This version of the form is not currently in use and is provided for reference only. Download this version of

Form ID K-1 (EFO00201)

for the current year.

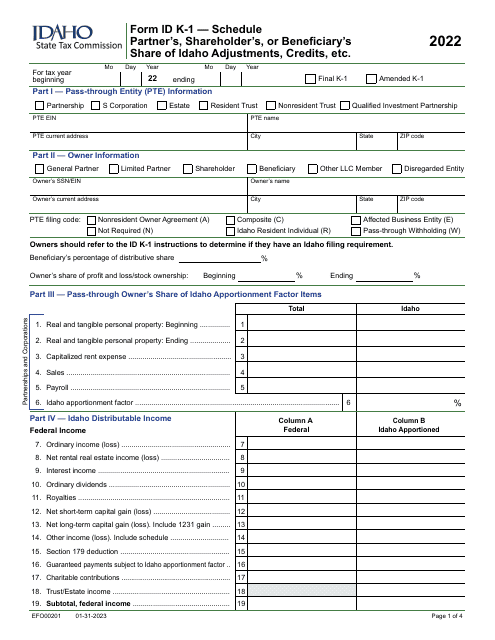

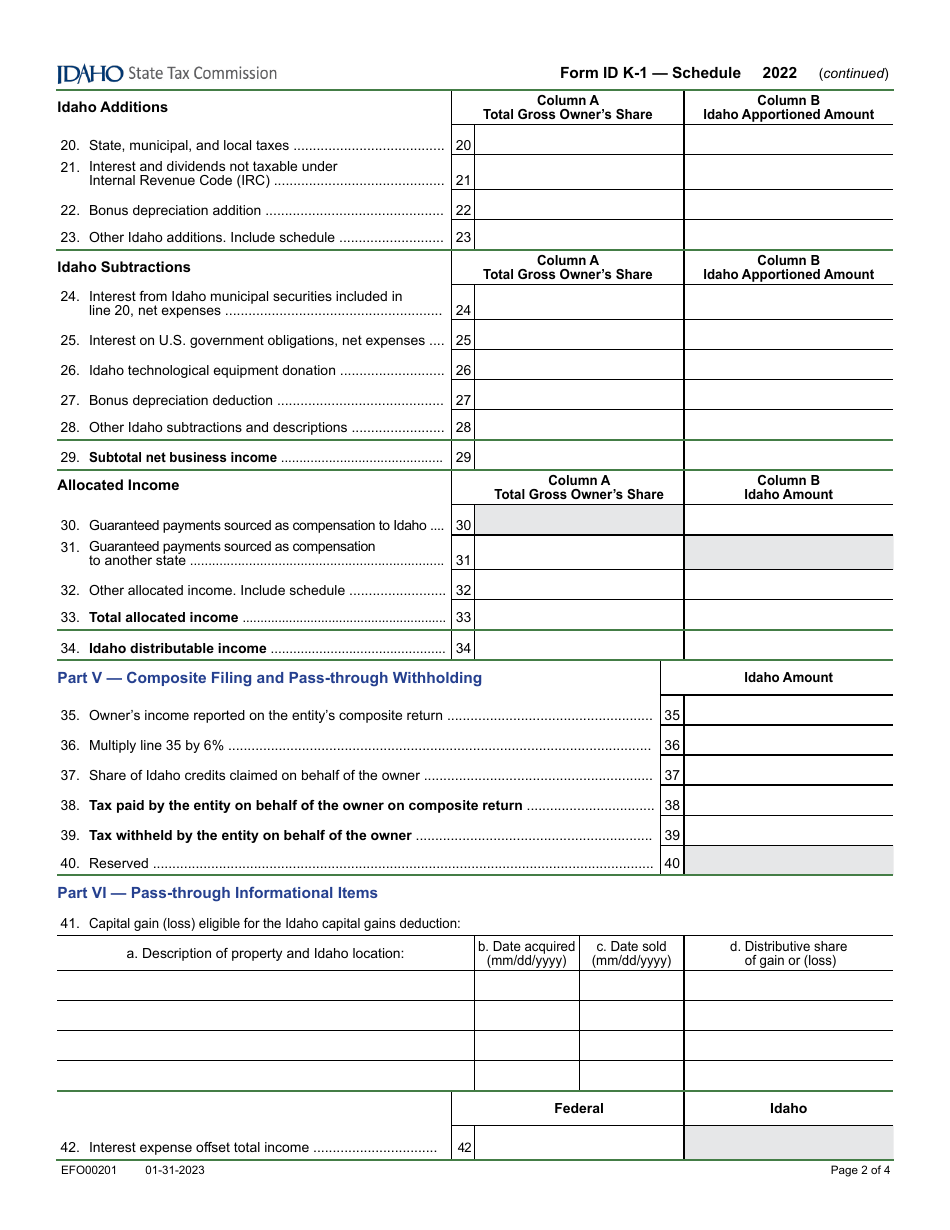

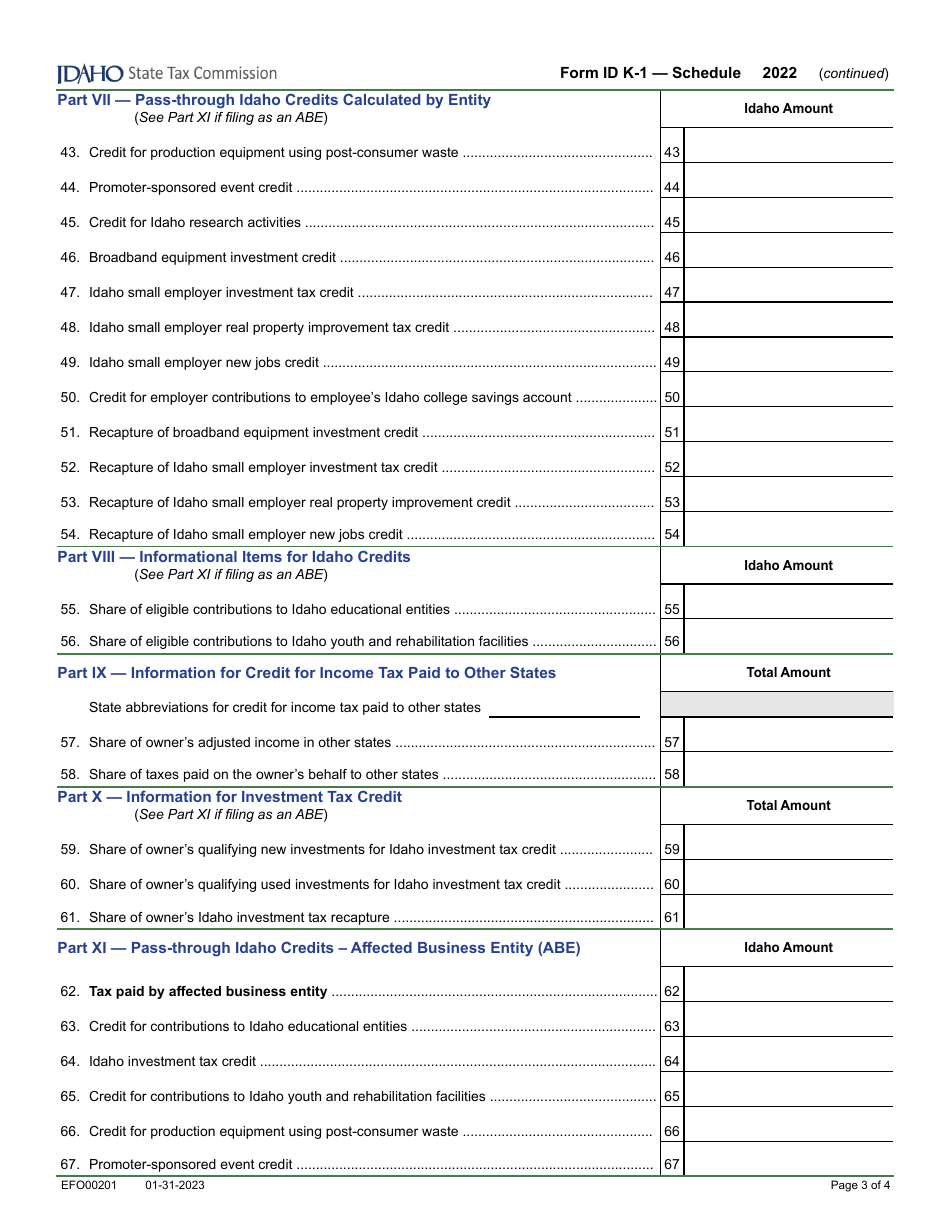

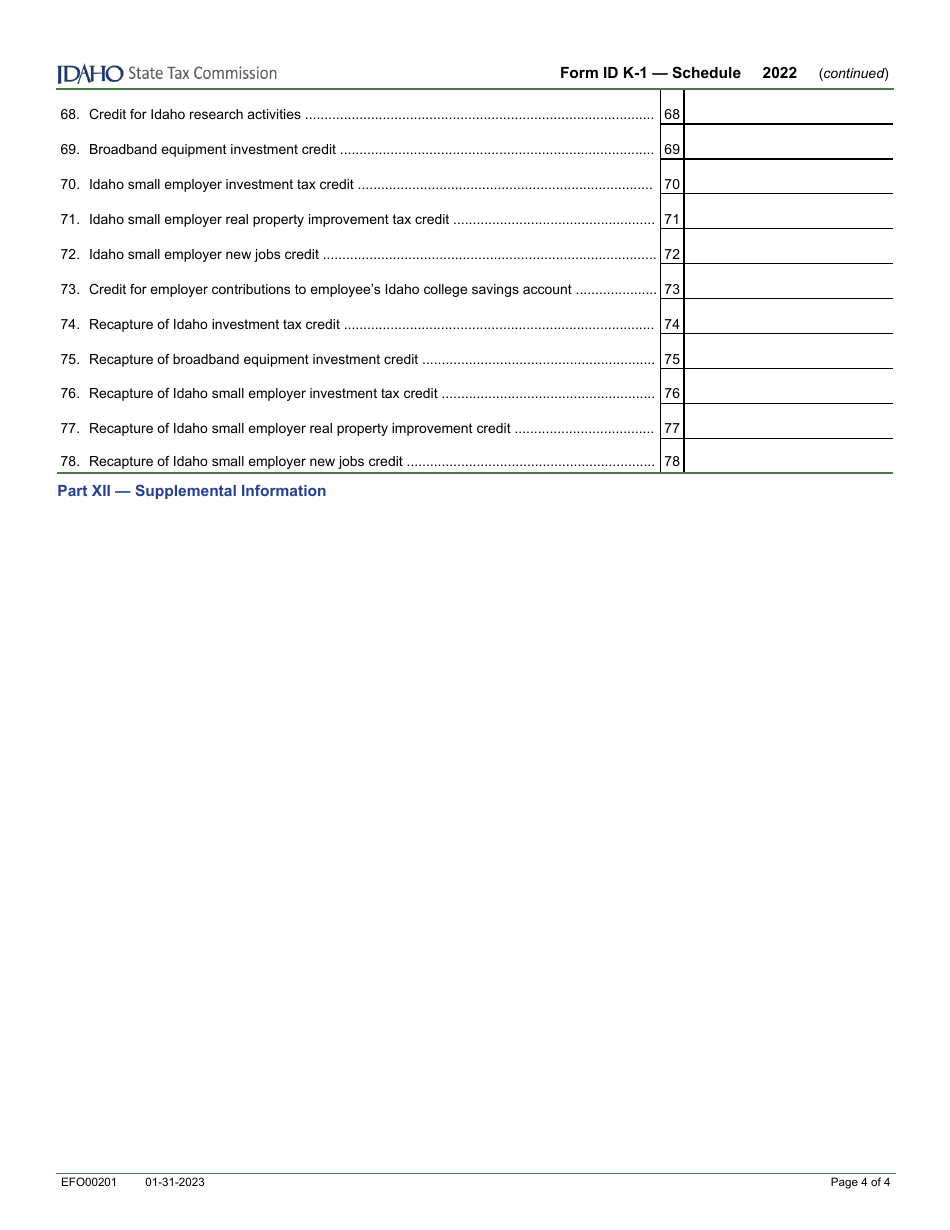

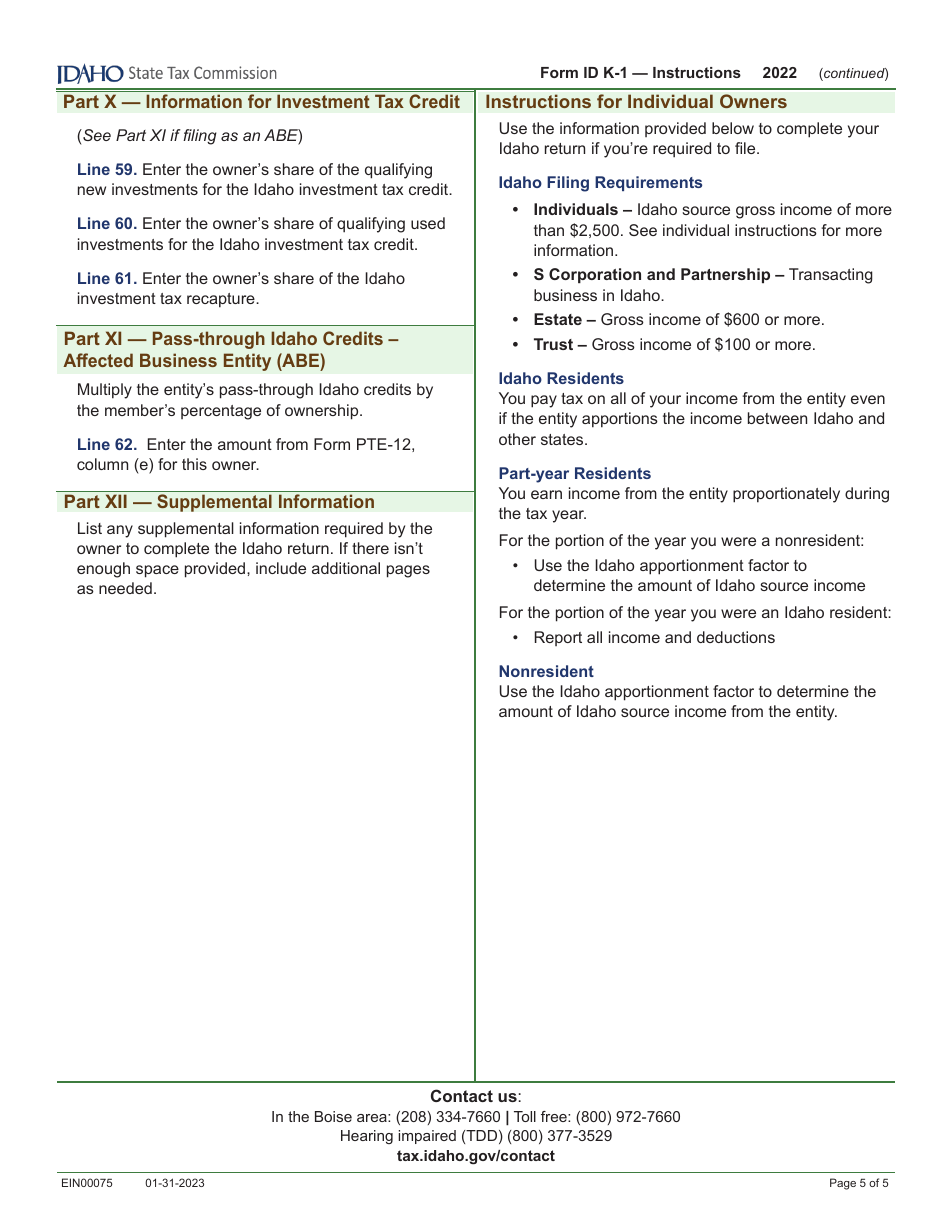

Form ID K-1 (EFO00201) Partner's, Shareholder's, or Beneficiary's Share of Idaho Adjustments, Credits, Etc. - Idaho

What Is Form ID K-1 (EFO00201)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ID K-1 (EFO00201)?

A: Form ID K-1 (EFO00201) is a tax form used to report a partner's, shareholder's, or beneficiary's share of Idaho adjustments, credits, etc.

Q: Who needs to file Form ID K-1 (EFO00201)?

A: Form ID K-1 (EFO00201) is typically filed by individuals who are partners, shareholders, or beneficiaries of entities that have Idaho adjustments, credits, etc.

Q: What is the purpose of Form ID K-1 (EFO00201)?

A: The purpose of Form ID K-1 (EFO00201) is to report the share of Idaho adjustments, credits, etc. that an individual is entitled to.

Q: Are there any filing deadlines for Form ID K-1 (EFO00201)?

A: The filing deadlines for Form ID K-1 (EFO00201) vary depending on the type of entity and the specific tax year. It is important to refer to the instructions provided with the form for accurate deadlines.

Q: What should I do if I have questions about Form ID K-1 (EFO00201)?

A: If you have questions about Form ID K-1 (EFO00201), you can contact the Idaho State Tax Commission directly for assistance.

Form Details:

- Released on January 31, 2023;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ID K-1 (EFO00201) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.