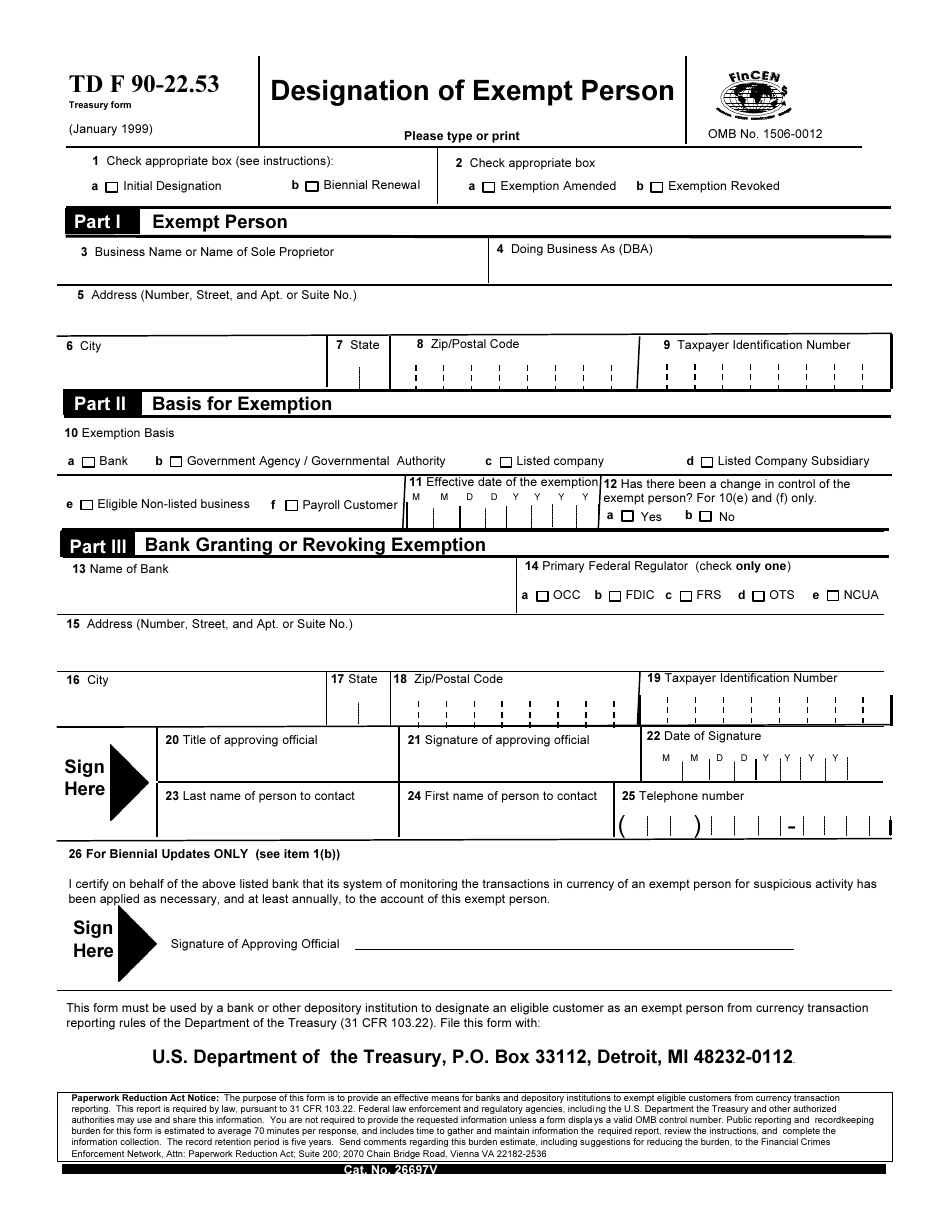

Form TD F90-22.53 Designation of Exempt Person

What Is Form TD F90-22.53?

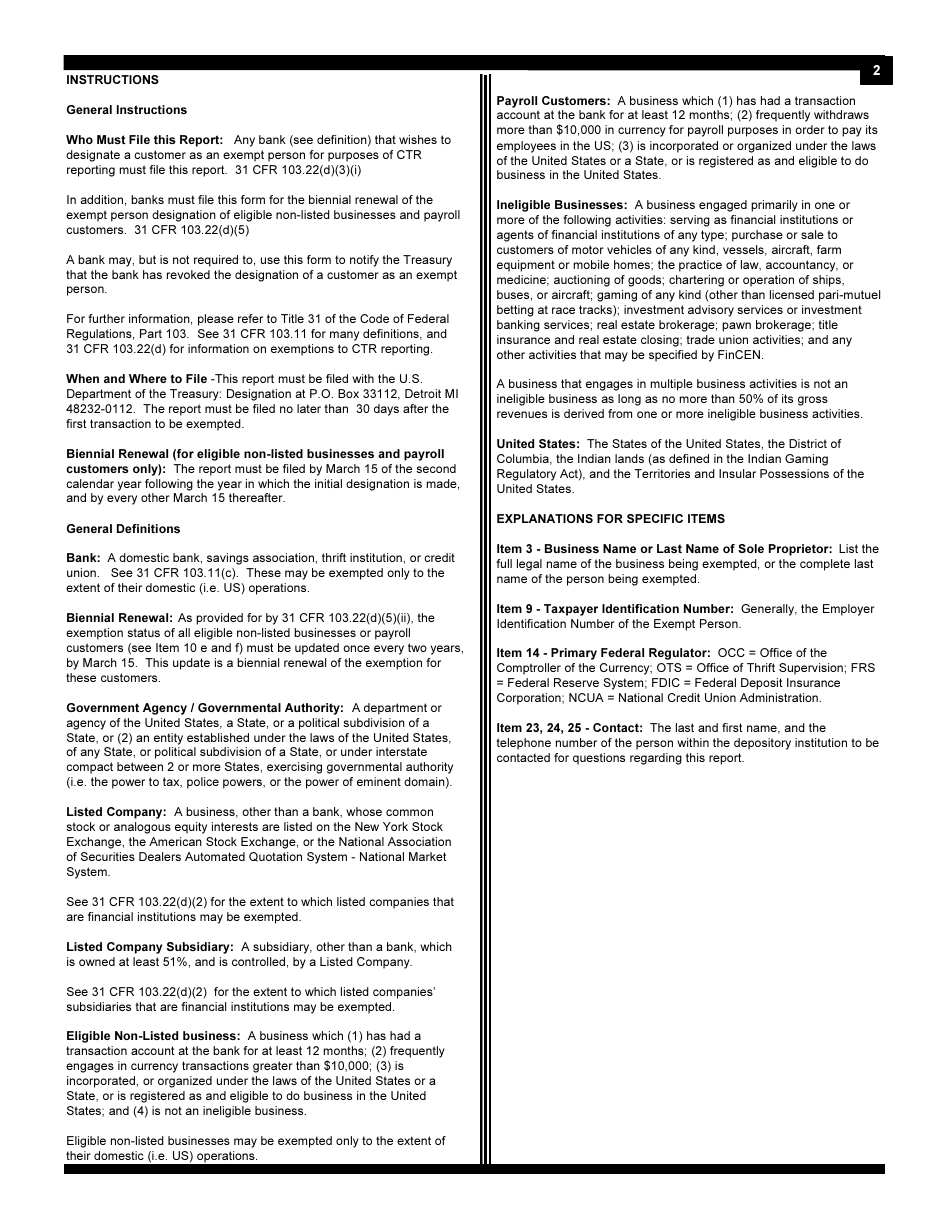

This is a legal form that was released by the U.S. Department of the Treasury on January 1, 1999 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TD F90-22.53?

A: Form TD F90-22.53 is a form used to designate an exempt person for purposes of Foreign Bank and Financial Accounts (FBAR) reporting.

Q: What is the purpose of Form TD F90-22.53?

A: The purpose of Form TD F90-22.53 is to provide information about individuals or entities who are exempt from reporting their foreign bank and financial accounts under FBAR regulations.

Q: Who needs to fill out Form TD F90-22.53?

A: Individuals or entities who have foreign bank and financial accounts that are exempt from FBAR reporting need to fill out Form TD F90-22.53.

Q: How do I designate an exempt person using Form TD F90-22.53?

A: To designate an exempt person, you need to provide their name, address, and Social Security number or employer identification number on Form TD F90-22.53.

Form Details:

- Released on January 1, 1999;

- The latest available edition released by the U.S. Department of the Treasury;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TD F90-22.53 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury.